gm 04/03

Summary

gm, President Donald Trump's announcement of a potential U.S. crypto strategic reserve including Bitcoin, Ethereum, XRP, Solana, and Cardano causes major market volatility. Initially, this news sparked a rally with Bitcoin surging to nearly $95,000, but the market has since retraced substantially due to concerns over trade tariffs and economic uncertainty. The SEC has continued its trend of dropping lawsuits against crypto firms, including Kraken and Yuga Labs, signaling a potential shift in regulatory approach. Meanwhile, Binance announced plans to delist several stablecoins in Europe to comply with MiCA regulations, highlighting ongoing regulatory challenges in different jurisdictions.

News Headlines

🔒 $1.5B Crypto Hack Losses Expose Bug Bounty Flaws

- February saw over $1.5 billion in crypto losses due to hacks, with Bybit losing $1.4 billion.

- The incidents highlight inadequacies in current bug bounty programs and security measures.

🌐 PayPal Aims to Integrate Crypto with Traditional Payments

- PayPal is working to seamlessly integrate digital currencies with traditional payment methods.

- The company sees stablecoins as a key component in bridging fiat and crypto transactions.

📊 Crypto ETPs See Record $2.9B Outflow Amid Market Volatility

- Crypto exchange-traded products experienced a record $2.9 billion outflow in one week.

- Bitcoin investment products were hit hardest, losing $2.6 billion.

💼 Binance to Delist Non-MiCA Compliant Stablecoins in Europe

- Binance will delist 9 stablecoins, including USDT and DAI, for European users on March 31.

- The move is to comply with the EU's Markets in Crypto-Assets (MiCA) regulations.

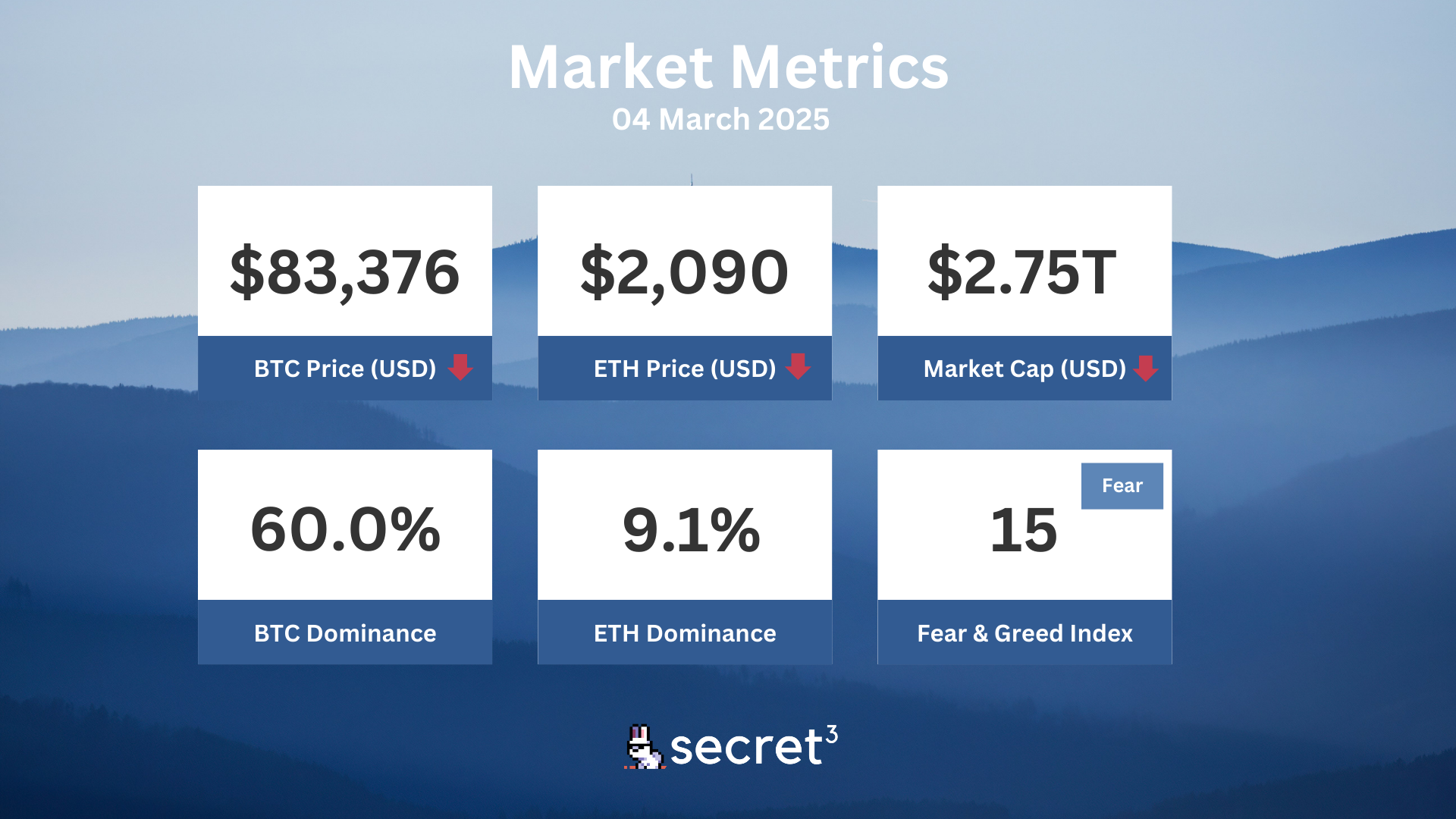

Market Metrics

Fundraising & VC

1. Lantern Finance (Undisclosed, $1M) - Crypto-backed loans platform

2. Prime Intellect (Undisclosed, $15M) - Peer to peer compute and intelligence protocol

On-chain Data

1. Immutable X (IMX) token unlock in 1 day ($6.38M, 0.59%)

2. Galxe (GAL) token unlock in 1 day ($2.39M, 1.59%)

3. Myria (myria) token unlock in 2 days ($881.48K, 2.66%)

4. Core DAO (CORE) token unlock in 4 days ($4.21M, 0.91%)

5. CoW Protocol (COW) token unlock in 4 days ($2.70M, 2.3%)

Regulatory

👥 New Congressional Crypto Caucus Formed

- A bipartisan "Congressional Crypto Caucus" was launched to promote crypto-friendly policies in the House.

- The caucus aims to support upcoming digital asset legislation on stablecoins and market structure.

🔍 SEC Creates New Crypto Task Force

- The SEC assembled a Crypto Task Force combining agency veterans and industry experts.

- Led by Commissioner Hester Peirce, it aims to refine the SEC's approach to crypto oversight and regulation.

🏦 NYSE Arca Proposes Bitwise Dogecoin ETF

- NYSE Arca filed to list and trade shares of a Bitwise Dogecoin ETF.

- If approved, it would be one of the first U.S.-listed memecoin ETFs, marking a new development in crypto investing.

🚨 $1.5B Lost to Crypto Hacks in February

- Cryptocurrency losses from hacks exceeded $1.5 billion in February, with Bybit losing over $1.4 billion.

- The incidents highlight ongoing security vulnerabilities in the crypto space.

🏛️ SEC Drops Lawsuits Against Major Crypto Firms

- The SEC is ending several lawsuits and investigations against crypto companies like Kraken, Coinbase, and Binance.

- This shift away from aggressive enforcement signals a more lenient regulatory approach under new SEC leadership.

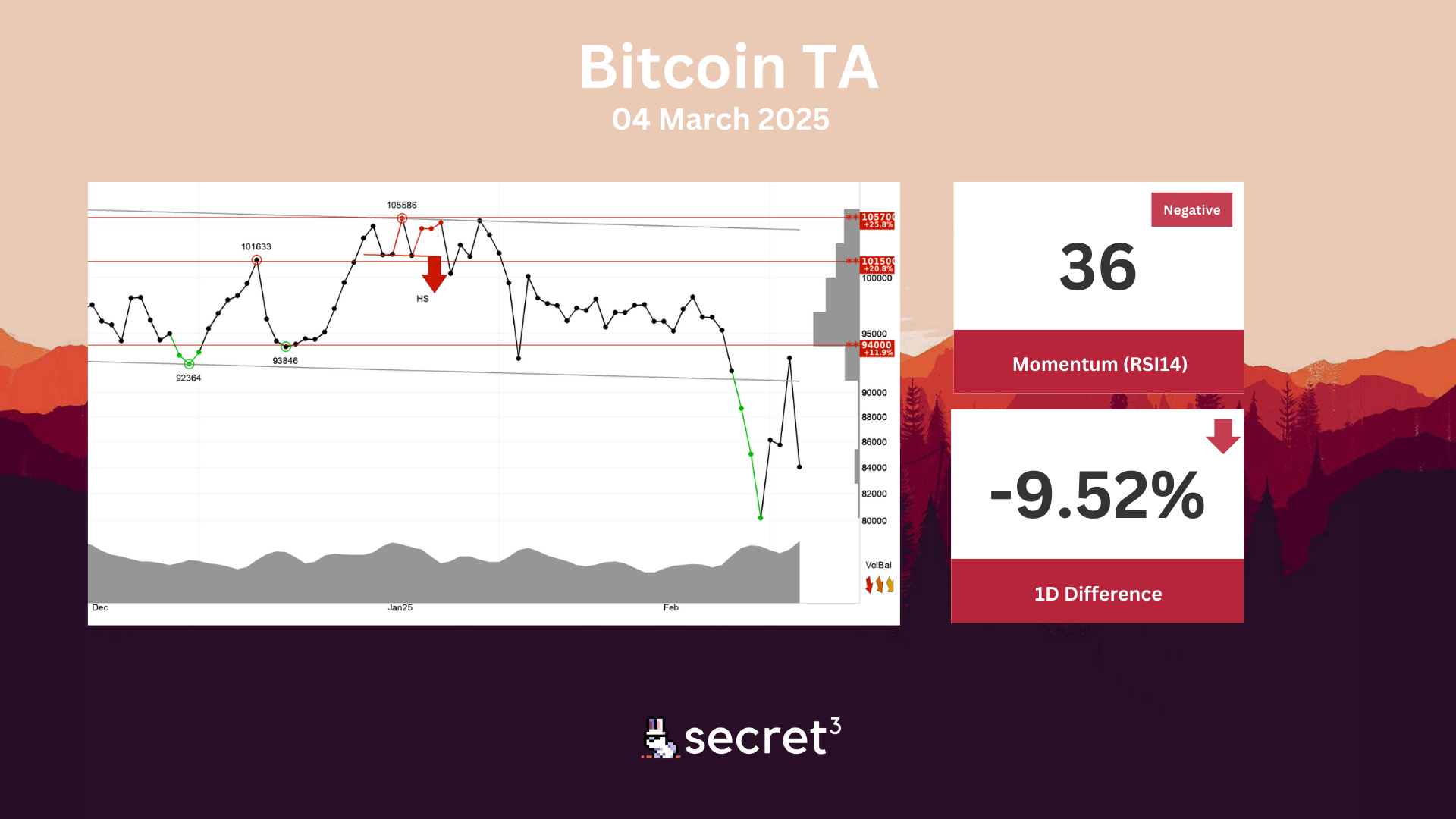

Technical Analysis

Bitcoin - Bitcoin has broken down from an approximate horizontal trend channel in the short term after investors have sold at ever lower prices. A negative signal has been triggered and further decline for the currency is indicated. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 94000 points. The currency is assessed as technically negative for the short term.

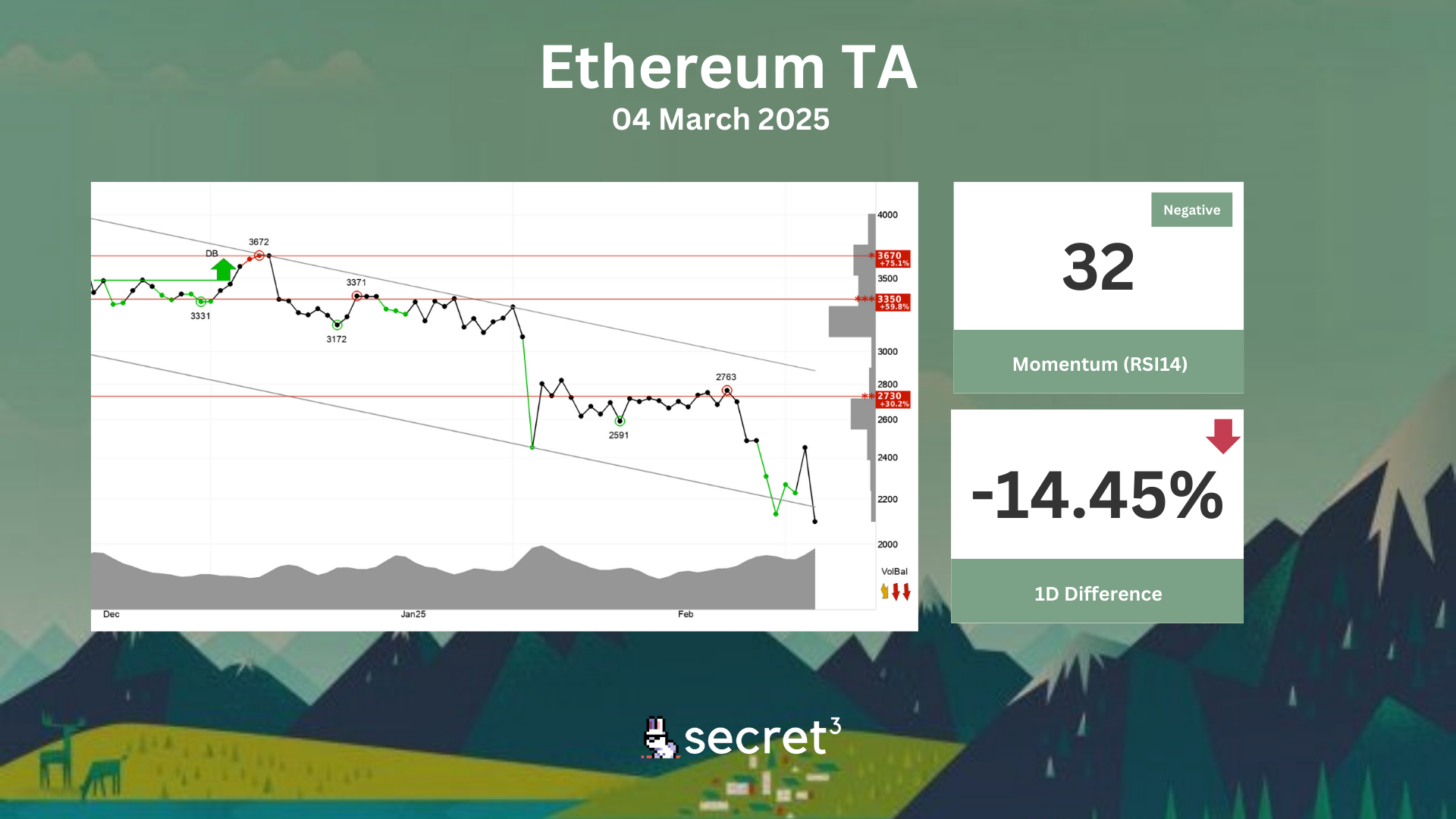

Ethereum - Ethereum has broken the falling trend channel down in the short term, which indicates an even stronger falling rate. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 2730 points. Negative volume balance shows that volume is higher on days with falling prices than days with rising prices. This indicates decreasing optimism among investors. The currency is overall assessed as technically negative for the short term.

Governance & Code

🦄 Uniswap DAO | Deploy Uniswap V3 on Hemi (Preliminary Discussion)

- This proposal aims to deploy Uniswap v3 on Hemi.

👻 Aave DAO | Add USR to Aave v3 Core Instance (Preliminary Discussion)

- This proposal aims to onboard Resolv's USR to the Aave v3 Core Market on Ethereum.

🏔️ Arbitrum DAO | Register Sky Custom Gateway Contracts in the Router

- This proposal requests Arbitrum DAO to register the Sky Custom Gateway contracts in the Router contracts to allow users bridging USDS and sUSDS through the official Arbitrum Bridge UI.