gm 04/02

Summary

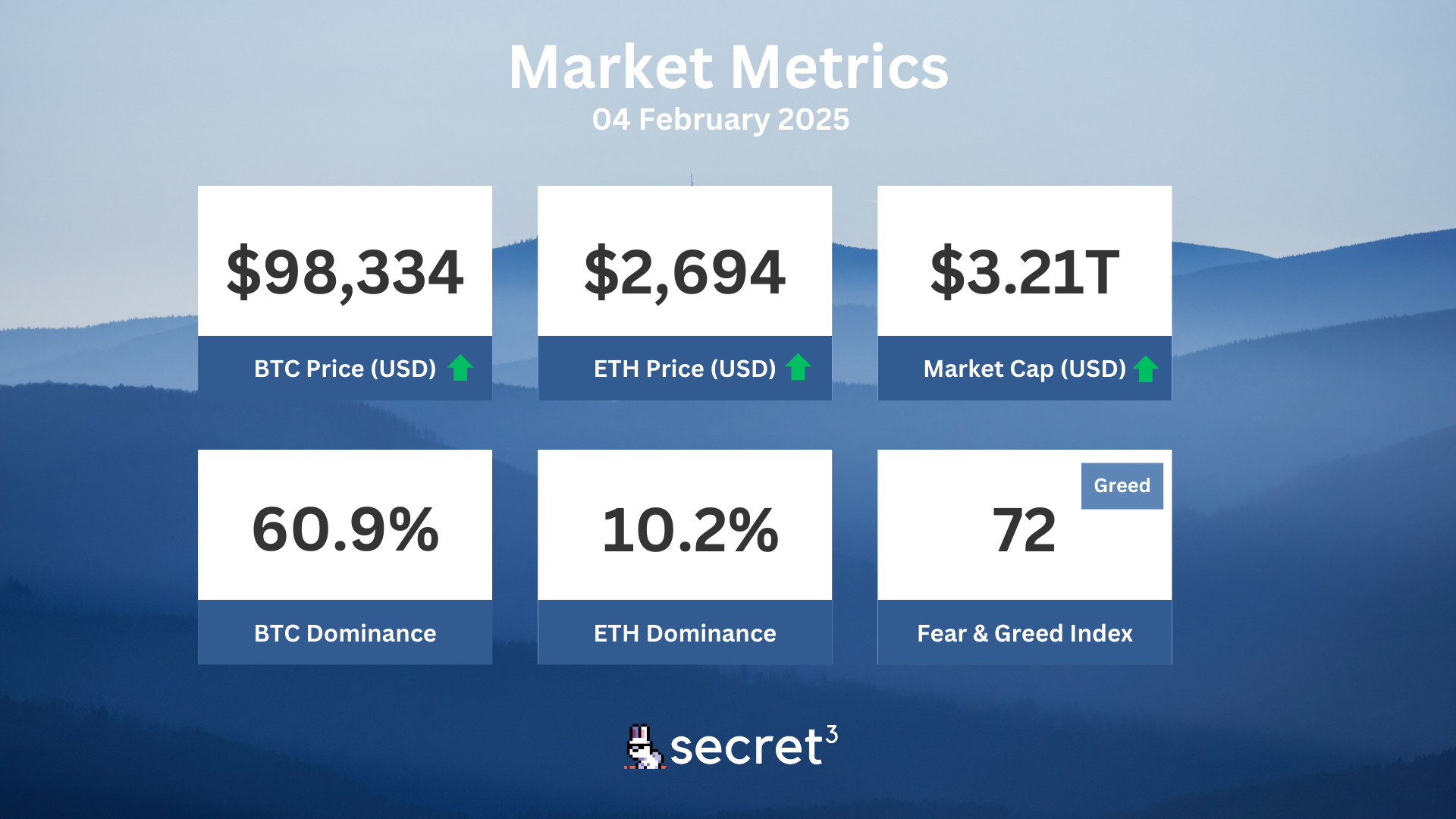

gm, The crypto market faced significant volatility, largely triggered by U.S. President Donald Trump's announcement of new tariffs on imports from Canada, Mexico, and China, which led Bitcoin to fall below $92,000 before recovering to around $99,000. Altcoins such as Ethereum and XRP experienced even sharper declines, with market turbulence causing between $2.3 and $10 billion in liquidations. Stability returned after Trump temporarily paused tariffs on Canada and Mexico, allowing partial market recovery. During this period, Coinbase secured approval from the UK's Financial Conduct Authority to provide digital asset services, marking a significant expansion into a key international market. Additionally, discussions about potentially including Bitcoin in a new U.S. sovereign wealth fund have begun, highlighting ongoing institutional interest despite market fluctuations.

News Headlines

📈 Real-World Asset (RWA) Tokens Lead Crypto Rebound

- Tokens in the real-world asset (RWA) sector significantly outperformed the broader crypto market during a recent recovery.

- Ondo Finance's MANTRA (OM) and Chintai's CHEX saw impressive gains of 16% and 27%, respectively.

🤖 AI Agents in Crypto See 'Remarkable Traction' but Value Unclear: Sygnum

- Interest in AI-related crypto projects is increasing, with the market cap of AI agents more than doubling to $10 billion in a single quarter.

- AI infrastructure projects like Bittensor, the Artificial Superintelligence Alliance, and Phala Network are addressing practical challenges in integrating AI with decentralized applications.

🔧 Ethereum Validators Signal Support for Increased Gas Limit

- Over 50% of Ethereum validators have expressed support for raising the gas limit, potentially increasing transaction capacity.

- This would be the first increase since Ethereum's transition to proof-of-stake in 2022.

🌐 Kraken Secures MiFID License to Offer Derivatives in Europe

- Kraken acquired a Markets in Financial Instruments Directive (MiFID) license, allowing it to offer derivative products across the European Union.

- The exchange aims to capitalize on Europe's growing crypto market, valued at $7 billion with a projected 15% growth rate until 2030.

Market Metrics

Fundraising & VC

1. Digihost (Post IPO, $5.35M) - Blockchain technology company

2. Mighty Bear Games (Strategic, $4M) - Web3 games studio

3. Midle (Grant, Undisclosed) - AI-airdrop agent

On-chain Data

1. Immutable X (IMX) token unlock in 1 day ($8.62M, 0.6%)

2. Galxe (GAL) token unlock in 1 day ($8.28M, 4.05%)

3. Myria (myria) token unlock in 2 days ($1.18M, 2.69%)

4. Heroes of Mavia (mavia) token unlock in 2 days ($3.28M, 33.25%)

Regulatory

🏛️ SEC's Evolving Stance May Open Floodgates for Crypto ETFs

- The SEC's changing approach could lead to significant increases in crypto ETF approvals, including for assets like XRP, Solana, and Dogecoin.

- Establishing new regulatory precedents may pave the way for multiple spot crypto ETF approvals this year.

💼 Trump Orders Creation of US Sovereign Wealth Fund

- President Trump signed an executive order to create a US sovereign wealth fund, potentially leading to government Bitcoin acquisition.

- While not explicitly mentioned, speculation suggests the fund could serve as a means for the government to acquire and hold Bitcoin.

🕵️ CFTC Investigates Super Bowl Wagers by Crypto.com and Kalshi

- The CFTC is investigating Super Bowl markets provided by Crypto.com and Kalshi for compliance with derivatives regulations.

- This review aims to ensure these contracts are not prone to manipulation and conform to existing regulations.

🚔 US Charges Canadian for $65M DeFi Hacks

- The US Department of Justice charged Canadian national Andean Medjedovic for exploiting two DeFi protocols, KyberSwap and Indexed Finance.

- Charges include attempted extortion, money laundering, and wire fraud, with potential penalties totaling 90 years in prison.

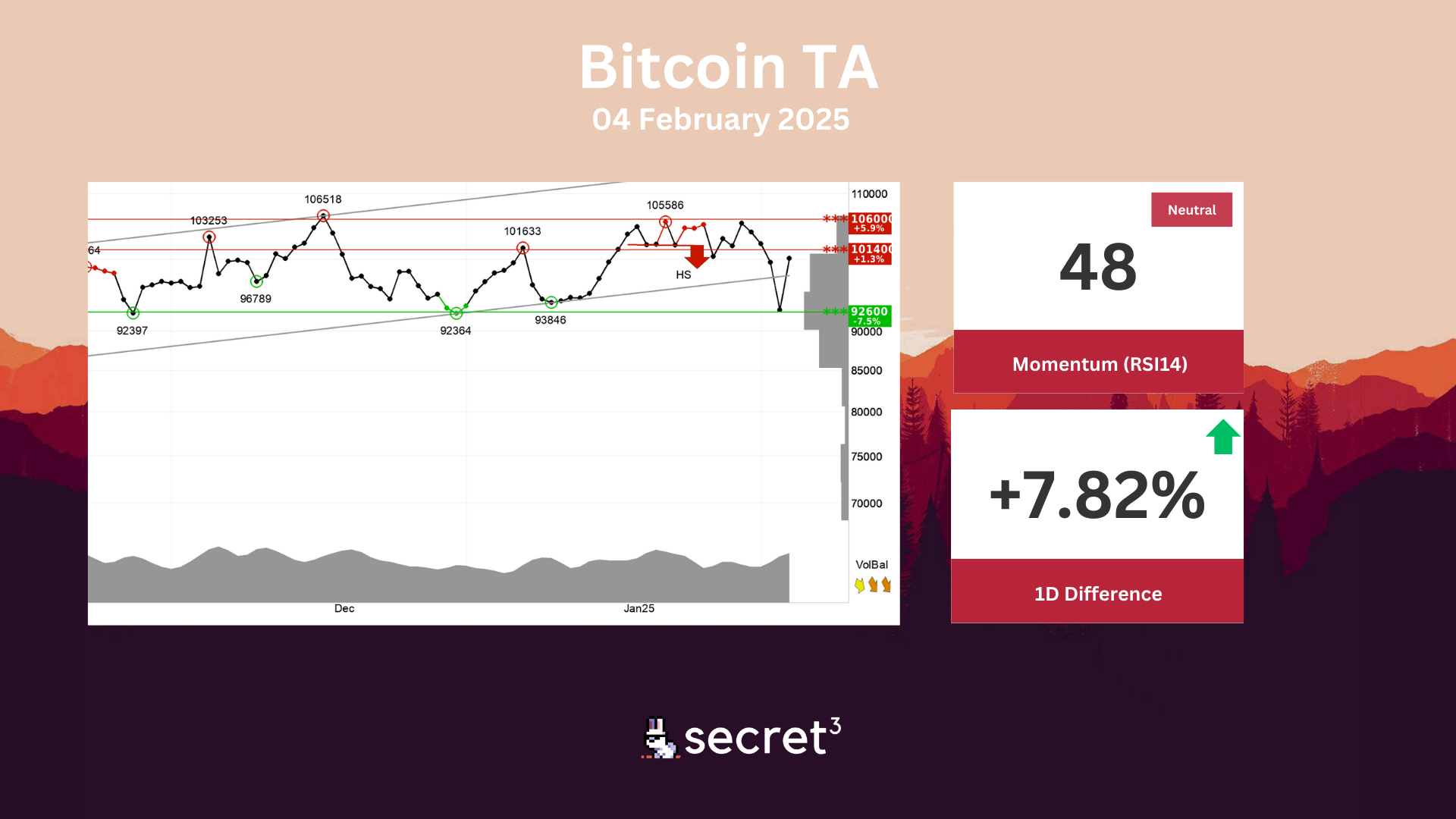

Technical Analysis

Bitcoin - Bitcoin is in a rising trend channel in the short term. This shows that investors over time have bought the currency at higher prices and indicates good development for the currency. The currency is testing resistance at points 101400. This could give a negative reaction, but an upward breakthrough of points 101400 means a positive signal. Volume has previously been low at price tops and high at price bottoms. This weakens the rising trend and could be an early signal of a coming trend break. The currency is overall assessed as technically neutral for the short term.

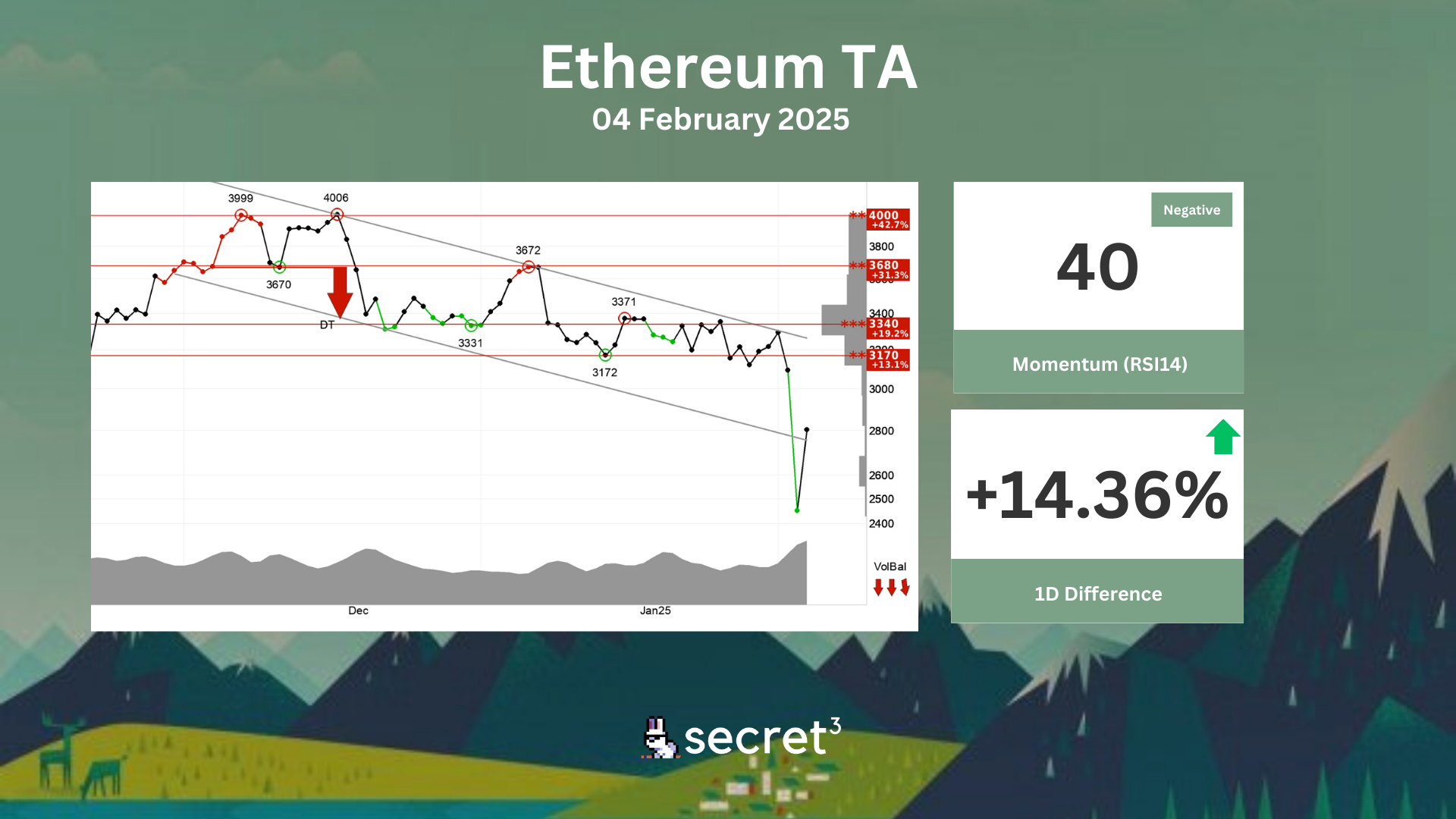

Ethereum - Ethereum is in a falling trend channel in the short term. This shows that investors over time have sold at lower prices to get out of the currency, and indicates negative development for the currency. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 3170 points. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. Volume balance is also negative, which confirms the trend. The currency is overall assessed as technically negative for the short term.

Governance & Code

👻 Aave DAO | Update USDS & GHO Borrow Rate (Preliminary Discussion)

- This proposal aims to update the USDS borrow rate and reduce the GHO borrow rate on the Prime instance.

💰 Compound DAO | Deploy Compound III on Unichain

- This proposal aims to deploy Compound on Unichain, which is expected to go live "in the coming weeks."

🌐 ENS DAO | 2025 H1 Budget: Public Goods Working Group

- This proposal suggests a budget of $343,480 USDC and 23 ETH for the first half of 2025, utilizing funds rolled over from 2024.