gm 07/05

Summary

gm, Bitcoin surged past $97,000, driven by optimism surrounding US-China trade negotiations and continued institutional interest. Meanwhile, New Hampshire became the first U.S. state to legalize cryptocurrency investments for its treasury, potentially setting a precedent for other states. On the regulatory front, a planned House hearing on crypto legislation was derailed due to concerns over potential conflicts of interest related to former President Trump's cryptocurrency ventures, highlighting the ongoing challenges in establishing a comprehensive regulatory framework for digital assets.

News Headlines

📊 BlackRock Bitcoin ETF Sees 16 Days of Inflows as BTC Reclaims $97K

- BlackRock's iShares Bitcoin Trust has experienced 16 consecutive days of inflows, totaling approximately $4.7 billion since early April.

- The ETF added nearly $36 million on May 6, coinciding with Bitcoin's surge to $97,000.

🔮 Binance's BNB Token Could Quadruple in Price by 2028: Standard Chartered

- Standard Chartered projects BNB could rise to approximately $2,775 by the end of 2028, a 360% increase from its current price.

- BNB has been trading similarly to Bitcoin and Ethereum since May 2021, showing consistent returns and volatility.

🏦 Citi and SDX Partner to Tokenize Pre-IPO Shares Market in Q3

- Citigroup is collaborating with Switzerland's SDX to tokenize and custody shares of late-stage, pre-IPO companies.

- This initiative aims to simplify liquidity management for early investors and enhance ownership tracking of company shares.

🤖 Coinbase Launches x402 Payments Protocol for AI Agent Autonomy

- Coinbase introduced the x402 protocol, enabling instant stablecoin transfers using standard HTTP communication.

- The protocol aims to allow seamless transactions for APIs, apps, and AI agents, enhancing automation in the internet economy.

🌐 Solana's Software Underpins Multiple Layer-1 Blockchains

- Several layer-1 blockchains are now using Solana's technology as their foundation, including Fogo, Pythnet, and Solayer.

- JupNet, an ambitious project from Jupiter, aims to aggregate decentralized transactions across multiple chains.

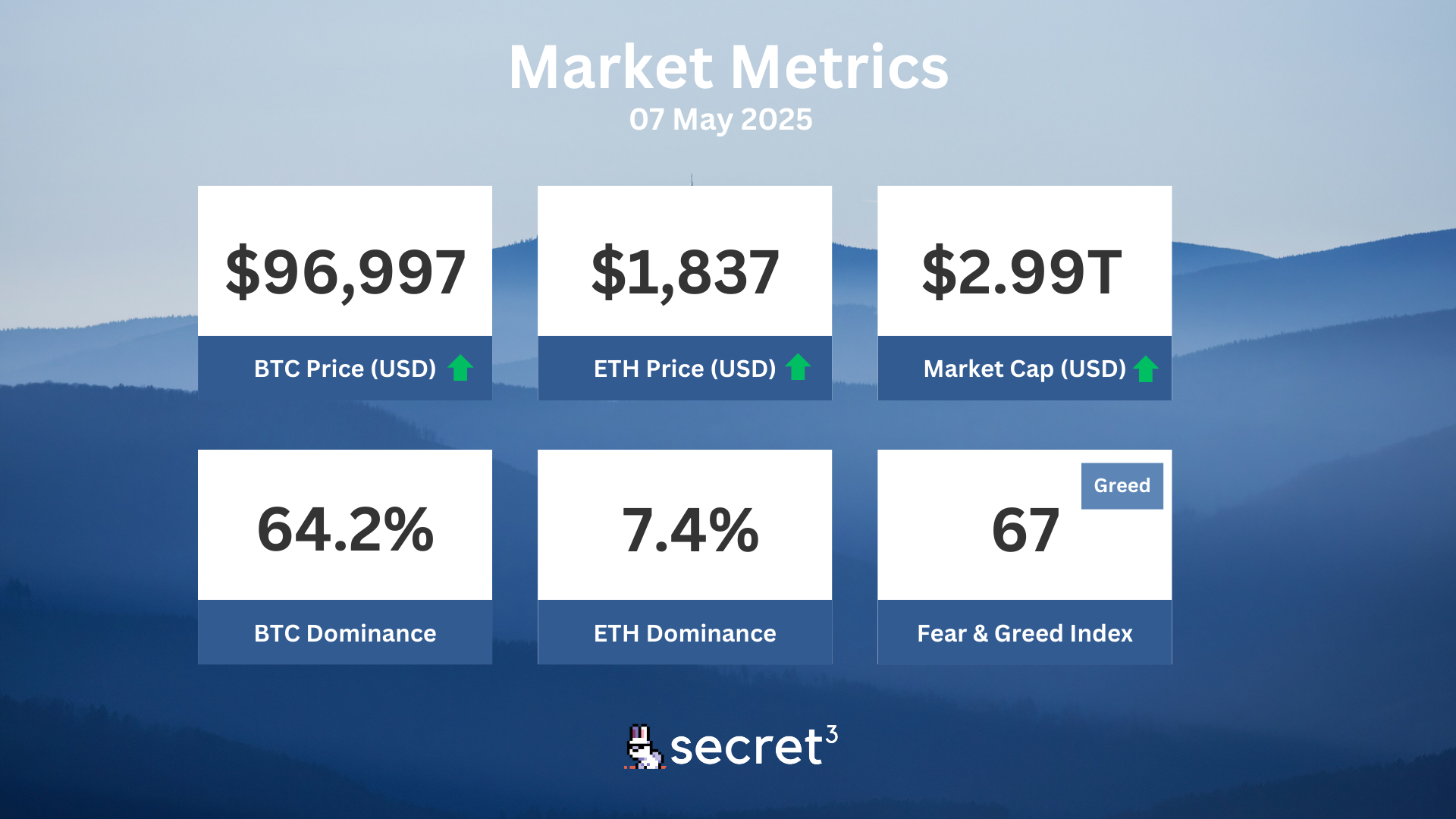

Market Metrics

Fundraising & VC

1. eToro (IPO, $500M) - Online trading platform

2. Sentora (Series A, $25M) - Institutional DeFi layer

3. DogeOS (Undisclosed, $6.9M) - App layer for Dogecoin

Regulatory

💰 UK Rules Out National Crypto Reserve

- UK Economic Secretary Emma Reynolds stated that establishing a national cryptocurrency reserve is "not the plan for us."

- The UK is looking to collaborate with the US on digital assets regulation but won't duplicate the EU's approach.

🚨 CFTC Drops Appeal in Kalshi Election Betting Case

- The Commodity Futures Trading Commission has dropped its appeal in a case involving Kalshi's election betting platform.

- This decision allows Kalshi to continue operating its event contracts for political outcomes.

⚖️ South Korean Presidential Candidate Pledges to Approve Bitcoin ETFs

- Lee Jae-myung, South Korea's Democratic Party leader, promised to approve spot crypto ETFs if elected president.

- His campaign aims to create a more crypto-friendly environment and enhance investment opportunities for youth.

🚫 Democrats Target Trump's Crypto Profits with New Bills

- US Democrats proposed two bills and launched an inquiry targeting President Trump's cryptocurrency activities.

- The MEME Act aims to prohibit federal officials from issuing or promoting digital assets, including meme coins.

🏛️ Senate to Vote on GENIUS Act Despite Opposition

- Senate Republicans are pushing for a vote on the GENIUS Act, a framework for regulating stablecoins.

- The bill faces bipartisan opposition due to last-minute changes and lack of formal briefings.

Technical Analysis

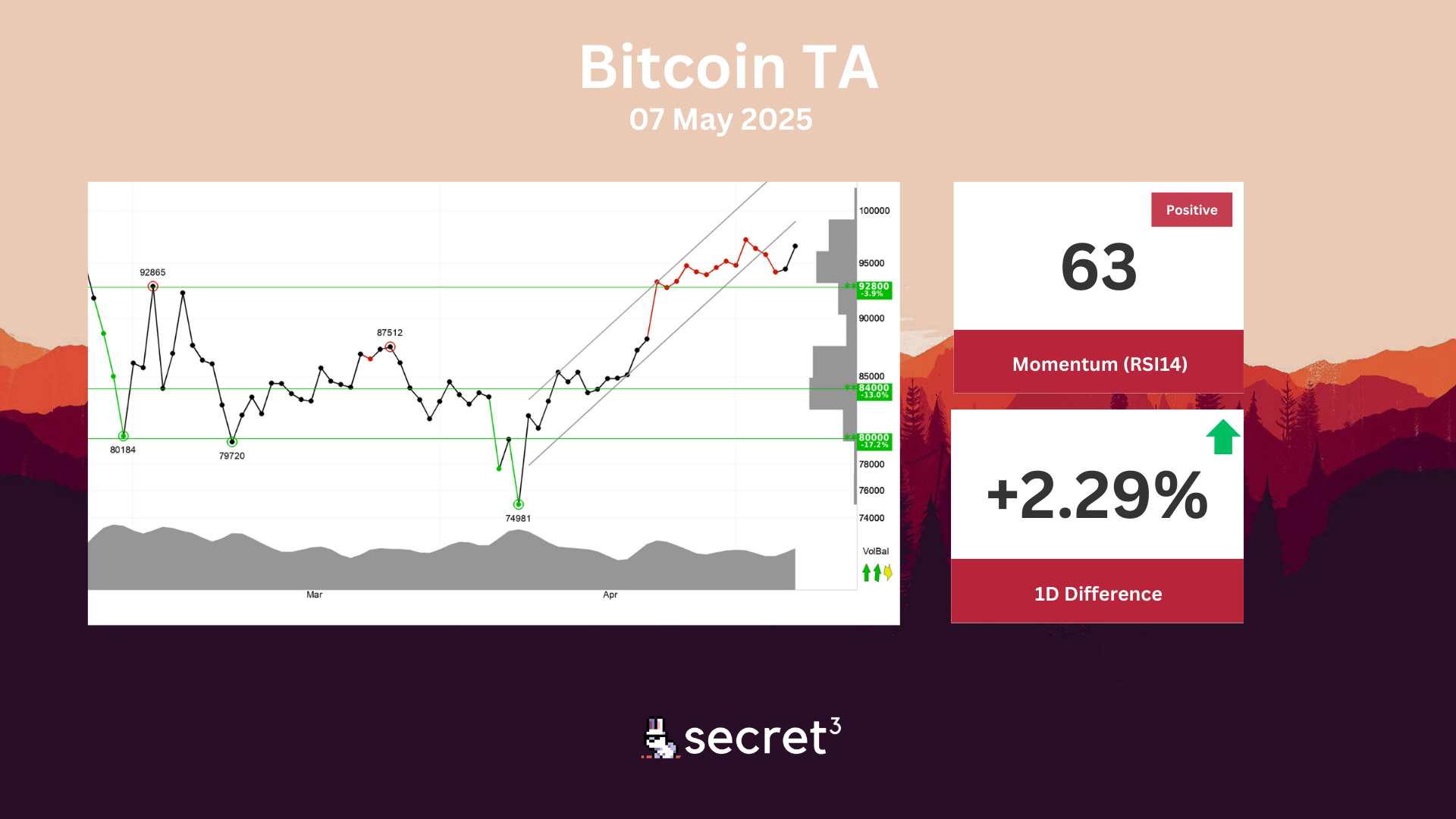

Bitcoin - Bitcoin has broken the floor of the rising trend channel in the short term, which indicates a weaker initial rising rate. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 92800 points. The volume balance is positive and strengthens the currency in the short term. The currency is overall assessed as technically positive for the short term.

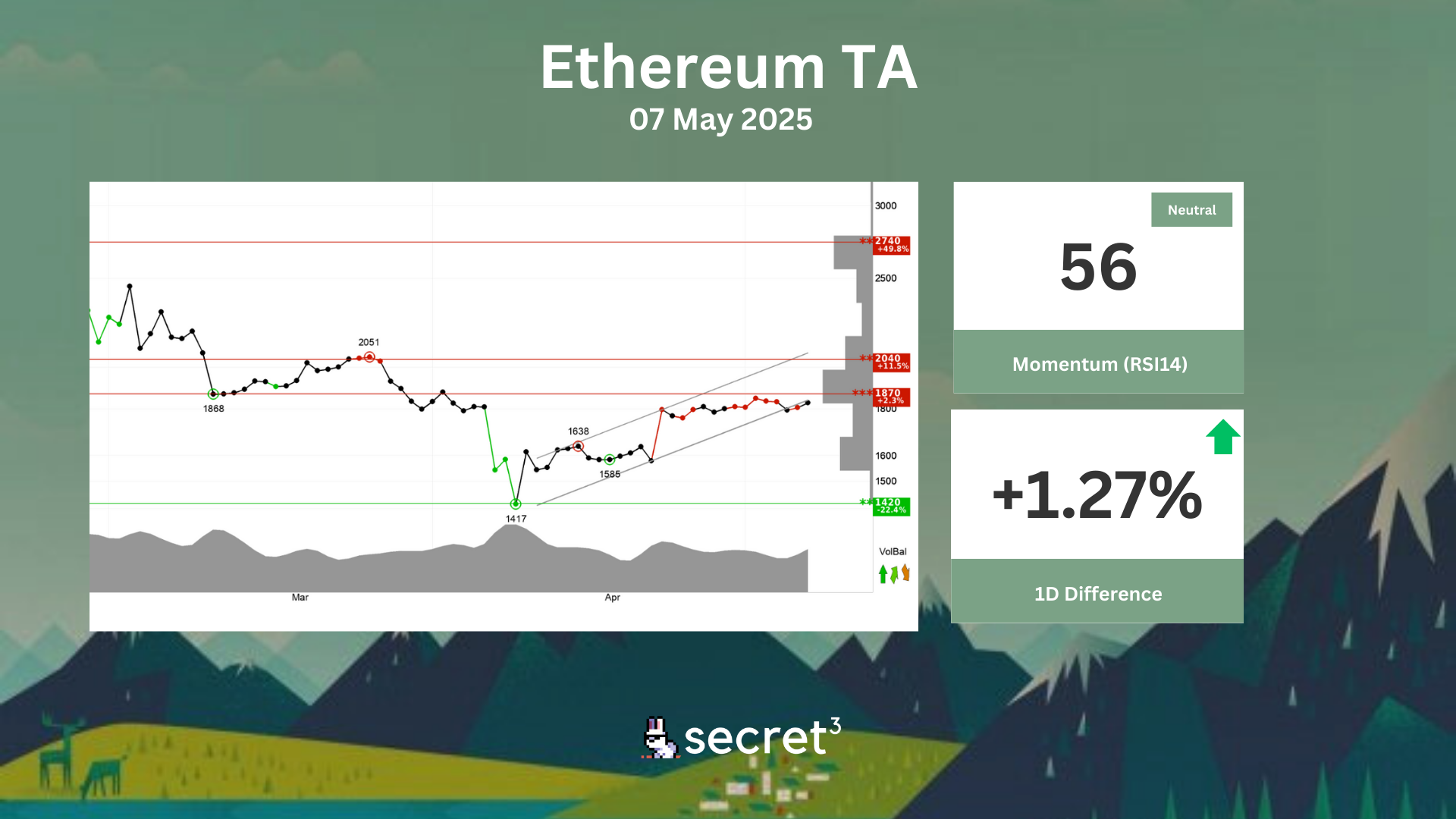

Ethereum - Ethereum has broken through the floor of a rising trend channel in the short term. This indicates a slower rising rate at first, or the start of a more horizontal development. The currency is testing resistance at points 1870. This could give a negative reaction, but an upward breakthrough of points 1870 means a positive signal. The currency is assessed as technically slightly positive for the short term.