gm 02/03

Summary

gm, Bitcoin rebounded to around $85,000 after a sharp decline to $78,000, with the market showing signs of recovery amid extreme fear sentiment. The Chicago Mercantile Exchange (CME) announced plans to launch Solana futures on March 17, potentially boosting Solana's prospects for ETF approval. Meanwhile, the Ethereum Foundation announced new leadership, appointing Hsiao-Wei Wang and Tomasz Stańczak as co-directors. Additionally, U.S. President Donald Trump is set to host the first White House Crypto Summit on March 7, signaling increased engagement with the crypto industry at the highest levels of government.

News Headlines

🔄 Ethereum Foundation Announces New Leadership

- The Ethereum Foundation has appointed Hsiao-Wei Wang and Tomasz Stańczak as new co-executive directors, effective March 17, following community concerns about the project's direction.

- This leadership change aims to transition Ethereum from an early-stage project to a robust, censorship-resistant platform serving as the backbone of global finance and software.

💼 MetaMask Announces Major Overhaul with Enhanced Features

- MetaMask is undergoing significant changes to enhance user experience, including a revised logo, reduced signature requests, and easier blockchain addition without complex codes.

- New features include gas-included swaps, the ability to pay gas fees in any held token, and support for multiple secret recovery phrases.

🔐 Vitalik Buterin Calls for Robust Wallet Security Solutions

- Ethereum founder Vitalik Buterin emphasized the need for effective wallet solutions to address accidental loss of crypto assets, a significant issue often overshadowed by concerns over theft.

- Buterin advocates for a 'social recovery' system to assist users in regaining access, where trusted parties like friends or family can act as guardians.

💰 XRP Price Surges 8% Amid Speculation of SEC Case Dismissal

- XRP price increased by 8%, reaching $2.17, driven by optimism over a potential dismissal of the SEC's lawsuit against Ripple and an oversold bounce indicating hope for a V-shaped recovery.

- Speculation surrounding the SEC possibly dismissing its case against Ripple, which alleges that XRP was sold as an unregistered security, has fueled the price increase.

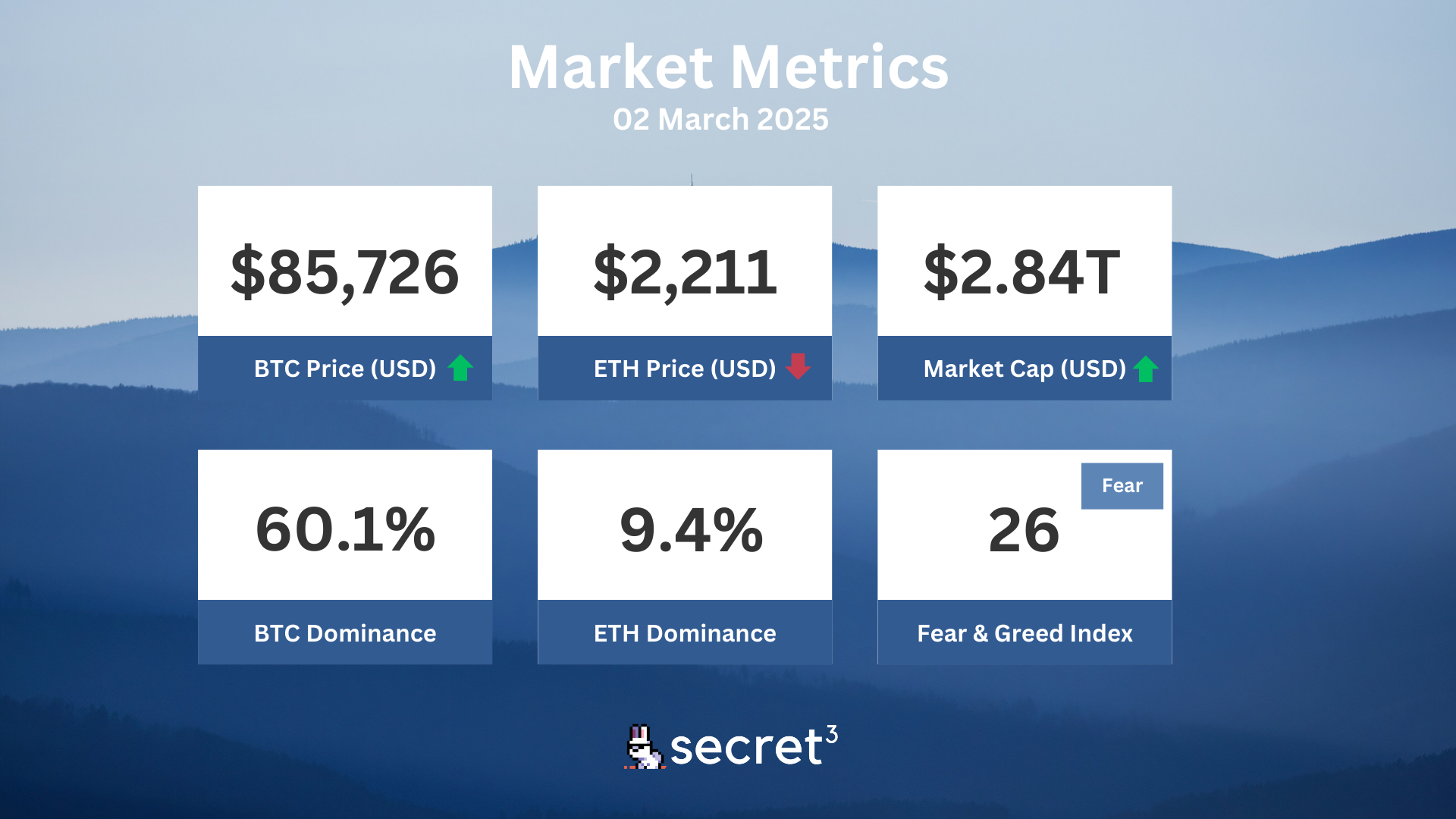

Market Metrics

Fundraising & VC

No fundraising data today.

On-chain Data

1. Wormhole (W) token unlock in 1 day ($5.95M, 1.54%)

2. Immutable X (IMX) token unlock in 3 days ($7.18M, 0.59%)

3. Galxe (GAL) token unlock in 3 days ($2.50M, 1.59%)

4. Myria (myria) token unlock in 4 days ($1.00M, 2.66%)

Regulatory

🚫 SEC Reverses Course on Crypto Enforcement

- The SEC has closed several investigations and lawsuits against major crypto companies like Coinbase and Binance.

- The agency plans to focus on developing clear regulatory policies rather than using enforcement to shape regulations.

🏦 Swiss National Bank Rejects Bitcoin as Reserve Asset

- SNB President Martin Schlegel cited volatility, liquidity concerns, and security risks as reasons for rejecting Bitcoin as a reserve asset.

- This comes despite a citizen initiative advocating for the SNB to hold Bitcoin alongside gold reserves.

👨⚖️ US Judge Dismisses SEC Fraud Suit Against Hex Founder

- A judge ruled that the SEC failed to prove US jurisdiction over Richard Heart's activities with Hex.

- The decision allows the SEC to amend its complaint within 20 days.

🔍 SEC Commissioner Dissents on Agency's Memecoin Stance

- Commissioner Caroline Crenshaw argues that memecoins could fulfill the Howey test requirements and be classified as securities.

- She criticizes the SEC's portrayal of memecoins as mere cultural projects, stating they are financial products aimed at profit-making.

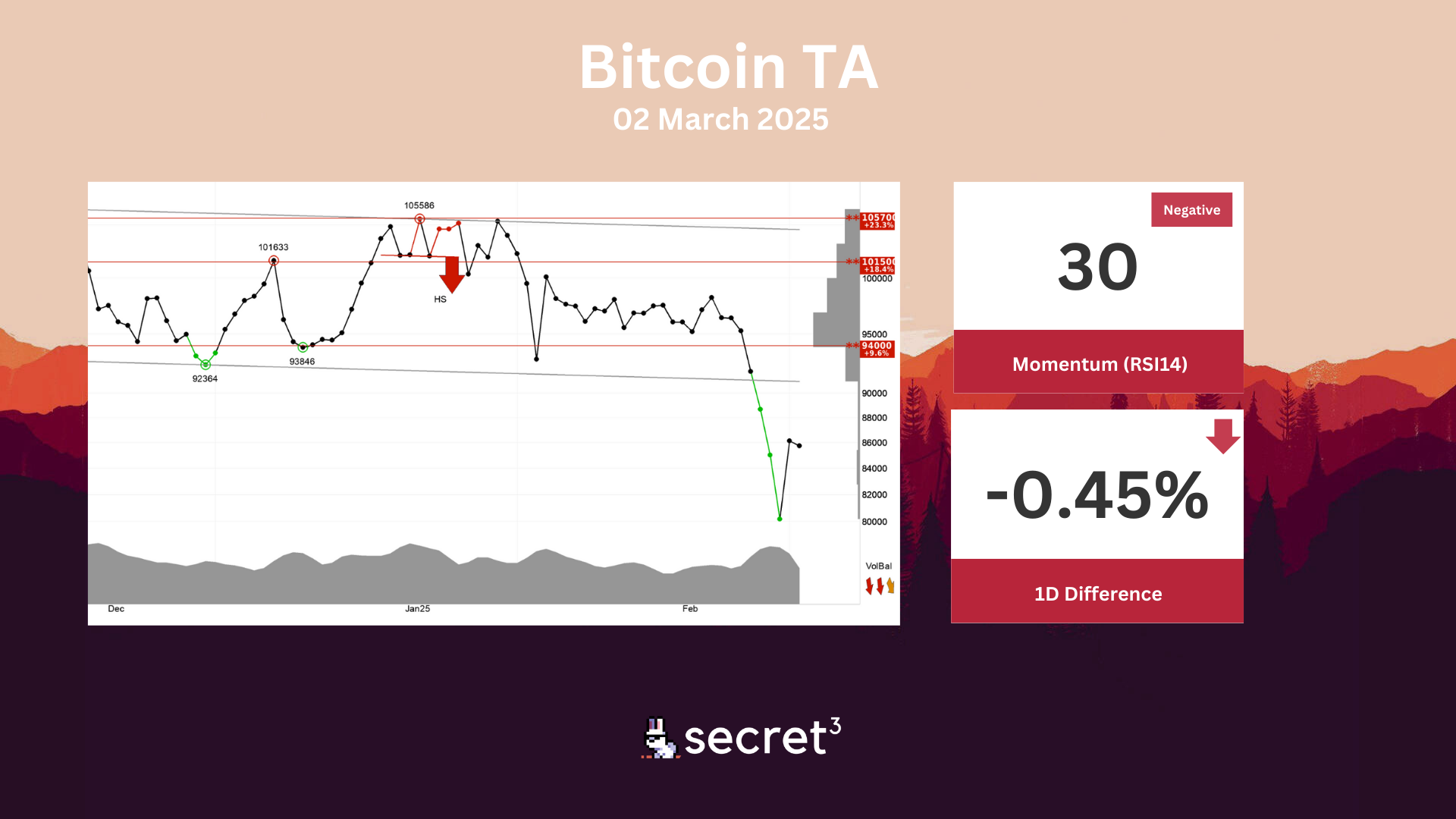

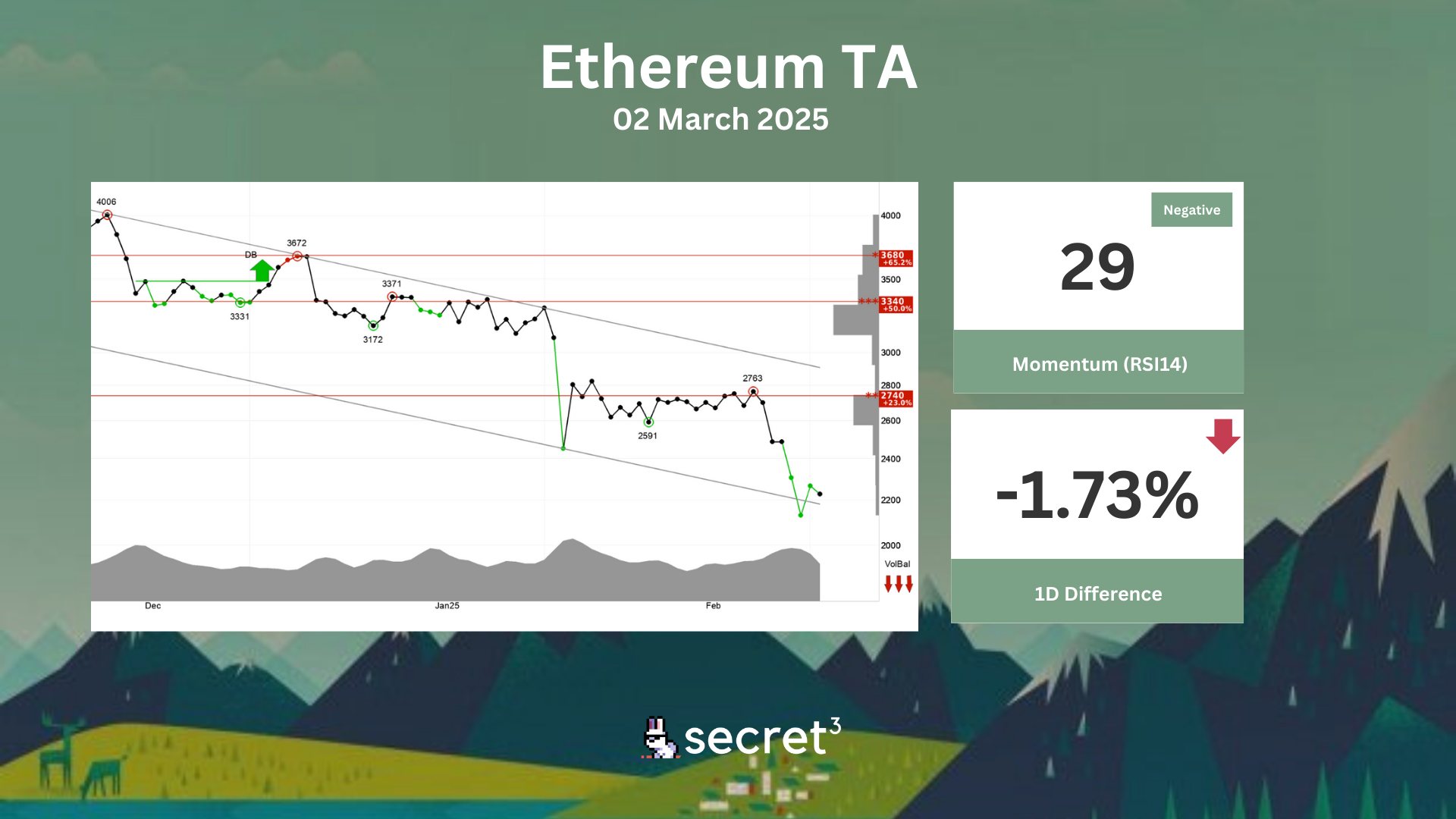

Technical Analysis

Bitcoin - Bitcoin has broken down from an approximate horizontal trend channel in the short term. This signals a continued weak development, and the currency now meets resistance on possible reactions up towards the floor of the trend channel. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 94000 points. Negative volume balance indicates that sellers are aggressive while buyers are passive, and weakens the currency. The currency is overall assessed as technically negative for the short term.

Ethereum - Ethereum shows weak development in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 2740 points. Volume tops and volume bottoms correspond badly with tops and bottoms in the price. Volume balance is also negative, which confirms the trend. RSI below 30 shows that the momentum of the currency is strongly negative in the short term. Investor have steadily reduced the price to sell the currency, which indicates increasing pessimism and continued falling prices. However, particularly in big stocks, low RSI may be a sign that the stock is oversold and that there is a chance for a reaction upwards. The currency is overall assessed as technically negative for the short term.

Governance & Code

👻 Aave DAO | Enhancements in Aave v3 Gnosis Chain Instance

- This proposal seeks to modify the Aave v3 Gnosis Chain instance by adjusting the parameters of USDC.e and sDAI to improve capital efficiency and encourage migration from USDC to USDC.e.

🏔️ Ampleforth DAO | FORTH Allocation for Liquidity Provisioning (2025)

- This proposal seeks authorization for the Ampleforth Foundation to borrow 800,000 FORTH from the DAO’s treasury over a 12-month period for liquidity provisioning on major centralized exchanges.