gm 06/02

Summary

gm, The U.S. Senate is set to introduce two key crypto bills, including the GENIUS Act for stablecoin regulation, within President Trump's first 100 days. Meanwhile, the SEC is restructuring its crypto enforcement unit, signaling a potential shift in regulatory approach. On the market front, Bitcoin experienced a sharp decline, briefly dropping below $93,000 due to trade war concerns, before recovering to around $98,000. Notably, BlackRock announced plans to launch a Bitcoin ETP in Europe, further expanding institutional access to cryptocurrencies.

News Headlines

💼 MicroStrategy Rebrands to "Strategy" and Adopts Bitcoin Logo

- MicroStrategy officially rebrands to "Strategy" with a new Bitcoin-themed marketing approach.

- The company maintains its focus on business intelligence software and Bitcoin treasury strategy.

📊 Bitcoin Price Consolidation May End Soon, Analysts Predict

- Bitcoin's price has been consolidating between $91,500 and $106,500 since November.

- Analysts anticipate the consolidation may conclude by the end of February due to increasing demand.

💰 Wealthy Investor Network 'TIGER 21' Holds Up to $6B Worth of Crypto

- TIGER 21, a network for high-net-worth individuals, has allocated about $6 billion to cryptocurrencies.

- This represents 1% to 3% of their total $200 billion portfolio.

🌐 Ondo Finance Launches New RWA Tokenization Platform

- Ondo Finance introduces Ondo Global Markets (Ondo GM) to tokenize traditional financial assets.

- The platform aims to bring stocks, bonds, and ETFs onchain.

🐻 Berachain Announces $632M BERA Airdrop and Mainnet Launch

- Berachain is set to airdrop approximately $632 million worth of its BERA token.

- About 80 million BERA tokens will be distributed to eligible users.

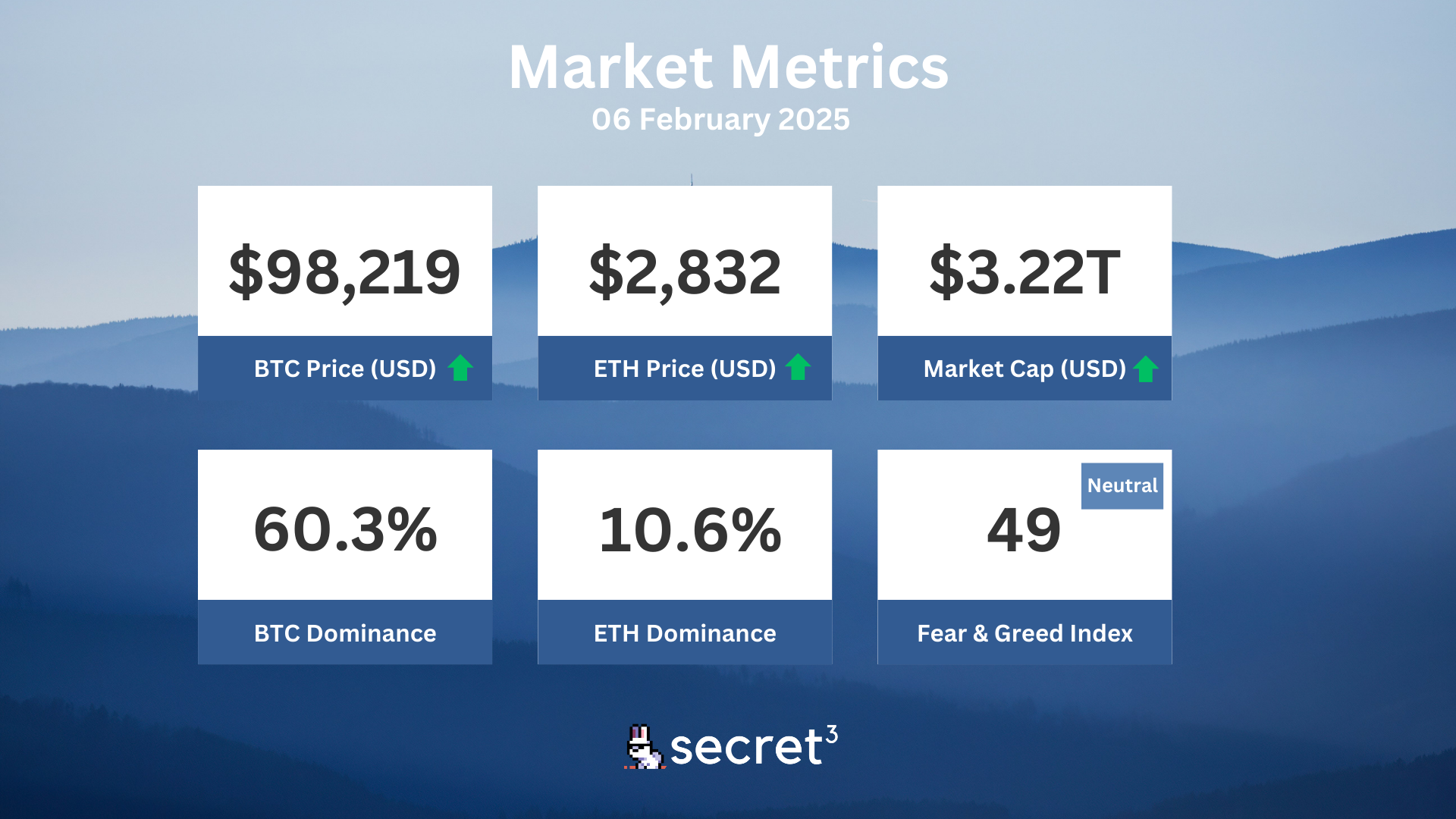

Market Metrics

Fundraising & VC

1. Reservoir (Series A, $14M) - Token trading infrastructure on every chain

2. Ola (Undisclosed, $13.8M) - Unified network for off-chain services

3. Flashnet (Seed, $4.5M) - Non-custodial Bitcoin exchange

4. Rho Protocol (Seed, $4M) - Professional-grade on-chain rates market

5. Henlo (Seed, $3M) - Bluechip meme of Berachain

On-chain Data

1. Myria (myria) token unlocked today ($1.20M, 2.69%)

2. Heroes of Mavia (mavia) token unlocked today ($2.86M, 33.25%)

3. CoW Protocol (COW) token unlock in 2 days ($3.89M, 2.87%)

4. Core DAO (CORE) token unlock in 2 days ($5.05M, 0.96%)

5. Aptos (APT) token unlock in 6 days ($69.15M, 1.97%)

Regulatory

🔍 FDIC Releases Crypto Documents Amid Scrutiny

- The FDIC released 790 pages of correspondence related to banks' requests to provide crypto services.

- Documents reveal the agency's historically resistant stance towards crypto and ongoing reevaluation of its approach.

💰 Trump Administration Focuses on Stablecoin Regulation

- The Trump administration is prioritizing stablecoin regulation to bring innovation onshore.

- Officials believe stablecoins could enhance the dollar's international dominance and drive demand for U.S. Treasuries.

🚫 Ohio Senator Introduces Bitcoin Reserve Bill

- An Ohio lawmaker introduced Senate Bill 57 to allow the state to invest in Bitcoin for an "Ohio Bitcoin Reserve Fund."

- The bill is part of a wider trend of U.S. states proposing legislation to allow local treasuries to purchase crypto assets.

🔐 Crypto Stealing Malware Discovered in Mobile Apps

- Researchers uncovered malware in Android and iOS apps that steals cryptocurrency wallet recovery phrases.

- The malware, named SparkCat, has been downloaded around 242,000 times, primarily targeting users in Europe and Asia.

🏛️ SEC Restructures Crypto Enforcement Unit

- The SEC is scaling back its 50-person crypto enforcement unit, reassigning some lawyers to different departments.

- This shift follows criticism of previous enforcement strategies and suggests a more constructive approach to crypto regulation under new leadership.

Technical Analysis

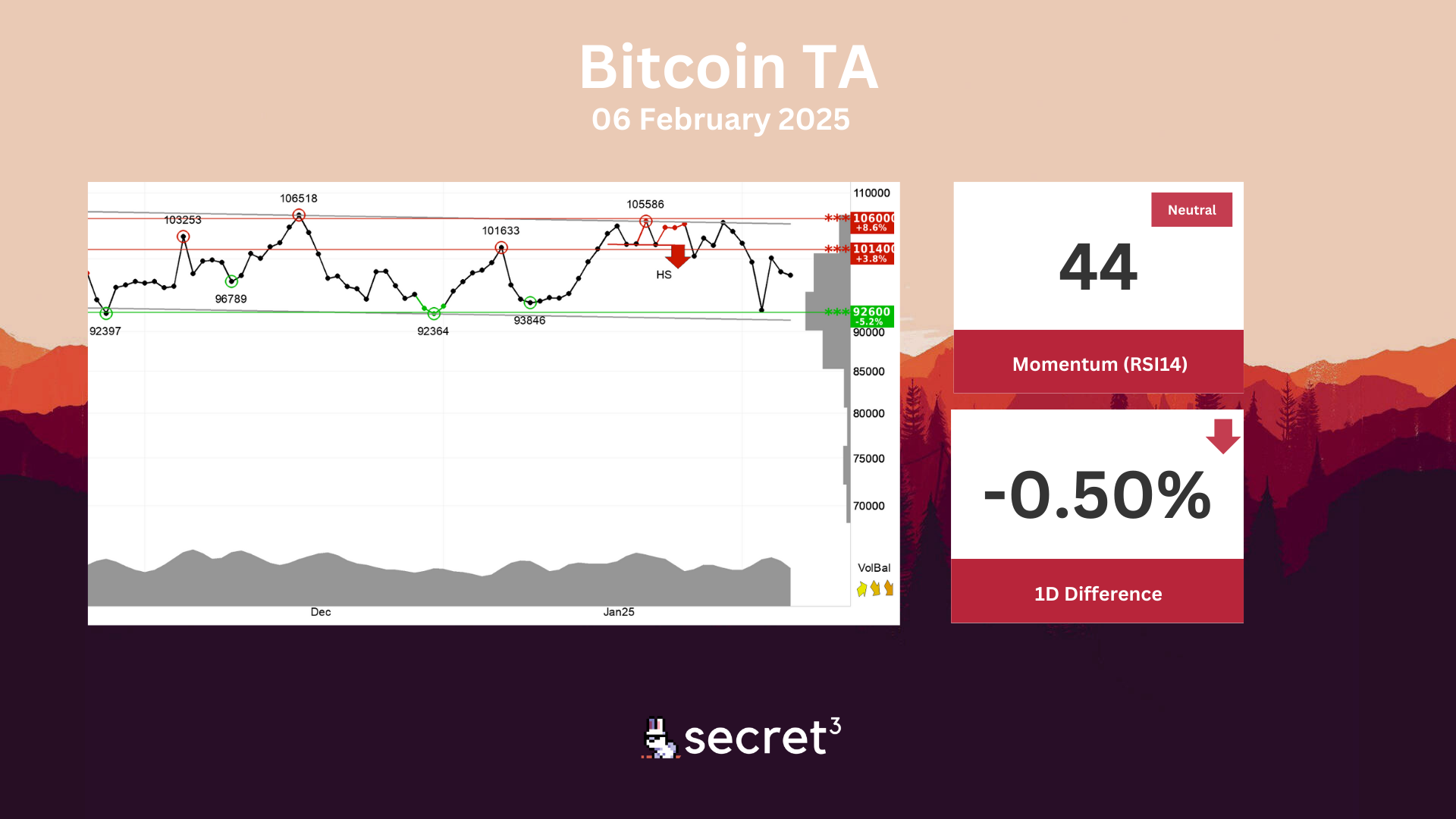

Bitcoin - Bitcoin is within an approximate horizontal trend channel in the short term, which indicates further development in the same direction. The currency has support at points 92600 and resistance at points 101400. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. This weakens the currency and indicates increased chance of a break down. The currency is overall assessed as technically neutral for the short term.

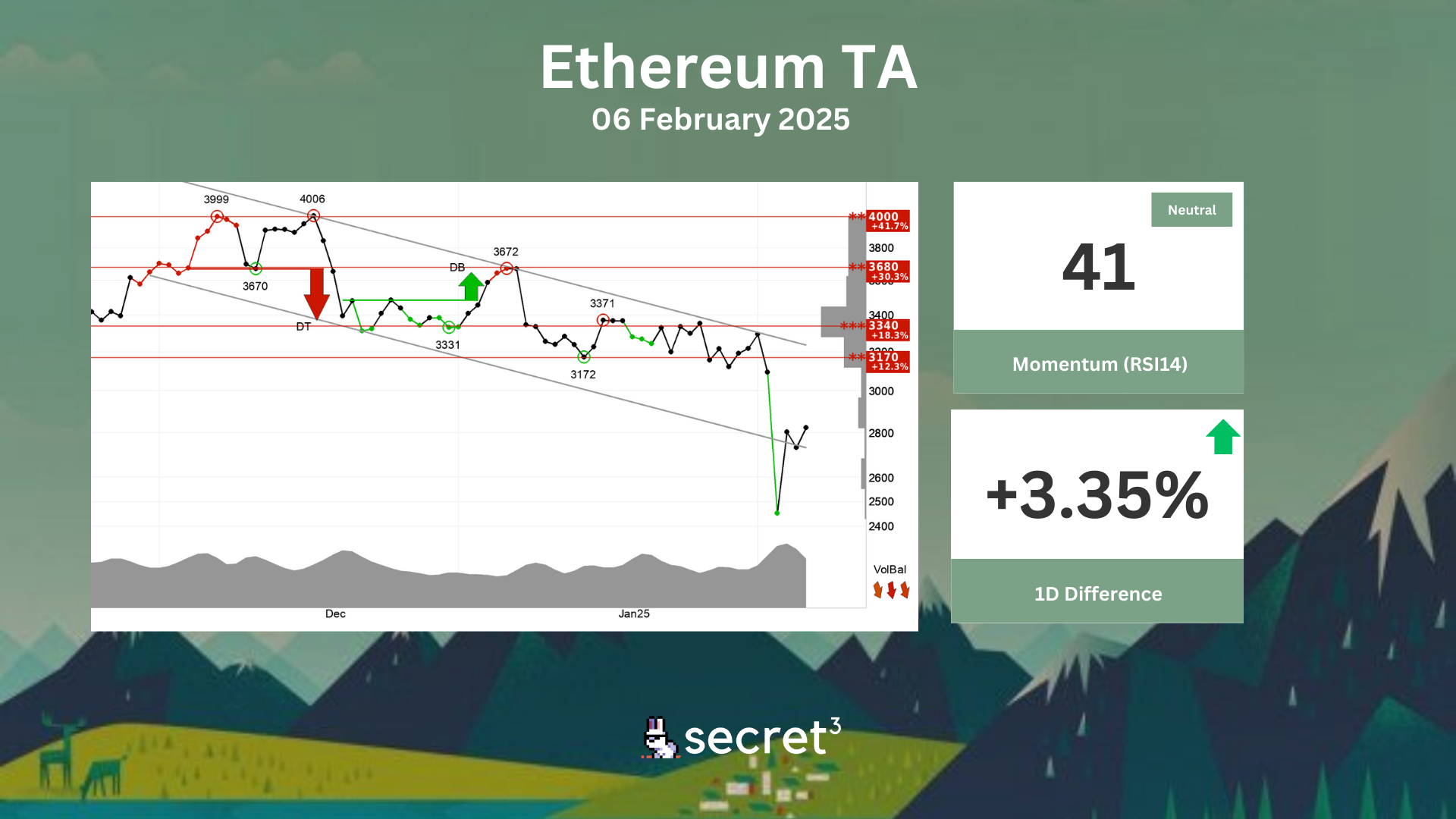

Ethereum - Ethereum shows weak development in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 3170 points. Volume has previously been low at price tops and high at price bottoms. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.

Governance & Code

👾 Threshold DAO | thUSD Bond Program (Preliminary Discussion)

- This proposal aims to introduce a bond program to address thUSD liquidity challenges.

👻 Aave DAO | Deploy stataUSDC GSM on Base (Preliminary Discussion)

- This proposal aims to deploy a stataUSDC GHO Stability Module (GSM) on Base supported by a facilitator on Ethereum.

🔮 Osmosis DAO | Burn 50% of OSMO Taker Fees (Preliminary Discussion)

- This proposal seeks to modify the distribution of taker fees collected in OSMO on the Osmosis protocol.