gm 08/04

Summary

gm, Bitcoin experienced a sharp decline, falling to a low of $74,500 before rebounding to around $79,825, while other major cryptocurrencies like Ethereum and XRP saw even steeper drops. The market turmoil led to over $1.4 billion in liquidations across crypto positions. Despite the downturn, some positive developments emerged, including Galaxy Digital receiving SEC approval for a Nasdaq listing and former Binance CEO Changpeng Zhao being appointed as an adviser to Pakistan's new Crypto Council. The Bitcoin network also reached a milestone with its hashrate surpassing 1 zetahash per second, highlighting the ongoing growth in mining activity.

News Headlines

🌐 RWA News: Tokenized Real-World Assets Could Reach $18.9T by 2033

- A report by Ripple and BCG projects the market for tokenized assets, including stablecoins, to reach $18.9 trillion by 2033.

- The growth signifies a compound annual growth rate of approximately 53%, with projections ranging from $12 trillion to $23.4 trillion.

🔒 Bitcoin Developer Proposes Protocol to Combat Quantum Computing Threat

- Bitcoin developer Agustin Cruz has proposed a Quantum-Resistant Address Migration Protocol (QRAMP) to protect Bitcoin from potential quantum computer attacks.

- The protocol mandates users to migrate funds from traditional ECDSA addresses to new quantum-resistant ones.

📉 Ethereum Price Falls to 2-Year Low, But Pro Traders Remain Optimistic

- Ethereum's price dropped to $1,410, its lowest level since March 2023, resulting in over $370 million in leveraged ETH futures liquidations.

- Despite the decline, professional traders show optimism based on Ethereum's on-chain metrics, with the 30-day futures premium improving to 4%.

🏦 Tether Considering Development of U.S.-Only Stablecoin Under New Regulations

- Tether is exploring the creation of a stablecoin exclusive to the U.S. market in response to new regulations.

- This initiative aims to align with emerging regulatory frameworks governing stablecoins within the United States.

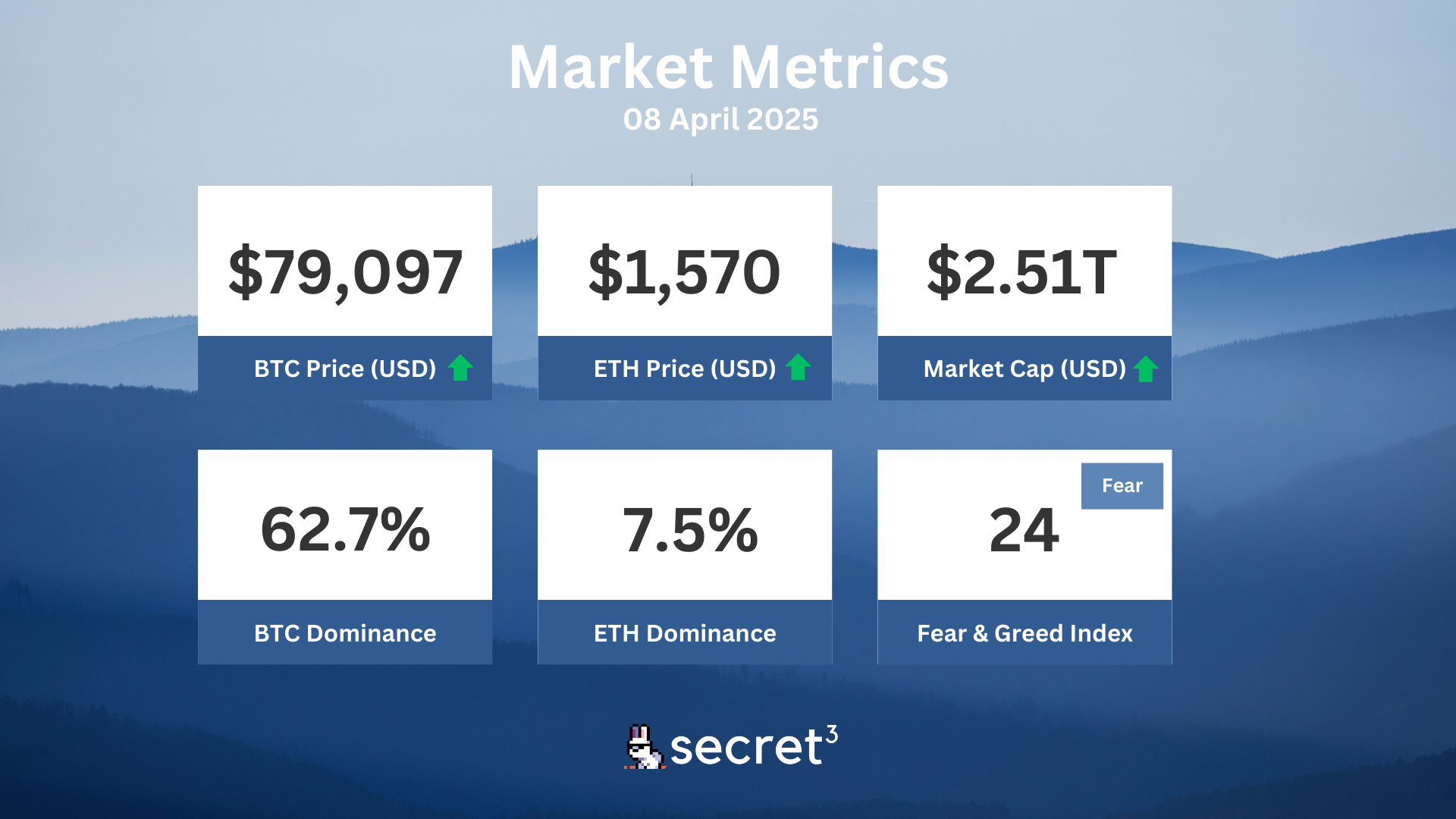

Market Metrics

Fundraising & VC

1. CAP Labs (Seed, $8M) - Stablecoin engine that outsource yield generation

2. P2P.me (Seed, $2M) - DeFi platform for on-chain FIAT/USDC swaps

3. Libraro (Extended Seed, $1M) - Publishing platform that utilizes Web3 technology

Regulatory

🏛️ Hong Kong Introduces Crypto Staking Rules

- Hong Kong's SFC now allows licensed platforms to offer staking services, bolstering its position as a crypto hub.

- Firms must secure custody of staked assets and comply with SFC regulations, including risk disclosure.

💼 US Agencies to Report Crypto Holdings

- US federal agencies must disclose their cryptocurrency holdings to the Treasury by April 7, 2025.

- This follows an executive order to establish a Strategic Bitcoin Reserve containing seized BTC from federal agencies.

🔍 Lawyer Sues DHS Over Alleged Satoshi Meeting

- Crypto lawyer James Murphy is suing the US Department of Homeland Security to uncover information about an alleged meeting with Bitcoin's creator.

- The lawsuit seeks documents related to claims that DHS officials met with individuals involved in Bitcoin's creation.

⚖️ Nigerian Court Postpones Binance Tax Case

- A Nigerian court has adjourned the $81.5 billion tax evasion case against Binance to April 30, 2025.

- Binance is challenging the legal service of documents, highlighting jurisdictional issues as it has no physical presence in Nigeria.

🏦 SEC to Host Crypto Trading Roundtable

- The SEC will hold a roundtable on April 11 with executives from Uniswap, Coinbase, and other major crypto firms.

- Discussions will focus on tailoring regulations for crypto trading as part of the "Spring Sprint Toward Crypto Clarity" initiative.

Technical Analysis

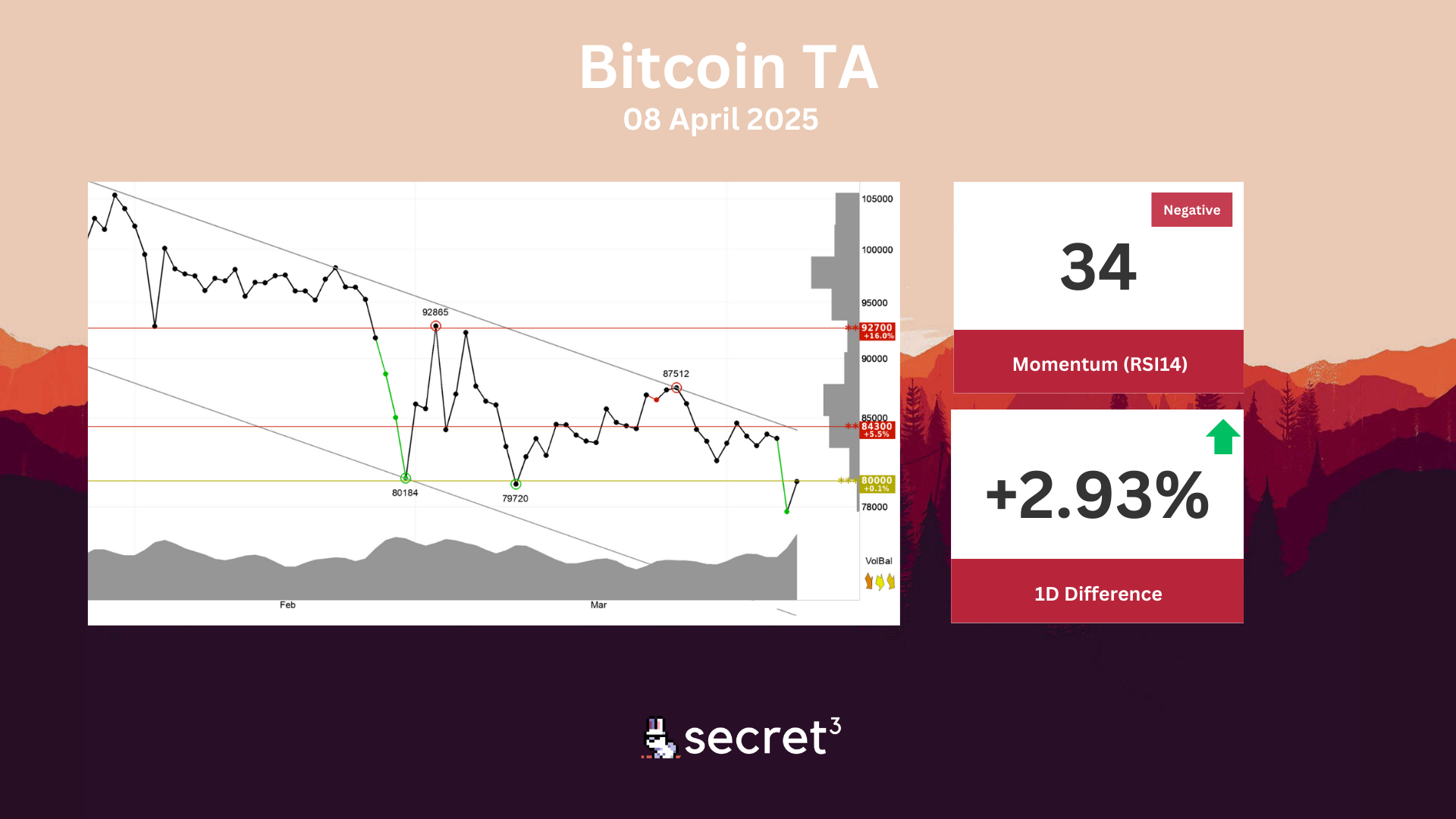

Bitcoin - Investors have accepted lower prices over time to get out of Bitcoin and the currency is in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. The currency is testing resistance at points 80000. This could give a negative reaction, but an upward breakthrough of points 80000 means a positive signal. The RSI curve shows a falling trend, which supports the negative trend. The currency is overall assessed as technically negative for the short term.

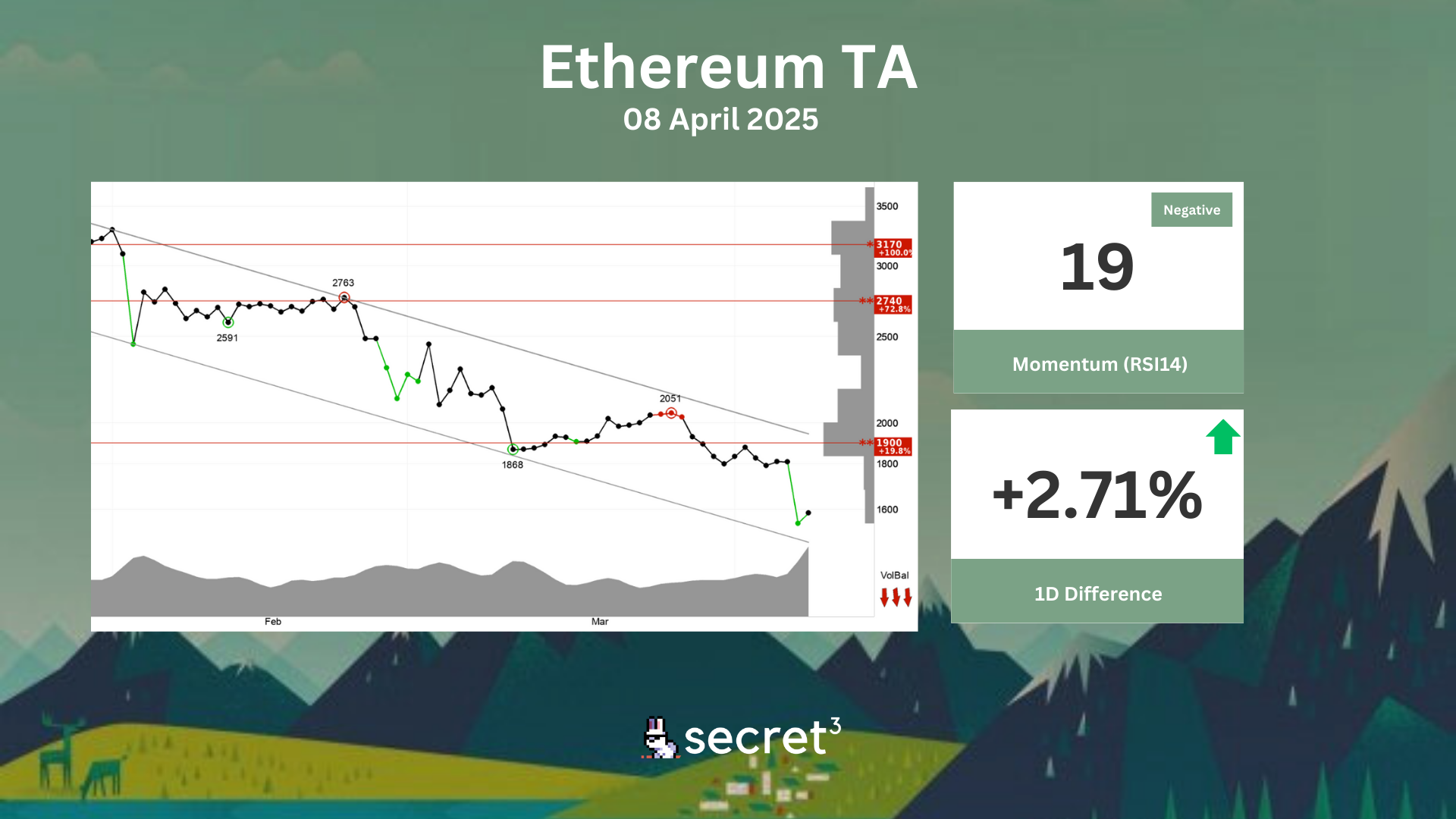

Ethereum - Ethereum shows weak development in a falling trend channel in the short term. This signals increasing pessimism among investors and indicates further decline for Ethereum. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 1900 points. Negative volume balance shows that volume is higher on days with falling prices than days with rising prices. This indicates decreasing optimism among investors. The short term momentum of the currency is strongly negative, with RSI below 30. This indicates increasing pessimism among investors and further decline for Ethereum. However, particularly in big stocks, low RSI may be a sign that the stock is oversold and that there is a chance for a reaction upwards. The currency is overall assessed as technically negative for the short term.