gm 05/05

Summary

gm, The Maldives government announced a $9 billion agreement to develop a major crypto hub in Malé, aiming to diversify its economy beyond tourism and fishing. In the United States, a group of pro-crypto Senate Democrats unexpectedly withdrew support for the GENIUS Act, a stablecoin bill, citing unresolved issues and potentially delaying regulatory frameworks. Meanwhile, Binance expanded its presence in Central Asia by signing an MOU with Kyrgyzstan's National Agency for Investments to introduce crypto payment infrastructure and blockchain education in the country. These events highlight the ongoing global interest in cryptocurrency adoption and regulation, as well as the challenges faced in implementing comprehensive frameworks.

News Headlines

🚀 Bitcoin Traders' Favorite "Lottery Ticket": The $300K BTC Call

- Bitcoin traders are showing significant interest in a $300K call option expiring on June 26, with over 5,000 active contracts and a notional open interest of $484 million.

- This speculative bet, likened to a lottery ticket, reflects growing optimism in the crypto market, partly fueled by positive regulatory narratives and initiatives like the BITCOIN Act.

🔄 Tokenization of Real-World Assets Gaining Momentum

- Major players like BlackRock are embracing blockchain technology, with plans to tokenize its $150 billion Treasury Trust fund.

- Experts predict that between 10% to 30% of global financial assets could be tokenized by the end of the decade, with the RWA market potentially reaching up to $50 trillion by 2030.

🔐 OKX Relaunches DEX with Enhanced Security Features

- OKX has re-launched its decentralized exchange aggregator with improved security measures following a suspension due to misuse by the Lazarus Group.

- New features include real-time abuse detection, a dynamic database of suspect addresses, and collaboration with blockchain security firms for audits.

💻 Vitalik Buterin Proposes Major Ethereum Upgrade for 100x Speed Increase

- Ethereum co-founder Vitalik Buterin suggests replacing Ethereum's Virtual Machine with RISC-V to achieve a 100x performance increase in zero-knowledge proofs.

- The proposed change aims to simplify Ethereum's architecture, making it more akin to Bitcoin's straightforward design.

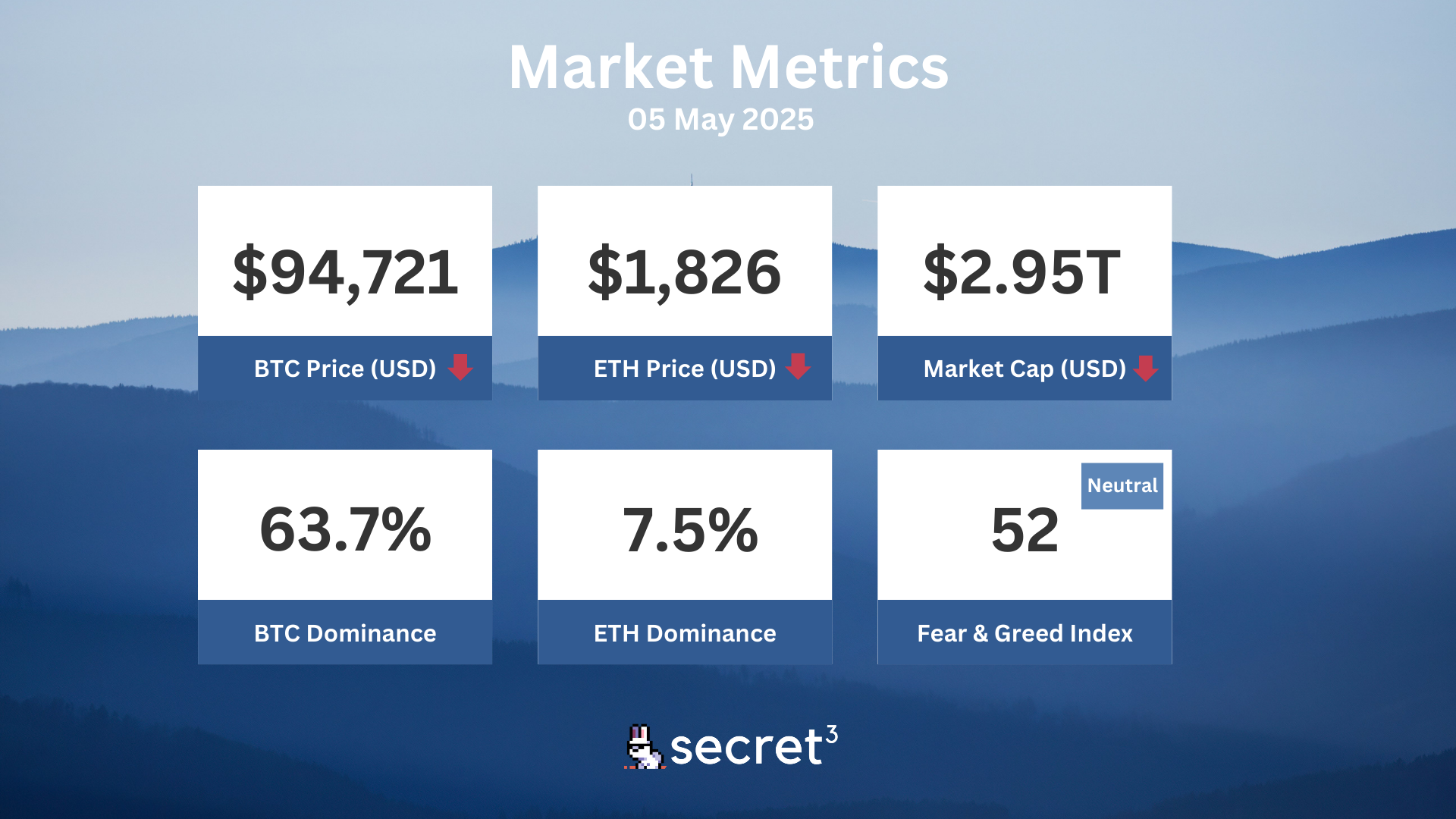

Market Metrics

Fundraising & VC

1. factCheck (Accelerator, $450K) - Prediction markets platform

2. Junction (Accelerator, $450K) - DeFi exchange

Regulatory

🏛️ Australian Crypto Industry Calls for Urgent Regulation

- Following the Labor party's re-election, the crypto industry urges swift action on digital asset legislation.

- Industry leaders call for establishing a Crypto-Asset Taskforce within the government's first 100 days.

🛡️ Solana Fixes Critical Token Minting Vulnerability

- Solana resolved a zero-day vulnerability that allowed potential unlimited minting of certain tokens.

- The bug specifically impacted Solana's privacy-focused Token-22 confidential tokens.

🏦 US Bitcoin ETFs Bought 6x More BTC Than Miners Produced Last Week

- Bitcoin ETFs in the US acquired 18,644 BTC in the past week, significantly outpacing the 3,150 BTC produced by miners during the same period.

- This substantial institutional demand coincided with Bitcoin prices reaching $97,700 before settling around $94,000, reflecting growing institutional engagement in the crypto market.

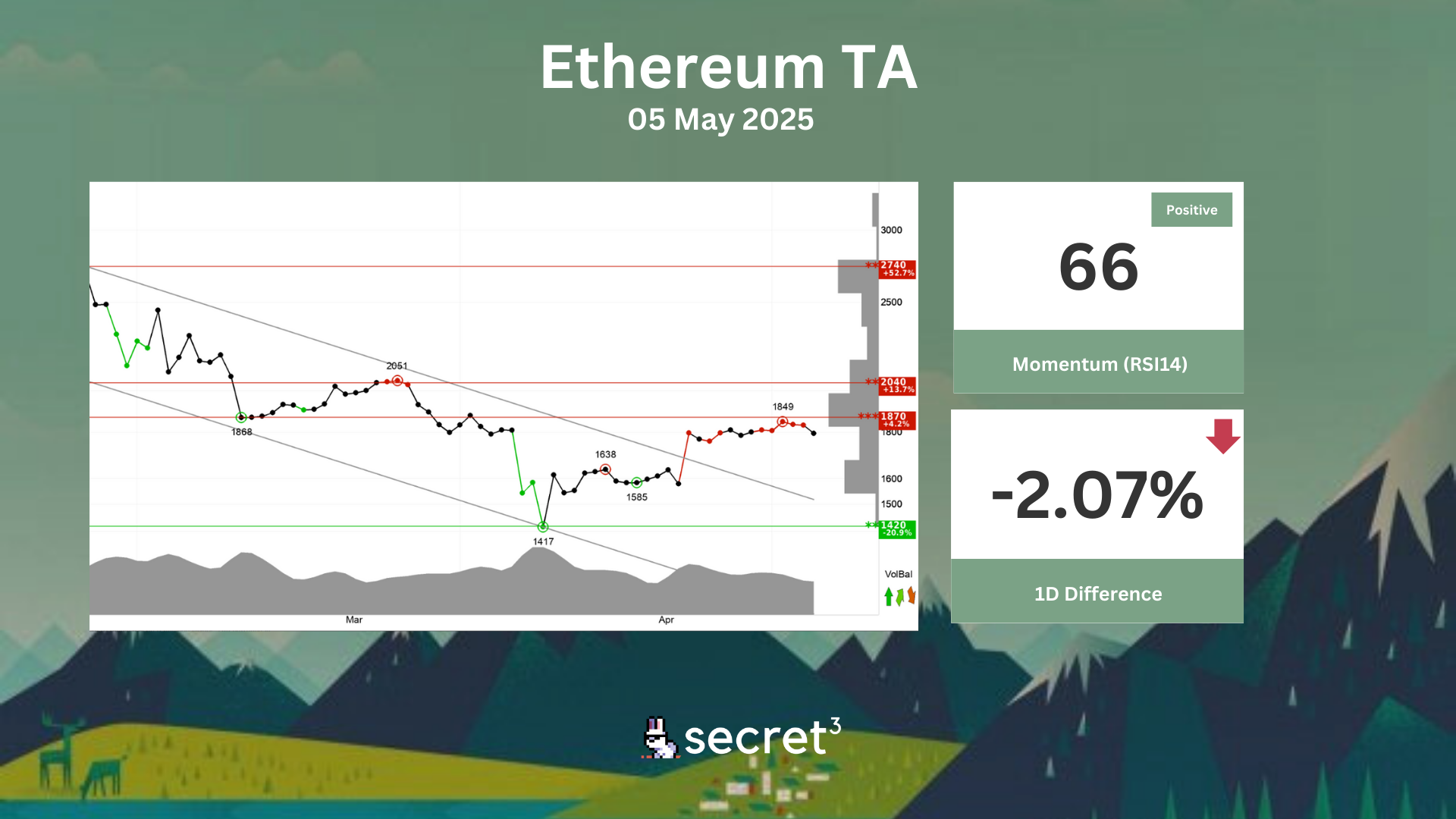

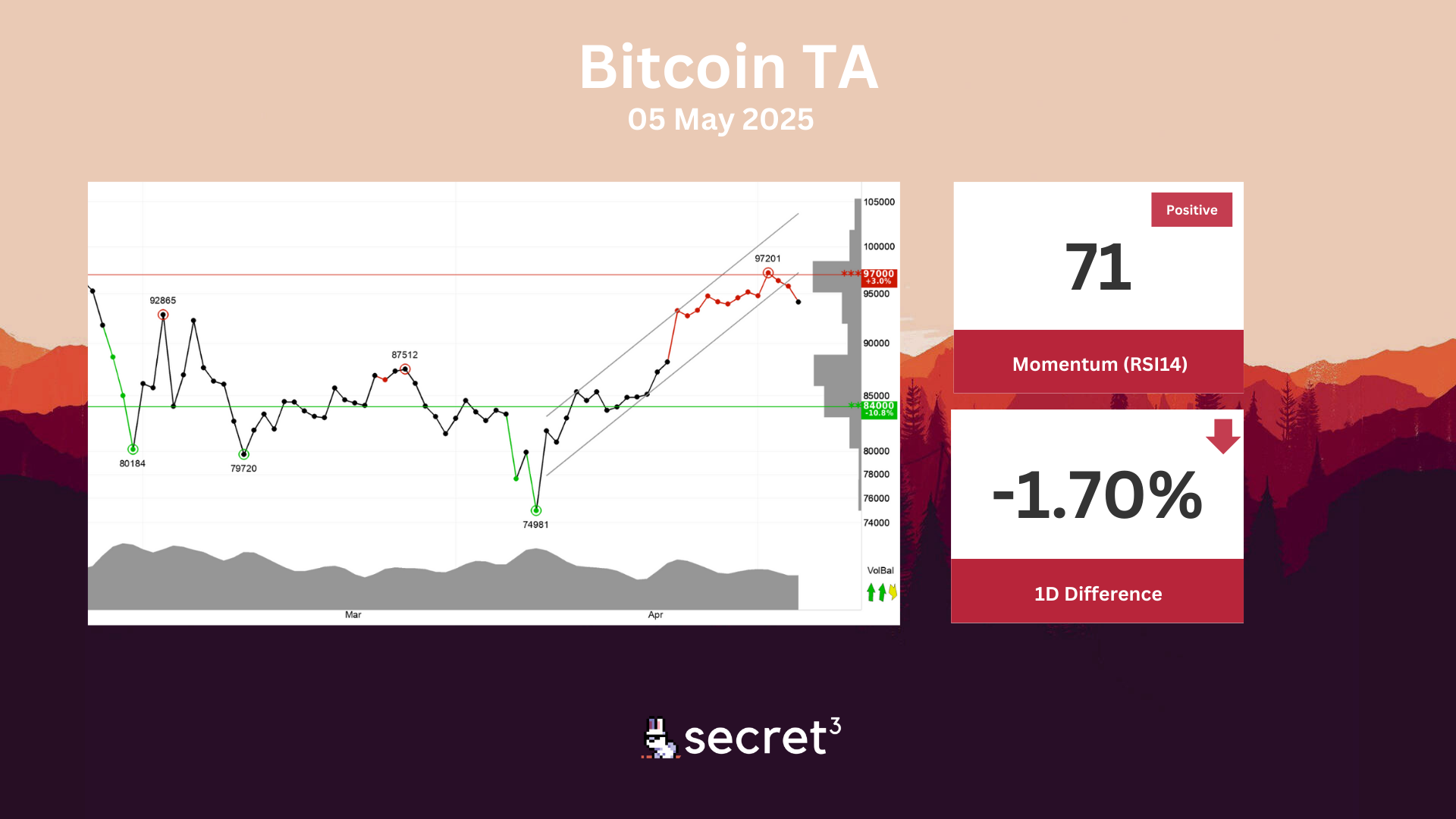

Technical Analysis

Bitcoin - Bitcoin has broken through the floor of a rising trend channel in the short term. This indicates a slower rising rate at first, or the start of a more horizontal development. The currency has support at points 84000 and resistance at points 97000. Positive volume balance strengthens the currency in the short term. RSI is above 70 after a good price increase the past weeks. The currency has strong positive momentum and further increase is indicated. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically positive for the short term.

Ethereum - Ethereum has broken the ceiling of the falling trend in the short term, which indicates a slower initial falling rate. The currency is approacing resistance at 1870 points, which may give a negative reaction. However, a break upwards through 1870 points will be a positive signal. The currency is assessed as technically slightly negative for the short term.