gm 10/05

Summary

gm, Bitcoin surpassed $100,000 and Ethereum experienced a substantial rally following its Pectra upgrade. Coinbase announced a major acquisition of Deribit for $2.9 billion, solidifying its position in the derivatives market. Meanwhile, the failure of the GENIUS Act in the Senate has raised concerns about the future of stablecoin regulation in the U.S. These events highlight the ongoing evolution of the crypto market, with increasing institutional interest and regulatory challenges shaping the industry's landscape.

News Headlines

📊 Standard Chartered: $120,000 Bitcoin Target for Q2 May Be Conservative

- Standard Chartered projects Bitcoin could reach $120,000 in Q2, suggesting this estimate may be conservative based on current market trends.

- Increasing institutional interest and broader adoption of cryptocurrencies are driving Bitcoin's value upward beyond expectations.

🤖 Google's Gemini 2.5 Pro Tops Coding Charts and MENSA Tests

- Google's Gemini 2.5 Pro outperforms competitors in coding benchmarks and MENSA IQ tests, achieving an IQ score of 115.

- It features a one million token context window, expandable to two million, enabling effective management of large codebases.

🚀 Solana Price Gains 500% as Key Metric Turns Bullish

- Solana's price has surged 18% this week, approaching a pivotal closing level above the 50-week exponential moving average (EMA).

- A similar upward trend in 2024 saw SOL rally by 515%, indicating potential for significant growth.

🌊 Layer 2s Impact on Ethereum: Beneficial or Extractive?

- Layer 2s have significantly reduced congestion on Ethereum's mainnet and driven down gas fees while maintaining security.

- Concerns arise regarding whether they are 'extractive', as they seem to be diverting fees and transaction activity from the mainnet.

🏢 Galaxy Digital Approved for US Domicile

- Galaxy Digital has received SEC approval to redomicile in the United States, clearing the way for its Nasdaq listing.

- This development coincides with a rising trend of cryptocurrency firms seeking to enter traditional financial markets.

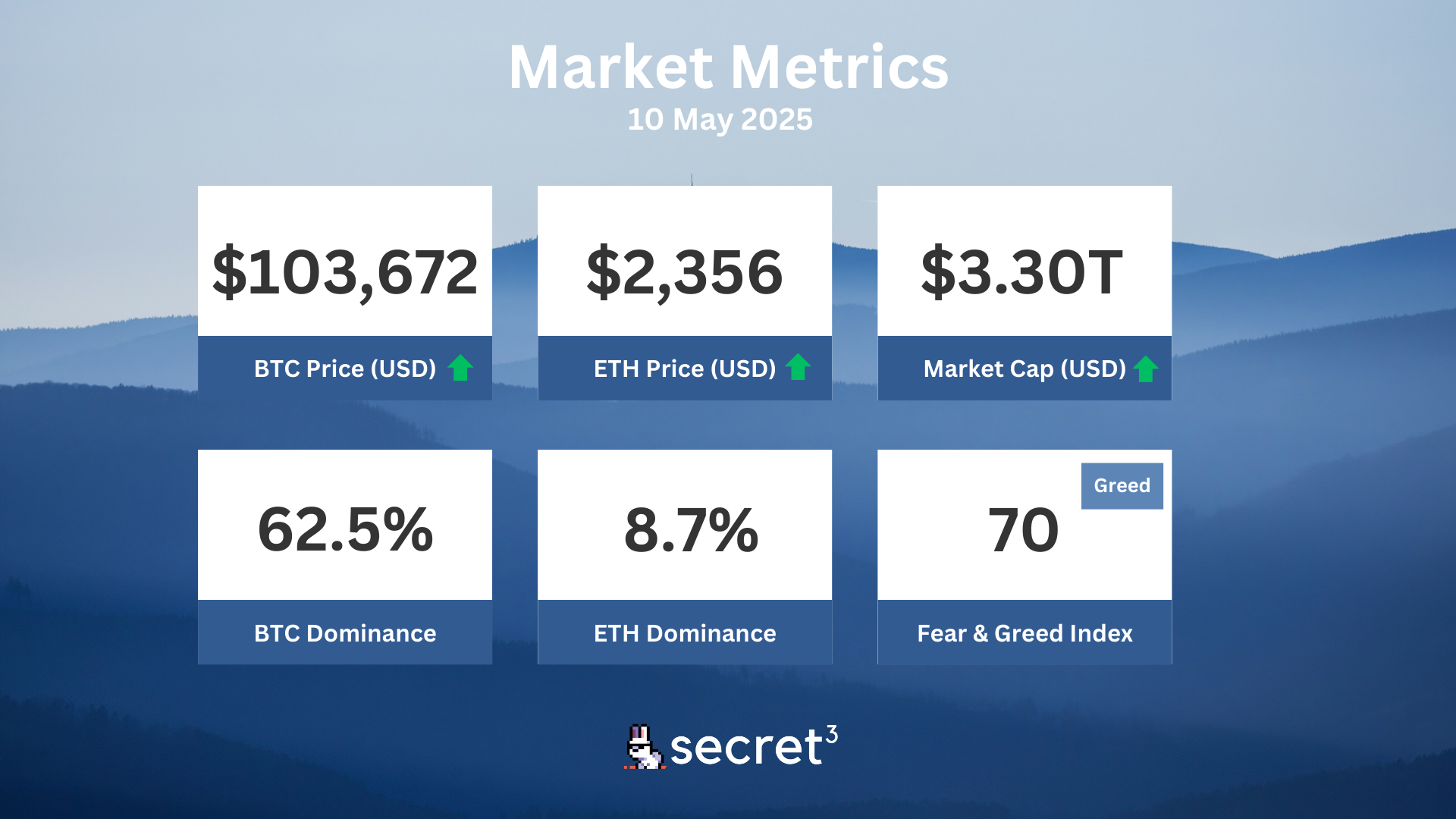

Market Metrics

Fundraising & VC

1. Fleek (Public Token Sale, $5M) - Open source app and AI agent deployment platform

2. Securitize (Strategic, Undisclosed) - Real-world asset tokenization platform

Regulatory

🔍 SEC Considers Easing Rules for Tokenized Securities

- The SEC is contemplating new rules to facilitate the issuance of tokenized securities.

- This potential exemption could allow decentralized exchanges (DEXs) to operate without registering as broker-dealers or exchanges.

🏦 Arizona Forms Second State Bitcoin Reserve

- Arizona has established a state-controlled bitcoin reserve fund, becoming the first state to secure unclaimed cryptocurrencies.

- This move illustrates a shift in how states are approaching cryptocurrency management and digital finance development.

💼 Gemini Secures License for Crypto Derivatives in Europe

- Gemini has obtained a MiFID II license from Malta to offer derivative trading services across the European Economic Area.

- This approval enables Gemini to expand its operational footprint in Europe's regulated derivatives market.

🔎 German Authorities Seize $37.4M from Crypto Exchange

- German authorities have confiscated $37.4 million in cryptocurrency from the now-defunct eXch exchange.

- The exchange was accused of enabling money laundering connected to major crypto hacks, including the $1.4 billion Bybit hack.

⚖️ US Senators Inquire About Binance-Trump Ties

- Democratic senators have requested a report on Binance's compliance measures, citing concerns over President Trump's ties to the crypto industry.

- The inquiry follows reports of Trump's involvement with cryptocurrencies and potential conflicts of interest.

Technical Analysis

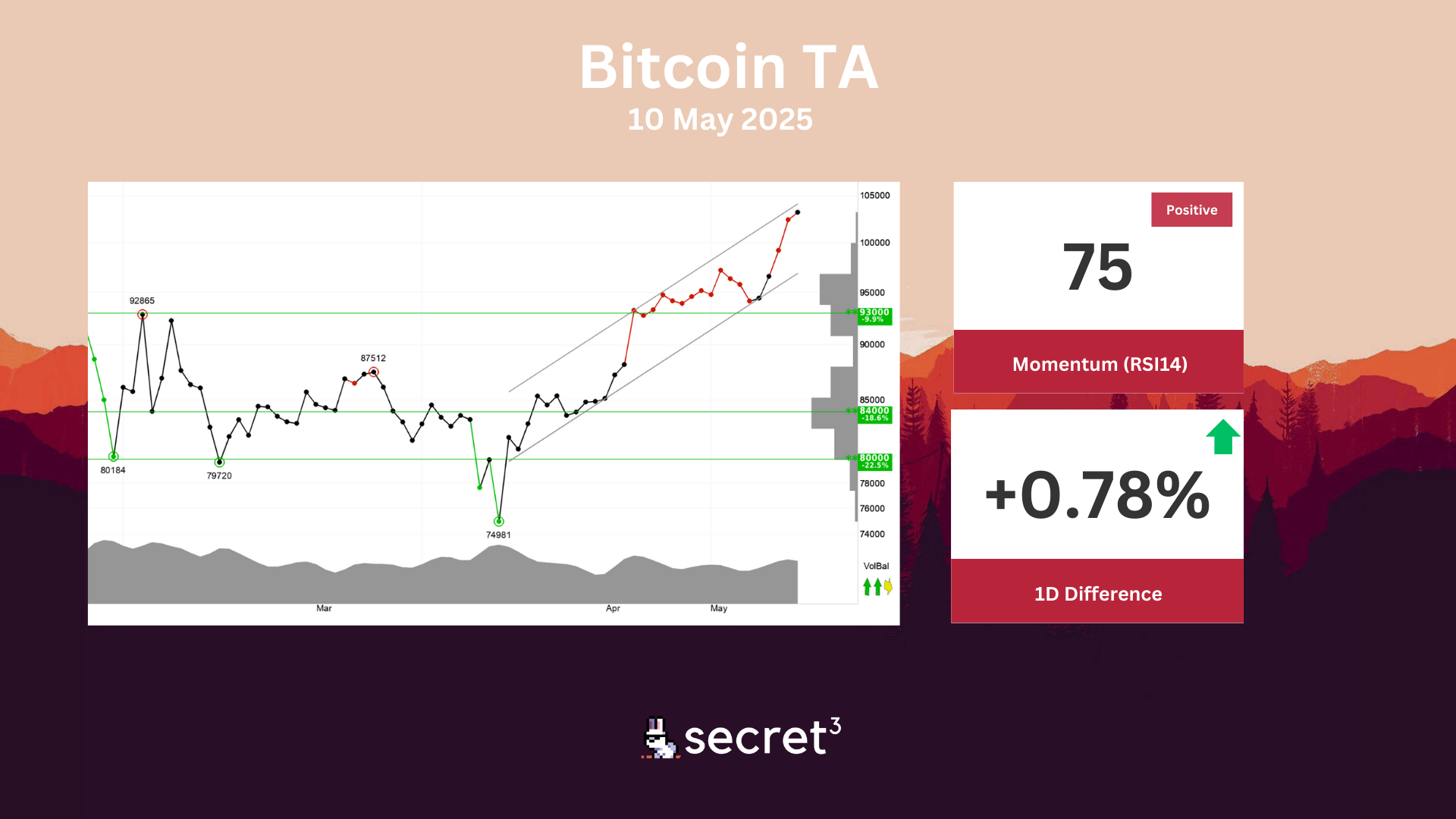

Bitcoin - Bitcoin shows strong development within a rising trend channel in the short term. Rising trends indicate that the currency experiences positive development and that buy interest among investors is increasing. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 93000 points. Positive volume balance indicates that buyers are aggressive while sellers are passive, and strengthens the currency. RSI above 70 shows that the currency has strong positive momentum in the short term. Investors have steadily paid more to buy the currency, which indicates increasing optimism and that the price will continue to rise. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. RSI diverges negatively against the price, which indicates danger of a reaction downwards. The currency is overall assessed as technically positive for the short term.

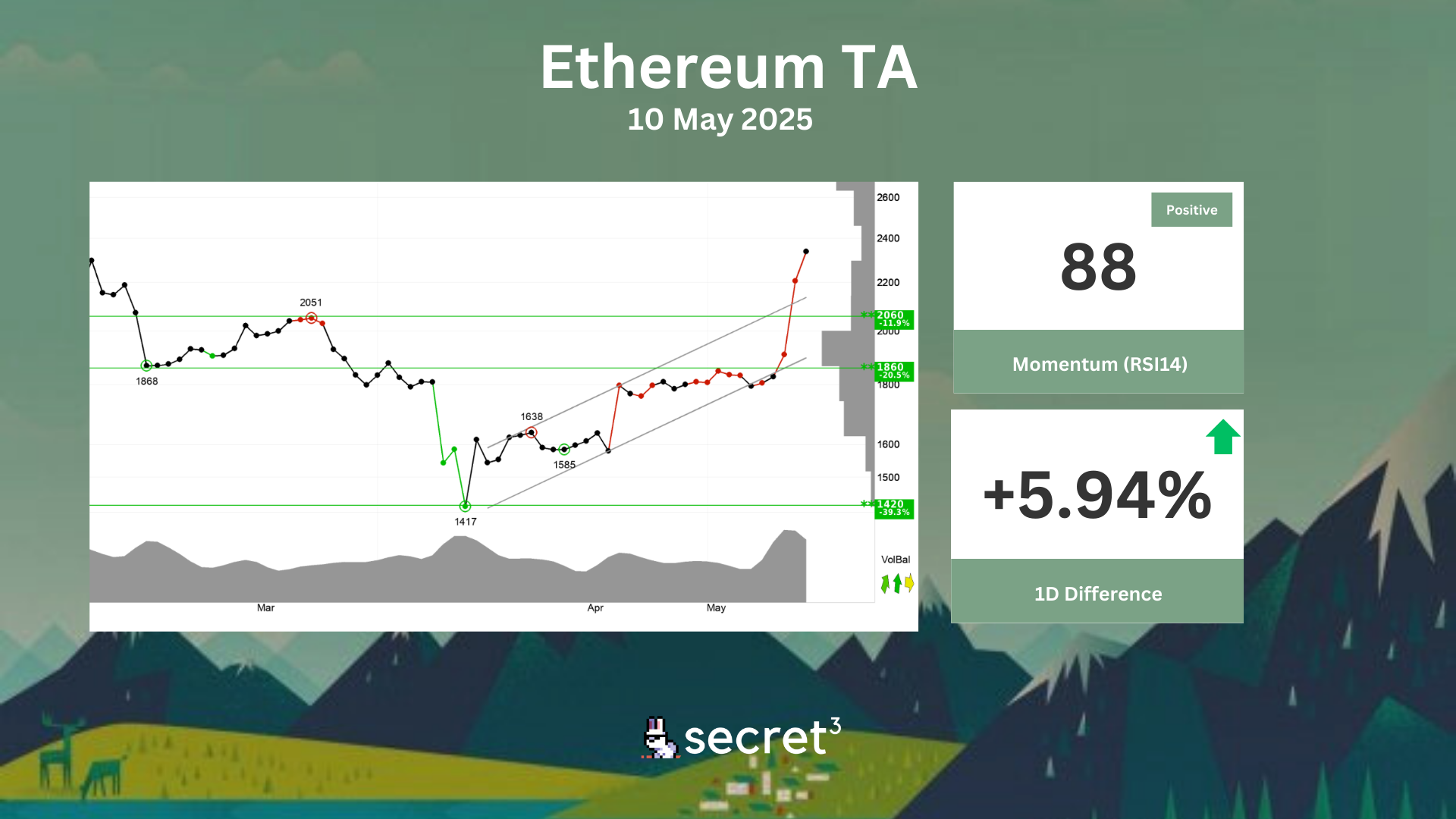

Ethereum - Ethereum has broken the rising trend up in the short term. This signals an even stronger rate of growth, but the positive development may result in corrections down in the short term. The currency has support at points 2060 and resistance at points 2770. Positive volume balance shows that volume is higher on days with rising prices than days with falling prices. This indicates increasing optimism among investors. RSI is above 70 after a good price increase the past weeks. The currency has strong positive momentum and further increase is indicated. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically positive for the short term.