gm 08/06

Summary

gm, Gemini filed a confidential S-1 with the SEC, following Circle's exceptional market performance that saw its stock price quadruple from its initial $31 IPO price to reach $123.51. Bitcoin showed resilience, climbing above $105,000 after briefly dipping to $100,000, while corporations like Strategy (formerly MicroStrategy) and Japan's Metaplanet announced ambitious plans to expand their Bitcoin holdings, with Metaplanet aiming to raise $5.3 billion for BTC purchases. On the regulatory front, the Digital Asset Market Clarity Act and the GENIUS Act are advancing in Congress, potentially providing clearer frameworks for cryptocurrencies and stablecoins, with major tech companies including X, Apple, and Google reportedly exploring stablecoin integration into their payment systems.

News Headlines

💼 Tigran Gambaryan Resigns from Binance Following Nigerian Ordeal

- Tigran Gambaryan has officially resigned from Binance after being detained in Nigeria for eight months and returning to the US in October 2024. Despite facing serious health issues during his detention and allegations of money laundering and tax evasion, he plans to remain active in the crypto industry.

- Gambaryan emphasized the increasing need for experienced professionals who can bridge the gap between technology, enforcement, and compliance as digital assets converge with traditional finance, suggesting he'll continue to make an impact either in public service or the private sector.

📱 World Foundation Launches World Build 2.0 for Mini App Developers

- World Foundation and Tools For Humanity have launched World Build 2.0, the next phase of their developer incentive campaign co-hosted with FWB, focused on accelerating mini app creation within the World mobile application. The program offers substantial funding opportunities including $300,000 in grants and $1 million in WLD tokens.

- With over 10 million downloads of the World app on Android and 300 mini apps already registered (accumulating around $12 million in venture capital funding), the initiative emphasizes global user adoption over immediate monetization.

📉 TRUMP Memecoin Shows Limited Price Response to WLF Endorsement

- The Official Trump memecoin experienced only a brief 6% price surge following Eric Trump's announcement that World Liberty Financial (WLF) would acquire a substantial position in the token. The price quickly retraced and currently sits at $10.10, down 8.65% over the past month.

- A significant $520 million token unlock is scheduled for July 18, when 50 million tokens will be released, raising concerns about potential downward price pressure if demand doesn't increase.

🧩 Maple Finance Expands to Solana with Yield-Bearing Stablecoin

- Maple Finance is launching its syrupUSD yield-bearing stablecoin on Solana with a $30 million liquidity provision to create a foundation for lending, trading, and collateral use within the ecosystem.

- Supported by Chainlink's crosschain Interoperability Protocol, the integration comes as Solana's DeFi ecosystem shows 500% growth in total value locked since December 2023.

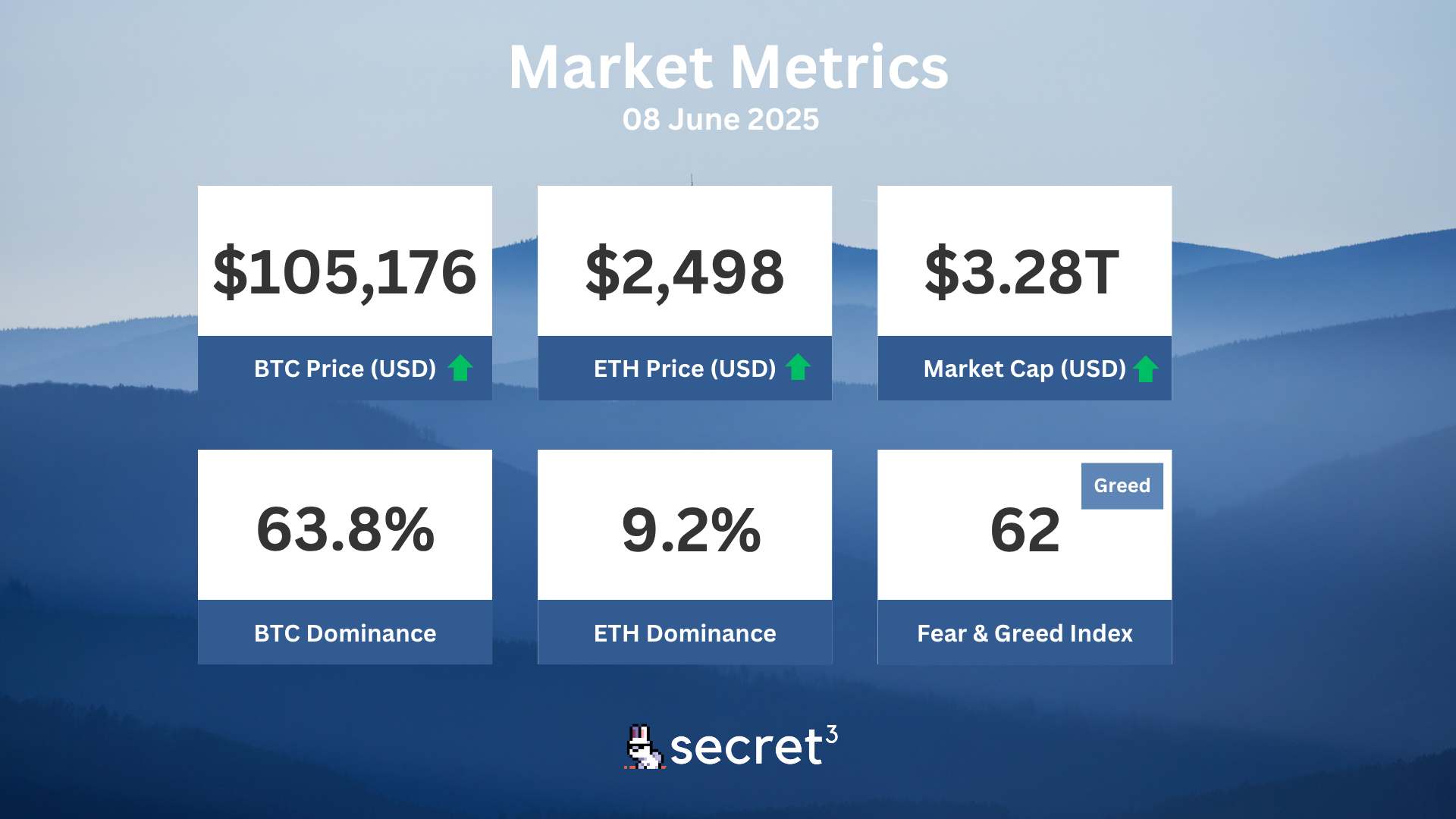

Market Metrics

Fundraising & VC

No fundraising data today.

Regulatory

🏛️ ETF Issuers Urge SEC to Return to First-to-File Approvals

- VanEck, 21Shares, and Canary Capital have urged the SEC to revert to the "first-to-file" principle for ETF applications, arguing that abandoning it stifles competition and innovation.

- The SEC continues to delay decisions on several applications, including Grayscale's spot ETF now pushed to October, raising concerns about the regulatory approach to innovation.

🚫 Trump Administration Dropping Major Crypto Enforcement Actions

- The SEC under President Trump is retreating from its aggressive stance against crypto companies, dropping significant lawsuits against major players like Binance, Coinbase, and OpenSea.

- This shift away from "regulation by enforcement" aims to establish clearer regulatory guidelines and foster innovation in the crypto space.

🌏 Singapore Tightens Crypto Regulations, Firms Face Global Challenges

- Singapore's Monetary Authority has mandated unlicensed crypto firms to cease offering services to overseas clients, ending regulatory loopholes some companies had exploited.

- Firms considering relocation to jurisdictions like Hong Kong or the Philippines face similar regulatory hurdles, as global pressure for stricter compliance continues to increase.

🏦 Fed Confirmation Signals Potential Regulatory Shift for Digital Assets

- Wyoming Senator Cynthia Lummis highlighted Michelle Bowman's confirmation as Federal Reserve vice chair for supervision as a turning point for digital assets, suggesting a shift toward evidence-based regulation.

- Bowman's appointment, secured by a narrow Senate vote of 48-46, could influence the Fed's approach to cryptocurrencies, including central bank digital currencies and stablecoins.

Technical Analysis

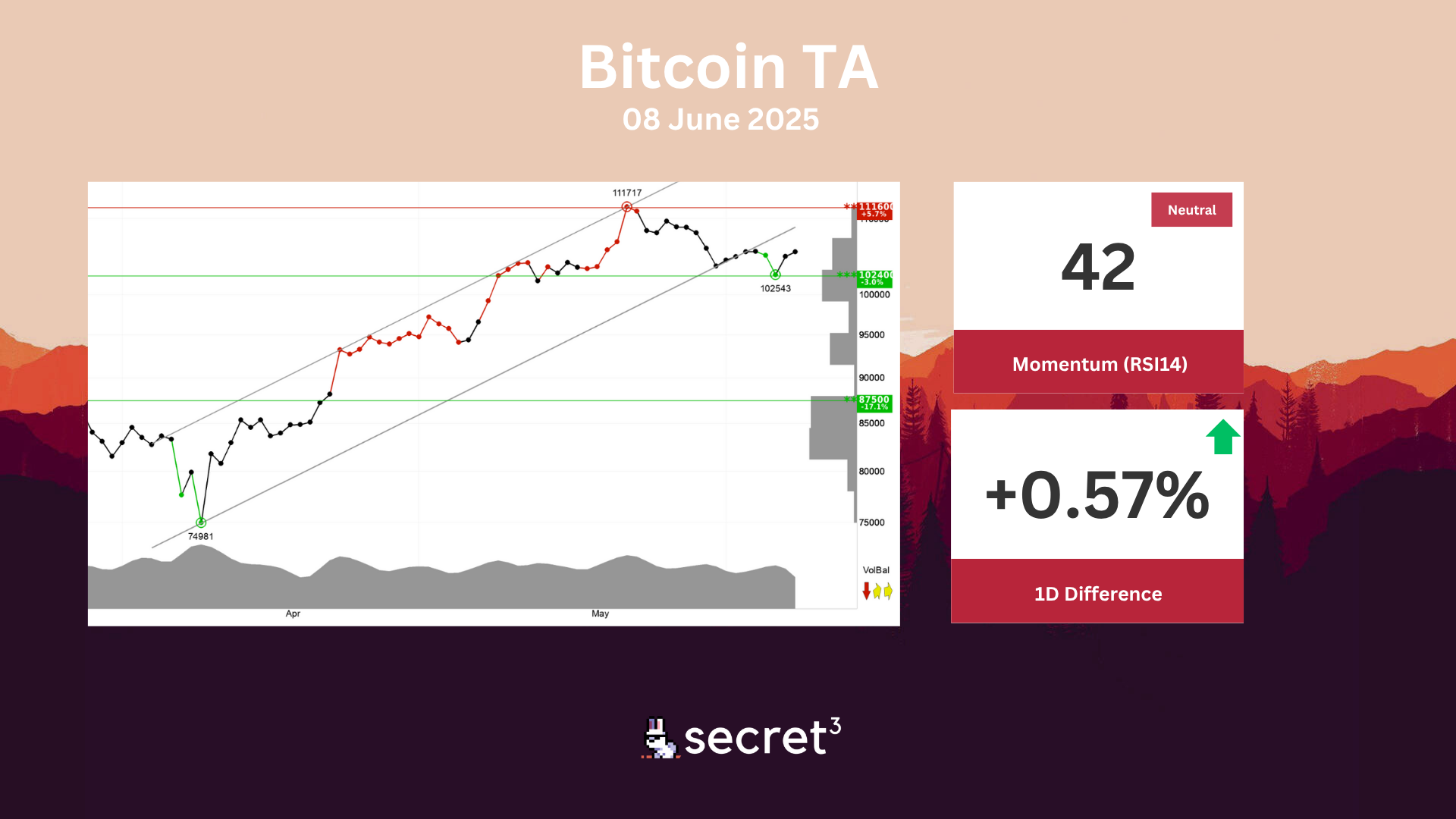

Bitcoin - Bitcoin has broken through the floor of a rising trend channel in the short term. This indicates a slower rising rate at first, or the start of a more horizontal development. The currency has support at points 102400 and resistance at points 111600. RSI diverges negatively against the price, which indicates danger of a reaction downwards. The currency is overall assessed as technically neutral for the short term.

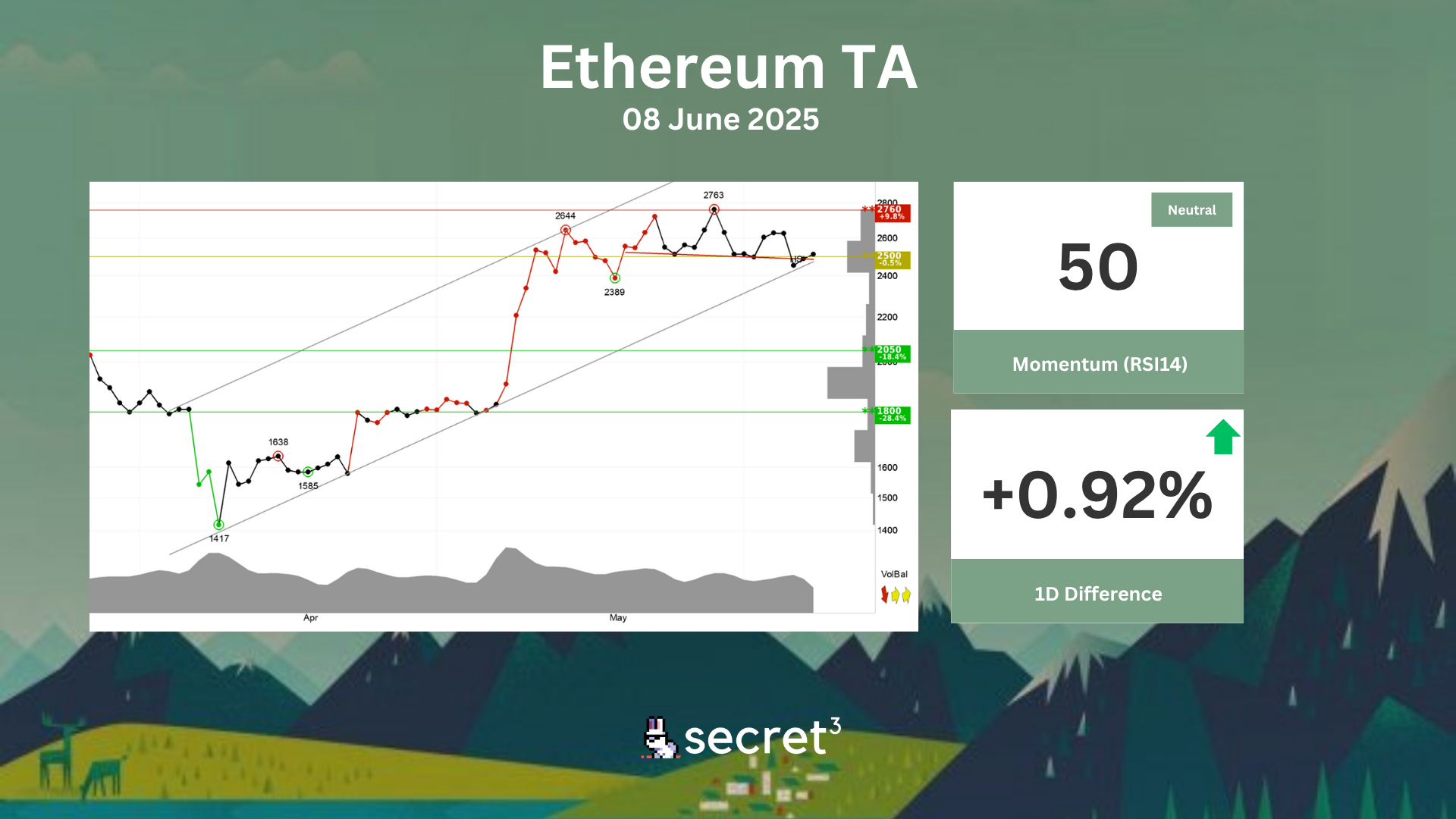

Ethereum - Ethereum shows strong development within a rising trend channel in the short term. This signals increasing optimism among investors and indicates continued rise. A head and shoulders formation is under development. A decisive break of the support at 2486, ideally with an increase in volume, signals a further fall. The currency is testing support at points 2500. This could give a positive reaction, but a downward breakthrough of points 2500 means a negative signal. Volume tops and volume bottoms correspond well with tops and bottoms in the price. This strengthens the trend. The currency is overall assessed as technically positive for the short term.