gm 08/02

Summary

gm, Bitcoin briefly surpassed $100,000 but retreated to around $96,000 following mixed U.S. employment data, which impacted market sentiment regarding potential interest rate cuts. Ethereum and other major altcoins experienced substantial declines, with ETH dropping over 3% to $2,620. Notably, the SEC began reviewing applications for spot XRP and Solana ETFs, signaling a potential shift in regulatory approach. Meanwhile, several U.S. states, including Utah and Florida, advanced legislation to establish Bitcoin reserves, reflecting growing institutional interest in cryptocurrencies.

News Headlines

💼 BlackRock Increases Stake in Strategy (formerly MicroStrategy) to 5%

- BlackRock has increased its stake in Strategy (formerly MicroStrategy) to 5%, reflecting growing institutional interest in Bitcoin exposure.

- Strategy is the largest corporate holder of Bitcoin, possessing 471,107 BTC valued at approximately $48 billion.

🌊 Crypto Market Experiences $10 Billion in Liquidations Amid Global Trade Concerns

- Over $10 billion in crypto liquidations occurred in 24 hours on February 3, 2025, driven by global trade war concerns.

- Bybit's CEO estimated actual liquidations could be as high as $10 billion, with the platform alone accounting for $2.1 billion.

🌐 XRP and Solana Race Toward Next Crypto ETF Approval

- XRP and Solana are competing for spot ETF approval, with XRP currently favored at 85% approval chance in 2025 compared to Solana's 80%.

- Solana's network activity and recent applications set an October deadline for a decision, while XRP benefits from a partial legal victory against the SEC.

⚖️ Coinbase to Face Lawsuit Over Unregistered Securities Sales

- A U.S. federal judge ruled that Coinbase must face allegations from investors that it sold unregistered securities, specifically 79 cryptocurrencies.

- Judge Paul Engelmayer rejected Coinbase's claim that it did not qualify as a 'statutory seller' under federal law.

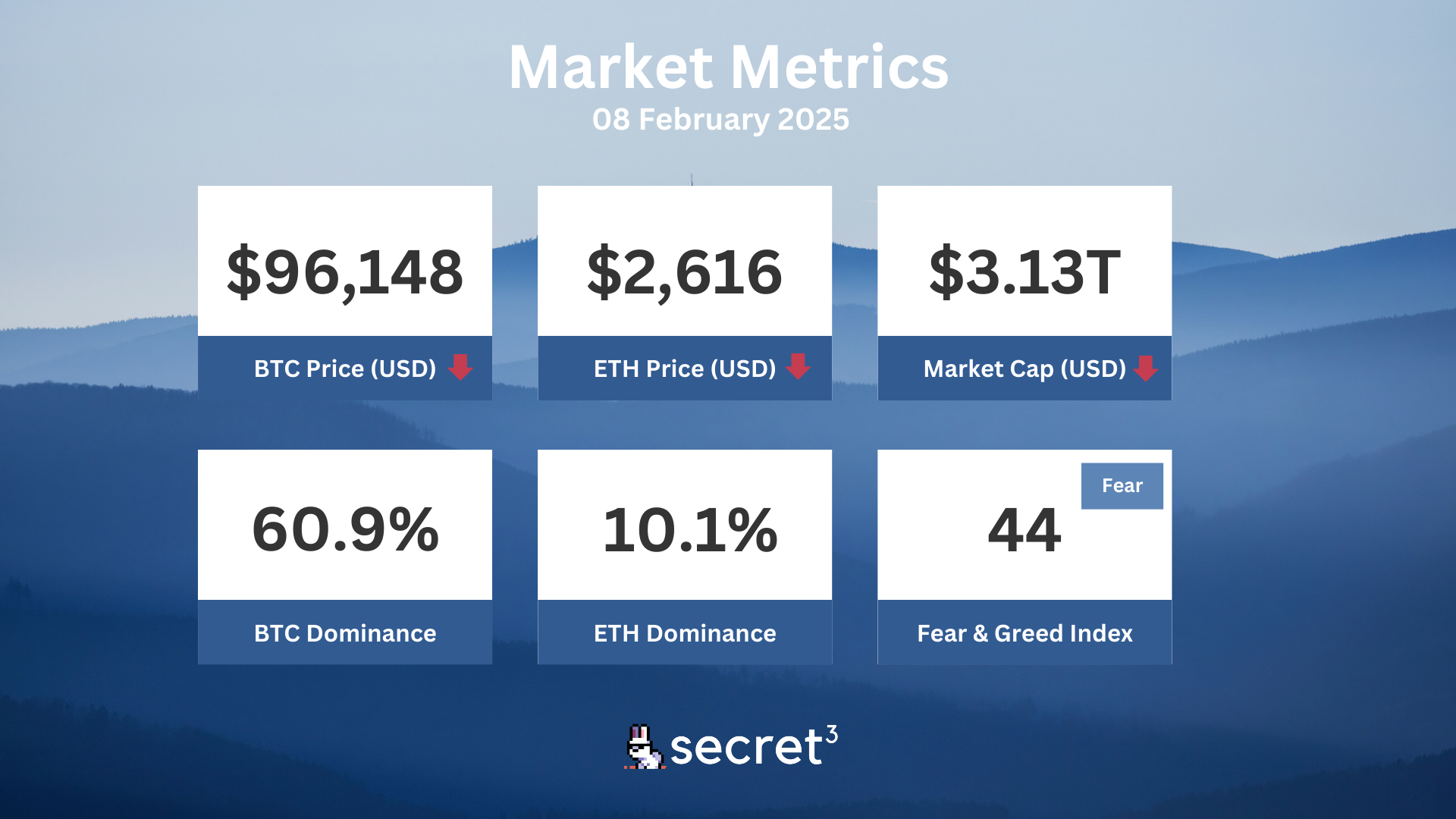

Market Metrics

Fundraising & VC

1. Fragmetric (Seed, $7M) - Liquid restaking protocol on Solana

2. Prodigy.Fi (Seed, $5M) - Decentralized yield and on-chain dual investment trading

3. Metya (Strategic, Undisclosed) - Web3-based dating platform

On-chain Data

1. CoW Protocol (COW) token unlocked today ($3.48M, 2.87%)

2. Core DAO (CORE) token unlocked today ($4.71M, 0.96%)

3. Maverick Protocol (MAV) token unlock in 1 day ($1.28M, 3.1%)

4. Aptos (APT) token unlock in 4 days ($63.06M, 1.97%)

Regulatory

🏛️ US Lawmakers Propose Stablecoin Bill to Boost Dollar Dominance

- Representatives French Hill and Bryan Steil introduced a discussion draft for a bill to create a regulatory framework for dollar-pegged stablecoins.

- The proposed legislation includes a two-year moratorium on endogenously collateralized stablecoins and mandates a study on stablecoins by the US Treasury.

🌐 CFTC Announces Crypto Industry Forum for Digital Asset Pilot Program

- The CFTC launched a forum for crypto industry CEOs to discuss an upcoming digital asset pilot program focusing on 'tokenized non-cash collateral,' including stablecoins.

- Key industry leaders from firms like Circle, Coinbase, Crypto.com, and Ripple are expected to participate.

🌐 Japan Orders Removal of Unregistered Crypto Exchange Apps

- Japan's Financial Services Agency requested Apple and Google to suspend downloads of five unregistered cryptocurrency exchanges, including Bybit and KuCoin.

- This action reflects Japan's proactive stance on digital asset regulation and aims to protect investors and maintain market integrity.

⚖️ Tornado Cash Developer Released Pending Appeal

- Alexey Pertsev, a developer of Tornado Cash, was released from prison custody on February 7 to prepare his appeal against a money laundering conviction.

- Pertsev's case has garnered attention from privacy advocates concerned about the implications for privacy-preserving technologies.

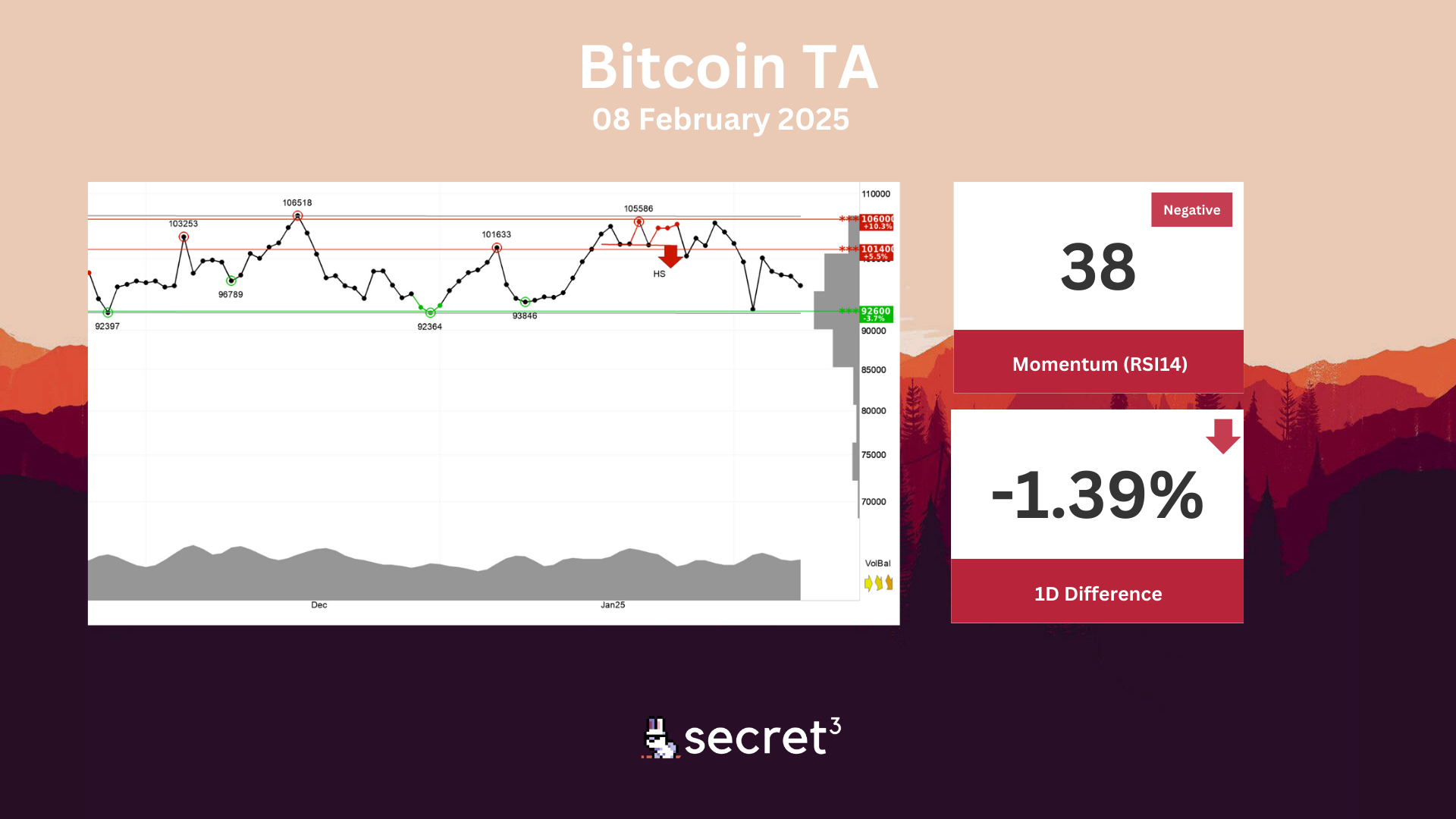

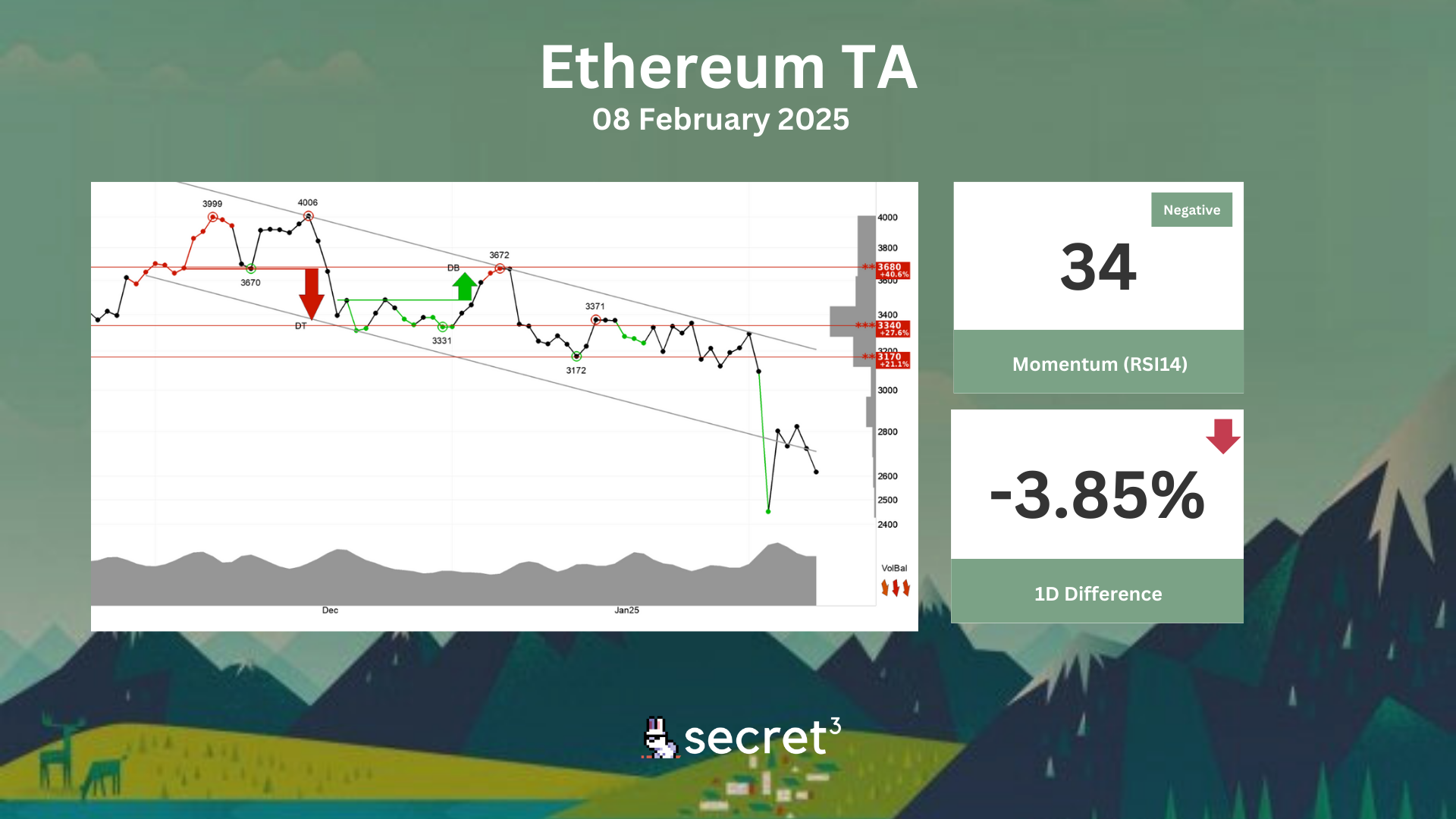

Technical Analysis

Bitcoin - Bitcoin is within an approximate horizontal trend channel in the short term, which indicates further development in the same direction. The currency has support at points 92600 and resistance at points 101400. Volume has previously been low at price tops and high at price bottoms. This weakens the currency and indicates increased chance of a break down. The currency is overall assessed as technically slightly negative for the short term.

Ethereum - Ethereum has broken down through the floor of the falling trend channel in the short term, which signals an even stronger falling rate. The negative development, however, may give rise to short term corrections up from today's level. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 3170 points. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.

Governance & Code

🔮 Osmosis DAO | Monthly BTC Purchase: January 2025 (901) (Active Vote)

- This proposal seeks to follow Proposal 881 to acquire roughly 1.4 BTC for the month of January 2025.

☁️ Sky DAO | Increase PSM3 Rate Limits (Preliminary Discussion)

- This proposal recommends increasing the PSM3 deposit and withdrawal limits to accommodate growing demand on Base.