gm 07/06

Summary

gm, Gemini filed a confidential S-1 with the SEC, signaling its intention to pursue its own public offering. Meanwhile, major corporations continued to enhance their Bitcoin holdings, with Strategy upsizing its preferred stock offering to $1 billion for BTC purchases and Japanese firm Metaplanet announcing plans to acquire 100,000 Bitcoin by 2026. In significant industry developments, Maple Finance expanded to the Solana ecosystem with its yield-bearing stablecoin, while Singapore's monetary authority announced stricter licensing requirements for crypto firms serving foreign clients.

News Headlines

📉 Bitcoin ETFs Experience $278M Outflow Amid Trump-Musk Feud

- U.S. Bitcoin ETFs saw $278 million in outflows as market sentiment shifted from "Greed" to "Fear" following the escalating public feud between Donald Trump and Elon Musk.

- ARK Invest led the outflows with $102 million in redemptions, while Ether ETFs maintained a 14-day inflow streak with $11.3 million in new investments on the same day.

📱 Romania's Postal Service Installs First Bitcoin ATM

- Romania's national postal service has installed its first Bitcoin ATM in Tulcea, partnering with Bitcoin Romania exchange to expand cryptocurrency access in underserved areas.

- Additional ATMs are planned for Alexandria, Piatra Neamț, Botoșani, and Nădlac, reflecting growing institutional adoption of digital assets despite global Bitcoin ownership remaining relatively limited at 14% in the U.S.

🔮 Polymarket Named Official Prediction Market for Elon Musk's X Platform

- Polymarket has launched a new tool that combines data from X and its event contracts to provide real-time insights into market movements, with xAI's Grok chatbot explaining market influences.

- This partnership aims to deliver data-driven analytical insights to millions of users worldwide, representing the first of multiple planned collaborations between the two companies.

🔒 SKALE Labs Launches FAIR, First MEV-Resistant L1 for AI and DeFi

- SKALE Labs has launched FAIR, the world's first MEV-resistant Layer 1 blockchain designed specifically for AI and DeFi applications, with Vodafone as a founding validator.

- The platform utilizes the BITE Protocol to eliminate miner extractable value at the consensus level, providing security and privacy for transactions while supporting AI-driven applications.

⚽ FIFA Launches Dedicated Blockchain Powered by Avalanche

- FIFA has launched a dedicated layer-1 blockchain using Avalanche's Subnet technology, moving away from its previous partnership with Algorand to enhance scalability and user experience.

- The new blockchain supports FIFA Collect for digital collectibles with real-world perks and FIFA Rivals, a mobile blockchain game allowing true digital ownership of in-game items as NFTs.

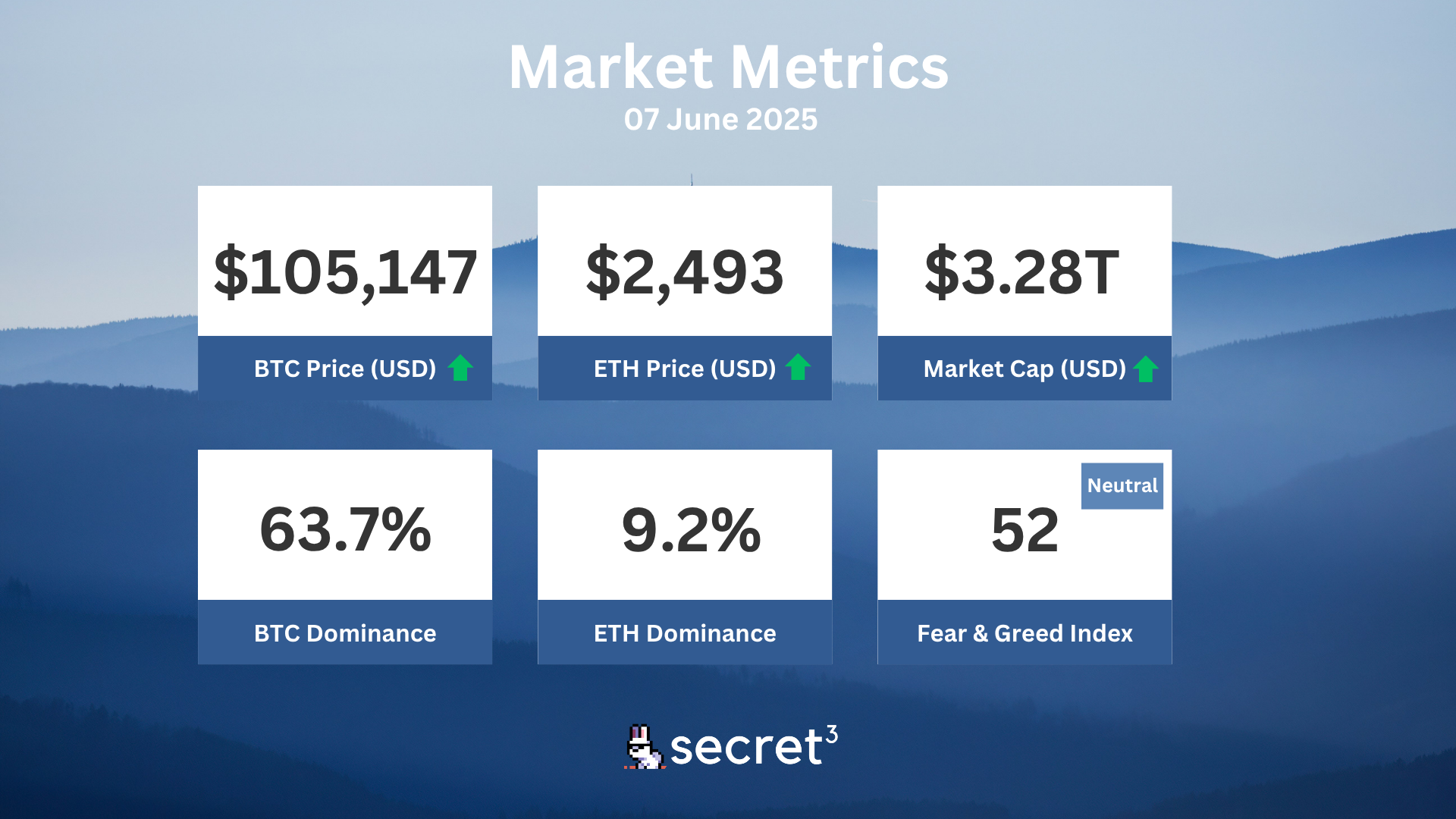

Market Metrics

Fundraising & VC

1. IOST (Strategic, $21M) - Multi-chain infra for RWA

2. Reveel (Strategic, Undisclosed) - AI-native stablecoins payments

Regulatory

🏛️ House Democrats Challenge CLARITY Act's Regulatory Framework

- Democratic lawmakers have expressed concerns about the CLARITY Act, warning it creates loopholes that could allow financial institutions to evade regulations by adopting blockchain technology.

- Critics argue the bill's exemptions from SEC oversight could incentivize firms to bypass securities laws by categorizing assets as "digital commodities," potentially undermining investor protections.

⚖️ UK Lifts Ban on Crypto ETNs for Retail Investors

- The UK's Financial Conduct Authority (FCA) has proposed ending its prohibition on cryptocurrency exchange-traded notes (ETNs) for retail investors, allowing individuals access to crypto ETNs listed on FCA-recognized exchanges.

- This regulatory shift aligns with the UK's broader strategy to position itself as a prominent player in the crypto sector while maintaining consumer protection through appropriate risk warnings.

💰 Switzerland to Share Crypto Tax Data with 74 Nations

- Switzerland has approved a bill enabling automatic sharing of cryptocurrency tax information with 74 partner countries, including all EU members and the UK, set to begin in 2027.

- The measure excludes the United States, Saudi Arabia, and China, and includes provisions requiring partner countries to comply with AEOI standards before data exchange occurs.

🌐 EU Preparing to Regulate DeFi in 2026 as MiCA Leaves Gaps

- European lawmakers are developing regulations for decentralized finance (DeFi) to address gaps in the existing Markets in Crypto-Assets (MiCA) framework, which currently leaves DeFi protocols in regulatory limbo.

- While MiCA indicates fully decentralized crypto-asset services may be exempt from certain regulations, questions remain about how decentralization will be defined and measured by authorities.

🔍 DOJ Seeks $7.7M in Crypto Linked to North Korean IT Worker Scheme

- The US Department of Justice has filed to seize $7.74 million in cryptocurrency allegedly obtained by North Korean IT workers who used fake identities to work remotely for blockchain companies.

- The funds, frozen in April 2023, were allegedly part of a sophisticated laundering operation using techniques like chain hopping and token swapping to move money back to the North Korean regime.

Technical Analysis

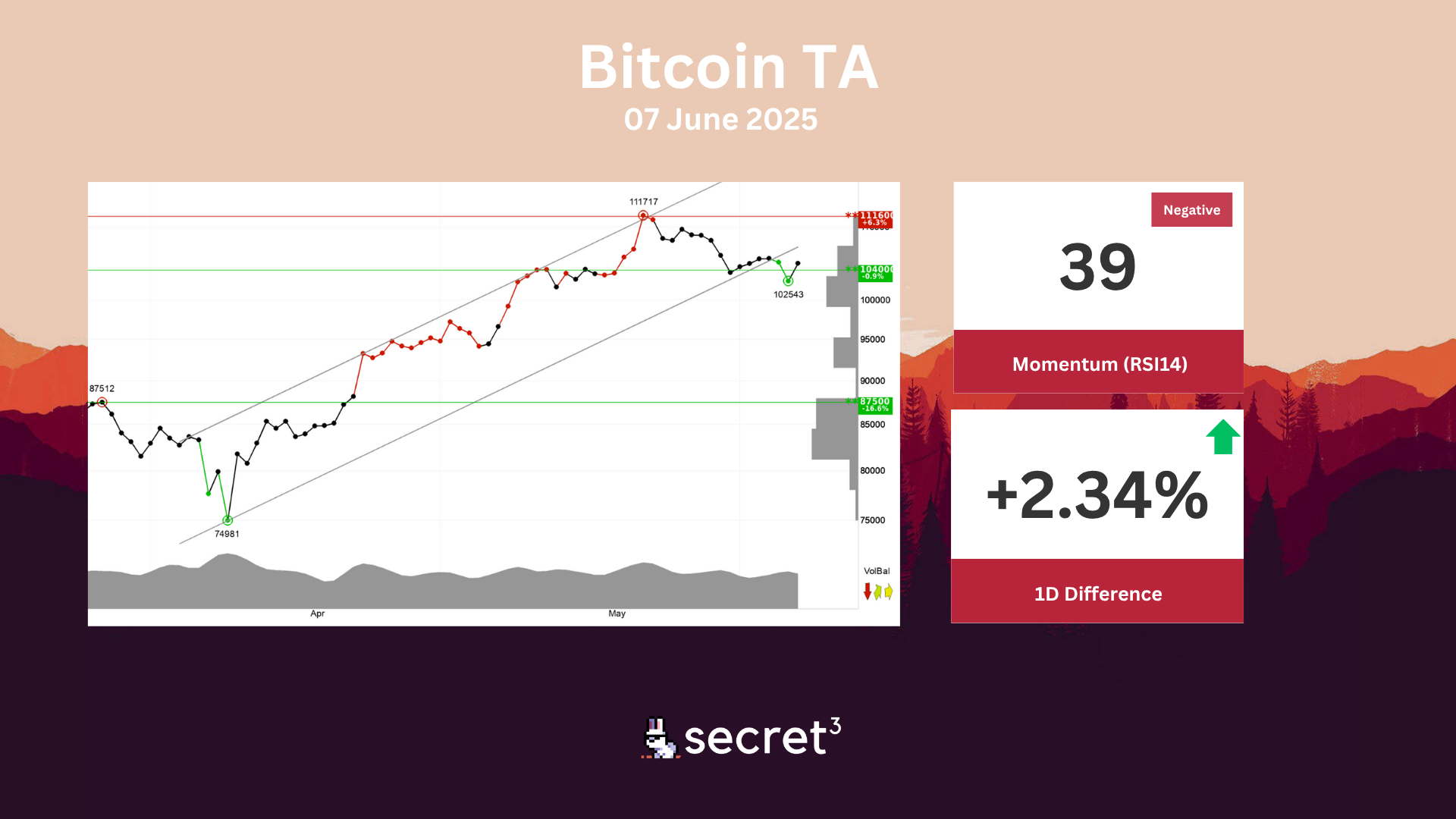

Bitcoin - Bitcoin has broken the floor of the rising trend channel in the short term, which indicates a weaker initial rising rate. The currency is testing support at points 104000. This could give a positive reaction, but a downward breakthrough of points 104000 means a negative signal. RSI diverges negatively against the price, which indicates danger of a reaction downwards. The currency is overall assessed as technically slightly positive for the short term.

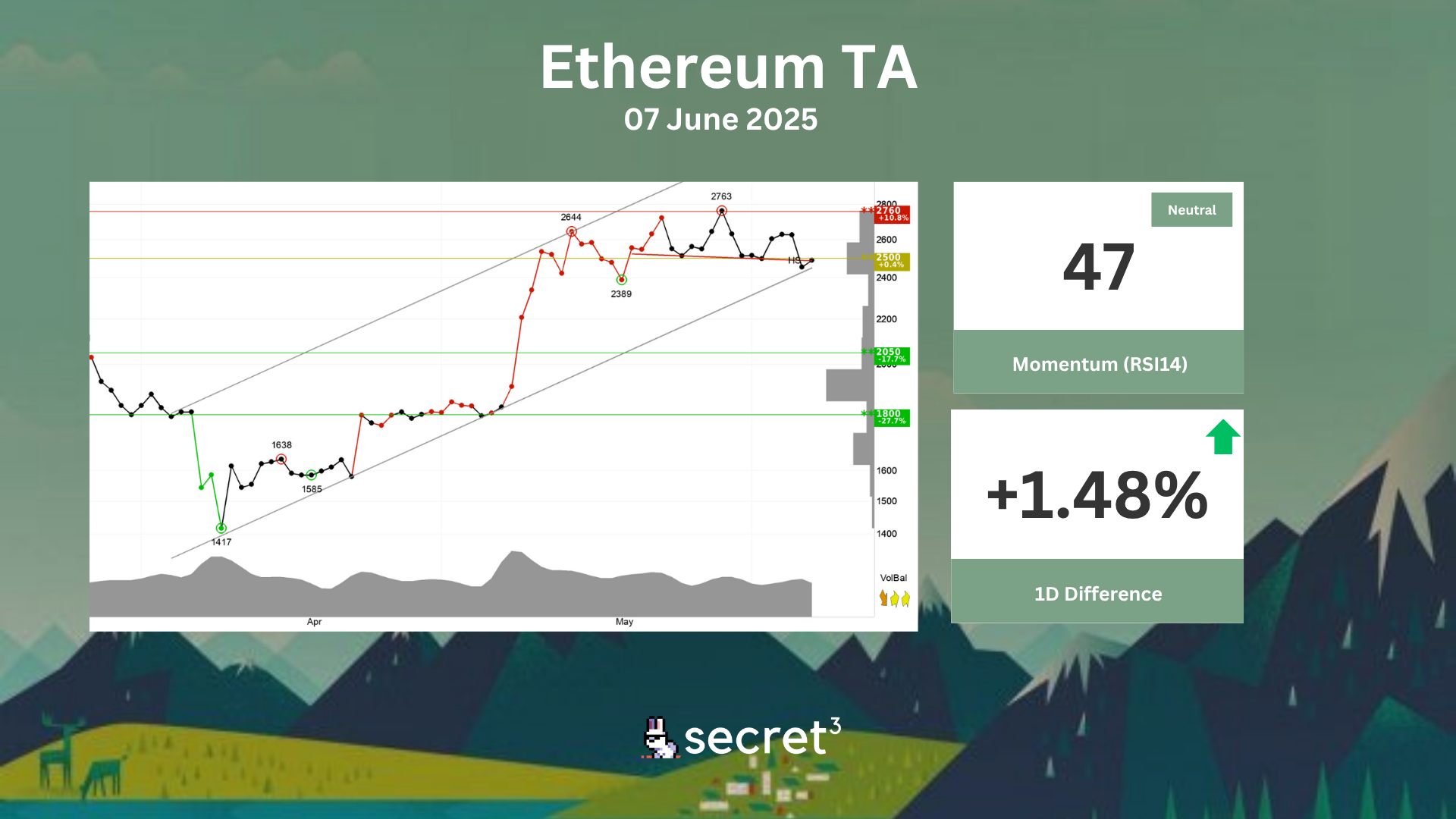

Ethereum - Investors have paid higher prices over time to buy Ethereum and the currency is in a rising trend channel in the short term. Rising trends indicate that the currency experiences positive development and that buy interest among investors is increasing. A head and shoulders formation is under development. A decisive break of the support at 2488, ideally with an increase in volume, signals a further fall. The currency is testing resistance at points 2500. This could give a negative reaction, but an upward breakthrough of points 2500 means a positive signal. Volume tops and volume bottoms correspond well with tops and bottoms in the price. This strengthens the trend. The currency is overall assessed as technically slightly positive for the short term.