gm 05/02

Summary

gm, President Trump's announcement of tariffs on Canada, Mexico, and China initially caused Bitcoin to drop below $92,000, but it later rebounded above $100,000 after tariffs on Mexico and Canada were temporarily paused. The market remains on edge as China introduced retaliatory tariffs on U.S. goods. Amidst this economic tension, regulatory changes are unfolding in the U.S.; the SEC is contemplating a reassessment of the security status of digital assets and may offer retroactive relief for past token offerings, while also scaling back its crypto enforcement unit in line with Commissioner Hester Peirce's critiques of former aggressive strategies. Concurrently, the Crypto Task Force is set to clarify industry regulations. In Europe, Kraken has secured a MiFID license to trade crypto derivatives, significantly expanding its operational footprint across the EU.

News Headlines

🏦 MicroStrategy Pauses Weekly Bitcoin Purchases Ahead of Earnings

- MicroStrategy has paused its weekly Bitcoin purchases after 12 weeks of aggressive buying totaling 218,887 BTC.

- The company now holds 471,107 Bitcoin worth approximately $46.6 billion.

🔄 Uniswap V4 Launches on 12 Chains

- Uniswap v4 has launched on 12 blockchain networks, introducing customizable liquidity pool logic through "hooks".

- This allows developers to create tailored DEX functionalities and integrate custom pricing/fee structures.

🤖 AI Shows Why Data Portability Matters for Crypto

- AI capabilities now provide a compelling reason for users to pursue data portability across applications.

- Innovative solutions like DataDAOs could create financial incentives for users to migrate data to self-sovereign systems.

📊 Price Analysis: BTC, ETH, XRP, SOL and Others React to Trade Tensions

- Bitcoin rebounded sharply to $99,700 after dipping near $90,000 due to trade war concerns.

- Ether and XRP faced declining trends, with XRP dropping below key support levels.

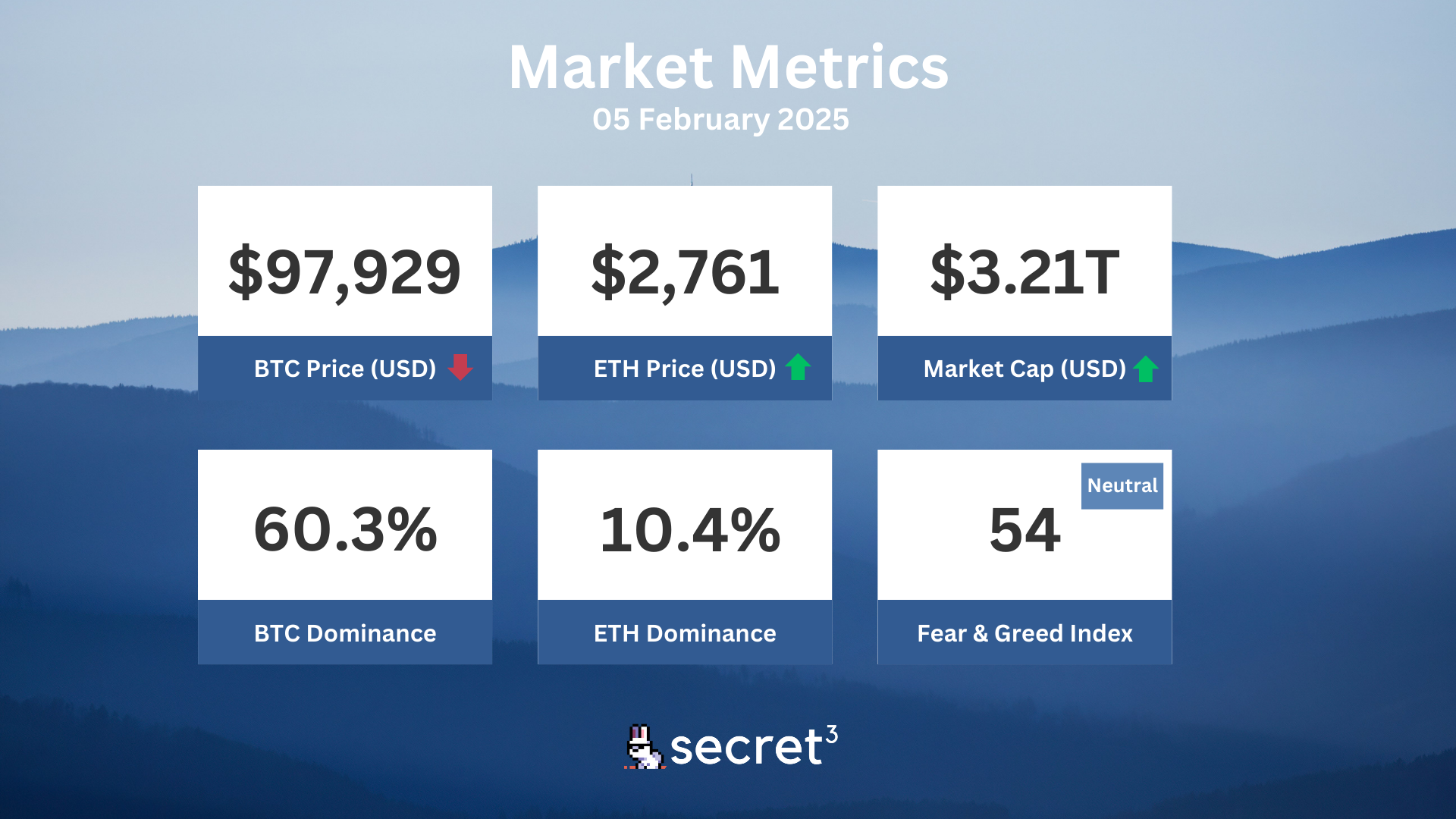

Market Metrics

Fundraising & VC

1. Beamable (Series A, $13.5M) - Open extensible game server platform

2. Herd (Pre Seed, $1.8M) - Crypto collaborative terminal

3. Corn (Private Token Sale, $1.5M) - Bitcoin-centric yield-generating network

On-chain Data

1. Immutable X (IMX) token unlocked today ($8.58M, 0.6%)

2. Galxe (GAL) token unlocked today ($7.96M, 4.05%)

3. Myria (myria) token unlock in 1 day ($1.29M, 2.69%)

4. Heroes of Mavia (mavia) token unlock in 1 day ($3.20M, 33.25%)

Regulatory

🏛️ Republicans Announce Bicameral Crypto Working Group

- Republican lawmakers form a bicameral working group to develop legislation on digital asset frameworks and stablecoins.

- The group involves representatives from key House and Senate committees focused on financial services and agriculture.

💱 Senator Introduces "GENIUS" Stablecoin Bill

- Senator Bill Hagerty introduces the GENIUS Act to create a regulatory framework for stablecoins under Federal Reserve rules.

- The bill requires audited reserve reports and imposes penalties for false information, aiming to foster innovation and support crypto growth.

🔍 CFTC Shifts Focus from Enforcement to Fraud Prevention

- Acting CFTC Chair Caroline Pham announces a shift away from regulation by enforcement towards fraud prevention.

- The agency restructures its Division of Enforcement, consolidating efforts into two main task forces for complex and retail fraud.

🏦 Coinbase Urges Removal of Crypto Banking Barriers

- Coinbase advocates for US regulators to clarify that banks can offer services to cryptocurrency businesses.

- The exchange seeks confirmation that state-chartered banks can provide crypto custody and execution services.

🌐 Hong Kong SFC Boosts Crypto Regulation Staff

- Hong Kong's Securities and Futures Commission plans to add eight new roles specifically for regulating cryptocurrencies.

- This expansion supports Hong Kong's initiative to license crypto firms and establish a stablecoin regulation framework.

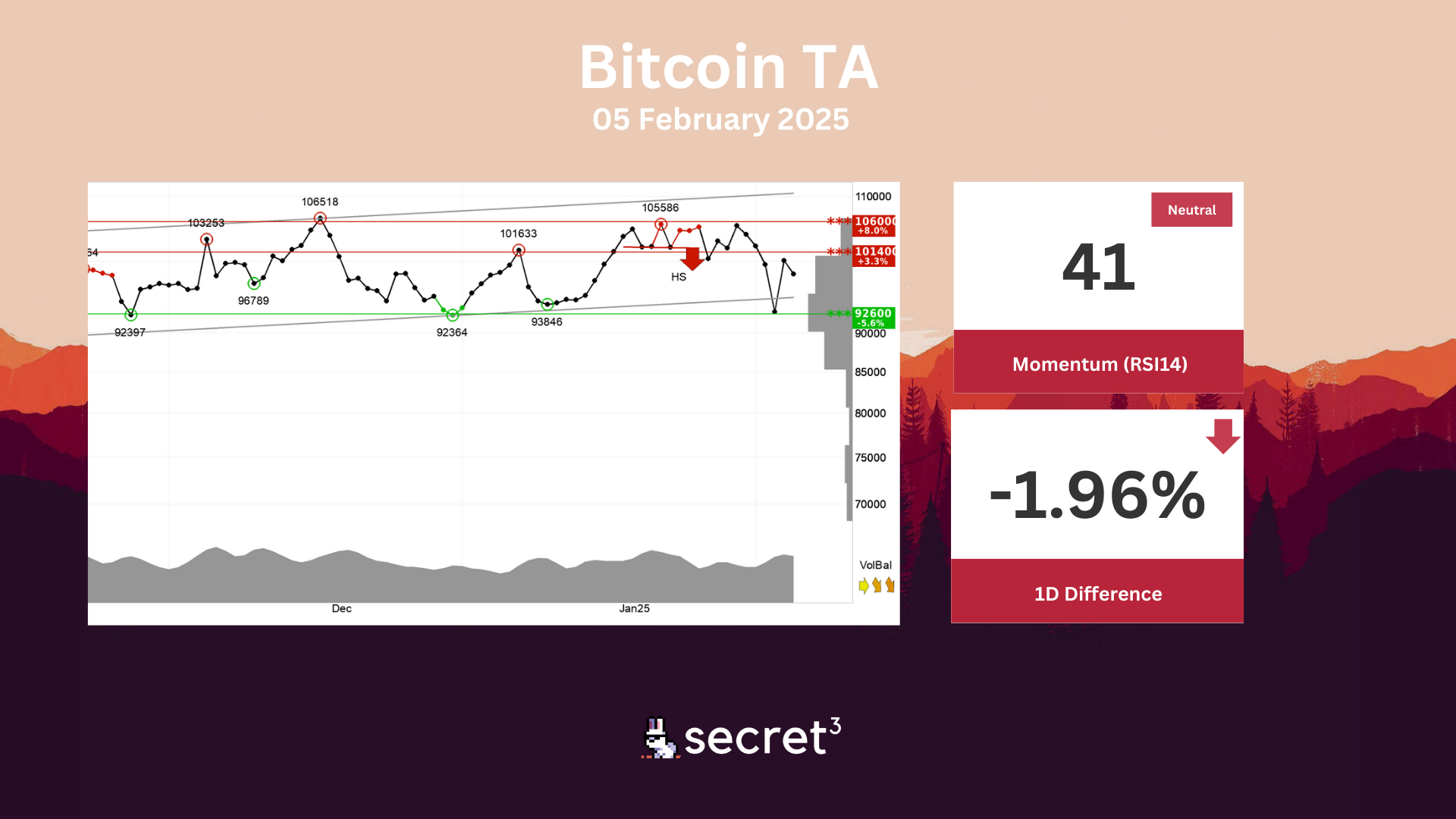

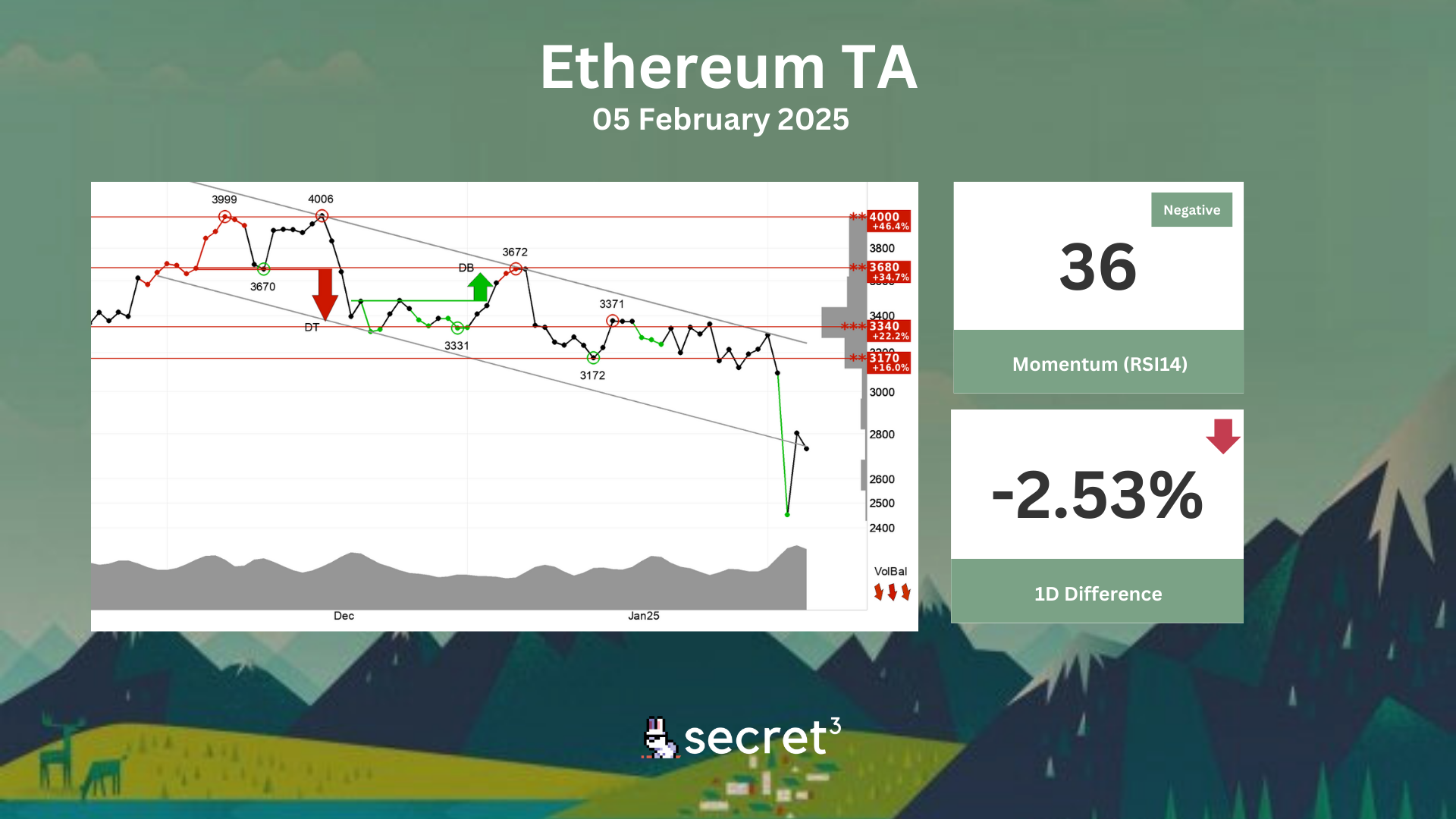

Technical Analysis

Bitcoin - Bitcoin is within an approximate horizontal trend channel in the short term. This indicates that investors are uncertain and waiting for signals of further direction. A break upwards will be a positive signal, while a break downwards will be a negative signal. The currency has support at points 92600 and resistance at points 101400. Volume has previously been low at price tops and high at price bottoms. This weakens the currency and indicates increased chance of a break down. The currency is overall assessed as technically slightly negative for the short term.

Ethereum - Ethereum has broken the falling trend channel down in the short term. This signals an even stronger falling rate, but the negative development may result in corrections up in the short term. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 3170 points. Volume has previously been low at price tops and high at price bottoms. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.

Governance & Code

👻 Aave DAO | BTC Correlated Asset Update (Preliminary Discussion)

- This proposal aims to add support for LBTC across Core and Base instances of Aave v3.

🔮 Osmosis DAO | Reduce Validator Set to 120

- This proposal aims to reduce the Osmosis Validator active set from 150 to 120 to "enhance network performance and validator sustainability."

💰 Compound DAO | Add Collateral wOS Market on Sonic

- This proposal aims to add a Wrapped Origin Sonic (wOS) market to Compound on Sonic.