gm 03/02

Summary

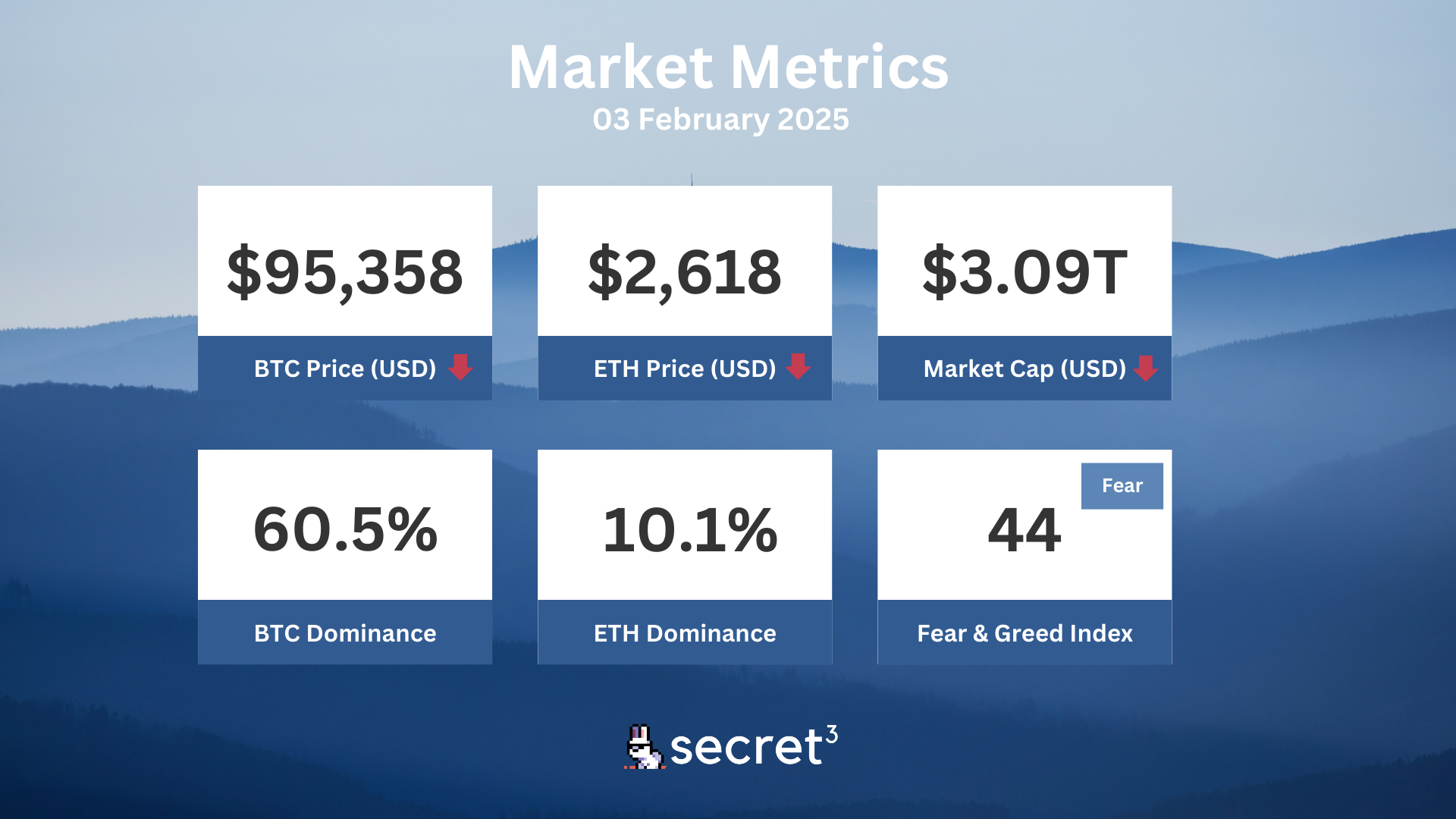

gm, Bitcoin dropped below $100,000, falling to around $94,225, a 6% decline in 24 hours, following US President Donald Trump's announcement of new tariffs on imports from China, Canada, and Mexico. This move has sparked fears of a global trade war and led to substantial sell-offs across the crypto market, with altcoins experiencing even steeper declines. Ethereum fell by nearly 20% to $2,510, while other major cryptocurrencies like XRP, Solana, and Dogecoin saw drops of 20-25%. The total crypto market cap decreased by over 12%, with liquidations exceeding $2.2 billion, marking the highest of the year.

News Headlines

💹 US Bitcoin ETFs Projected to Exceed $50B in Inflows for 2025

- Bitwise CIO Matt Hougan predicts US spot Bitcoin ETFs could see over $50 billion in inflows by the end of 2025, based on strong January performance.

- BlackRock's iShares Bitcoin Trust ETF (IBIT) led January inflows with $3.2 billion, followed by Fidelity's Wise Origin Bitcoin Fund (FBTC) with $1.3 billion.

🌎 El Salvador Accelerates Bitcoin Purchases, Adds Two BTC in One Day

- El Salvador added two more Bitcoin to its national reserve in a single day, increasing its total holdings to 6,055 BTC, valued over $612 million.

- The country continues its strategic asset initiative despite IMF limitations, potentially expanding Bitcoin purchases in 2025.

🏦 Coinbase Acquires Spindl to Enhance Onchain Discovery for Base Network

- Coinbase acquired Spindl, an onchain advertising platform, to improve project visibility on its Ethereum layer-2 network, Base.

- The acquisition aims to address the onchain discovery problem and provide tools for builders to effectively connect with their audience.

💼 Monochrome Introduces First Australian Bitcoin and Ethereum ETFs in Singapore

- Australian firm Monochrome Group has registered Bitcoin and Ethereum ETFs with Singapore's Monetary Authority, targeting accredited and institutional investors.

- The move aims to provide regulated crypto products amid increasing demand and market turbulence, with a minimum transaction of S$200,000.

Market Metrics

Fundraising & VC

No fundraising data today.

On-chain Data

1. Wormhole (W) token unlocked today ($7.69M, 1.56%)

2. Immutable X (IMX) token unlock in 2 days ($7.81M, 0.6%)

3. Galxe (GAL) token unlock in 2 days ($5.87M, 4.05%)

4. Myria (myria) token unlock in 3 days ($1.03M, 2.69%)

Regulatory

🏛️ Utah Poised to Become First US State with Bitcoin Reserve

- Utah is likely to be the first US state to establish a Bitcoin reserve, driven by a short legislative calendar and favorable political climate.

- The bill would allow Utah to invest public funds in Bitcoin and other eligible cryptocurrencies with substantial market caps.

💼 India Reconsiders Crypto Policy Amid Global Adoption

- India is potentially revising its strict stance on cryptocurrencies in response to growing global adoption.

- Economic affairs secretary Ajay Seth indicated that digital assets transcend borders, suggesting a need for policy adaptation.

💰 Indian Crypto Holders Face 70% Tax Penalty on Undisclosed Gains

- New amendments to India's Income Tax Act could result in hefty penalties for undisclosed cryptocurrency profits.

- Cryptocurrencies will be classified as Virtual Digital Assets (VDAs) and subject to block assessments for undisclosed gains.

🌐 Thailand SEC to Launch Tokenized Securities Trading System

- Thailand's SEC is set to launch a trading platform for digital tokens using distributed ledger technology.

- The system aims to enhance capital market efficiency and establish an electronic securities ecosystem.

🔐 Social Security Numbers Deemed Privacy Liability

- Social Security numbers (SSNs) are considered poor identifiers due to their predictability and compromised secrecy.

- Studies show many SSNs can be guessed in a few attempts based on personal information.

Technical Analysis

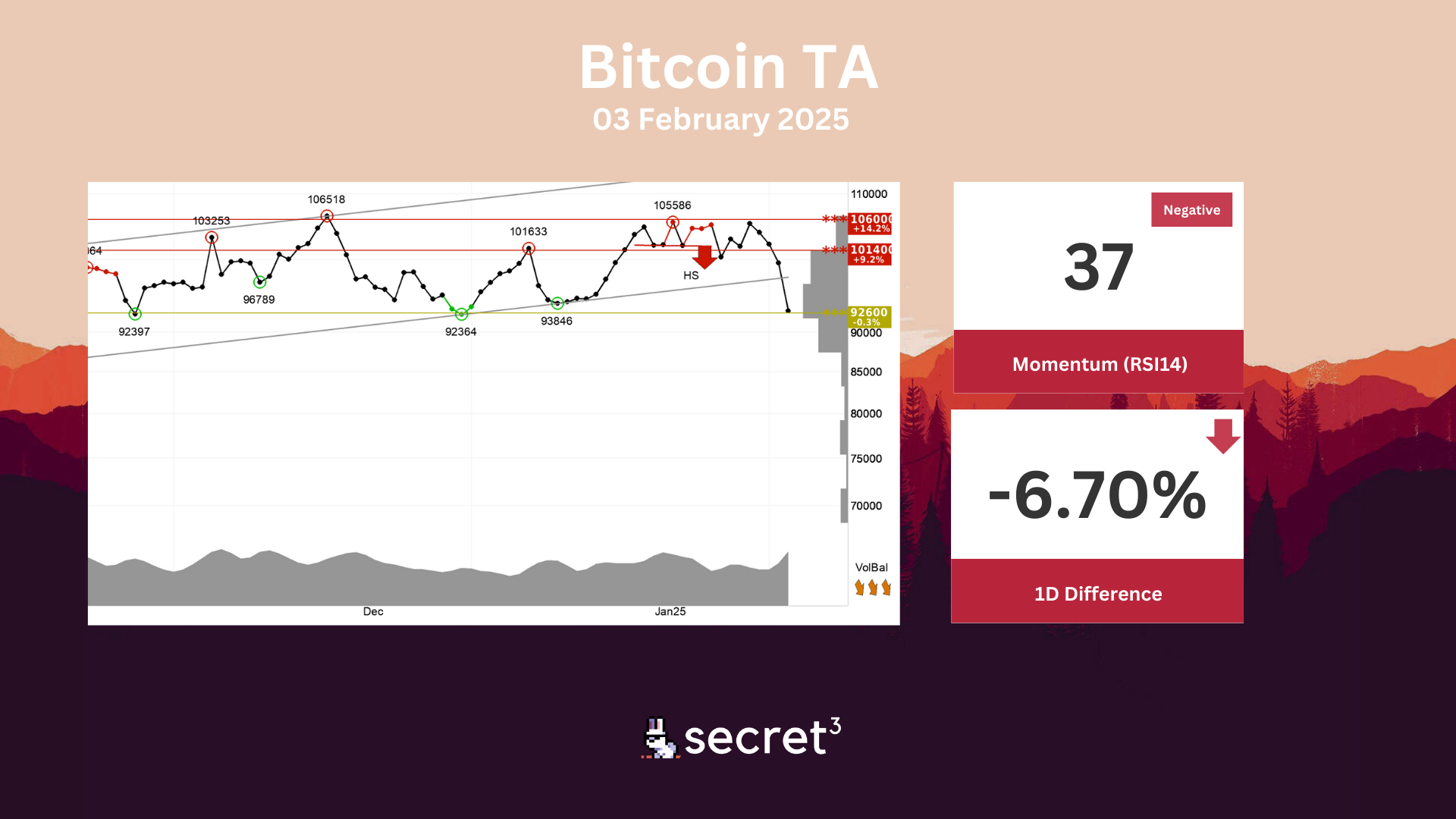

Bitcoin - Bitcoin has broken the floor of the rising trend channel in the short term, which indicates a weaker initial rising rate. The currency is testing support at points 92600. This could give a positive reaction, but a downward breakthrough of points 92600 means a negative signal. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. This weakens the currency. The currency is overall assessed as technically neutral for the short term.

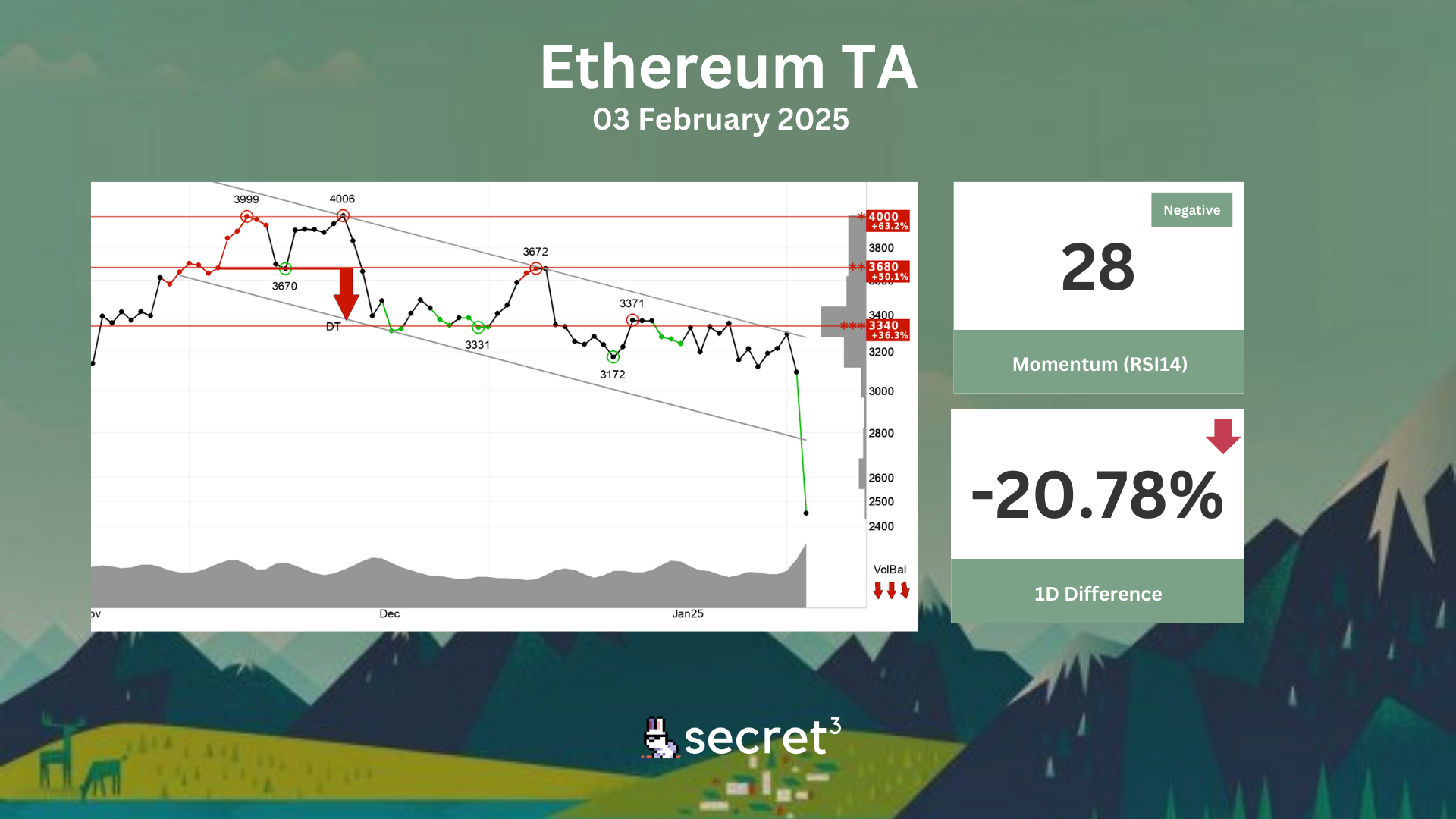

Ethereum - Ethereum has broken the falling trend channel down in the short term. This signals an even stronger falling rate, but the negative development may result in corrections up in the short term. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 3340 points. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. Volume balance is also negative, which confirms the trend. The short term momentum of the currency is strongly negative, with RSI below 30. This indicates increasing pessimism among investors and further decline for Ethereum. However, particularly in big stocks, low RSI may be a sign that the stock is oversold and that there is a chance for a reaction upwards. The currency is overall assessed as technically negative for the short term.

Governance & Code

🚀 Rocket Pool DAO | On-Chain pDAO Quora (RPIP 64) (Active Vote)

- This proposal seeks to align the on-chain voting system’s quorum with Snapshot by adjusting protocol parameters.

✈️ Airswap DAO | Monthly Update: Feb. 1, 2025 (Active Vote)

- This monthly update aims to signal support for AirSwap's progress over Jan. 2024.