gm 02/05

Summary

gm, Bitcoin surged past $96,000, reaching its highest level since February, driven by growing expectations of a potential Federal Reserve rate cut. Institutional interest in crypto continues to expand, with Morgan Stanley reportedly planning to launch crypto trading on its E*Trade platform by 2026. In other news, Worldcoin, co-founded by Sam Altman, officially launched in the US, introducing its eye-scanning identity verification system in major cities. Meanwhile, Tether reported a Q1 operating profit of nearly $1 billion, showcasing the stablecoin issuer's strong financial position. These developments reflect the ongoing maturation and adoption of cryptocurrencies in both retail and institutional sectors.

News Headlines

💳 Visa and Baanx Launch USDC Stablecoin Payment Cards

- Visa partnered with Baanx to introduce payment cards linked to self-custodial wallets, allowing users to spend USDC directly from their crypto wallets.

- The cards utilize smart contracts to authorize payments instantly, converting USDC into fiat currency in real-time.

📊 Ethereum Set for UX Overhaul With New Address Standards

- Ethereum developers are finalizing two new standards, ERC-7930 and ERC-7828, to simplify transactions across multiple chains.

- These standards provide a uniform format for recognizing network-specific addresses and introduce human-readable addresses.

🌐 MultiBank, MAG, Mavryk Sign $3B RWA Tokenization Deal

- MultiBank Group entered a $3 billion agreement to tokenize real-world assets (RWAs) with UAE-based MAG and blockchain provider Mavryk.

- The deal will tokenize MAG's luxury real estate portfolio on MultiBank's regulated marketplace, making these assets accessible to global investors.

🔒 Synthetic Court System Coming to Crypto with GenLayer

- YeagerAI is developing GenLayer, a protocol using AI models as judges for on-chain disputes in the cryptocurrency space.

- The system enables platforms like prediction markets and DAOs to rely on swift, impartial third-party decision-making.

🏦 Galaxy Digital Plans Nasdaq Listing Amid Crypto Stock Rebound

- Galaxy Digital is set to transition from the Toronto Stock Exchange to the Nasdaq on May 16, pending shareholder approval.

- CEO Mike Novogratz stated the listing will facilitate broader access for investors to the digital asset and AI ecosystems.

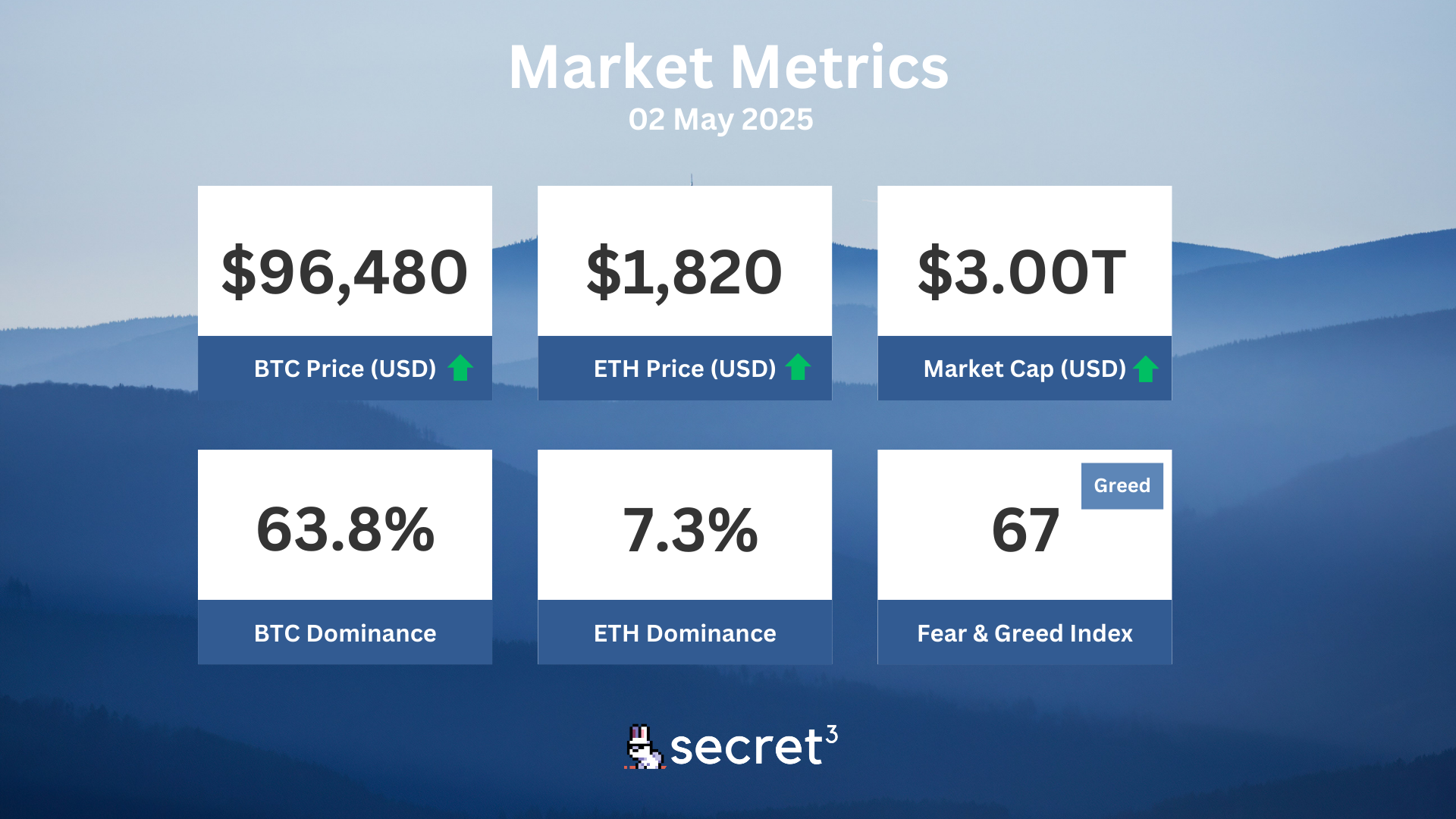

Market Metrics

Fundraising & VC

1. Dinari (Series A, $12.7M) - U.S. equities onchain

2. Terminal 3 (Seed, $8M) - Enterprise identity and data security solutions

3. ZAR (Seed, $7M) - Stablecoin company

Regulatory

🌐 Tether CEO Defends Skipping EU's MiCA Registration

- Tether's CEO called the EU's MiCA regulations "very dangerous" for stablecoins, defending the decision not to register USDT.

- Concerns were raised that compliance could lead to exchanges delisting USDt in regulated markets.

🏦 US Treasury Moves to Cut Off Cambodian Firm from Financial System

- The US Treasury proposed severing Cambodia's Huione Group from the US financial system over $4B money laundering claims.

- Huione is accused of processing illicit funds linked to North Korean cyber operations and other cybercrimes.

🔍 SEC Drops Case Against Crypto Promoter Ian Balina

- The SEC filed to drop its lawsuit against YouTuber Ian Balina regarding unregistered securities offers.

- This action is part of a broader trend of reduced SEC enforcement actions against crypto firms.

🚫 Coinbase Suspends Trading for MOVE Token

- Coinbase announced the suspension of trading for the MOVE token from Movement Labs, effective May 15.

- The decision cites the token's failure to meet Coinbase's listing standards.

🔒 CIA Deputy Director Calls Bitcoin 'Another Tool' in Fight Against China

- Michael Ellis, Deputy Director of the CIA, stated that Bitcoin and cryptocurrencies serve as tools for the U.S. to counter adversaries like China.

- He emphasized the importance of positioning the U.S. in technological competition, indicating cryptocurrencies' potential for intelligence gathering.

Technical Analysis

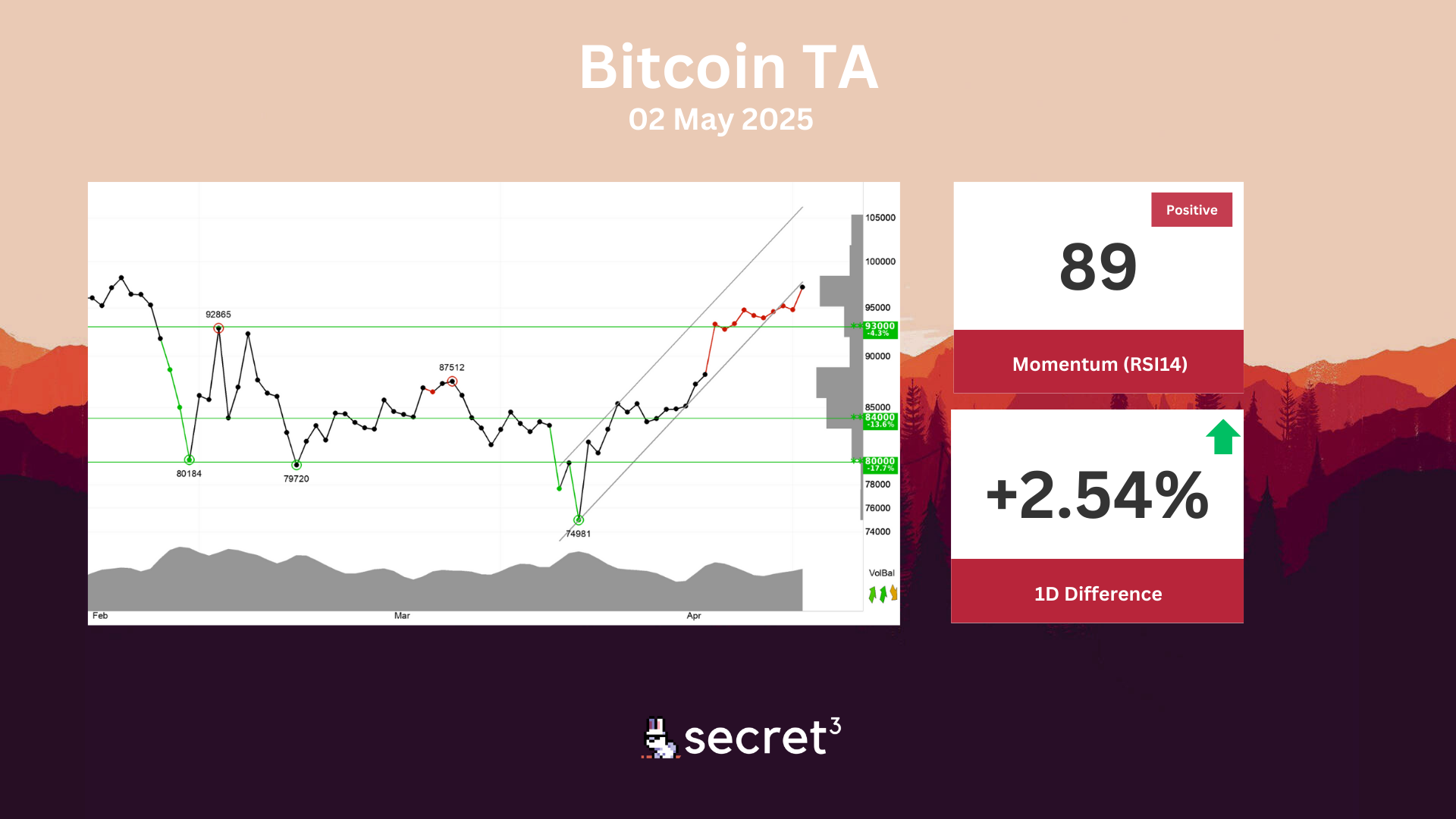

Bitcoin - Bitcoin has broken through the floor of a rising trend channel in the short term. This indicates a slower rising rate at first, or the start of a more horizontal development. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the currency has support at approximately 93000 points. Positive volume balance shows that volume is higher on days with rising prices than days with falling prices. This indicates increasing optimism among investors. The short term momentum of the currency is strongly positive, with RSI above 70. This indicates increasing optimism among investors and further price increase for Bitcoin. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically positive for the short term.

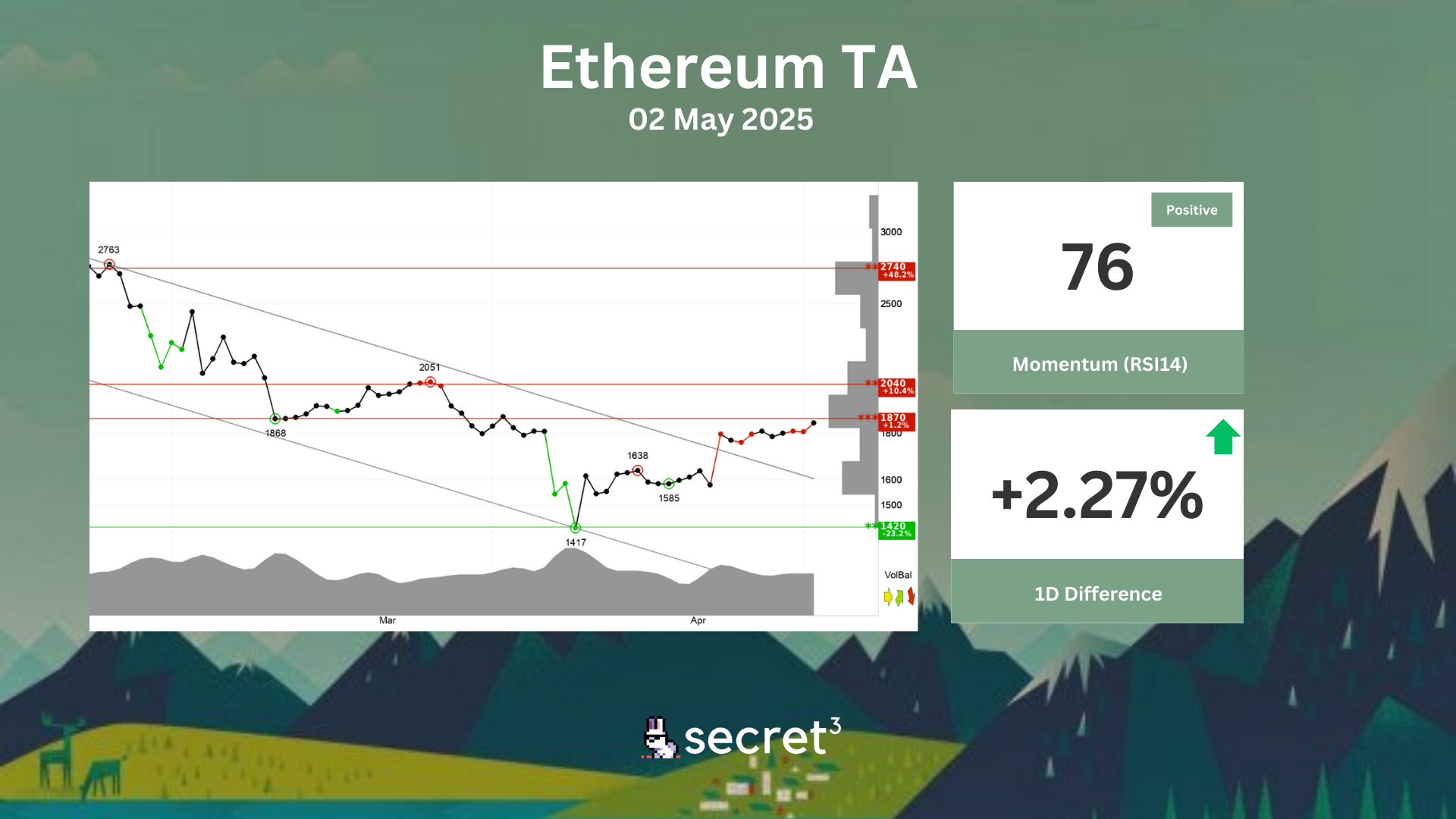

Ethereum - Ethereum has broken the ceiling of the falling trend in the short term, which indicates a slower initial falling rate. The currency is testing resistance at points 1870. This could give a negative reaction, but an upward breakthrough of points 1870 means a positive signal. RSI above 70 shows that the currency has strong positive momentum in the short term. Investors have steadily paid more to buy the currency, which indicates increasing optimism and that the price will continue to rise. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically negative for the short term.