gm 03/06

Summary

gm, Circle increased its IPO target to $896 million amid strong investor interest and favorable regulatory conditions, signaling growing institutional confidence in stablecoins. In Singapore, the Monetary Authority mandated local crypto firms to cease overseas operations by June 30 or face penalties up to $200,000, highlighting a global trend toward stricter regulatory frameworks. Meanwhile, GameStop joined the Bitcoin treasury trend by purchasing 4,710 BTC (approximately $512 million) as a hedge against currency devaluation, while TON blockchain experienced a brief 40-minute outage due to a masterchain dispatch error but quickly recovered. On the technology front, Wintermute introduced "CrimeEnjoyor," a new tool designed to flag malicious Ethereum contracts that exploit leaked private keys, enhancing security for users of the recently implemented EIP-7702 feature.

News Headlines

🌊 CZ Proposes Dark Pool DEXs to Prevent Market Manipulation

- Binance founder Changpeng Zhao has proposed creating a dark pool-style perpetual swap decentralized exchange that would conceal trades and liquidation points from the public to protect users from front-running and manipulation.

- CZ highlighted that large traders prefer to keep their orders hidden until execution to avoid increased costs, noting the importance of privacy in derivatives markets to prevent coordinated liquidation attacks against exposed positions.

🚨 BitMEX Thwarts North Korean Lazarus Group Phishing Attempt

- BitMEX successfully blocked a phishing attempt by the North Korean Lazarus Group, which tried to lure an employee on LinkedIn into executing a malicious GitHub project disguised as a Web3 NFT collaboration.

- Despite being responsible for sophisticated breaches like the $1.4 billion Bybit hack, BitMEX noted that Lazarus often uses basic phishing techniques, highlighting poor operational security in their initial engagement methods.

🚀 Arthur Hayes Predicts Bitcoin to Hit $250K This Year Due to Money Printing

- Arthur Hayes, co-founder of BitMEX, forecasts Bitcoin reaching $250,000 within the year, attributing this to shifts in U.S. fiscal policy under President Trump away from tariffs toward increased money printing as midterm elections approach.

- Hayes believes the administration will stimulate the housing market via changes to Fannie Mae and Freddie Mac, enhancing liquidity and support for risk assets, while also potentially exempting banks from leverage ratios for U.S. Treasuries.

🔄 Bitcoin Traders Target $100K and Under as Monthly Close Seals 11% Gain

- Bitcoin traders are closely monitoring price levels below $100,000 following an 11% gain in May, with notable support at $97,000 and the psychological $100,000 mark as technical indicators show a bearish divergence in the RSI.

- Analysts suggest that while a temporary dip below $100,000 may occur, overall bullish market sentiment remains intact, supported by a solid bullish structure at $84,000, with healthy market adjustments expected as liquidity accumulates around key price points.

🏦 Metaplanet Becomes 9th Largest Bitcoin Holder with $117M Purchase

- Japanese investment company Metaplanet has acquired 1,088 BTC for $117.9 million at an average price of $108,400, bringing its total holdings to over 8,888 BTC and making it the world's ninth-largest corporate Bitcoin holder.

- The company's strategic Bitcoin acquisition comes amid rising financial uncertainty, with some analysts predicting Bitcoin could reach over $200,000 based on current market conditions, despite recent price retractions from the $112,000 high.

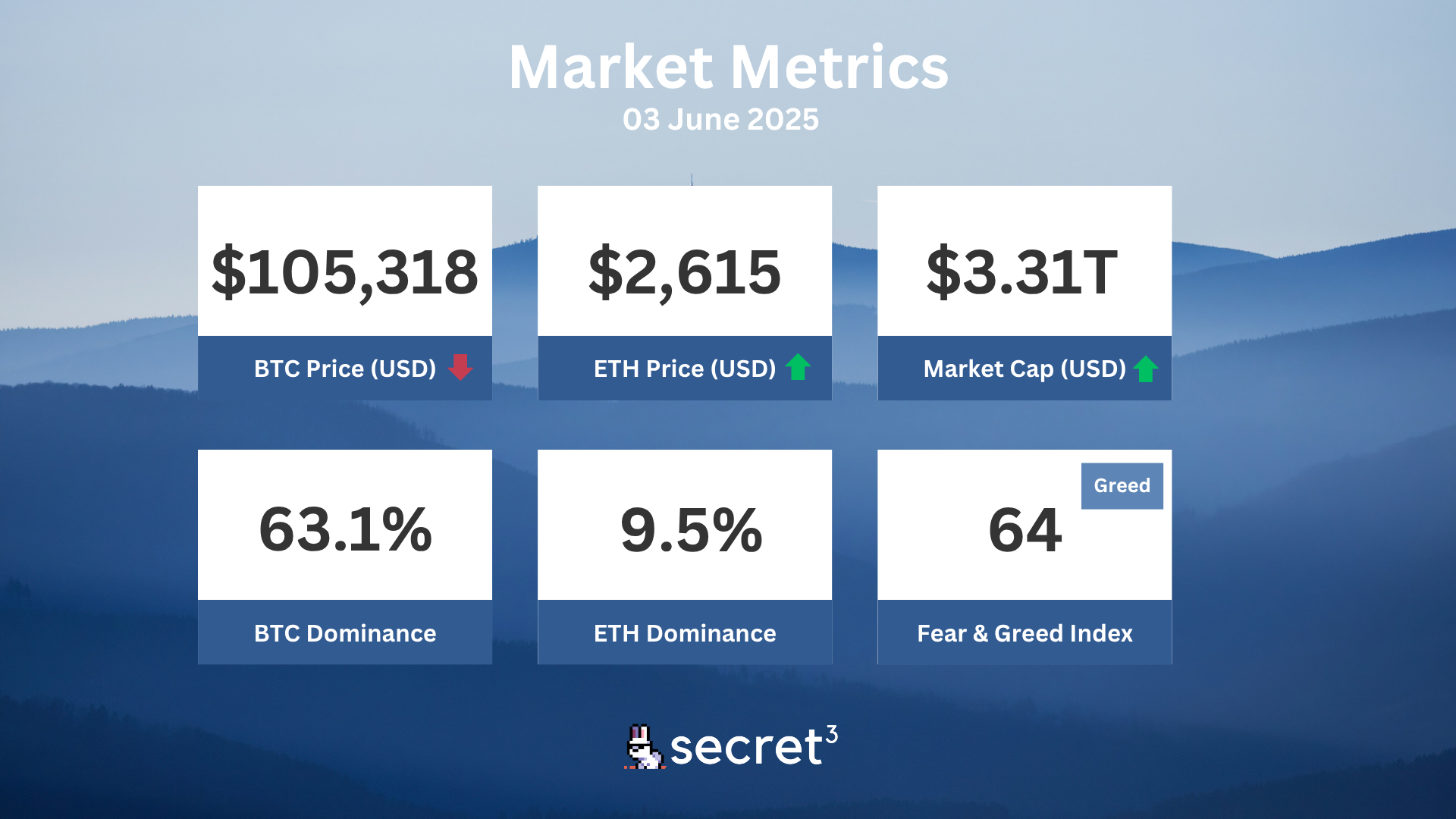

Market Metrics

Fundraising & VC

1. Neutral Trade (Undisclosed, $2M) - On-chain, multi-strategy hedge fund platform

2. Reddio (Series A, Undisclosed) - Parallel EVM powered by GPU for Autonomous AI

Regulatory

🏛️ SEC Faces Criticism Over Crypto Staking Guidance Shift

- The SEC's new guidance suggesting some staking offerings might not be securities has drawn criticism for contradicting previous court rulings and enforcement actions against Binance and Coinbase.

- Commissioner Caroline Crenshaw expressed concern that the agency's current analysis doesn't align with established case law, highlighting inconsistencies in how digital assets like Ether and Solana are treated.

⚖️ SEC's 2025 Guidance on Crypto Securities Classification

- The SEC's April 2025 guidance updates the Howey test for crypto tokens, classifying those marketed for profit, governed centrally, or offering financial incentives as securities.

- Stablecoins, utility tokens without profit expectations, and truly decentralized tokens are less likely to be considered securities, though the guidance still allows for subjective interpretation.

🏦 Russia's Sber Launches Bitcoin-Linked Bonds

- Russia's largest commercial bank, Sber, has introduced Bitcoin-linked bonds that track Bitcoin's price and the dollar-to-ruble exchange rate, currently available to qualified investors.

- The bonds will soon be listed on Russia's premier stock exchange, following the Bank of Russia's recent approval allowing financial institutions to offer select crypto financial instruments to accredited investors.

💰 UK's IG Group Launches Direct Crypto Trading for Retail Investors

- UK-listed IG Group has expanded its cryptocurrency offering by launching direct trading for retail investors, allowing them to buy, sell, and hold 31 crypto assets including Bitcoin, Ethereum, and popular memecoins.

- The move represents a significant milestone in UK's crypto adoption, aligning with recent regulatory efforts by the Financial Conduct Authority to establish industry standards for digital assets.

🛡️ Australia Tightens Crypto ATM Regulations Amid Rising Scams

- Australia's AUSTRAC has revoked a crypto ATM provider's license and implemented $5,000 transaction caps following fraud targeting seniors, with people over 50 accounting for 72% of transaction value.

- The regulatory crackdown comes as Australia's crypto ATMs have grown from 23 in 2019 to over 1,800 today, prompting enhanced customer due diligence requirements and educational materials near machines.

Technical Analysis

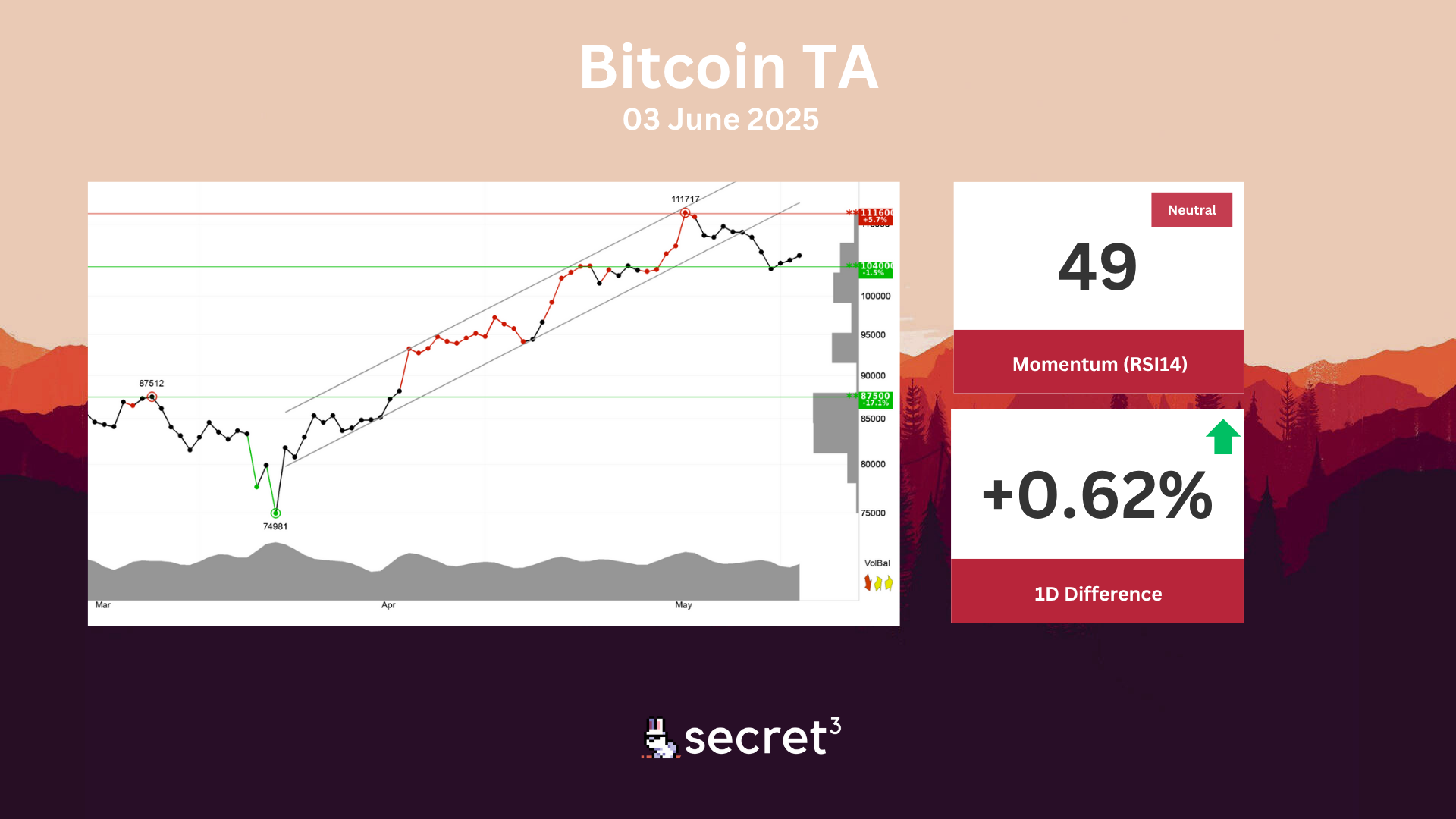

Bitcoin - Bitcoin has broken the floor of the rising trend channel in the short term, which indicates a weaker initial rising rate. The currency is approaching support at 104000 points, which may give a positive reaction. However, a break downwards through 104000 points will be a negative signal. RSI diverges negatively against the price, which indicates danger of a reaction downwards. The currency is overall assessed as technically slightly positive for the short term.

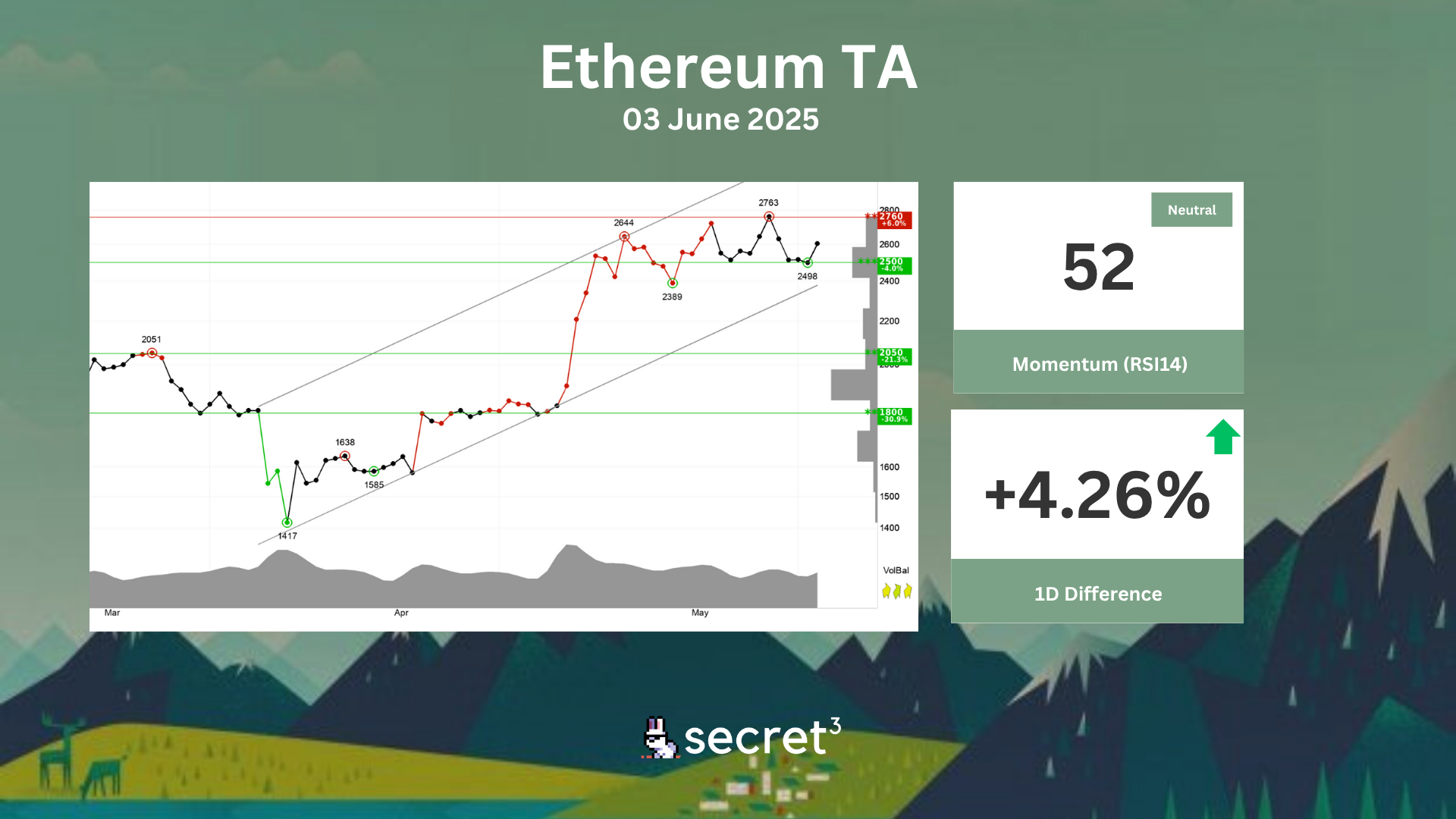

Ethereum - Ethereum shows strong development within a rising trend channel in the short term. Rising trends indicate that the currency experiences positive development and that buy interest among investors is increasing. The currency is between support at points 2500 and resistance at points 2760. A definitive break through of one of these levels predicts the new direction. Volume tops and volume bottoms correspond well with tops and bottoms in the price. This strengthens the trend. RSI diverges negatively against the price, which indicates danger of a reaction downwards. The currency is overall assessed as technically positive for the short term.