gm 05/03

Summary

gm, Bitcoin experienced a sharp decline, dropping from around $95,000 to below $83,000, before recovering to around $87,000. This sell-off was triggered by President Trump's announcement of new tariffs against Canada, Mexico, and China, sparking fears of a trade war. Meanwhile, the SEC continued its shift in regulatory approach, dropping several high-profile lawsuits against crypto firms, including Kraken and Cumberland DRW. In positive news for the industry, the U.S. Senate passed a resolution to repeal a controversial IRS rule targeting DeFi protocols, signaling potential easing of crypto regulations.

News Headlines

💼 Blockstream Launches Three New Institutional Crypto Funds

- Blockstream is preparing to launch three investment funds in April 2025, with two focused on crypto lending and borrowing.

- The funds aim to address challenges in the crypto lending space and encourage growth following the collapse of several lending firms.

💱 USDC Becomes First Dollar-Pegged Stablecoin Approved in Japan

- Circle's USDC has received approval to be the first dollar-pegged stablecoin issued in Japan.

- Japanese crypto exchange SBI will list and distribute USDC to investors, with trading expected to start on March 12, 2025.

🤝 White House to Host Inaugural Crypto Summit with Industry Leaders

- The White House will host its first crypto summit on March 7, featuring 20-25 leaders from the crypto sector including executives from Coinbase, Kraken, and Robinhood.

- The summit aims to discuss policy issues related to digital assets and explore a regulatory framework for cryptocurrencies.

📊 Crypto Market Faces Second-Worst Day in History Amid Economic Concerns

- The crypto market experienced its second-worst day ever, with leading coins seeing significant declines of over 20%.

- Factors contributing to the downturn include fears related to tariffs and broader economic concerns.

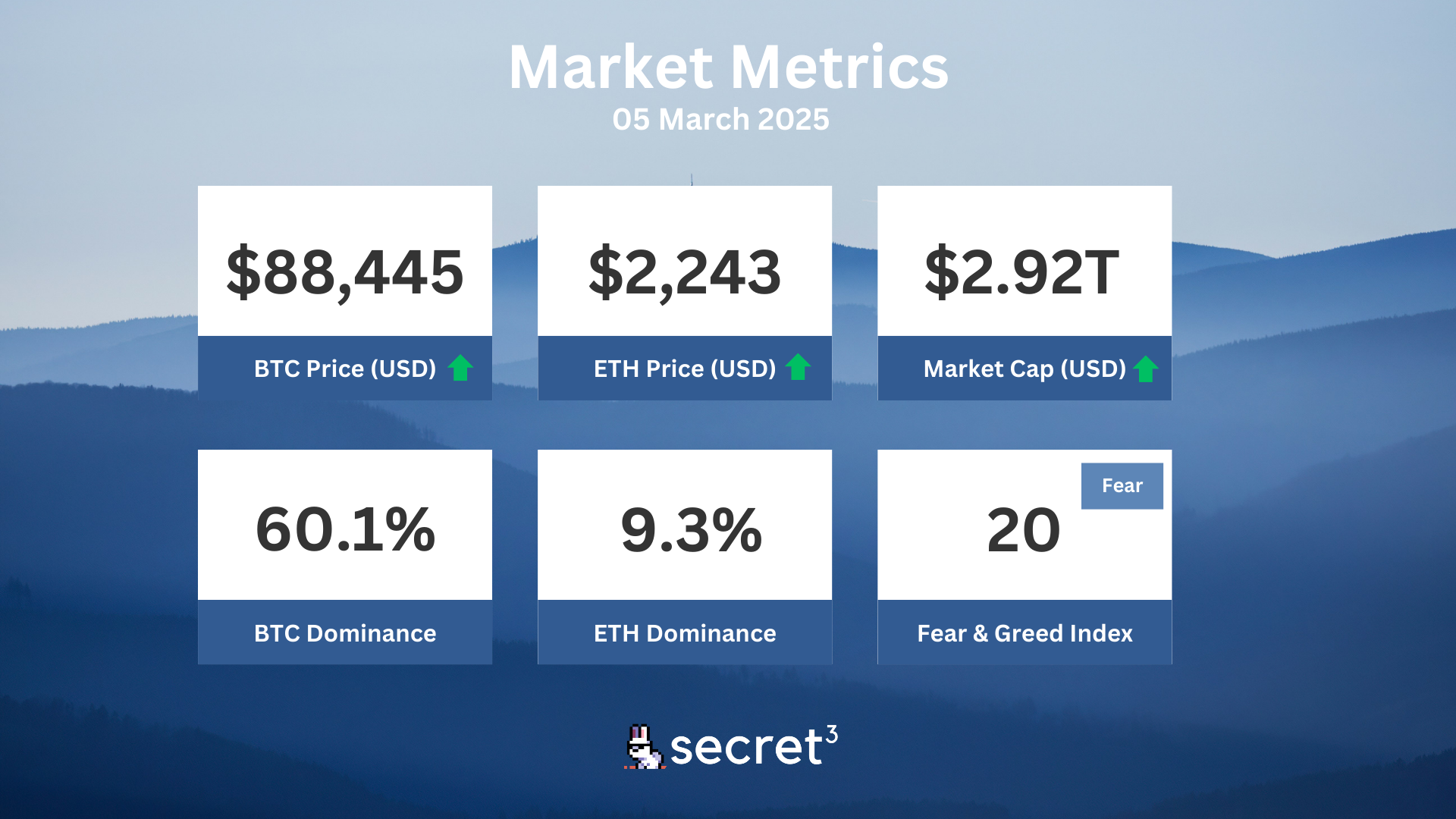

Market Metrics

Fundraising & VC

1. Metaplanet Inc. (Post IPO, $87M) - Japan publicly listed Bitcoin treasury company

2. Flowdesk (Extended Series B, $52M) - Full-service digital asset trading and technology firm

3. Across (Private Token Sale, $41M) - Cross-chain bridge protocol

4. Infrared Finance (Series A, $14M) - Proof of Liquidity (PoL) staking protocol on Berachain

5. FastLane (Strategic, $6M) - MEV on Monad

On-chain Data

1. Immutable X (IMX) token unlocked today ($6.32M, 0.59%)

2. Galxe (GAL) token unlocked today ($2.33M, 1.59%)

3. Myria (myria) token unlock in 1 day ($857.05K, 2.66%)

4. Core DAO (CORE) token unlock in 3 days ($4.32M, 0.91%)

5. CoW Protocol (COW) token unlock in 3 days ($2.90M, 2.29%)

Regulatory

🗳️ US Senate Votes to Overturn Controversial Crypto Tax Rule

- The Senate passed a resolution to repeal an IRS rule mandating brokers to report digital asset sales.

- This bipartisan effort aims to prevent burdensome compliance requirements on DeFi protocols.

🌎 IMF Imposes New Bitcoin Restrictions on El Salvador

- The IMF's $1.4 billion loan to El Salvador includes conditions limiting Bitcoin purchases by the public sector.

- El Salvador must liquidate its Fidebitcoin trust fund and discontinue government participation in the Chivo wallet system.

🏦 Vietnam to Establish Legal Framework for Digital Assets

- Vietnam plans to introduce a legal framework for digital assets by the end of March.

- The initiative aims to foster economic growth and provide clarity for crypto businesses.

🏛️ Israel Releases Preliminary CBDC Design for Digital Shekel

- The Bank of Israel unveiled a preliminary design proposal for its digital shekel CBDC.

- The design outlines potential motivations, functionality, and regulatory considerations for the digital currency.

🚨 Thai Police Raid Five Crypto Firms in Regulatory Crackdown

- Thai authorities raided five unlicensed cryptocurrency firms, arresting 11 employees.

- The action is part of efforts to regulate the cryptocurrency sector and prevent money laundering.

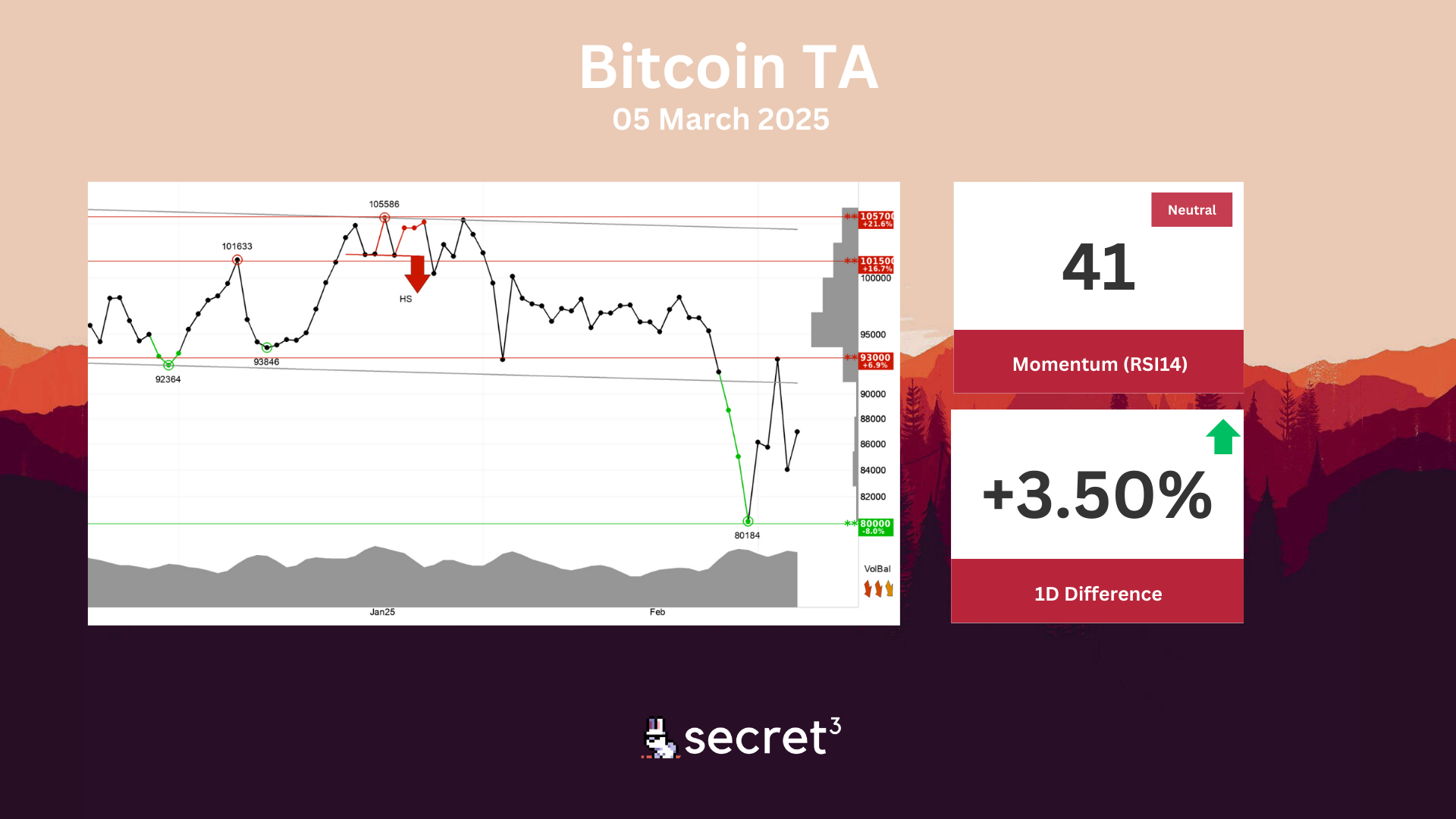

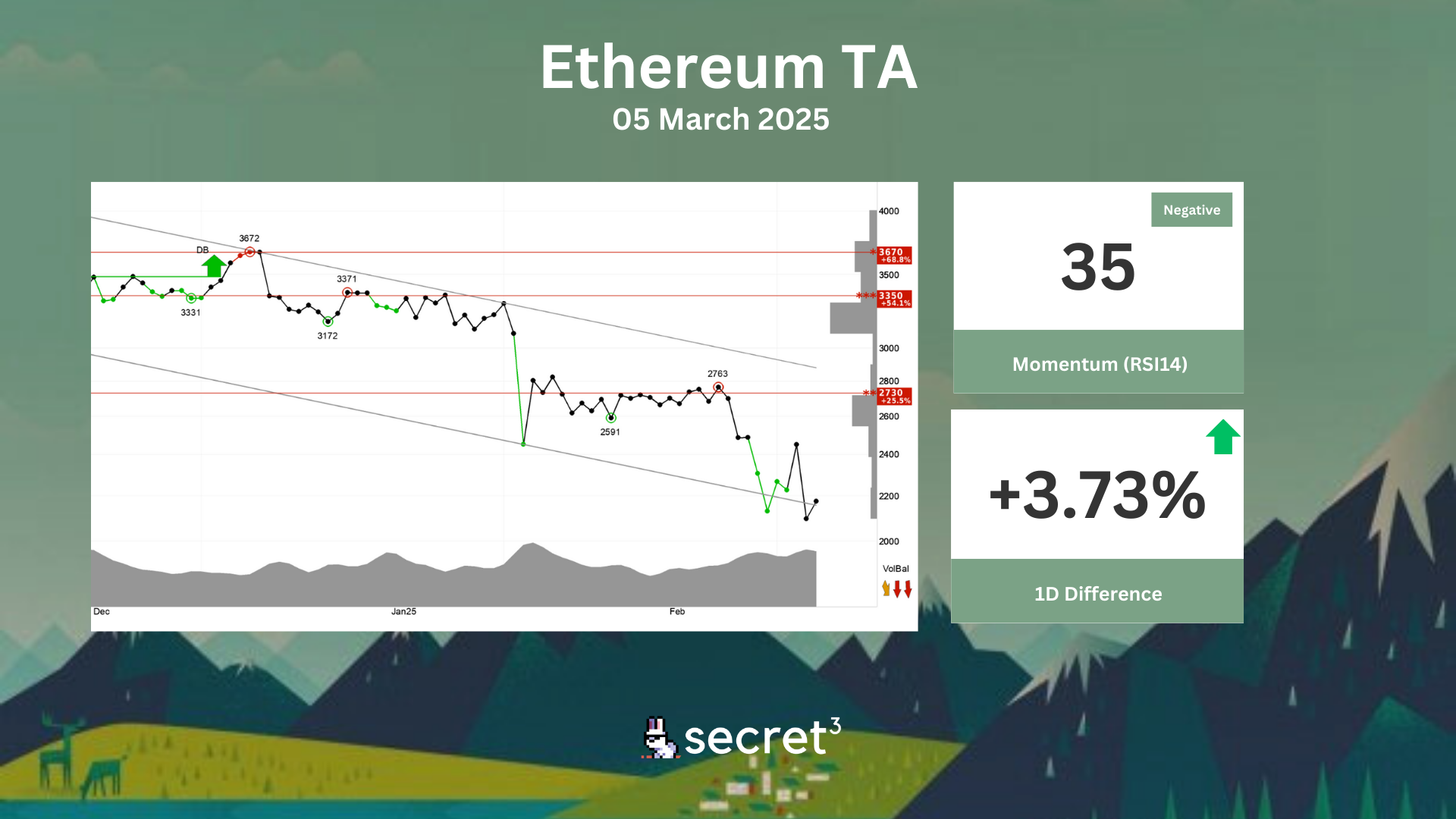

Technical Analysis

Bitcoin - An approximate horizontal trend channel in the short term is broken down. A continued weak development is indicated, and the currency now meets resistance on possible reactions up towards the trend lines. The currency has support at points 80000 and resistance at points 93000. The currency is assessed as technically negative for the short term.

Ethereum - Ethereum is in a falling trend channel in the short term. This signals increasing pessimism among investors and indicates further decline for Ethereum. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 2730 points. Negative volume balance weakens the currency in the short term. The currency is overall assessed as technically negative for the short term.

Governance & Code

🔮 Osmosis DAO | Monthly BTC Purchase: February 2025 (910) (Active Vote)

- This proposal aims to allocate a portion of non-OSMO taker fees to purchase approximately 1.1 BTC for February 2025.

👾 Aura DAO | Optimizing AURA Emissions (Preliminary Discussion)

- This proposal aims to modify its AURA emissions structure by shifting all emissions to the AIP 42 format instead of minting them with BAL emissions.

👻 Aave DAO | GHO Aave Savings Upgrade (Preliminary Discussion)

- This proposal aims to introduce sGHO, which is described as a "low-risk savings product that rewards users for staking GHO by earning the Aave Savings Rate (ASR), that compounds over time."