gm 09/03

Summary

gm, President Trump hosted a historic Crypto Summit at the White House, marking a significant shift towards embracing cryptocurrency and aiming to position the U.S. as a global leader in the field. This initiative seeks to reverse previous restrictive measures like Operation Chokepoint 2.0, aiming to create a more favorable regulatory environment and attract crypto businesses back to the U.S. At the summit, Michael Saylor presented a bold strategy to potentially unlock $100 trillion in economic value by 2035 through strategic acquisitions of bitcoin and robust regulatory reforms that ensure the U.S. dollar remains central in global commerce. Concurrently, the Office of the Comptroller of the Currency (OCC) relaxed restrictions on banks' cryptocurrency activities, enhancing their ability to manage custody and certain stablecoin operations. Despite these advances, the crypto market experienced volatility, with Bitcoin slightly down at $86,000 and altcoins like XRP and Cardano facing steeper drops. The summit's discussions and directives have laid the groundwork for potentially transformative stablecoin legislation and clearer crypto regulations, setting the stage for broader institutional engagement in the cryptocurrency market.

News Headlines

📊 Crypto Projects Raised $1.1B in February Despite Market Volatility

- In February, venture capital activity in the crypto space saw a slight decline compared to January, with a total of $1.11 billion raised by 137 companies, down from January's $1.57 billion.

- Decentralized finance (DeFi) attracted substantial attention, with 20 companies raising approximately $175 million, continuing the trend from January.

🚀 Bitcoin Staking Platform Core Expands to APAC with Cobo Partnership

- Core, the issuer of lstBTC, is partnering with Cobo, a Singapore-based custodian, to expand its presence in the Asia-Pacific (APAC) region.

- This collaboration allows Cobo's institutional clients to earn yields on their Bitcoin holdings while retaining control over their assets.

📈 Coinbase Stock Initiated with Buy Rating at Rosenblatt

- Rosenblatt has initiated coverage on Coinbase's (COIN) stock with a buy rating and a price target of $305, suggesting a potential 45% upside.

- Analyst Chris Brendler believes that the recent 30% decline in COIN shares presents a buying opportunity, citing favorable conditions due to a pro-crypto administration.

🚨 Ripple Co-founder's $150M XRP Theft Linked to LastPass Breach

- The $150 million theft from Ripple co-founder Chris Larsen's wallet has been linked to a security breach at LastPass in 2022.

- Hackers accessed Larsen's private keys stored in LastPass following a major hack that exposed encrypted customer password vaults and metadata for around 25 million users.

📉 Bitcoin ETFs Experience $370 Million in Outflows Following US Reserve Announcement

- Bitcoin exchange-traded funds (ETFs) experienced net outflows of nearly $370 million following President Trump's announcement of a US strategic Bitcoin reserve.

- The limited scope of the executive order, which didn't mandate government purchases, led to considerable disappointment in the market.

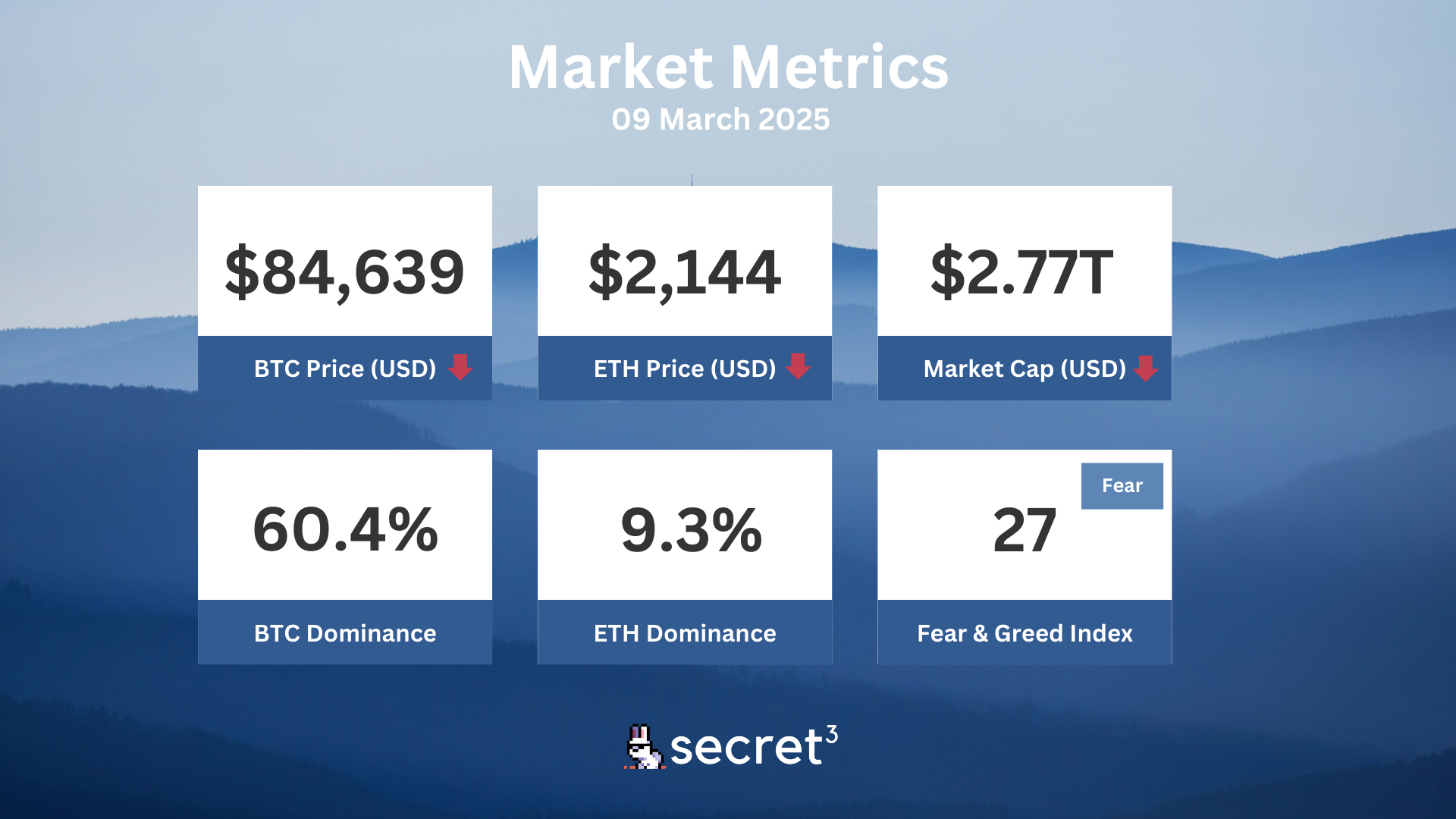

Market Metrics

Fundraising & VC

1. Fortytwo (Pre Seed, $2.3M) - Decentralized AI protocol

2. Magpie Protocol (Public Token Sale, $500K) - Decentralized protocol for cross-chain asset swaps

On-chain Data

1. Maverick Protocol (MAV) token unlocked today ($1.21M, 3.1%)

2. Aptos (APT) token unlock in 3 days ($67.43M, 1.92%)

3. Sei Network (SEI) token unlock in 6 days ($46.76M, 4.72%)

Regulatory

🏦 US Establishes Strategic Bitcoin Reserve

- The U.S. government has created a Strategic Bitcoin Reserve, holding approximately 200,000 Bitcoin from forfeiture cases.

- White House crypto czar David Sacks emphasized Bitcoin's scarcity and long-term value as key factors in this decision.

🌎 El Salvador Continues Bitcoin Acquisitions Despite IMF Deal

- El Salvador has acquired over 13 BTC since March 1, despite agreeing to reduce Bitcoin involvement in an IMF loan deal.

- The country now holds over 6,105 BTC, valued at over $527 million, continuing its daily Bitcoin accumulation strategy.

💱 Stablecoins to Bolster Dollar Hegemony

- Treasury Secretary Scott Bessent announced plans to leverage stablecoins to maintain the dollar's global reserve currency status.

- The government aims to use overcollateralized stablecoins backed by US Treasury bills to enhance demand for US debt instruments.

Technical Analysis

Bitcoin - Investors have accepted lower prices over time to get out of Bitcoin and the currency is in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. The currency has support at points 80000 and resistance at points 92600. The currency is assessed as technically negative for the short term.

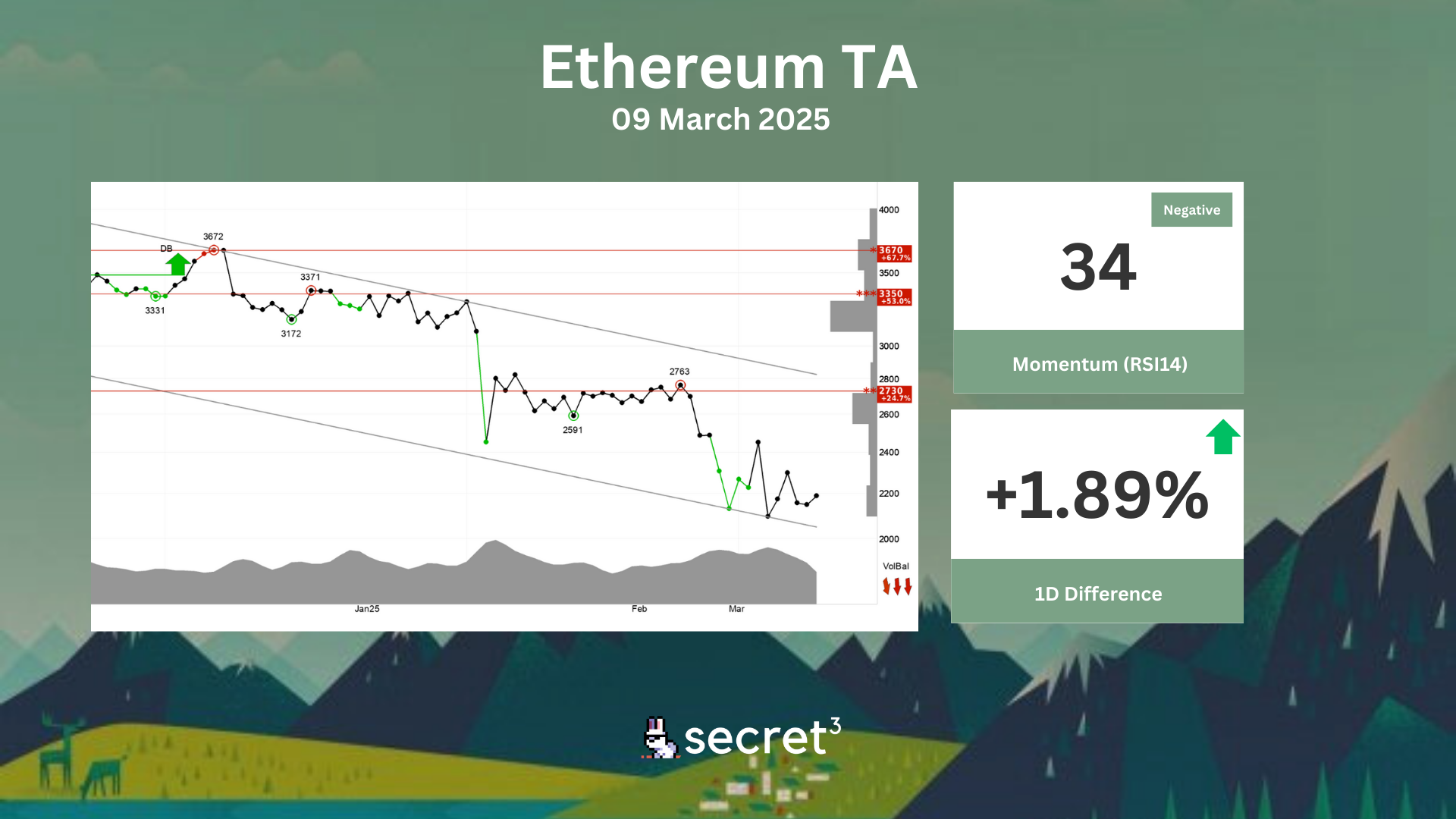

Ethereum - Ethereum is in a falling trend channel in the short term. This signals increasing pessimism among investors and indicates further decline for Ethereum. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 2730 points. Negative volume balance indicates that sellers are aggressive while buyers are passive, and weakens the currency. The currency is overall assessed as technically negative for the short term.

Governance & Code

💧 Lido DAO | Lido Ecosystem BORG Grant Funding Request

- This proposal request $10.6 million in funding for the Lido Ecosystem BORG to support stETH adoption, institutional onboarding, and brand positioning through the end of 2025.

❄️ Everclear DAO | Increasing Liquidity for CLEAR via Mainnet Vault

- This proposal seeks to bridge 3.84 million CLEAR from the DAO Safe on Arbitrum to Ethereum mainnet and "deploy these funds into the Arrakis mainnet vault."