gm 07/02

Summary

gm, Bitcoin's price stabilized above $97,000 after a recent dip, with analysts noting bullish indicators such as decreased exchange reserves and increased institutional interest. Meanwhile, the Ethereum ecosystem is facing challenges, with critics highlighting a disconnect between the Ethereum Foundation's focus and community demands. In regulatory news, the SEC has shown signs of advancing applications for various crypto ETFs, including those for XRP, Litecoin, and Solana, indicating a potential shift towards a more crypto-friendly stance. Additionally, Trump Media and Technology Group announced plans to launch Bitcoin-related ETFs, further highlighting the growing mainstream acceptance of cryptocurrencies.

News Headlines

💼 BlackRock to Launch Bitcoin ETP in Europe

- BlackRock, the world's largest asset manager, is set to introduce a Bitcoin exchange-traded product (ETP) in Europe, expanding on its successful US-based iShares Bitcoin Trust.

- The new European Bitcoin ETP will be based in Switzerland, with marketing expected to begin soon.

🏦 Winklevoss Brothers Consider IPO for Gemini Crypto Exchange

- The Winklevoss brothers are exploring an initial public offering (IPO) for their cryptocurrency exchange, Gemini, after previously deciding against it in 2021.

- This consideration aligns with predictions that several crypto unicorns might seek public listings in 2025, including Circle, Figure, and Kraken.

💰 Strategy (Formerly MicroStrategy) Reports Q4 Loss; BTC Holdings at 471,107

- Strategy (formerly MicroStrategy) reported a Q4 net loss of $3.03 per share, down from a profit of $0.50 per share a year earlier.

- The company maintains its Bitcoin holdings at 471,107 tokens, valued at approximately $45 billion.

🏦 CME Crypto Volumes Hit All-Time High in January

- Cryptocurrency trading volumes on the CME reached an all-time high of approximately $285 million in January, marking an 8% increase from the previous month.

- The surge in activity indicates growing institutional interest in cryptocurrency derivatives trading.

🔄 Bitcoin Outflows from Exchanges Reach $1.6B in Largest Bullish Operation Since April

- Over 17,000 BTC (worth more than $1.6 billion) left centralized exchanges on February 5, 2025, marking the largest single-day outflow since April 2024.

- This trend, primarily driven by Coinbase, suggests significant institutional purchasing and a preference for direct asset custody.

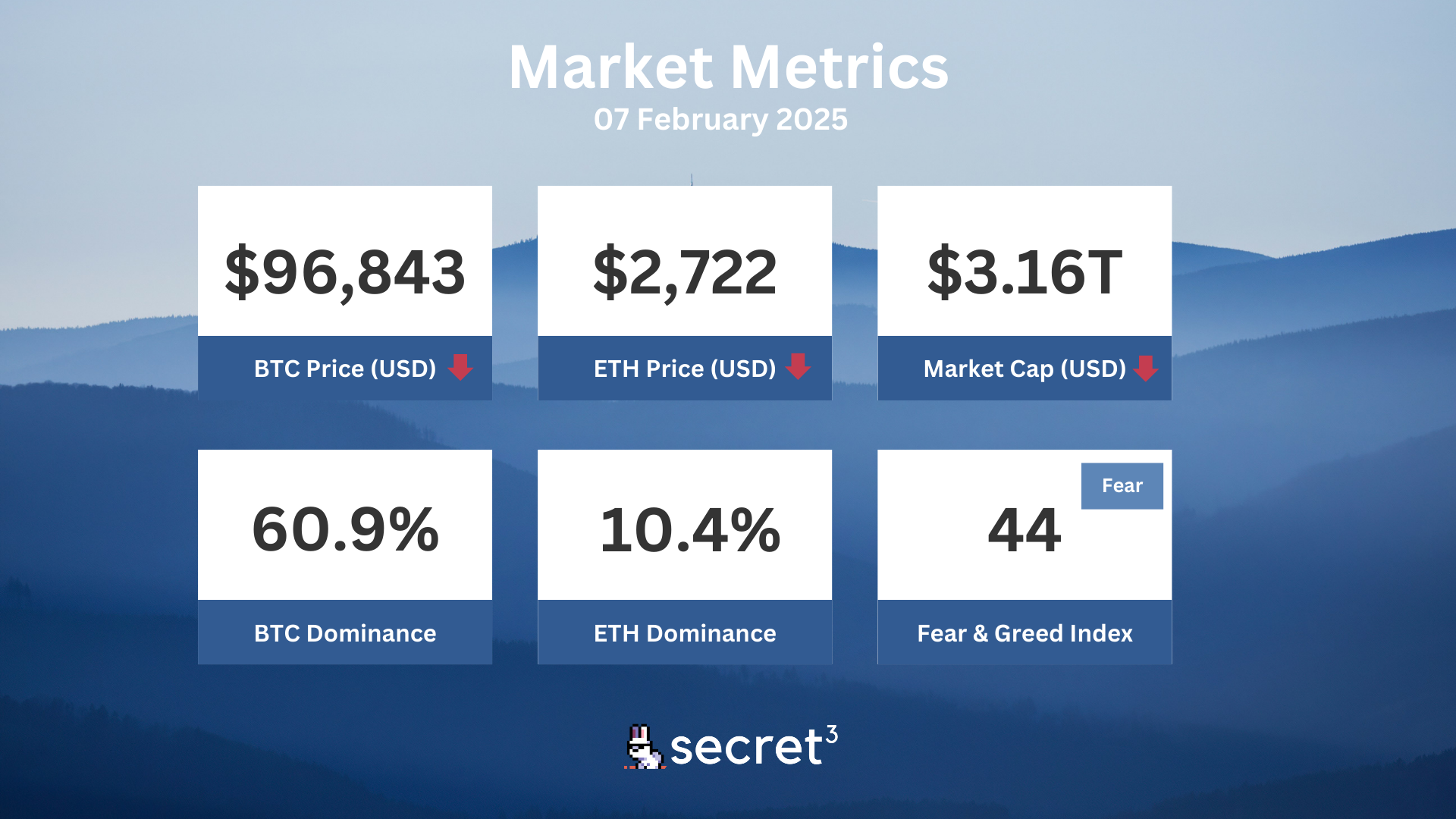

Market Metrics

Fundraising & VC

1. The Game Company (Public Token Sale, $7.5M) - AI & Web3 cloud-based gaming platform

2. Fraktion (Seed, $1.14M) - Fractional real estate investment platform on Tezos

3. Keystone Hardware Wallet (Grant, Undisclosed) - Open-sourced hardware wallet

On-chain Data

1. CoW Protocol (COW) token unlock in 1 day ($3.55M, 2.87%)

2. Core DAO (CORE) token unlock in 1 day ($4.71M, 0.96%)

3. Maverick Protocol (MAV) token unlock in 2 days ($1.30M, 3.1%)

4. Aptos (APT) token unlock in 5 days ($65.84M, 1.97%)

Regulatory

🏛️ Czech Republic Signs "Landmark" Crypto Bill

- Czech President Petr Pavel signed significant cryptocurrency legislation, bringing regulatory clarity to digital assets in Czechia.

- The new law simplifies crypto tax regulations and encourages innovation in the industry.

💼 Congressmen Push for NFT Protections in Crypto Bill

- U.S. Congressmen William Timmons and Ritchie Torres advocate for legal protections for certain NFTs within a revised crypto market structure bill.

- The proposed legislation aims to provide clear regulatory guidelines for digital assets and prevent regulatory overreach.

🏦 Fed Governor Backs Regulated Stablecoins

- Federal Reserve Bank Governor Christopher Waller advocates for the regulation of stablecoins to strengthen the US dollar's global dominance.

- Waller argues that clear guidelines for stablecoins could expand the dollar's reach in international trade and finance.

📊 SEC Acknowledges Multiple Crypto ETF Filings

- The SEC has taken steps to advance several crypto-related ETF applications, including those for XRP, Litecoin, and Solana.

- This marks a significant change in the SEC's approach to crypto ETFs under new leadership.

🌍 Latin American Companies Increase Bitcoin Treasury Adoption

- Major Latin American firms like Mercado Libre and Bitfarms are significantly investing in Bitcoin as a treasury asset.

- This trend mirrors the growing interest in corporate Bitcoin adoption seen in the US, as companies seek to hedge against inflation and economic instability.

Technical Analysis

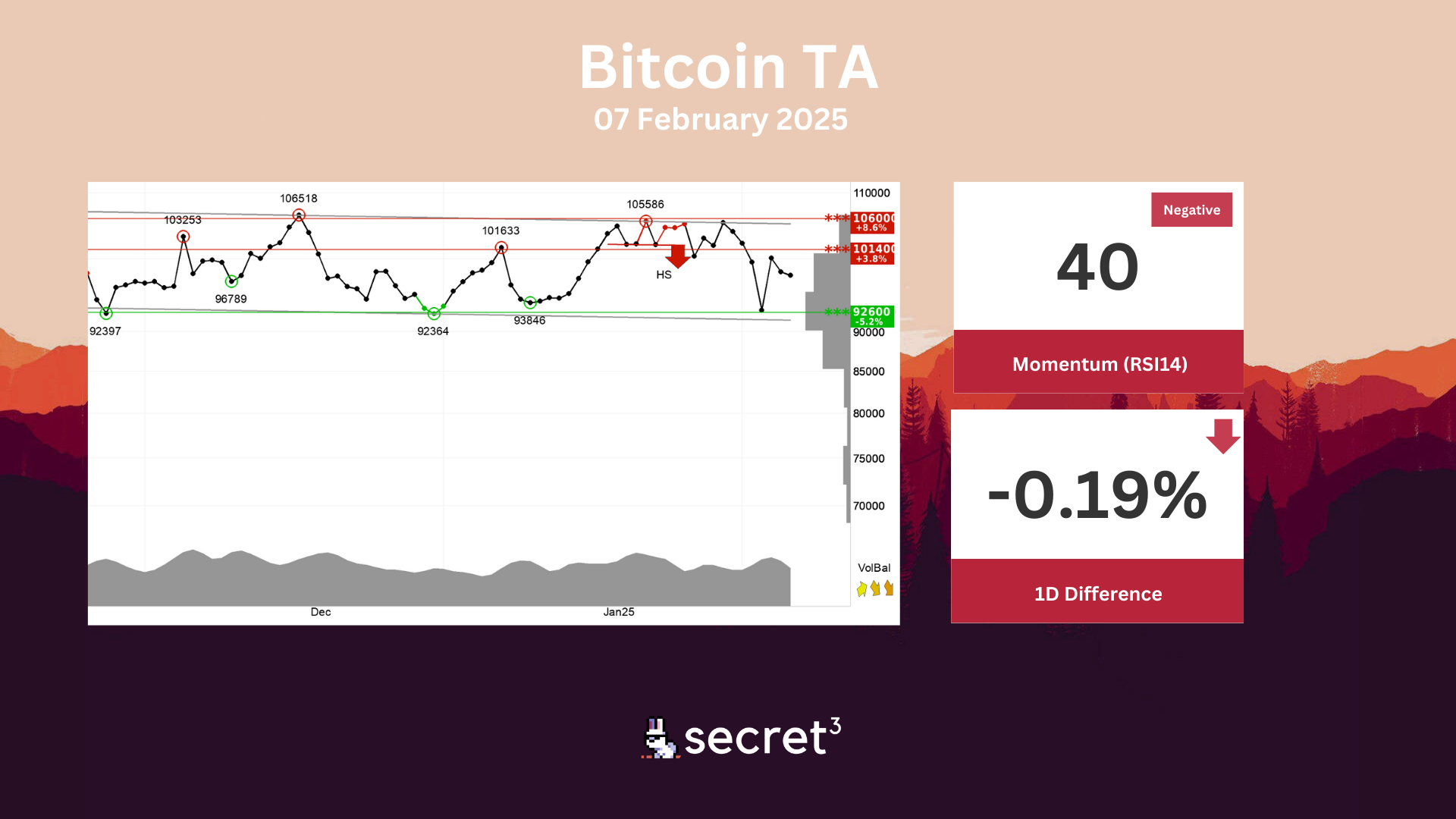

Bitcoin - Bitcoin is within an approximate horizontal trend channel in the short term, which indicates further development in the same direction. The currency has support at points 92600 and resistance at points 101400. Volume has previously been low at price tops and high at price bottoms. This weakens the currency and indicates increased chance of a break down. The currency is overall assessed as technically slightly negative for the short term.

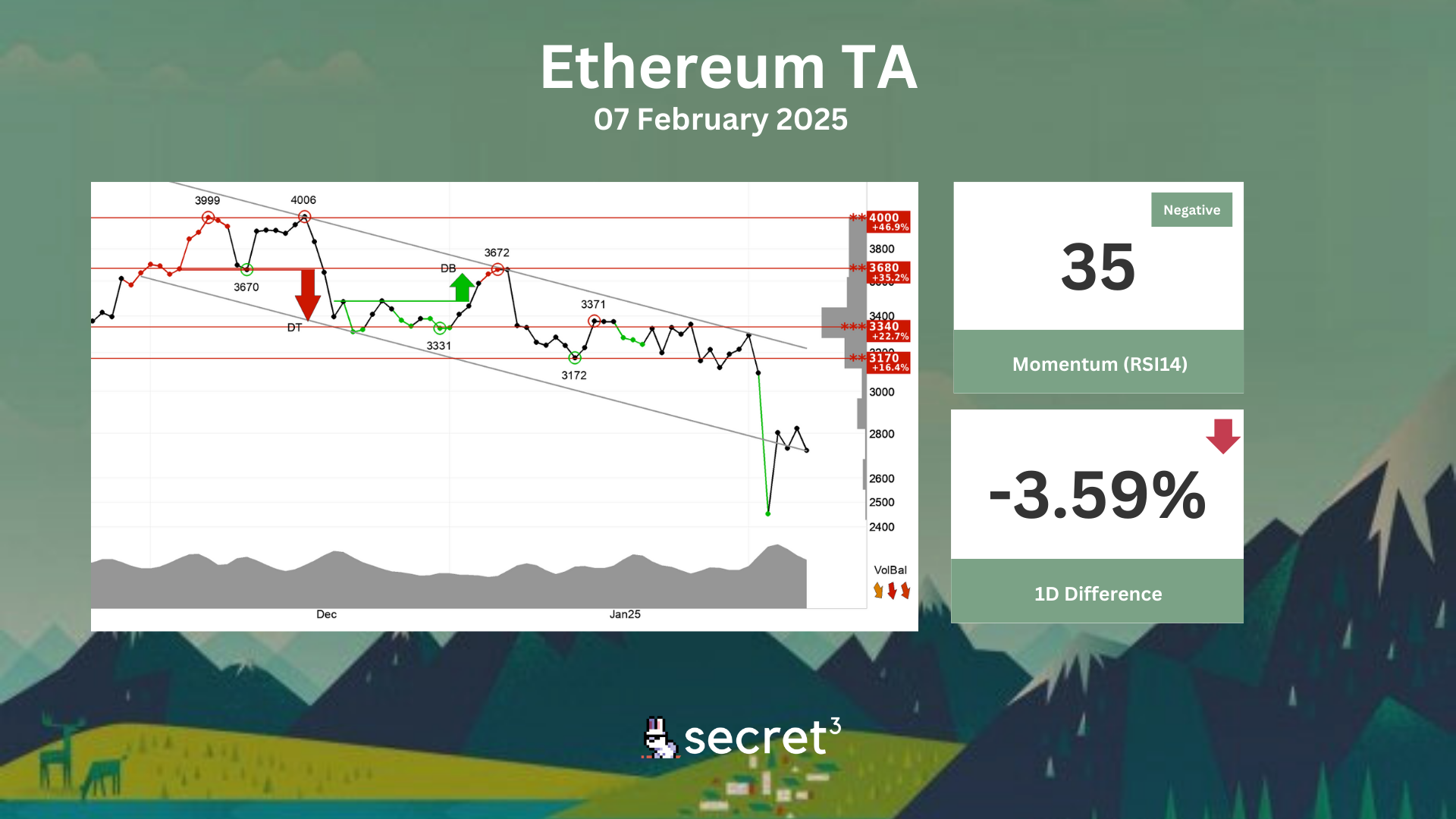

Ethereum - Ethereum is in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 3170 points. Volume has previously been low at price tops and high at price bottoms. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.

Governance & Code

⚡ dYdX DAO | Kuyen Labs - VIP Affiliate Whitelist Proposal (209) (Active Vote)

- This proposal seeks to whitelist new VIP affiliates within the dYdX ecosystem.

👻 Aave DAO | Pendle Principal Token Risk Oracle (Preliminary Discussion)

- This proposal seeks to introduce a Risk Oracle framework for integrating Pendle Finance’s Principal Tokens (PTs) into Aave’s lending markets.

💰 Yearn DAO | Annul & Remove Protocol Guardian Role

- This proposal from Humpy aims to annul and permanently remove the Protocol Guardian Role established through YIP 81.