gm 08/03

Summary

gm, President Donald Trump signs an executive order to establish a Strategic Bitcoin Reserve and a Digital Asset Stockpile. This move, aimed at integrating Bitcoin into the US financial system, initially caused market volatility with Bitcoin dropping to around $85,000 before rebounding. The reserve will consist of Bitcoin forfeited from government criminal cases, signaling a shift in how Bitcoin is viewed among financial assets. Additionally, the Texas Senate passed a bill to create a state-level Bitcoin strategic reserve, further emphasizing the growing importance of digital currencies. Despite initial market reactions, analysts view this as a significant step towards legitimizing Bitcoin and potentially inspiring other nations to follow suit.

News Headlines

💼 Coinbase Plans 1,000 New US Hires in 2025

- Coinbase CEO Brian Armstrong announced plans to hire 1,000 US-based employees in 2025.

- The expansion is attributed to President Trump's pro-crypto policies and a favorable regulatory environment.

🚀 Kraken Eyes 2026 IPO as Regulatory Climate Improves

- Crypto exchange Kraken is considering an initial public offering (IPO) by Q1 2026.

- The move is prompted by a more favorable regulatory environment in the US.

💱 US to Leverage Stablecoins for Dollar Hegemony

- Treasury Secretary Scott Bessent announced plans to use stablecoins to maintain the dollar's global reserve currency status.

- The government aims to create a regulatory framework for stablecoins and support overcollateralized stablecoins backed by US Treasury bills.

📈 Analysts Predict Limited Bitcoin Upside After Reserve News

- Analysts express caution about significant Bitcoin price increases following the Strategic Bitcoin Reserve announcement.

- The plan's lack of new government Bitcoin purchases has disappointed many investors.

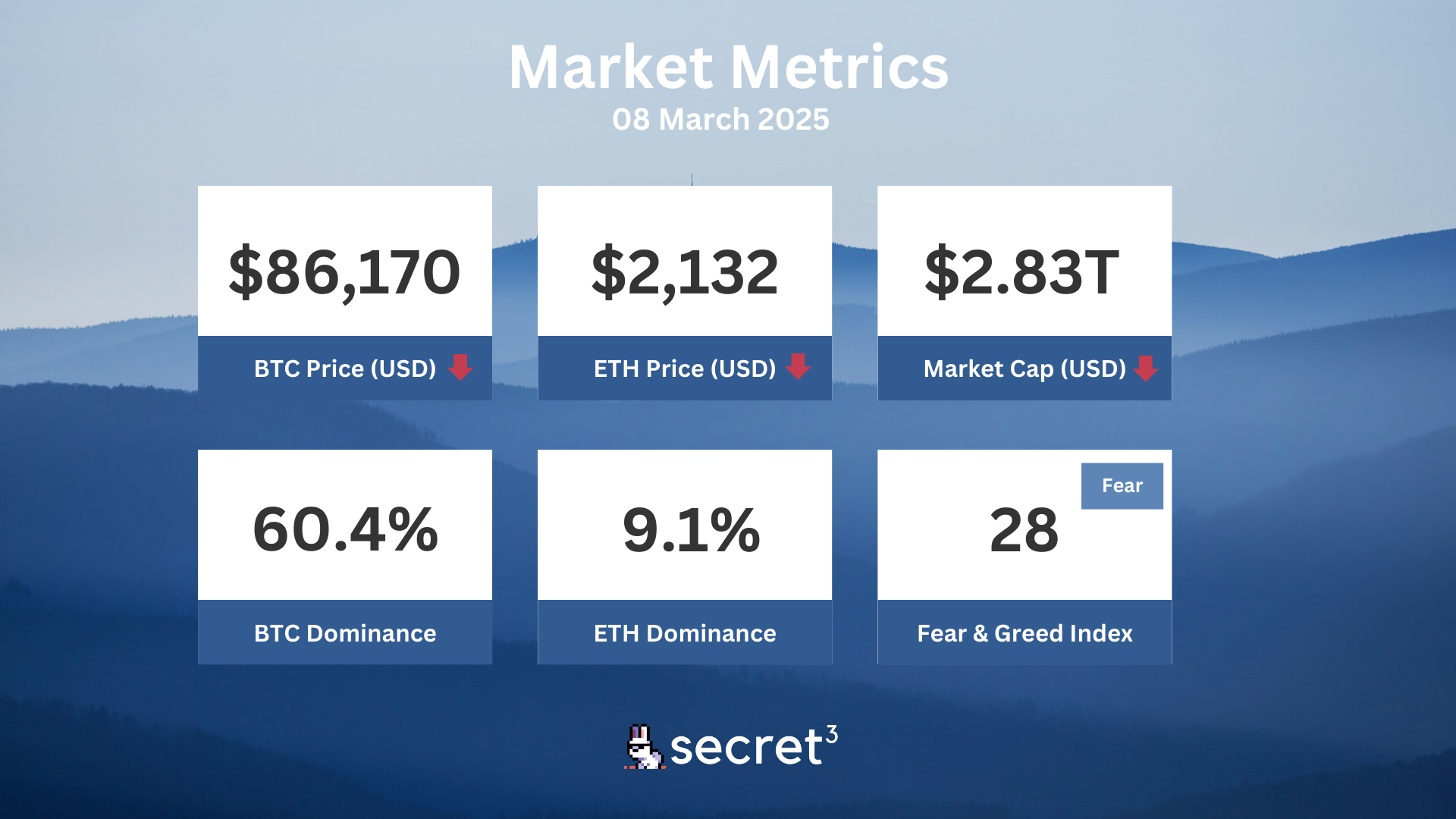

Market Metrics

Fundraising & VC

1. Validation Cloud (Series A, $15M) - Web3 infrastructure platform

2. August (Series A, $10M) - Institutional grade platform for crypto

3. Galaxis (Strategic, $5M) - DeSci & smart certificate solutions

On-chain Data

1. Core DAO (CORE) token unlocked today ($4.13M, 0.91%)

2. CoW Protocol (COW) token unlocked today ($2.68M, 2.29%)

3. Maverick Protocol (MAV) token unlock in 1 day ($1.19M, 3.1%)

4. Aptos (APT) token unlock in 4 days ($68.95M, 1.92%)

5. Sei Network (SEI) token unlock in 7 days ($48.82M, 4.72%)

Regulatory

🚫 Trump Vows to End "Operation Chokepoint 2.0"

- President Trump promised to end "Operation Chokepoint 2.0," which had limited crypto firms' access to traditional banking services.

- The OCC relaxed guidelines for banks engaging in cryptocurrency activities, reducing regulatory burden.

🏦 OCC Allows Banks to Engage in Crypto Custody and Stablecoin Activities

- The OCC announced that federally regulated banks can now provide crypto custody and conduct certain stablecoin activities without prior approval.

- This decision marks a significant shift in the regulatory stance on banks' involvement in the crypto industry.

🔍 Senator Warren Demands Financial Disclosures from Trump's Crypto Czar

- Senator Elizabeth Warren requested financial disclosures from David Sacks, the White House AI and Crypto Czar.

- Warren expressed concerns about potential conflicts of interest in overseeing digital asset policies.

💼 Japan's LDP Proposes Reducing Crypto Tax to 20%

- Japan's ruling Liberal Democratic Party proposed cutting the tax rate on crypto gains from 55% to 20%.

- The plan aims to reclassify cryptocurrency as a distinct asset class under the Financial Instruments and Exchange Act.

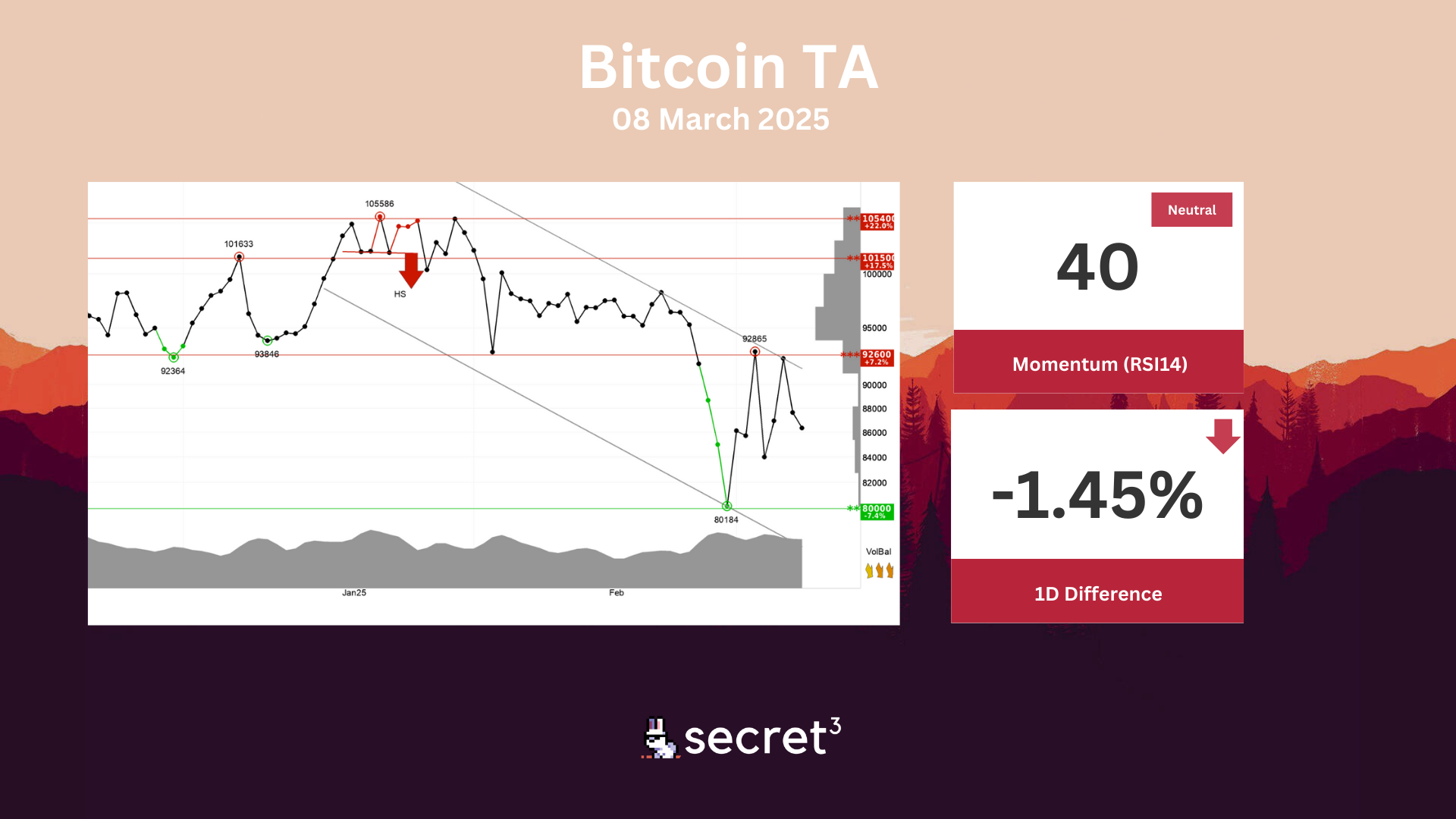

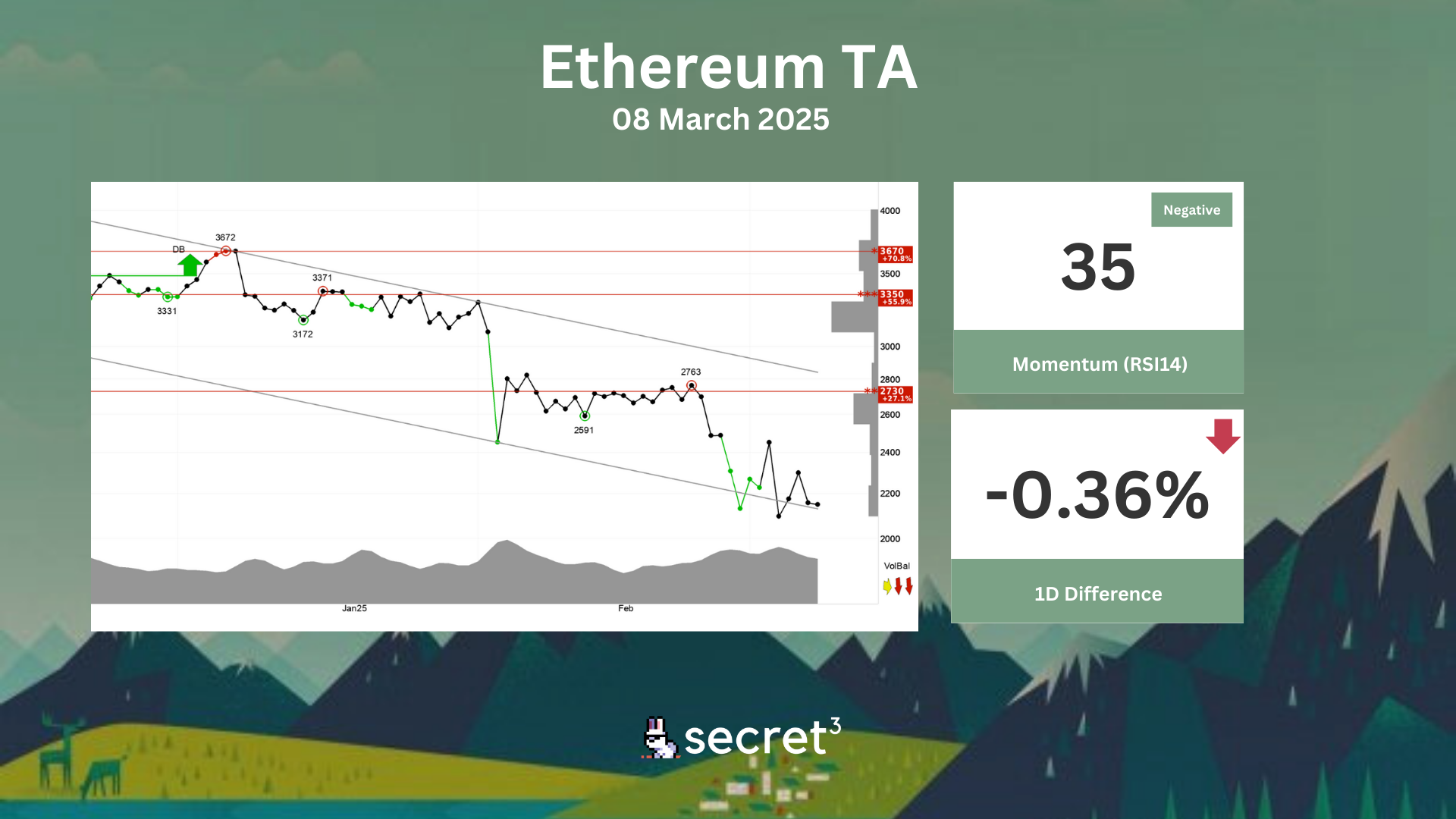

Technical Analysis

Bitcoin - Bitcoin is in a falling trend channel in the short term. This signals increasing pessimism among investors and indicates further decline for Bitcoin. The currency has support at points 80000 and resistance at points 92600. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. This confirms the trend. The currency is overall assessed as technically negative for the short term.

Ethereum - Ethereum is in a falling trend channel in the short term. This signals increasing pessimism among investors and indicates further decline for Ethereum. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 2730 points. Negative volume balance shows that volume is higher on days with falling prices than days with rising prices. This indicates decreasing optimism among investors. The currency is overall assessed as technically negative for the short term.

Governance & Code

⚙️ Frax DAO | WTGXX as Reserve Asset for Frax USD (Preliminary Discussion)

- This proposal seeks to integrate the WisdomTree Government Money Market Digital Fund (WTGXX) as a reserve backing asset for Frax USD.

💧 Lido DAO | Lido Labs BORG Grant Funding Request (Preliminary Discussion)

- This proposal requests $34.9 million in funding for the Lido Labs BORG through the end of 2025 to support protocol research, development, and governance initiatives, with a focus on Lido v3 implementation.