gm 04/04

Summary

gm, Sentient Labs launches Open Deep Search (ODS), an open-source AI search framework claiming to outperform closed-source competitors like GPT-4o and Perplexity AI. In regulatory news, the US House Financial Services Committee approved the STABLE Act, aimed at regulating stablecoins, while the Senate Banking Committee advanced Paul Atkins' nomination for SEC chair. On the market front, Bitcoin experienced volatility, dropping to around $82,000 following President Trump's announcement of new global tariffs, which also impacted broader financial markets. Meanwhile, Fidelity introduced new retirement accounts allowing Americans to invest in cryptocurrencies with minimal fees, signaling growing institutional interest in digital assets.

News Headlines

🌊 Solana's Jupiter Acquires DRiP Haus, Expanding into NFTs

- Jupiter, a major decentralized exchange on Solana, has acquired DRiP Haus, marking its entry into the NFT sector.

- This strategic move aims to broaden Jupiter's offerings beyond DeFi and integrate NFTs within their digital finance solutions.

💼 Circle's IPO Valuation Could Top $5B Post-Roadshow

- Circle is aiming for a valuation between $4 billion and $5 billion as it approaches its IPO roadshow.

- Experts suggest this valuation may be intentionally low, especially compared to Coinbase's near $100 billion valuation during its IPO.

⛏️ Bitcoin Miner Bitfarms Secures $300M Loan from Macquarie

- Bitfarms has entered into a loan agreement with Macquarie Group for up to $300 million to develop high-performance computing data centers.

- The initial $50 million is designated for its Panther Creek data center in Pennsylvania, with potential for an additional $250 million based on development milestones.

🌐 WisdomTree Expands Tokenized Fund Platform to Multiple Chains

- WisdomTree has expanded its WisdomTree Connect platform to include access for institutional clients across Arbitrum, Base, Avalanche, Ethereum, and Optimism.

- The expansion responds to strong interest from institutional clients for tokenized funds, leading to the launch of 13 new tokenized funds on the platform.

🔍 Ethereum's Pectra Upgrade Set for May 7 Following Technical Hurdles

- Ethereum's Pectra upgrade, initially scheduled for March 2025, will now launch on May 7, 2025, after overcoming technical issues on various testnets.

- The upgrade aims to improve scalability and increase validator staking limits from 32 ETH to 2,048 ETH.

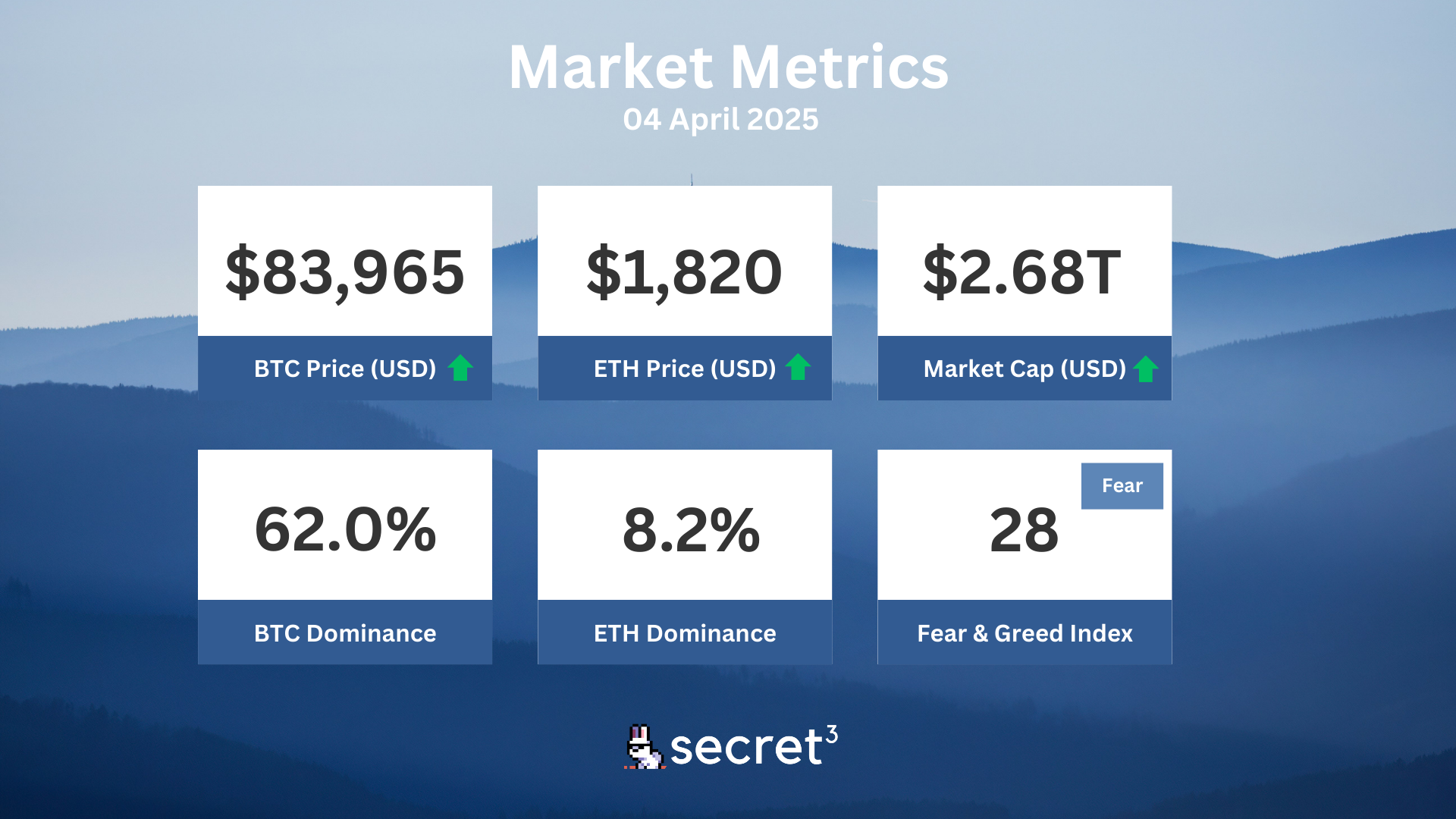

Market Metrics

Fundraising & VC

1. Bitfarms (Post IPO Debt, $50M) - Bitcoin mining company

2. Ultra (Undisclosed, $12M) - Blockchain-based gaming platform

3. StakeStone (Public Token Sale, $1M) - Omni-chain LST protocol

4. Hyperstable (Public Token Sale, $381.8K) - DeFi platform that issues USDH

Regulatory

🚫 House Committee Approves Anti-CBDC Bill

- The CBDC Anti-Surveillance State Act passed committee with a 27-22 vote.

- The bill aims to prevent the Federal Reserve from issuing a central bank digital currency.

🏛️ Lawmakers Press SEC for Details on Trump's Crypto Connections

- Sen. Warren and Rep. Waters raise concerns over Trump family's crypto firm ties.

- They requested the SEC preserve all records related to World Liberty Financial Inc.

🏦 Illinois to Drop Staking Lawsuit Against Coinbase

- Illinois joins other states in dropping lawsuit over Coinbase's staking program.

- This move follows the SEC's retreat from similar charges at federal level.

🚨 US Sanctions Crypto Wallets Tied to Houthis

- The US Treasury sanctioned 8 crypto wallets linked to Houthi financial facilitators.

- The wallets used Tether's USDT for transactions since at least 2023.

👨⚖️ CLS Global Fined $428K for Wash Trading

- UAE-based market maker fined for wash trading on Uniswap DEX.

- The company used algorithm for self-trades to create misleading volume impression.

Technical Analysis

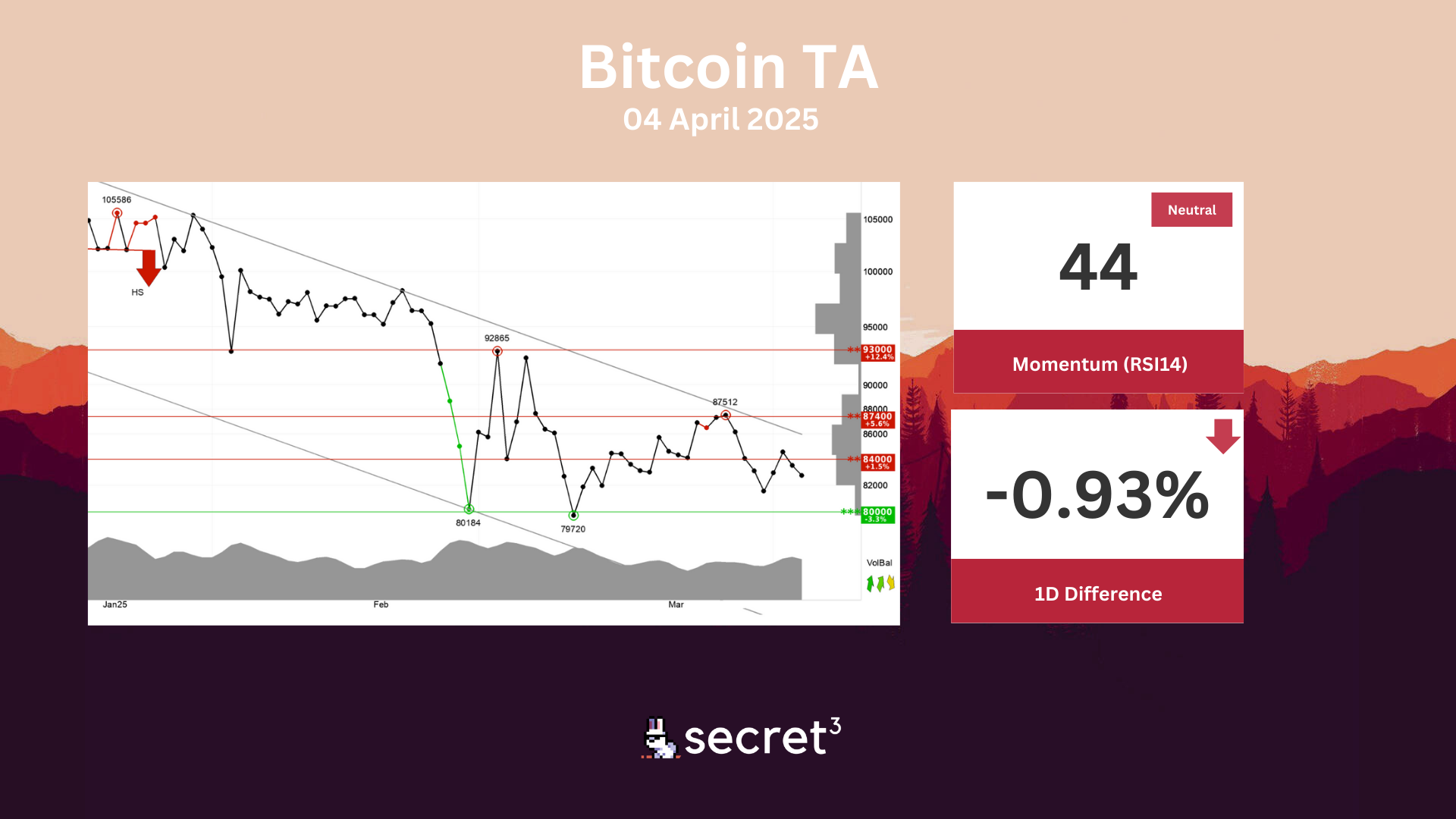

Bitcoin - Investors have accepted lower prices over time to get out of Bitcoin and the currency is in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. The currency is approacing resistance at 84000 points, which may give a negative reaction. However, a break upwards through 84000 points will be a positive signal. The RSI curve shows a falling trend, which supports the negative trend. The currency is overall assessed as technically negative for the short term.

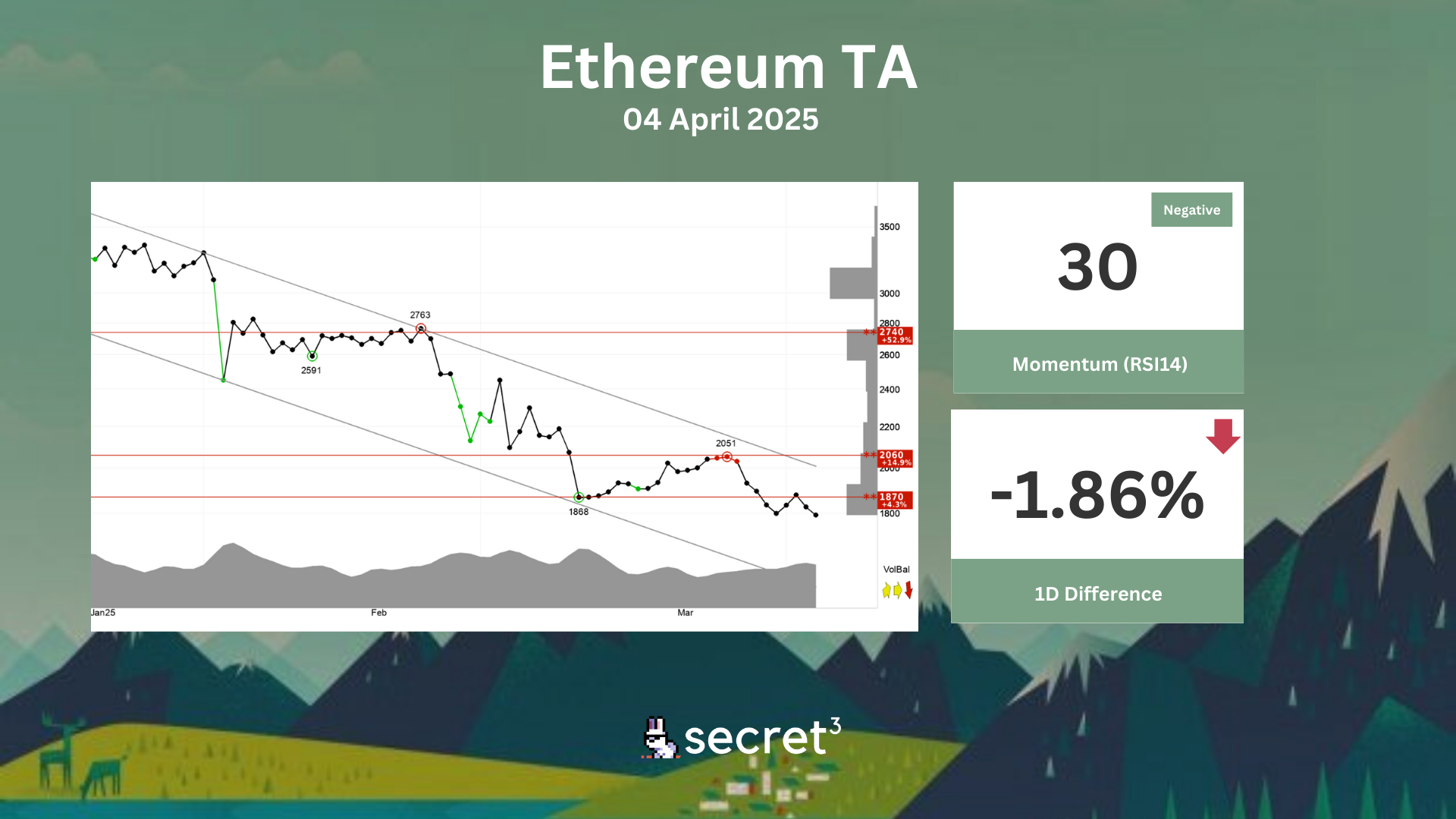

Ethereum - Ethereum shows weak development in a falling trend channel in the short term. This signals increasing pessimism among investors and indicates further decline for Ethereum. The currency has broken down through support at points 1870. This predicts a further decline. The currency is assessed as technically negative for the short term.