gm 03/05

Summary

gm, the US Senate advances a landmark stablecoin bill and Bitcoin surges past $97,000 amid strong jobs data. Tether reported Q1 profits exceeding $1 billion, while Strategy announced plans to raise $21 billion for further Bitcoin purchases. Additionally, Worldcoin launched in the US with a new Orb Mini device, and Movement Labs suspended its co-founder following controversy over a market maker agreement. These events highlight ongoing regulatory progress, institutional interest, and the evolving landscape of crypto projects.

News Headlines

🕵️ Kraken Thwarts North Korean Hacker's Job Application Attempt

- Kraken uncovered a suspected North Korean hacker attempting to infiltrate the exchange through a job application.

- The applicant displayed suspicious behavior, including using different names and inconsistent responses during interviews.

🌐 Ethereum's Dominance in Decline as Competition Heats Up

- Ethereum's dominance among layer-1 blockchain networks has significantly decreased, with its total value locked dropping from 96% in 2021 to about 51% currently.

- Smaller chains like Solana are gaining traction, surpassing Ethereum in metrics such as active addresses and transaction volume.

💰 Dao5 Raises $222M Fund to Invest in Blockchain Projects

- Crypto investment firm Dao5 has raised $222 million for its second investment fund, increasing total assets under management to $550 million.

- The fund will focus on stablecoin networks and blockchain infrastructure as institutional investors increasingly engage with digital assets.

🎮 Ubisoft and LayerZero Launch Network for Migrating Crypto Game Assets

- Ubisoft partnered with LayerZero to establish a Decentralized Verification Network (DVN) for secure cross-chain gaming asset transfers.

- The system allows transactions across over 130 blockchains, enhancing digital ownership security and enabling seamless asset transfers.

🏦 Grayscale Bitcoin Trust Dominates ETF Revenue

- Despite significant outflows, Grayscale Bitcoin Trust (GBTC) generated $268.5 million in annual revenue, outpacing other US spot Bitcoin ETFs.

- GBTC's 1.5% expense ratio contributes to its revenue lead, even as lower-fee competitors attract new capital.

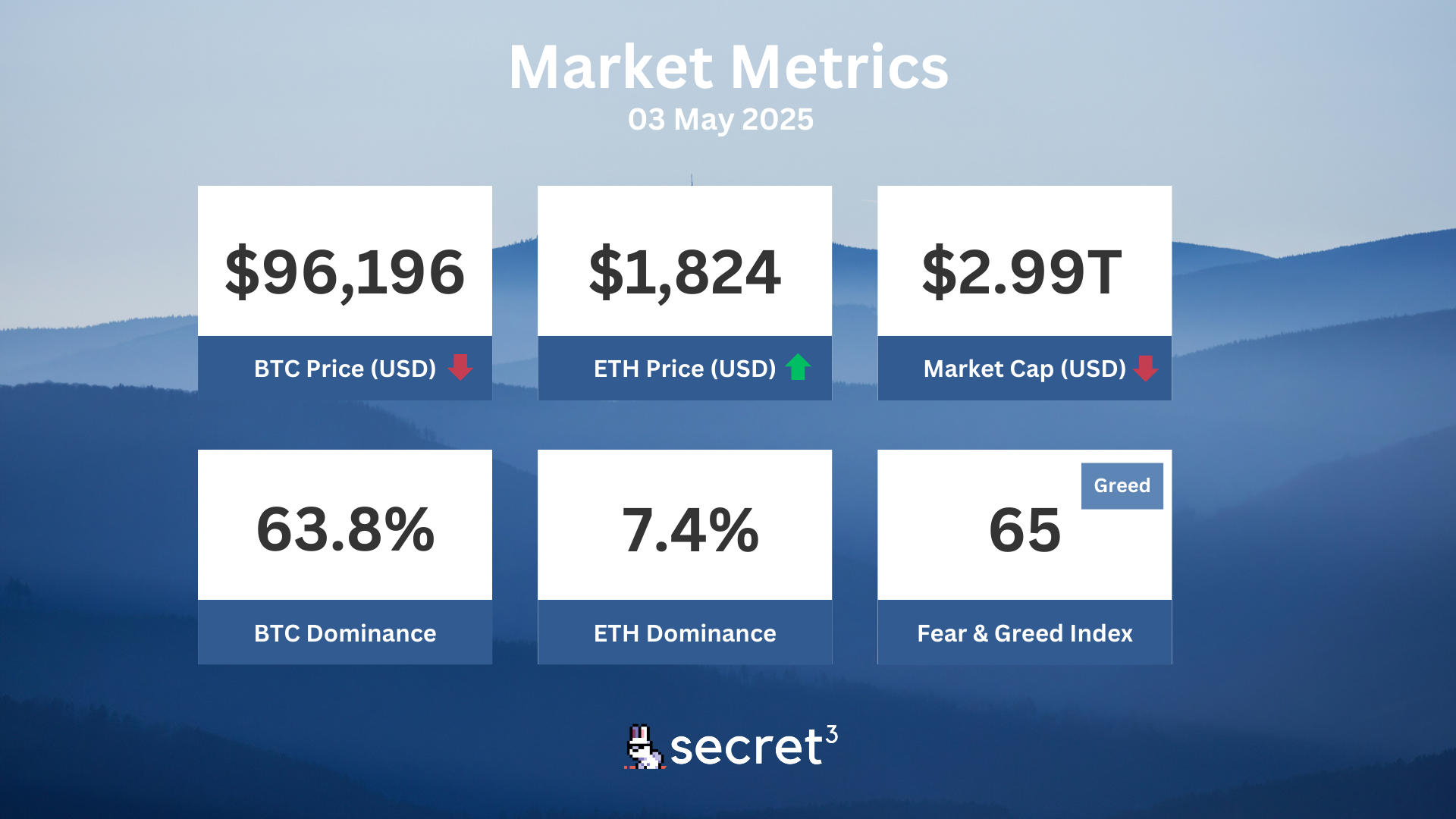

Market Metrics

Fundraising & VC

1. aZen Protocol (Seed, $1.2M) - Computing infrastructure for ubiquitous AI

2. Fido (Accelerator, $450K) - DeFi neobank

3. WootzApp (Accelerator, $450K) - Chromium-based mobile crypto browser

Regulatory

🏛️ EU to Ban Anonymous Crypto Wallets and Privacy Tokens by 2027

- The European Union plans to implement new Anti-Money Laundering regulations prohibiting anonymous cryptocurrency accounts and privacy tokens.

- Financial institutions and crypto asset service providers will be forbidden from maintaining anonymous accounts or processing privacy-enhanced cryptocurrencies starting in 2027.

🚫 UK Regulator Considers Ban on Crypto Purchases with Credit

- The UK's Financial Conduct Authority (FCA) is proposing a ban on using credit for cryptocurrency purchases to prevent unsustainable debt.

- The proposal would prohibit any crypto purchases using borrowed funds, including credit cards or loans.

📱 Apple Eases NFT and Crypto Rules for iOS Apps

- Apple has updated its iOS app developer guidelines, loosening restrictions on NFTs and crypto-related features.

- Developers can now include buttons or links allowing users to browse NFT collections and make purchases from secondary marketplaces.

🏙️ Cannes to Accept Crypto Payments by Summer 2025

- Merchants in Cannes, France, are preparing to accept cryptocurrency payments by summer 2025.

- The local government aims for a 90% adoption rate among merchants to modernize commerce and attract high-spending tourists.

⚖️ Australian Election to Bring Pro-Crypto Laws

- Both major Australian political parties are committing to regulate cryptocurrencies, with the Liberal Party promising draft regulations within 100 days of taking office.

- The crypto industry in Australia has experienced stagnation due to regulatory inaction for over a decade.

Technical Analysis

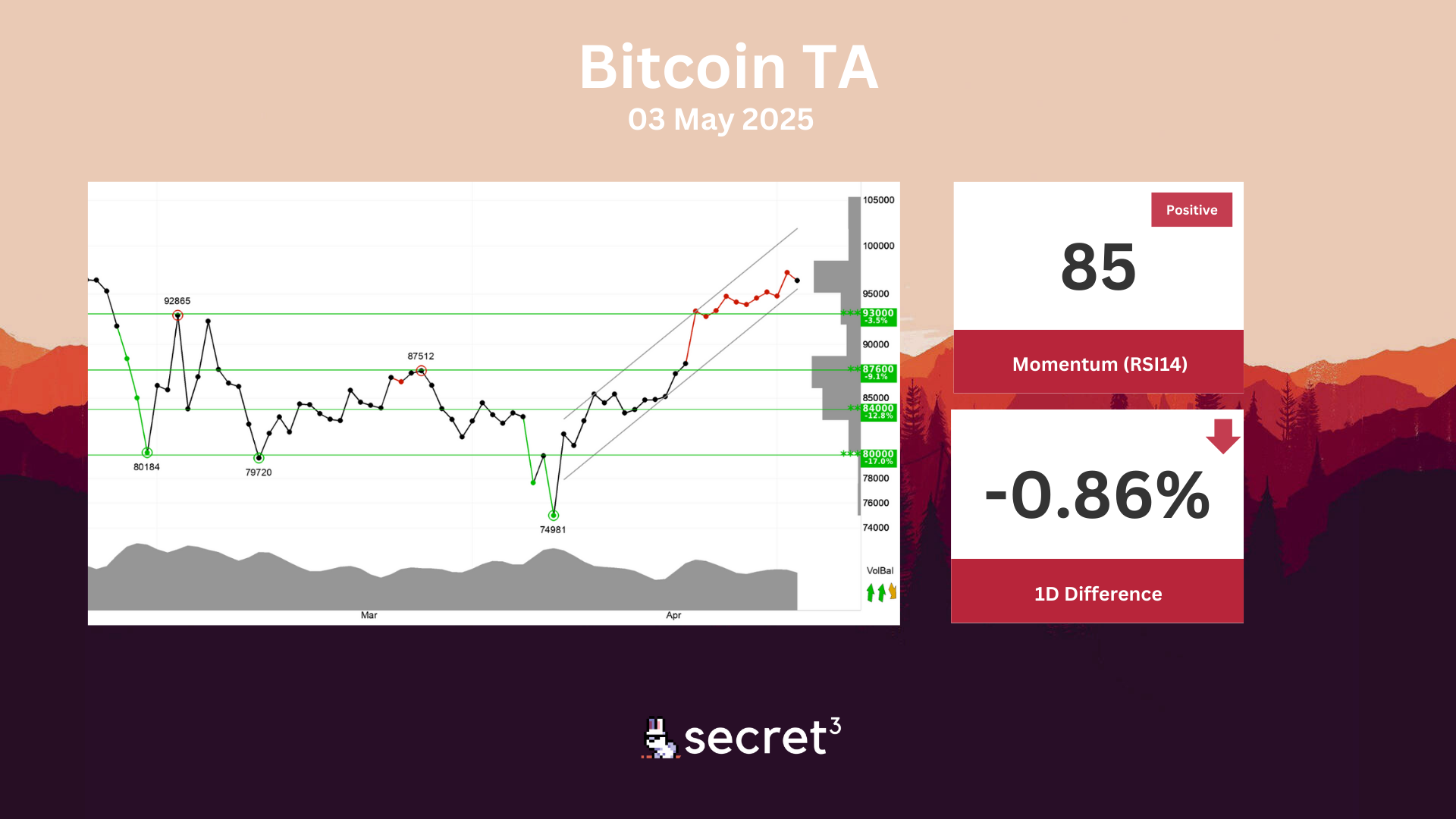

Bitcoin - Bitcoin shows strong development within a rising trend channel in the short term. This signals increasing optimism among investors and indicates continued rise. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 93000 points. Positive volume balance indicates that volume is high on days with rising prices and low on days with falling prices, which strengthens the currency. RSI above 70 shows that the currency has strong positive momentum in the short term. Investors have steadily paid more to buy the currency, which indicates increasing optimism and that the price will continue to rise. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically positive for the short term.

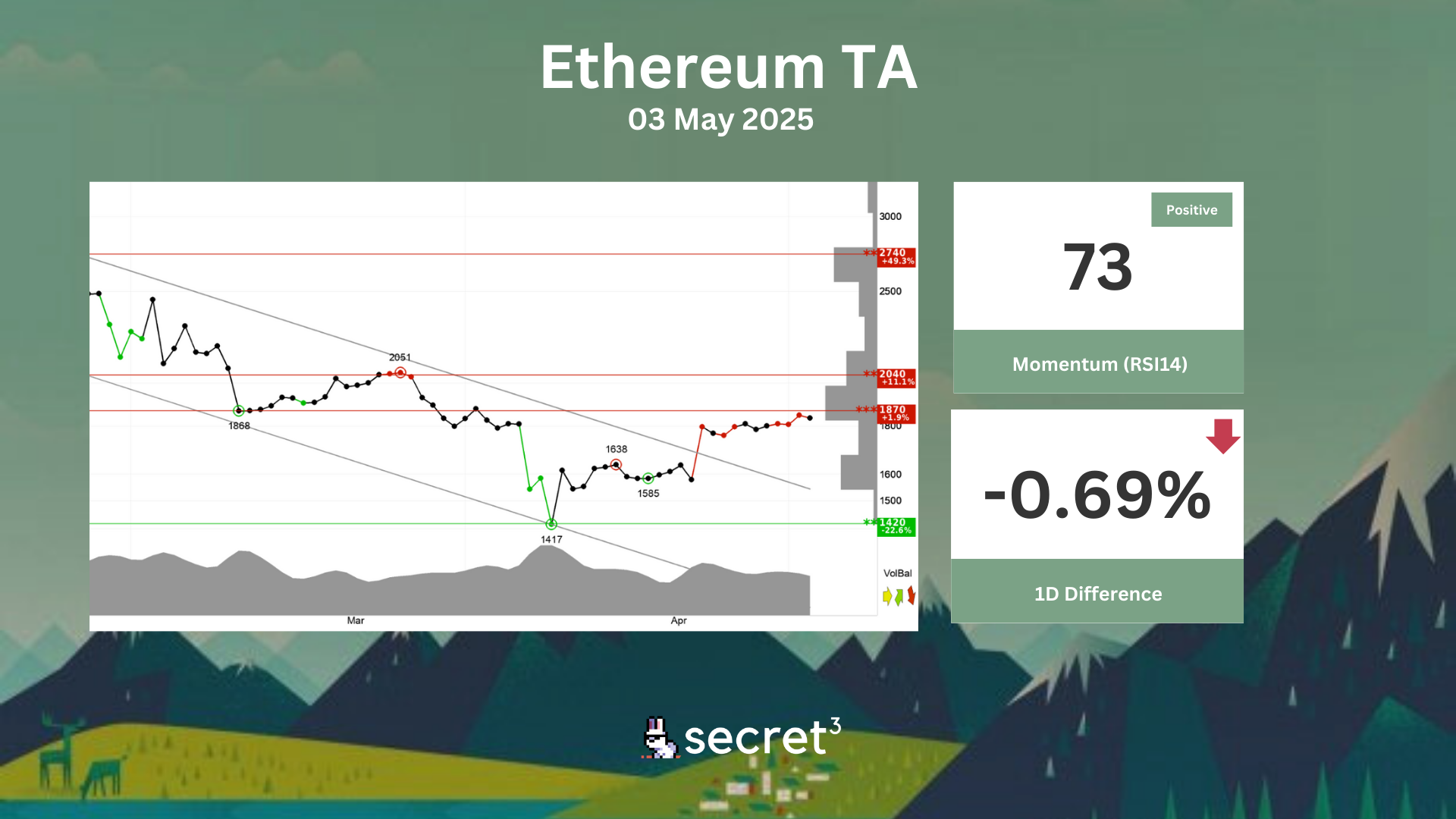

Ethereum - Ethereum has broken the ceiling of the falling trend in the short term, which indicates a slower initial falling rate. The currency is testing resistance at points 1870. This could give a negative reaction, but an upward breakthrough of points 1870 means a positive signal. RSI is above 70 after a good price increase the past weeks. The currency has strong positive momentum and further increase is indicated. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically negative for the short term.