gm 09/02

Summary

gm, The Commodity Futures Trading Commission (CFTC) announced a forum for crypto industry CEOs to discuss an upcoming digital asset pilot program, focusing on exploring tokenized non-cash collateral, including stablecoins. This move, alongside recent regulatory changes, signifies a shift towards more crypto-friendly policies. Meanwhile, Bitcoin's price faced pressure due to looming trade war concerns, with analysts emphasizing the importance of maintaining support above $93,000 to avoid potential liquidations. In the altcoin space, Solana (SOL) saw a notable surge of 8.2% amid predictions from VanEck of reaching $520 by year-end, while Ethereum (ETH) experienced a 1.5% increase despite ongoing discussions about its upcoming Pectra upgrade and competition in the layer-2 space.

News Headlines

🚀 Layer 2 Solutions Poised for Growth in 2025

- Kaiko analysts predict a resurgence for Layer 2 (L2) solutions, with projections suggesting $47 billion worth of bitcoin could be bridged to L2s by 2030.

- Sector rotation may favor L2 assets as investors look beyond Bitcoin, which dominated the market in 2024 due to significant institutional investments in BTC ETFs.

📊 Bitcoin ETF Inflows Reach $5 Billion in January

- Bitcoin exchange-traded funds (ETFs) saw nearly $5 billion in inflows during January, primarily driven by major players like BlackRock and Fidelity.

- MicroStrategy, the largest corporate holder of Bitcoin, has rebranded to Strategy and halted its Bitcoin purchases after a significant buying spree.

🏦 Coinbase's AUM Surpasses $420 Billion

- Coinbase's assets under management (AUM) have exceeded $420 billion, making it more valuable than the 21st largest bank in the United States.

- The company posted a $273 million net profit for Q4 2024, marking its first positive income since Q4 2021.

🖼️ Christie's Launches First AI Art Auction

- Christie's is hosting its first auction focused exclusively on AI-created artworks, featuring over 20 pieces from notable digital artists.

- The auction, titled "Augmented Intelligence," marks a significant milestone in the intersection of art, technology, and blockchain.

🔮 Quantum Computing Could Access Lost Bitcoin Wallets in the Future

- Tether CEO Paolo Ardoino suggests that quantum computing may eventually be able to access lost Bitcoin wallets, potentially reintroducing those funds into circulation.

- While not an immediate concern, this development could have significant implications for the Bitcoin market in the long term.

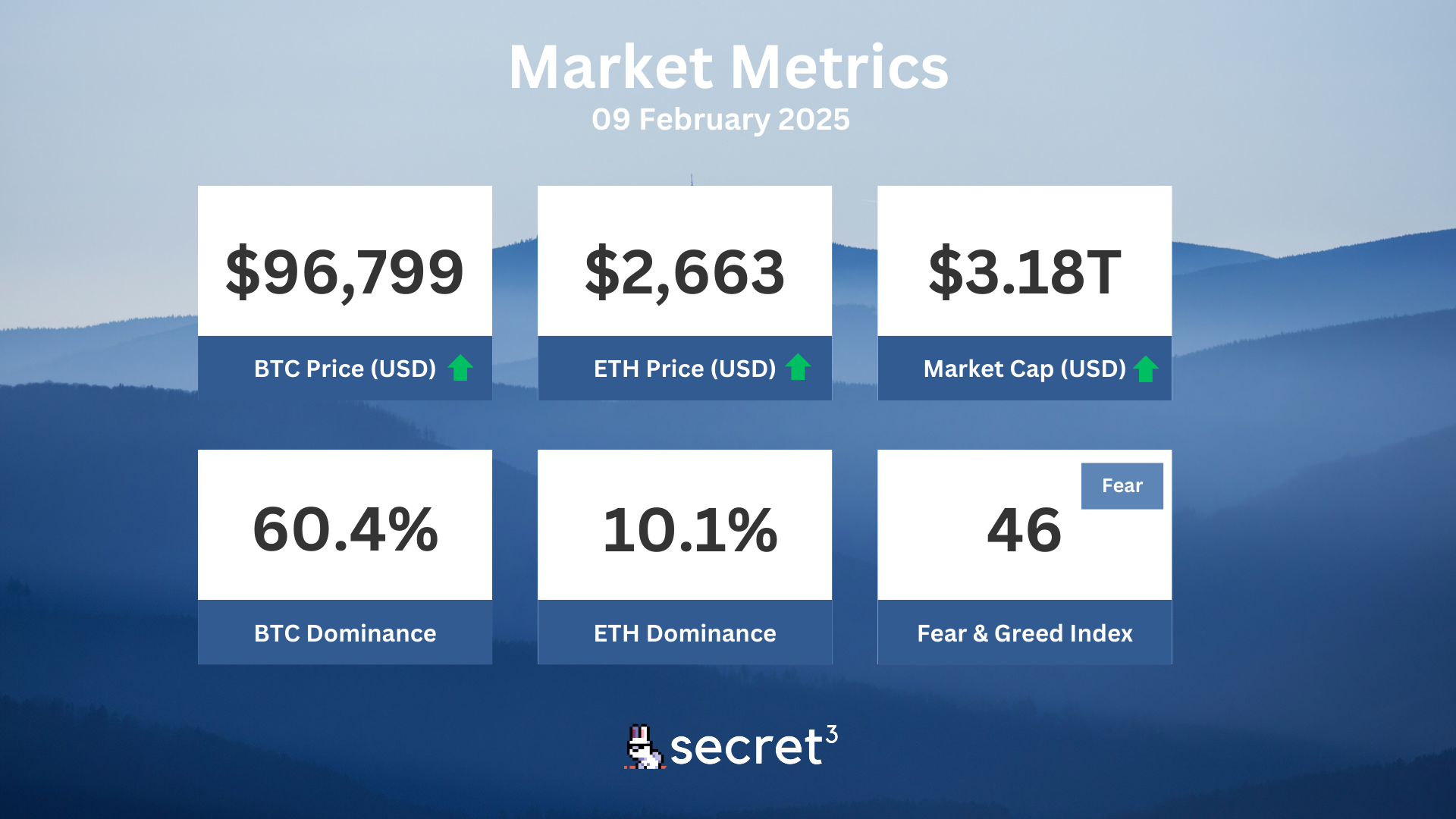

Market Metrics

Fundraising & VC

No fundraising data today.

On-chain Data

1. Maverick Protocol (MAV) token unlocked today ($1.39M, 3.1%)

2. Aptos (APT) token unlock in 3 days ($66.40M, 1.97%)

3. NAVI (NAVX) token unlock in 4 days ($301.61K, 1.03%)

4. Sei Network (SEI) token unlock in 6 days ($50.18M, 4.96%)

Regulatory

📊 Florida Senator Proposes Bitcoin Investment for State Funds

- Senator Joe Gruters introduces bill advocating for state funds investment in Bitcoin to combat inflation.

- The proposal suggests allowing state's chief financial officer to invest Bitcoin in various funds, capping holdings at 10%.

🚀 SEC Acknowledges Spot Solana ETF Application

- SEC recognizes application for spot Solana ETF, potentially shifting framework for cryptocurrency products.

- The move could pave way for further institutional interest in Solana, similar to Bitcoin and Ethereum ETFs.

💼 Utah Advances Crypto Investment Bill

- Utah legislation to allow public investment in cryptocurrencies awaits senate and governor approval.

- The bill could enable state to invest in stablecoins and cryptocurrencies with market cap over $500 billion.

🏦 TradFi Hesitant on DeFi Until Risks Managed

- Traditional finance remains skeptical of DeFi due to regulatory uncertainties and volatility.

- DeFi must improve regulatory standing through measures like KYC and risk management strategies.

Technical Analysis

Bitcoin - Bitcoin is within an approximate horizontal trend channel in the short term, which indicates further development in the same direction. The currency has support at points 92500 and resistance at points 101400. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. This weakens the currency and indicates increased chance of a break down. The currency is overall assessed as technically neutral for the short term.

Ethereum - Ethereum has broken the falling trend channel down in the short term, which indicates an even stronger falling rate. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 3180 points. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.

Governance & Code

☁️ Sky DAO | Increase weETH Supply Cap Parameters (Preliminary Discussion)

- This proposal recommends increasing the max and gap parameters to facilitate better UX.

👻 Aave DAO | Update AAVE Token LTV/Liquidation Percentages

- This proposal aims to adjust AAVE’s LTV percentage from 66% to 71% and the liquidation ratio from 73% to 78%