gm 06/05

Summary

gm, Strategy adds 1,895 Bitcoin worth $180 million to its holdings, bringing its total to 555,450 BTC. VanEck filed for the first BNB ETF in the US, signaling growing institutional interest in alternative cryptocurrencies. Tether announced its entry into AI with TetherAI, a platform enabling Bitcoin and USDT payments. Meanwhile, the Solana Foundation addressed a critical security vulnerability that could have allowed unlimited minting of certain tokens, highlighting the ongoing importance of blockchain security. Despite a slight dip in Bitcoin's price to around $94,000, market sentiment remains cautiously optimistic as investors await the upcoming Federal Reserve meeting.

News Headlines

🔄 Ripple Commits $25M to US School Nonprofits

- Ripple has pledged $25 million in Ripple USD (RLUSD) to educational nonprofits DonorsChoose and Teach For America.

- The initiative aims to support teachers and students, addressing significant funding gaps in K-12 education.

💼 eToro Aims for $4B Valuation in US IPO

- eToro Group is pursuing a valuation of up to $4 billion for its upcoming IPO on the Nasdaq.

- The company plans to raise $500 million by offering 10 million shares priced between $46 to $50 each.

🚨 Crypto Market Manipulation Schemes Becoming Increasingly Coordinated

- Market manipulation poses a growing threat to both crypto and traditional financial markets, with schemes becoming more subtle and organized.

- The highly fragmented crypto market allows groups of traders to collaborate effectively, often using platforms like Telegram to orchestrate market movements.

📈 Bitcoin Investors' Expectations Evolve as 88% of BTC Supply Is in Profit

- 88% of Bitcoin's supply is currently in profit, particularly below $95,000, indicating a reset in investor expectations.

- The Market Value to Realized Value (MVRV) Ratio stands at 1.74, historically a support zone that indicates cooling unrealized gains.

🏦 Bernstein: Corporate Treasuries Will Add $330 Billion in Bitcoin by 2029

- Analysts at Bernstein predict corporate treasuries will acquire approximately $330 billion in Bitcoin within the next five years.

- Strategy (formerly MicroStrategy) is expected to be the main driver behind this growth, having pioneered Bitcoin acquisition as a treasury asset.

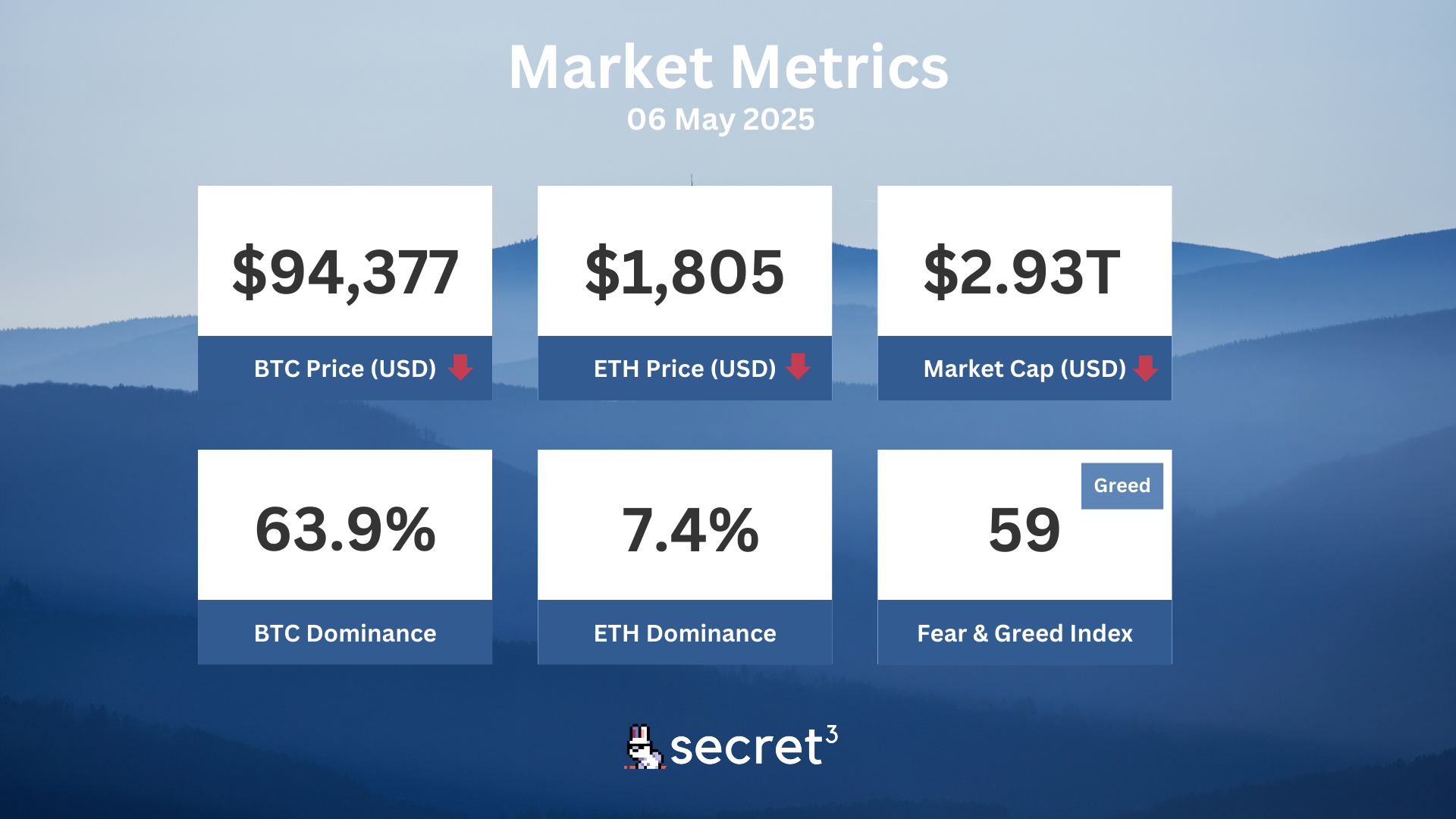

Market Metrics

Fundraising & VC

1. Doppel (Series B, $35M) - Social engineering defense platform

2. Banxa (Debt Financing, $5M) - Global crypto on/off-ramp platform

3. Tea-Fi (Strategic, Undisclosed) - Platform that integrates tools for yield enhancement

Regulatory

🏛️ House Republicans Unveil Crypto Market Structure Bill

- The bill aims to remove SEC oversight over most major crypto assets, redefining 'digital commodities' and transferring regulatory authority to the CFTC.

- Many popular tokens like Ethereum, Solana, and XRP may qualify as digital commodities under this framework, potentially exempting them from SEC regulation.

🚫 Florida Withdraws Bitcoin Reserve Bills

- Florida has withdrawn two significant cryptocurrency bills, House Bill 487 and Senate Bill 550, which aimed to establish a state crypto reserve.

- The bills were indefinitely postponed following the adjournment of the legislative session on May 2.

📅 SEC Delays Decision on Litecoin ETF

- The SEC has delayed its decision on Canary Capital's application for a spot Litecoin exchange-traded fund (ETF).

- This postponement is part of a broader trend where the SEC has yet to make determinations on numerous altcoin ETF applications.

⚖️ Indonesia Suspends Sam Altman's World Project

- Indonesian regulators have suspended the operations of World, a biometric ID project led by Sam Altman, CEO of OpenAI.

- The suspension comes after allegations that the project failed to register for the necessary licenses, including the Electronic System Organizer Registration Certificate.

🌐 Kenyan Court Orders World to Delete User Data

- A Kenyan court has ordered Sam Altman's World project to delete all biometric data collected in the country, citing violations of privacy law.

- The ruling mandates the deletion of all collected data under government supervision within seven days.

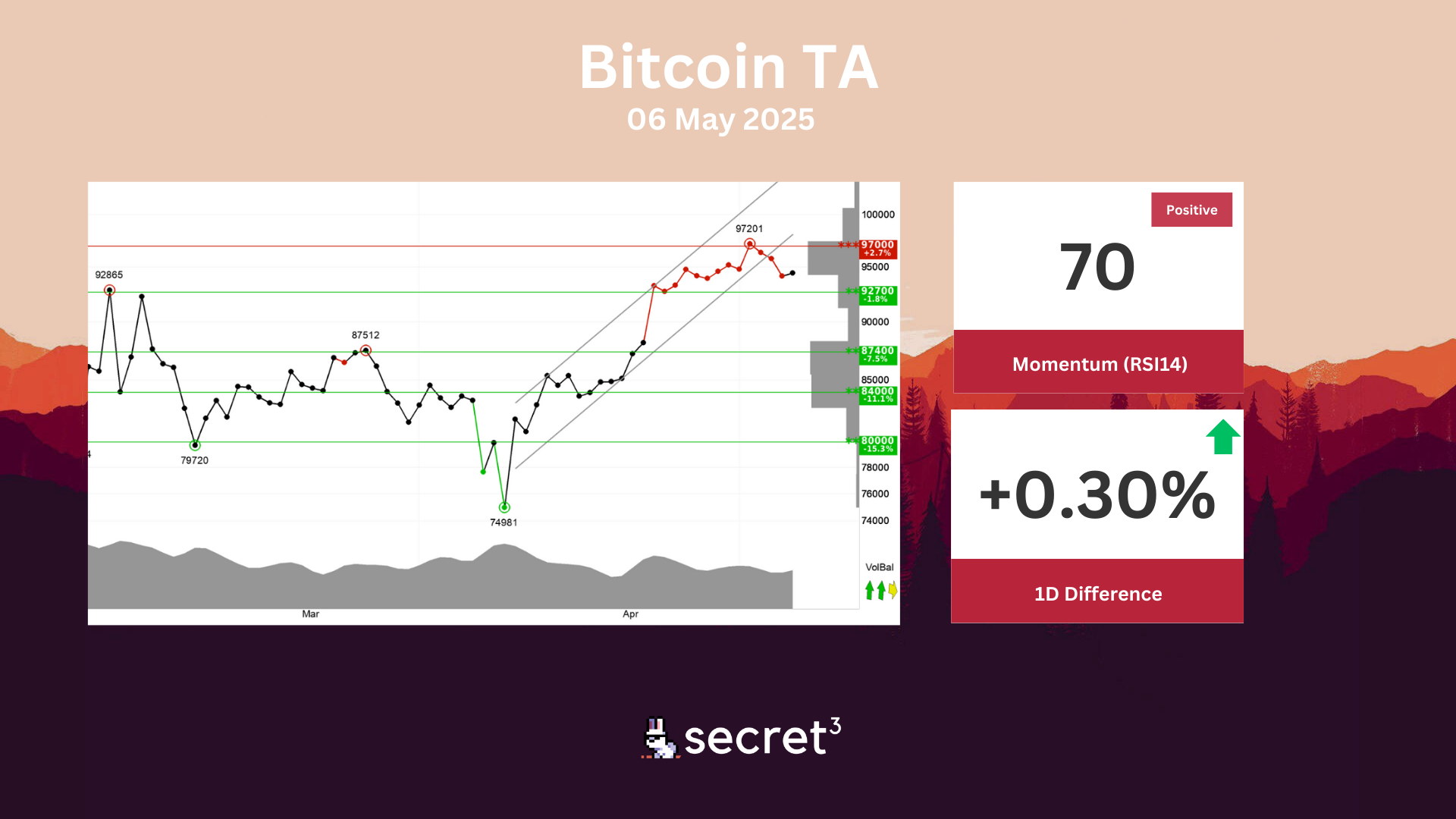

Technical Analysis

Bitcoin - Bitcoin has broken through the floor of a rising trend channel in the short term. This indicates a slower rising rate at first, or the start of a more horizontal development. The currency is between support at points 92700 and resistance at points 97000. A definitive break through of one of these levels predicts the new direction. Positive volume balance indicates that buyers are aggressive while sellers are passive, and strengthens the currency. The currency is overall assessed as technically positive for the short term.

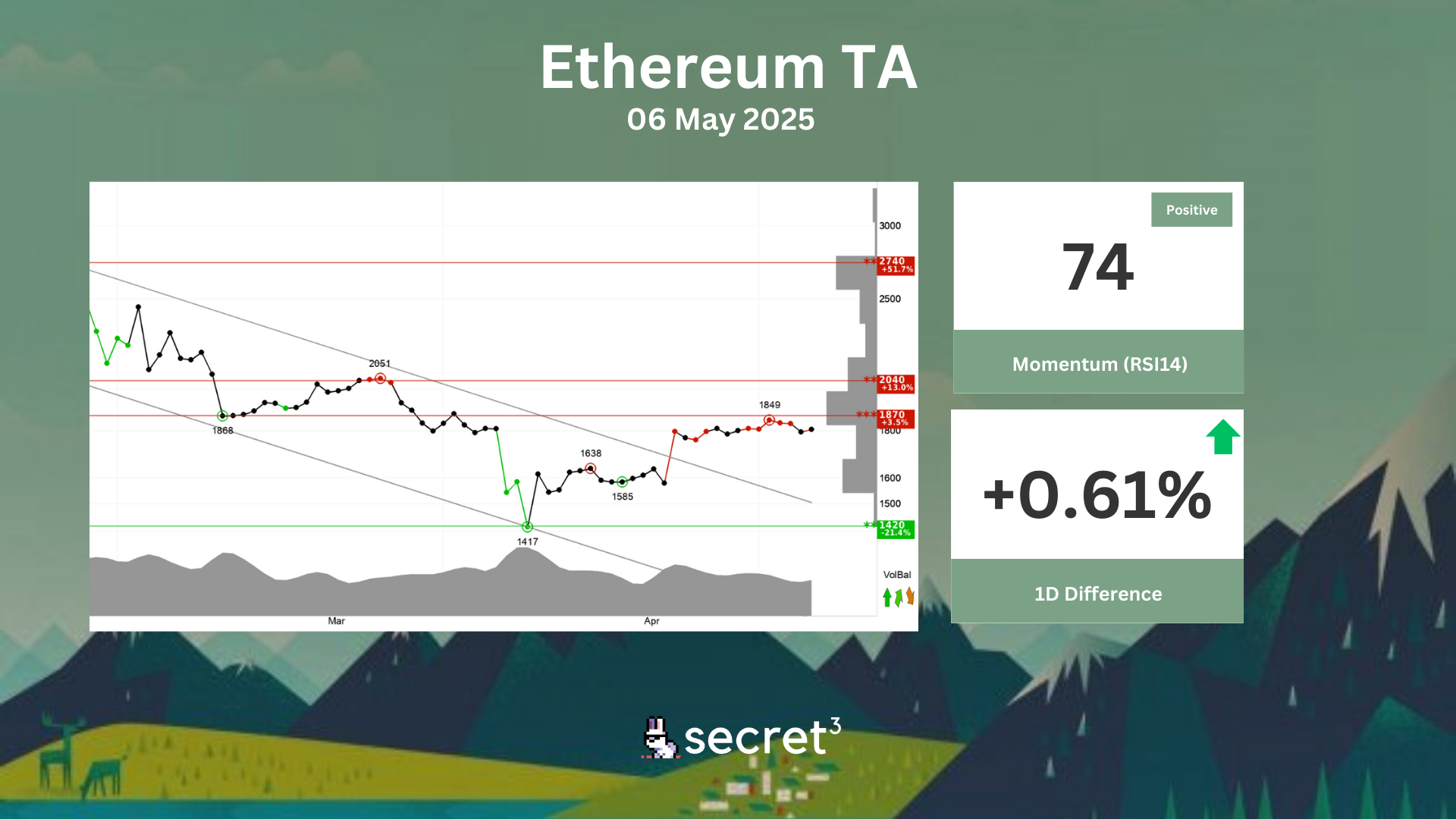

Ethereum - Ethereum has broken the ceiling of the falling trend in the short term, which indicates a slower initial falling rate. The currency is approaching resistance at 1870 points, which may give a negative reaction. However, a break upwards through 1870 points will be a positive signal. The short term momentum of the currency is strongly positive, with RSI above 70. This indicates increasing optimism among investors and further price increase for Ethereum. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically slightly negative for the short term.