gm 07/03

Summary

gm, President Trump signed an executive order to establish a Strategic Bitcoin Reserve using seized assets, causing initial market optimism followed by a price drop as details emerged. Texas and New Hampshire advanced legislation to allow public funds to be invested in cryptocurrencies, while Ethereum's Pectra upgrade was postponed due to testing issues. Additionally, the crypto market experienced volatility amid global economic concerns, with Bitcoin struggling to maintain $90,000 and Ethereum sentiment reaching yearly lows despite potential for recovery.

News Headlines

💼 Bitwise Partners with Maple Finance for DeFi Lending

- Crypto asset manager Bitwise has entered decentralized finance (DeFi) through a partnership with Maple Finance for on-chain credit.

- Bitwise deposited over $1 million in USDC into Maple's strategies, aiming for a 9.5% yield on idle funds.

🔍 Ethereum's Pectra Upgrade Delayed Due to Testing Issues

- Ethereum's major Pectra upgrade has been postponed following significant issues during testnet deployments.

- Developers will continue testing on a "shadow fork" of the Holesky testnet to avoid further delays.

📊 Total Crypto Market Cap Could Reach $4 Trillion in Q2

- Analyst Mark Quant suggests the total crypto market cap could rebound to over $4 trillion by Q2 2025.

- This projection is based on a rising Global Liquidity Index, which has a strong correlation with crypto market performance.

🔒 SafeWallet Releases Bybit Hack Post-Mortem Report

- The $1.4 billion Bybit hack in February was caused by compromised AWS session tokens of a Safe developer.

- North Korean hackers bypassed multifactor authentication and prepared the attack over 19 days.

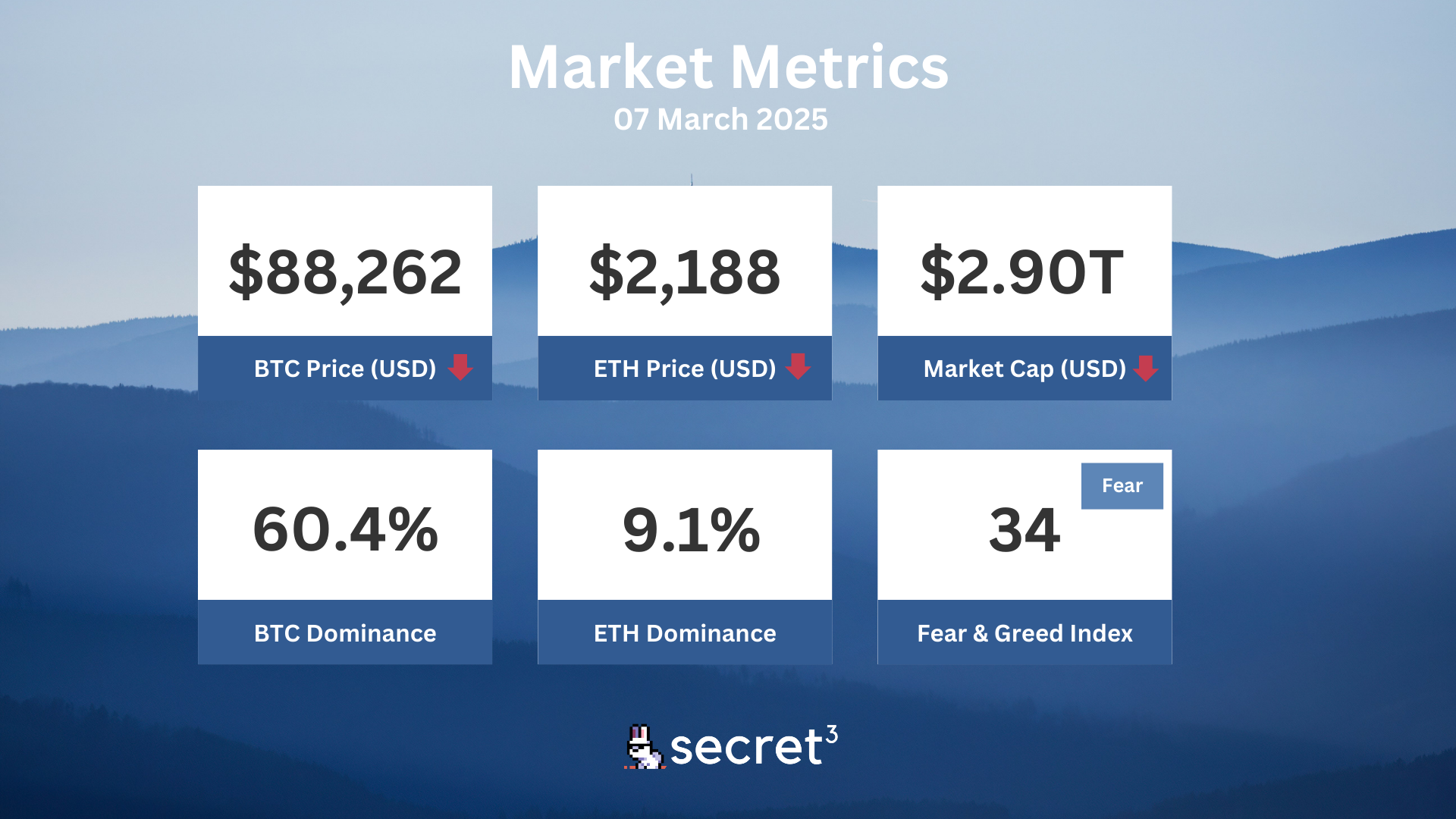

Market Metrics

Fundraising & VC

1. DoubleZero (Undisclosed, $28M) - Global base layer (N1)

2. Seismic (Seed, $7M) - Encrypted blockchain platform

3. Fortytwo (Pre Seed, $2.3M) - Decentralized AI network

4. fija (Extended Seed, $430K) - DeFi platform providing yield strategies

On-chain Data

1. Core DAO (CORE) token unlock in 1 day ($4.17M, 0.91%)

2. CoW Protocol (COW) token unlock in 1 day ($2.78M, 2.29%)

3. Maverick Protocol (MAV) token unlock in 2 days ($1.14M, 3.1%)

4. Aptos (APT) token unlock in 5 days ($69.99M, 1.92%)

5. Sei Network (SEI) token unlock in 8 days ($48.47M, 4.72%)

Regulatory

🚫 Rep. Tom Emmer Reintroduces CBDC Anti-Surveillance State Act

- Rep. Tom Emmer reintroduced the CBDC Anti-Surveillance State Act to prevent the Federal Reserve from issuing a digital dollar.

- The bill aims to amend the Federal Reserve Act to ban any digital currency similar to a CBDC, citing financial privacy concerns.

💼 Senate Banking Chair Pushes Debanking Bill After Crypto Uproar

- Senator Tim Scott is advocating for legislation to prevent U.S. regulators from using "reputational risk" to deny banking services to clients.

- The FIRM Act seeks to eliminate references to reputational risk in bank safety and soundness assessments.

🏦 Hex Trust Secures Major Payment Institution License in Singapore

- Hex Trust, a cryptocurrency custodian and trading platform, received a Major Payment Institution license from Singapore's Monetary Authority.

- This license allows Hex Trust to offer cross-border money transfers and digital payment token services within Singapore's regulatory framework.

💰 Transak Expands to Australia with AUSTRAC Registration

- Global fiat on/off ramp service Transak obtained Digital Currency Exchange registration with AUSTRAC in Australia.

- This regulatory approval ensures compliance with Australia's strict anti-money laundering and counter-terrorism financing regulations.

🏛️ New York Bill Aims to Protect Crypto Investors from Memecoin Scams

- New York lawmakers introduced Bill A06515 to combat cryptocurrency scams, particularly targeting rug pulls.

- The bill aims to create new criminal charges for offenses like "virtual token fraud" and defines "virtual tokens" to include security tokens and stablecoins.

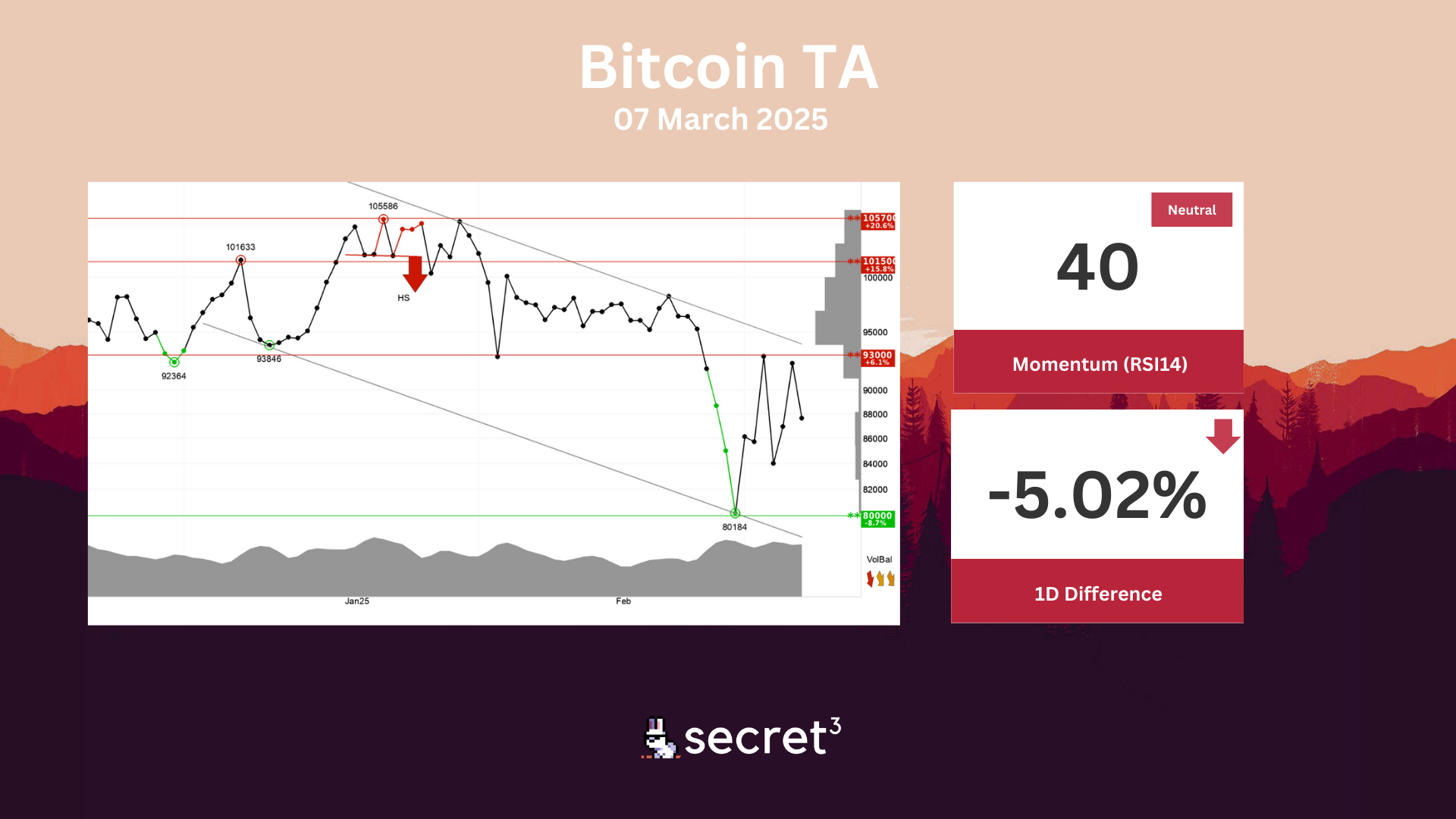

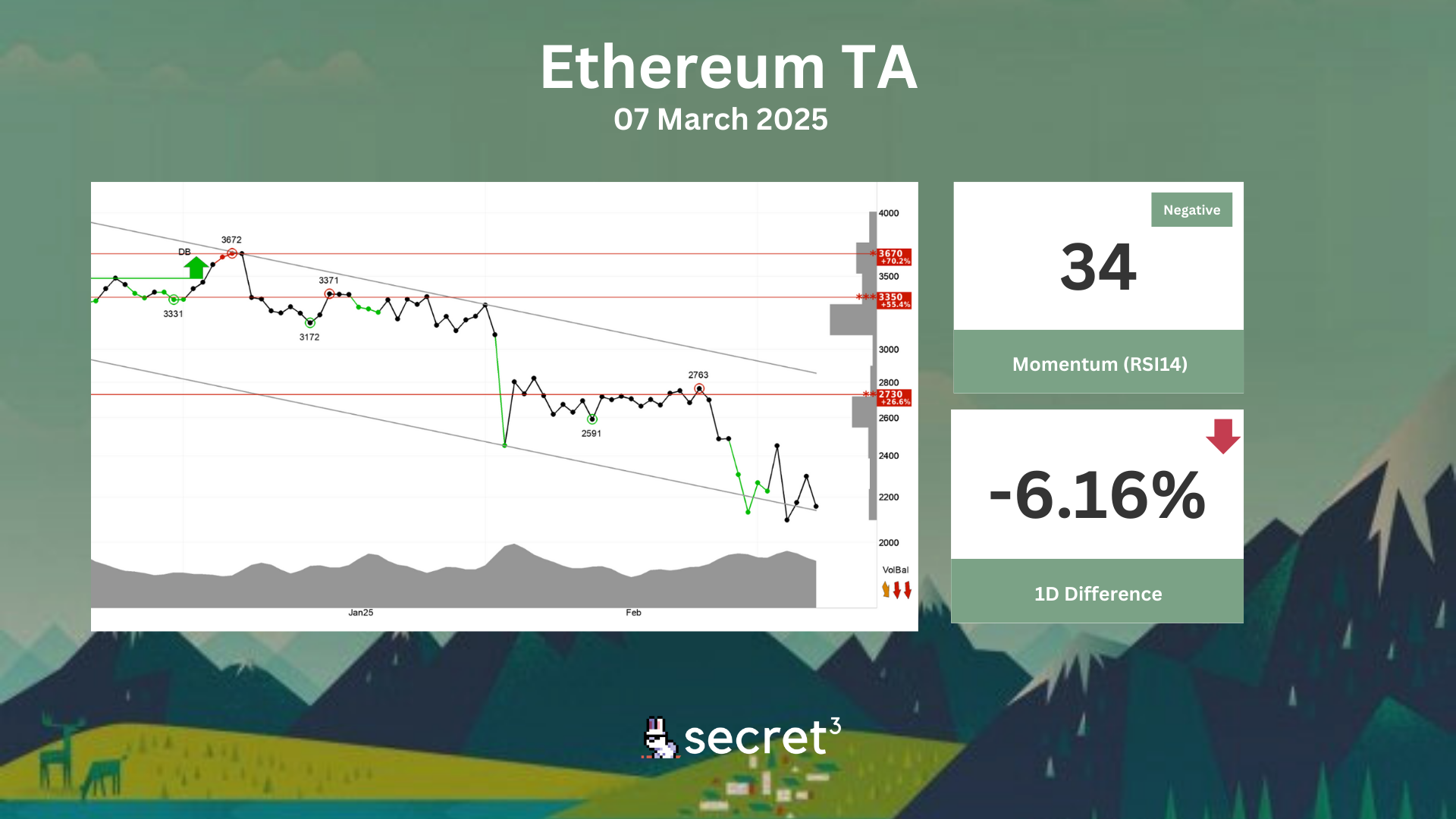

Technical Analysis

Bitcoin - Bitcoin is in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. The currency has support at points 80000 and resistance at points 93000. Volume has previously been low at price tops and high at price bottoms. This confirms the trend. The currency is overall assessed as technically negative for the short term.

Ethereum - Ethereum is in a falling trend channel in the short term. This shows that investors over time have sold at lower prices to get out of the currency, and indicates negative development for the currency. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 2730 points. Negative volume balance indicates that sellers are aggressive while buyers are passive, and weakens the currency. The currency is overall assessed as technically negative for the short term.

Governance & Code

👾 Cryptex DAO | Claim TCAP Perp Fees (Active Vote)

- This proposal aims claim TCAP perp fees.

⛰️ Arbitrum DAO | TMC Recommendation (Active Vote)

- This proposal outlines voting options regarding the Stablecoin Allocation and ARB Allocation outlined in the Treasury Management v1.2 proposal.

⚖️ Balancer DAO | Fund Balancer Maxis for Q2 to Q3 2025

- This proposal requests funding for the Balancer Maxis service provider team for Q2 and Q3 of 2025, with a budget of 255,072 USDC and 22,189 BAL (locked for one year).