gm 01/06

Summary

gm, Trump Media & Technology Group announced a successful $2.4 billion fundraise intended to establish a Bitcoin treasury, potentially making it one of the largest Bitcoin holders on Wall Street. Meanwhile, the market experienced a notable correction with over $800 million in liquidations, primarily affecting long positions as Bitcoin dropped below $104,000, influenced by macroeconomic headwinds rather than spot Bitcoin ETF flows. On the institutional front, FTX initiated a $5 billion payout to creditors, and REX Shares filed for what could be the first Ethereum and Solana staking ETFs in the U.S., though the SEC has already raised concerns about their unique corporate structure. Additionally, Canary Capital filed with the SEC to offer a Cronos (CRO) ETF, highlighting the growing institutional interest in providing exposure to altcoins beyond Bitcoin.

News Headlines

🔄 FTX Starts $5B Payouts — Here's What You Need to Know

- FTX Recovery Trust has begun distributing $5 billion to creditors, with varying distribution rates: 72% for Dotcom Customer Entitlement Claims, 54% for US Customer Entitlement Claims, and 120% for Convenience Claims. Recipients should receive payouts within 1-2 business days via Kraken and BitGo.

- Controversy surrounds the reimbursements as a court ruled claims will be paid based on petition date values rather than current market prices, significantly impacting holders due to the much lower Bitcoin prices at that time. Additionally, individuals from 163 countries are barred from receiving reimbursements.

💸 SharpLink Gaming Plans $1B ETH Purchase

- SharpLink Gaming has announced plans to raise up to $1 billion through a common stock offering to fund its newly launched Ether treasury, with most proceeds earmarked for acquiring Ether. Following this announcement, the company's stock surged by 400%.

- The community has likened SharpLink to an "Ethereum version of Michael Saylor," though the company also highlighted regulatory risks in its SEC filing, particularly if Ether is classified as a security, which could subject it to more stringent regulations.

⚠️ MEXC Detects 200% Surge in Fraud During Q1

- MEXC exchange reported a 200% increase in fraudulent trading activity in Q1 2025, identifying over 80,000 organized fraud attempts from more than 3,000 fraud syndicates, including market manipulation, wash trading, and exploitation through automated trading bots.

- India was the most affected region with nearly 27,000 flagged accounts, followed by the Commonwealth of Independent States and Indonesia, highlighting the urgent need for better education and awareness to protect users from crypto scams.

🌐 Xend Finance and Risevest Launch Tokenized Stocks Platform in Africa

- A new platform launched by Xend Finance and Risevest provides Africans tokenized access to global real estate and stock markets, allowing investments in fractional shares with as little as $5 using stablecoins like USDT and USDC.

- This development marks a significant advance for Web3 projects in Africa, which is rapidly becoming a key market for real-world asset tokenization, helping to address currency volatility issues and democratizing access to global investment opportunities.

👾 OpenSea Adds Rewards Questing with 'Voyages' in OS2 Public Launch

- OpenSea has officially launched OS2, ending its beta phase and introducing 'Voyages,' a gamified rewards program allowing users to earn XP for activities like buying or selling NFTs across various blockchains.

- The platform has hinted at an upcoming SEA token, with the rewards program potentially influencing eligibility for future token distributions, while also overhauling its Discord community and expanding support for various tokens across multiple chains.

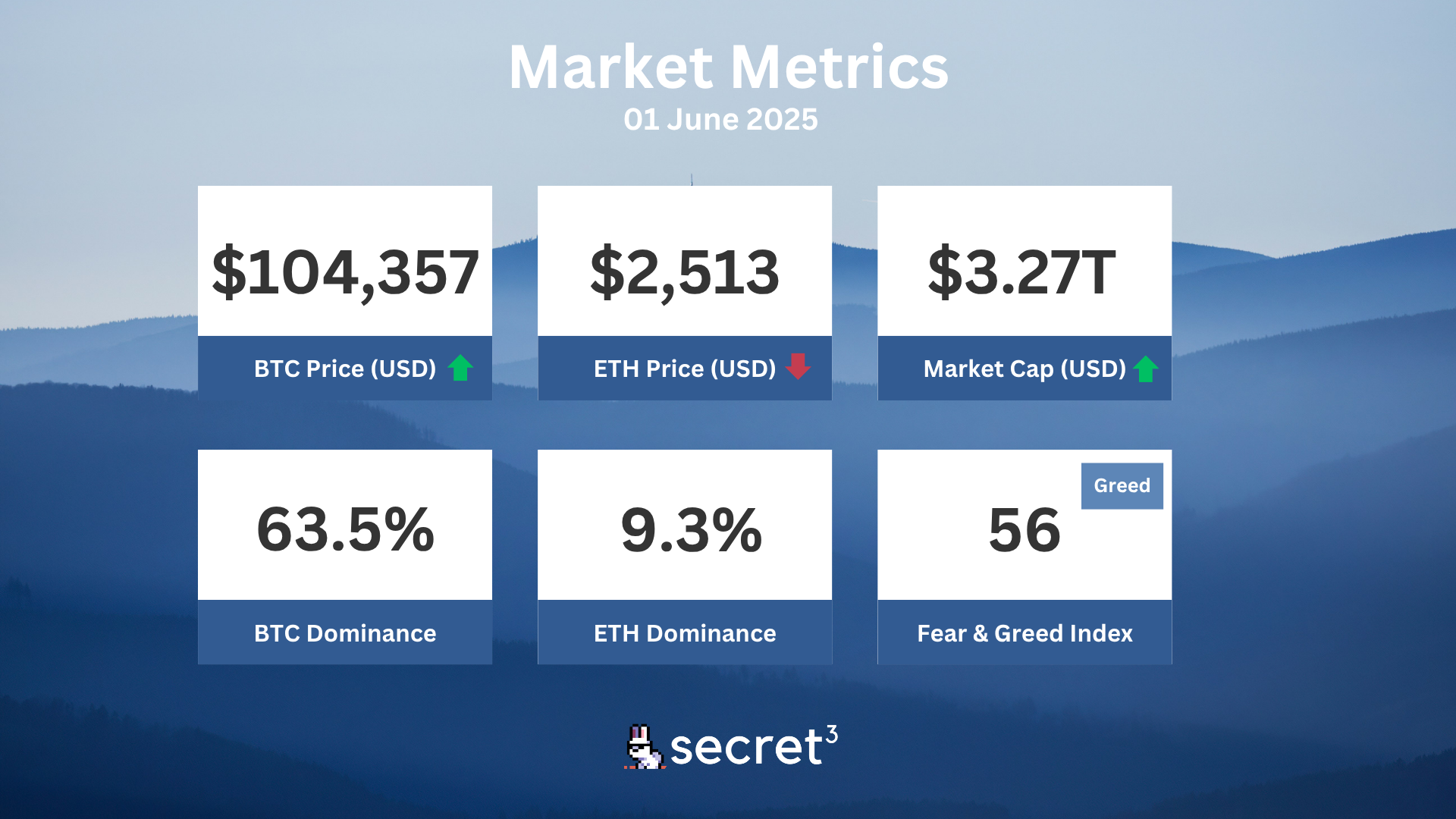

Market Metrics

Fundraising & VC

No fundraising data today.

Regulatory

💼 IRS Crypto Records Case Reaches Supreme Court

- The US government has urged the Supreme Court to reject Coinbase user James Harper's claim that the IRS violated his Fourth Amendment rights by accessing his crypto transaction records through a "John Doe" summons.

- Solicitor General D. John Sauer argued that Harper voluntarily shared data with Coinbase, making it accessible to the IRS through legal channels, citing precedents that users lack reasonable privacy expectations for financial records kept by third parties.

💡 IMF Questions Pakistan's Bitcoin Mining Power Plan

- The IMF has expressed concerns about Pakistan's plan to allocate 2,000 megawatts of electricity for Bitcoin mining and AI data centers while the country negotiates for fiscal support.

- The international lender is seeking urgent clarification from Pakistan's Finance Ministry regarding the legality of cryptocurrency mining and its implications for a country already facing severe energy shortages and economic challenges.

📊 Five US States Enact Crypto Legislation

- Five US states enacted significant crypto legislation in May: Texas established a state Bitcoin reserve, Nebraska granted local utilities authority over Bitcoin miners, and Arizona created a Digital Assets Reserve Fund.

- These state-level regulatory developments came during the same month that Bitcoin reached an all-time high exceeding $111,000 and Coinbase joined the S&P 500 with a 19.37% stock increase.

🕵️ BitMEX Exposes North Korean Hackers' Security Flaws

- BitMEX's security researchers discovered significant operational security failures within the North Korean state-sponsored Lazarus Group, including the accidental disclosure of an IP address in Jiaxing, China.

- The findings suggest the group is fragmented into sub-groups with varying skill levels, revealing vulnerabilities that could be exploited to counteract their crypto-targeting activities.

💳 Stablecoin Leaders Predict Financial Infrastructure Revolution

- At the inaugural Stablecon event, industry leaders from Circle, Visa, and Mastercard emphasized that stablecoins represent a fundamental shift in financial infrastructure, not just a digital currency option.

- Visa's Catherine Gu stated that by 2025, every financial entity should devise a stablecoin strategy, while traditional banks like Bank of America are contemplating entry into the sector following regulatory clarity.

Technical Analysis

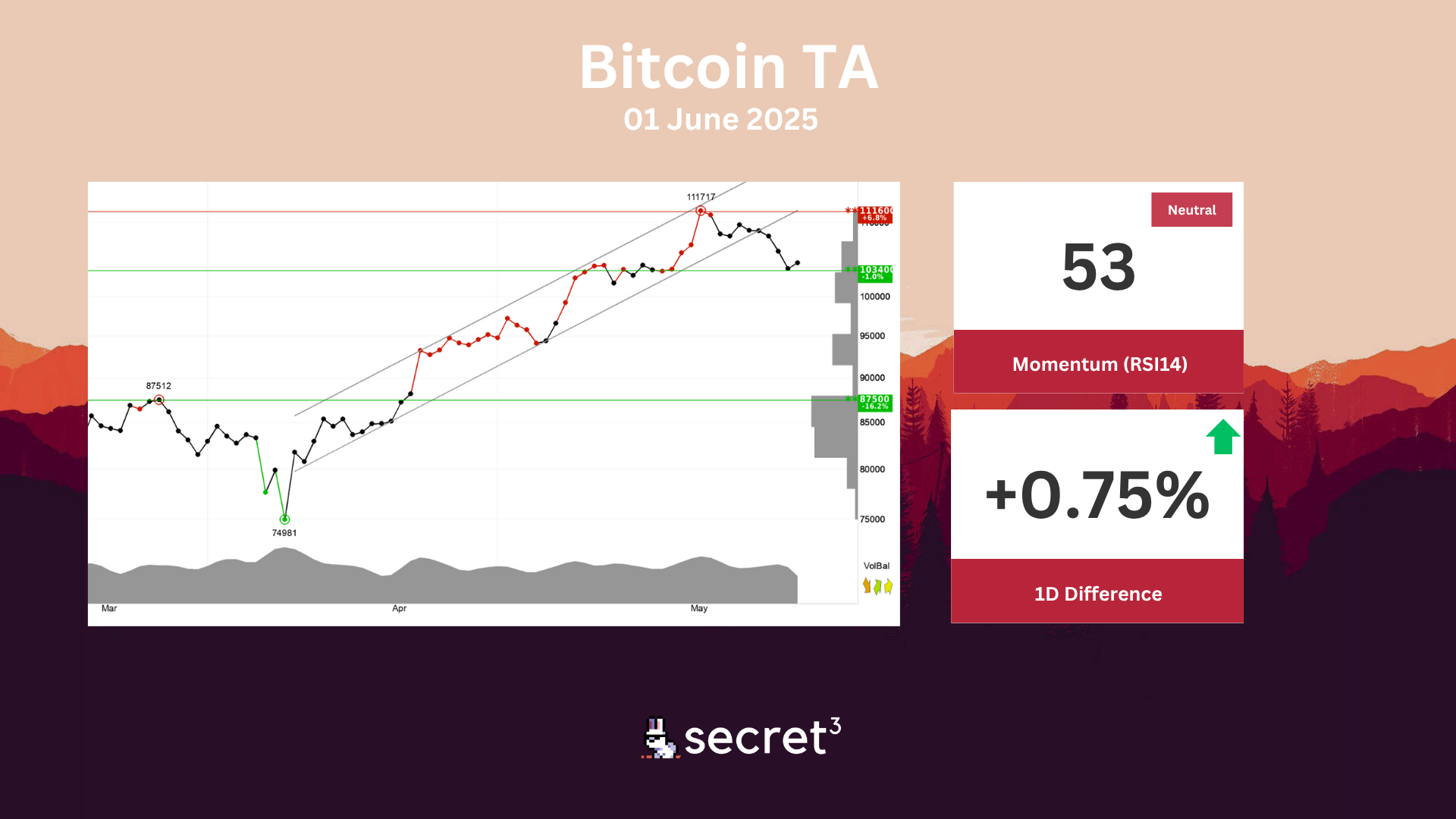

Bitcoin - Bitcoin has broken through the floor of a rising trend channel in the short term. This indicates a slower rising rate at first, or the start of a more horizontal development. The currency is testing support at points 103400. This could give a positive reaction, but a downward breakthrough of points 103400 means a negative signal. RSI diverges negatively against the price, which indicates danger of a reaction downwards. The currency is overall assessed as technically positive for the short term.

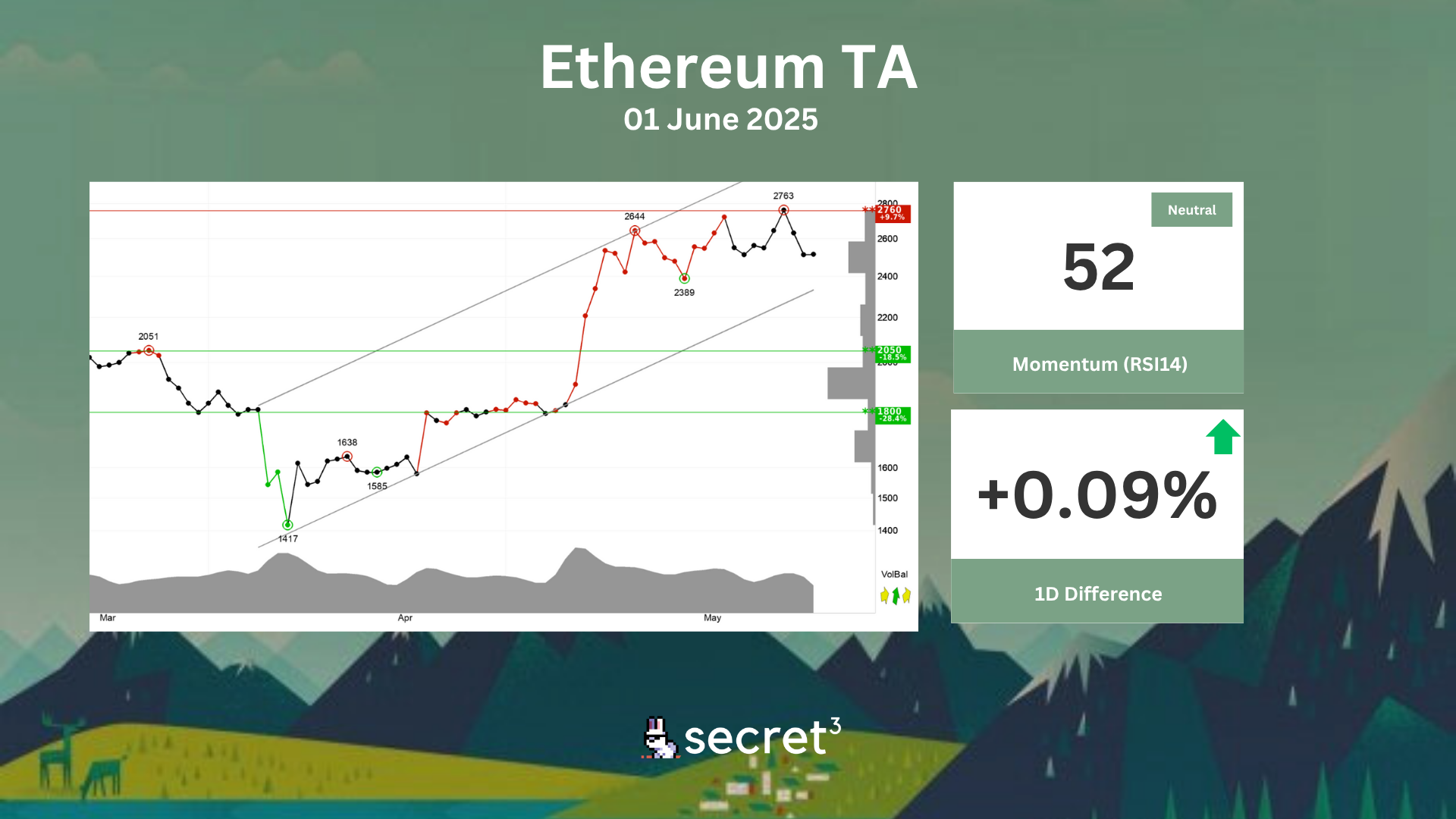

Ethereum - Ethereum is in a rising trend channel in the short term. This signals increasing optimism among investors and indicates continued rise. The currency has support at points 2050 and resistance at points 2760. Volume has previously been high at price tops and low at price bottoms. Volume balance is also positive, which strengthens the trend. The currency is overall assessed as technically positive for the short term.