gm 08/05

Summary

gm, Ethereum successfully implemented its Pectra upgrade, enhancing scalability and efficiency. Meanwhile, Bitcoin surged to nearly $98,000, driven by optimism surrounding US-China trade talks and the Federal Reserve's decision to hold interest rates steady. Notably, Visa invested in stablecoin infrastructure startup BVNK, signaling growing institutional interest in digital assets. Additionally, Robinhood announced plans to develop a blockchain for tokenized securities trading in Europe, potentially expanding cryptocurrency adoption in traditional finance.

News Headlines

💰 BlackRock's Spot Bitcoin ETF Surpasses Gold Fund in Inflows

- BlackRock's Spot Bitcoin ETF has outpaced the world's largest gold fund, the SPDR Gold Trust (GLD), in year-to-date inflows.

- This shift reflects a growing preference among investors for Bitcoin as a viable asset class.

🏦 OCC Allows Banks to Buy and Sell Customers' Crypto Assets

- The Office of the Comptroller of the Currency (OCC) has issued guidance permitting banks to buy and sell crypto assets held in custody for their clients.

- This change allows banks to directly engage in trading activities on behalf of customers, expanding their role in blockchain-related transactions.

🚨 $45 million stolen from Coinbase users in the last week

- $45 million has been stolen from Coinbase users through social engineering scams within the last week.

- This brings the estimated annual losses from such scams targeting Coinbase users to approximately $330 million.

🔐 Safeheron Launches Open-Source Intel SGX TEE Framework

- Safeheron introduced an open-source Trusted Execution Environment (TEE) framework to enhance security in Web3.

- The framework aims to protect code and data by isolating operations against external and internal threats.

🌐 Robinhood Developing Blockchain-Based Program for U.S. Securities in Europe

- Robinhood is developing a blockchain-based program aimed at enabling the trading of U.S. securities in Europe.

- The initiative aligns with Robinhood's strategy to expand its offerings and potentially tap into the European market for securities trading.

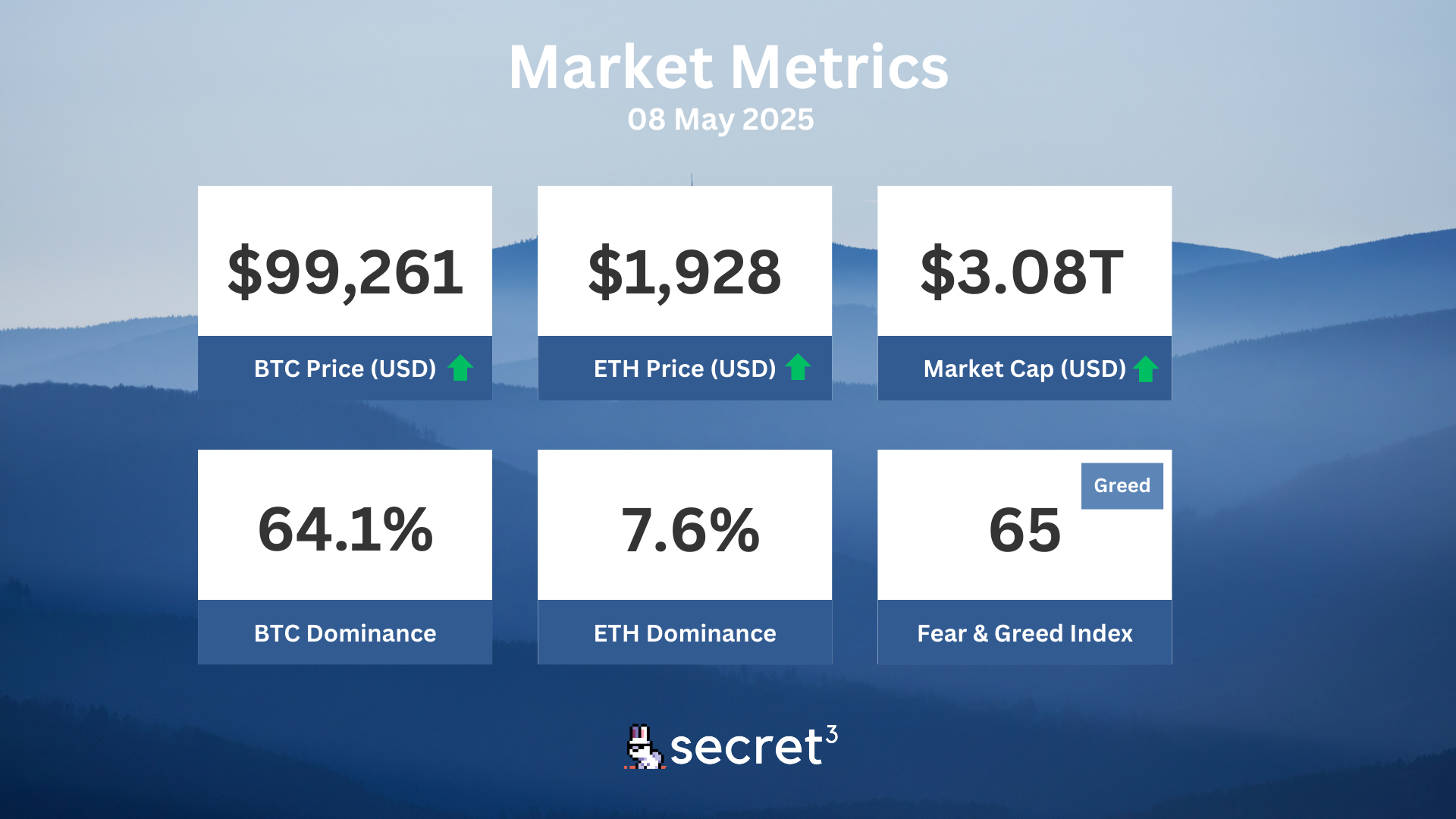

Market Metrics

Fundraising & VC

1. Litheum (Undisclosed, $750K) - Layer-1 blockchain platform

2. BVNK (Strategic, Undisclosed) - Stablecoin payments infrastructure

Regulatory

🚫 House Democrats Walk Out on Digital Assets Hearing Over Trump's Crypto

- Democrats staged a walkout during a digital assets hearing to protest President Trump's involvement in the cryptocurrency sector.

- They sought to add language preventing the president from profiting from crypto ventures while in office, citing corruption concerns.

🔍 Senator Launches Investigation into Trump's Crypto Ventures

- Democratic Senator Richard Blumenthal initiated an investigation into President Trump's cryptocurrency ventures.

- Concerns were raised about potential violations of federal laws and unethical "pay-to-play" schemes involving the Trump meme coin.

💰 Arizona Governor Signs Law for State to Keep Unclaimed Crypto

- Arizona enacted a law allowing the state to claim ownership of digital assets abandoned for over three years.

- The legislation enables the establishment of a "Bitcoin Reserve Fund" without using taxpayer money.

🌎 G7 Summit to Discuss North Korea's Crypto Hacks

- The upcoming G7 summit is set to address North Korea's growing cyber threats and cryptocurrency thefts.

- North Korean hacking groups have stolen billions in cryptocurrency, posing significant concerns for global security.

📈 Fed Holds Rates Steady Amid Rising Unemployment and Inflation Risks

- The Federal Reserve kept interest rates unchanged, citing increased risks of higher unemployment and inflation.

- This decision reflects the Fed's cautious stance and ongoing assessment of economic conditions, impacting crypto markets.

Technical Analysis

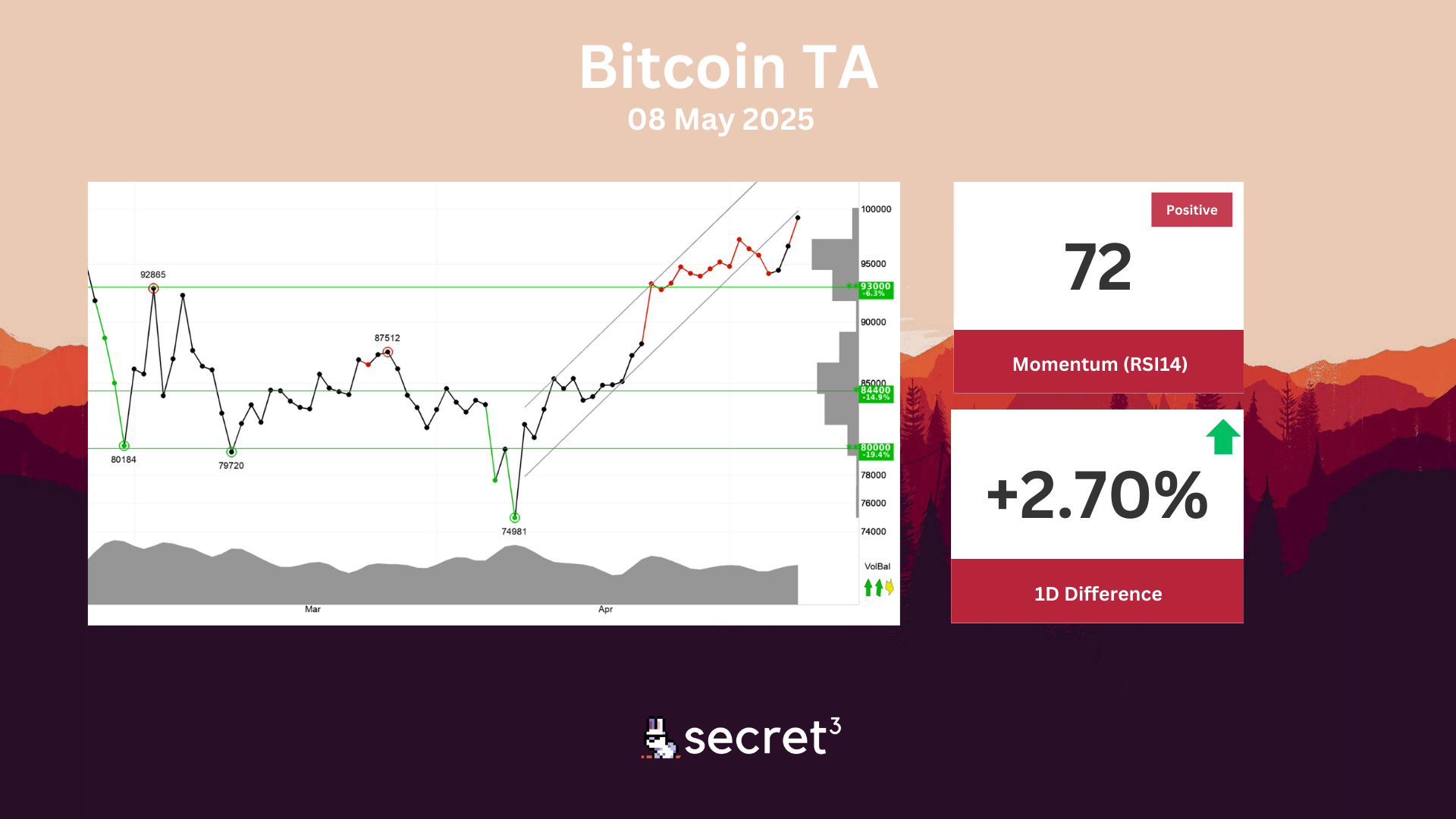

Bitcoin - Bitcoin has broken through the floor of a rising trend channel in the short term. This indicates a slower rising rate at first, or the start of a more horizontal development. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 93000 points. Positive volume balance indicates that buyers are aggressive while sellers are passive, and strengthens the currency. RSI above 70 shows that the currency has strong positive momentum in the short term. Investors have steadily paid more to buy the currency, which indicates increasing optimism and that the price will continue to rise. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically positive for the short term.

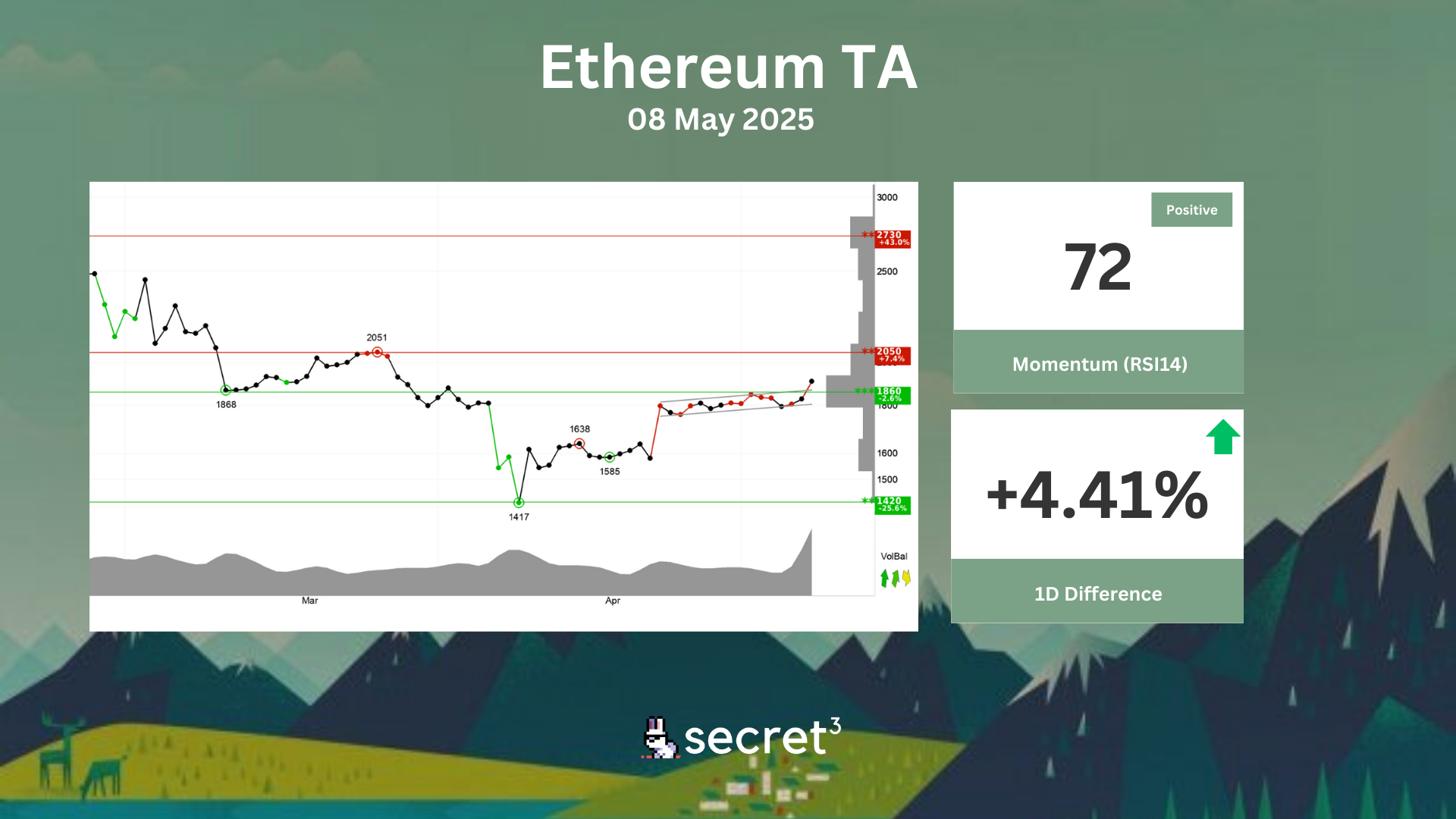

Ethereum - Ethereum has broken up from an approximate horizontal trend channel in the short term. This signals a continued strong development, and the currency now meets support on possible reactions down towards the ceiling of the trend channel. The currency is between support at points 1860 and resistance at points 2050. A definitive break through of one of these levels predicts the new direction. The short term momentum of the currency is strongly positive, with RSI above 70. This indicates increasing optimism among investors and further price increase for Ethereum. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically positive for the short term.