gm 01/05

Summary

gm, Coinbase's Base Network achieved 'stage 1' rollup status, enhancing decentralization and security through the introduction of a global security council. Nasdaq filed for a rule change to list 21Shares Dogecoin ETF, signaling growing institutional interest in meme tokens. Arizona lawmakers moved closer to establishing a digital assets reserve, potentially becoming the first state to join federal efforts in planning a Bitcoin reserve. WonderFi announced plans to build a zkSync-powered Layer-2 blockchain, merging centralized and decentralized finance. Meanwhile, an MIT Bitcoin experiment from 2014 has appreciated to $110 million, highlighting the long-term growth potential of cryptocurrencies.

News Headlines

💼 BlackRock Files for $150 Billion Tokenized Treasury Trust Offering

- BlackRock is introducing a digital share class called "DLT Shares" for its $150 billion Treasury Trust fund.

- These shares will use blockchain to mirror share ownership records, potentially accelerating the adoption of digital assets in traditional finance.

🔄 Ethereum Upgrade 'Pectra' Set for May 7 Launch

- Ethereum's Pectra upgrade is scheduled for May 7, aiming to enhance staking efficiency and user experience.

- The upgrade introduces improvements allowing regular user wallets to function like smart contracts and increases validator staking limits.

🌐 Visa to Pilot Stablecoin-Linked Cards in Latin America

- Visa is launching a pilot program for stablecoin-linked cards in six Latin American countries.

- The service will allow users to make purchases through a stablecoin balance at any merchant that accepts Visa.

💰 BlackRock Files for Digital Shares of Money Market Fund

- BlackRock submitted a filing to create digital ledger technology shares for its BLF Treasury Trust Fund.

- The initiative aims to use blockchain for transparency while maintaining traditional ownership records.

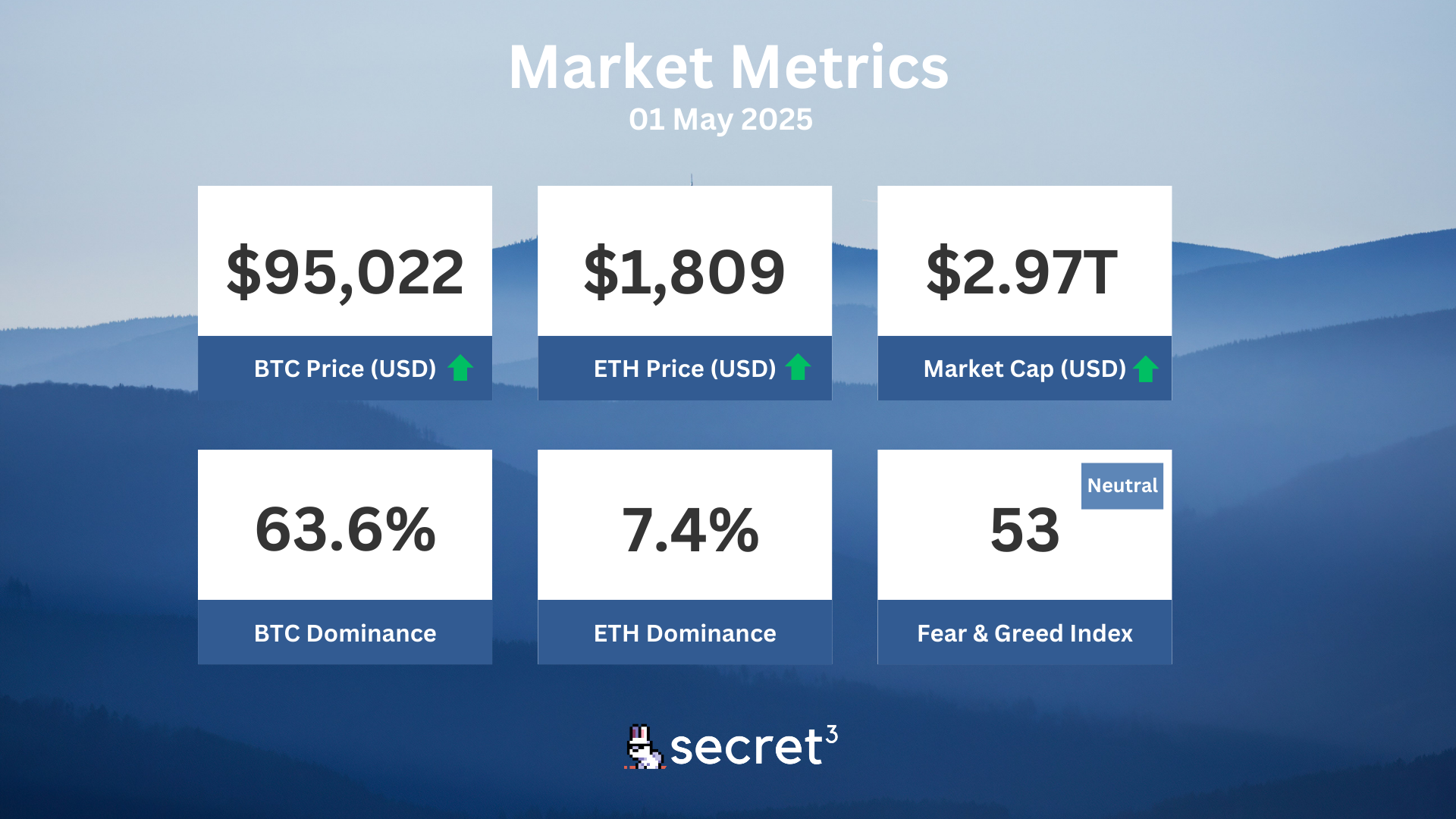

Market Metrics

Fundraising & VC

1. Unto Labs (Seed, $14.4M) - Blockchain technology company

2. Gata (Seed, $4M) - Decentralized data platform for AI

3. ROVR (Seed, $2.6M) - Decentralized 3D data platform for robotics, autonomous driving and spatial AI

4. B2 Network (Public Token Sale, $300K) - Layer-2 solution for Bitcoin

Regulatory

🏛️ North Carolina House Passes Crypto Investment Bill

- North Carolina's House approved a bill allowing the state treasurer to invest up to 5% of funds in approved cryptocurrencies.

- The Digital Assets Investment Act requires third-party assessments to ensure secure custody and regulatory compliance.

⚖️ Coinbase Urges Supreme Court to Protect User Privacy

- Coinbase filed an amicus brief urging the Supreme Court to reconsider the third-party doctrine in digital privacy.

- The case stems from a 2016 IRS summons demanding data on over 14,000 Coinbase users.

📈 US Treasury Predicts $2T Stablecoin Market Cap by 2028

- The US Treasury projects USD-pegged stablecoins to reach a $2 trillion market cap by 2028.

- Current stablecoin market cap is around $230 billion, dominated by Tether and USDC.

🌐 Crypto Groups Push SEC for Staking Clarity

- A coalition of crypto firms is urging the SEC to clarify that crypto staking doesn't fall under securities regulations.

- They argue staking is a technical process for securing blockchains, not an investment scheme.

Technical Analysis

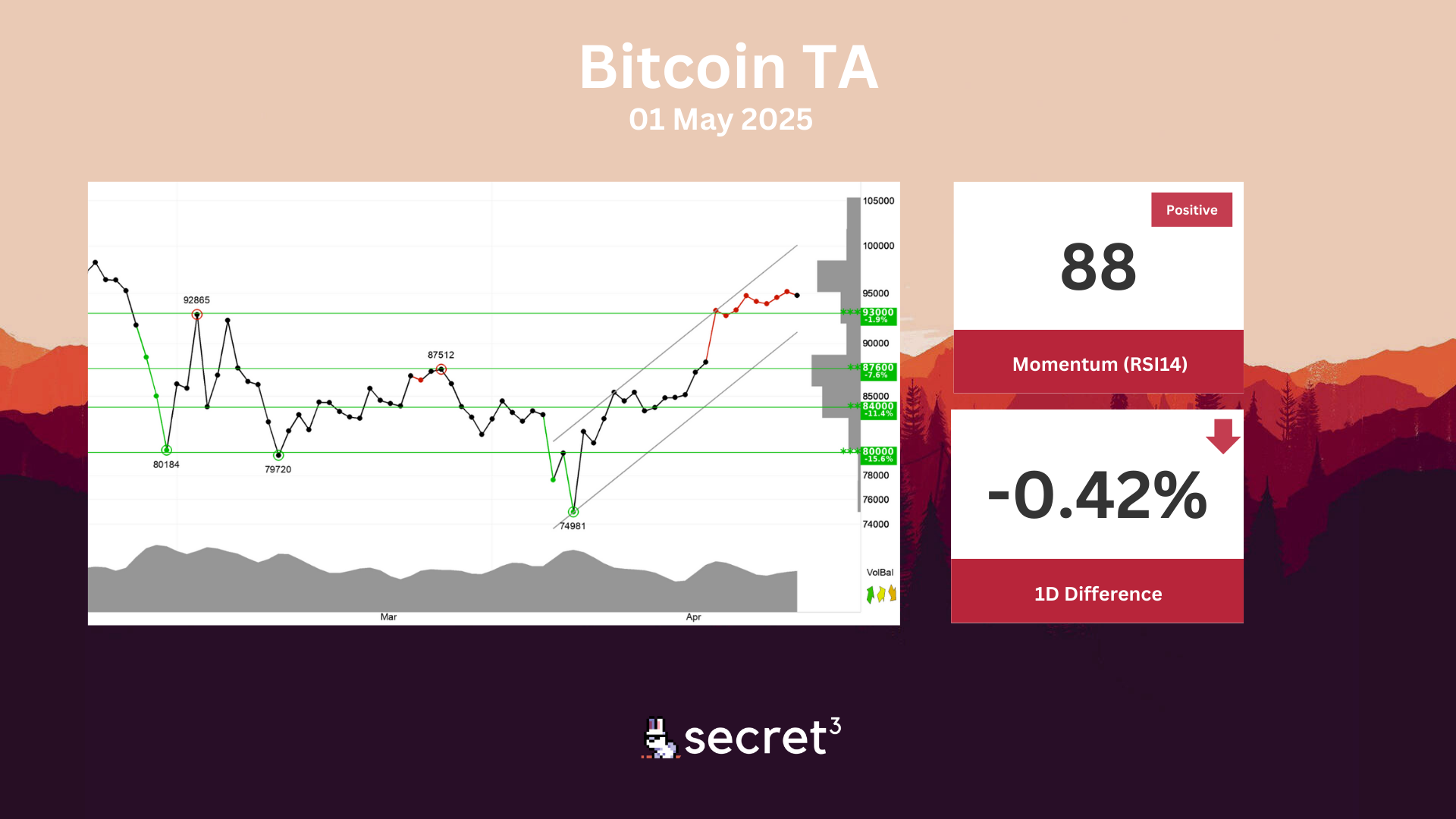

Bitcoin - Bitcoin is in a rising trend channel in the short term. Rising trends indicate that the currency experiences positive development and that buy interest among investors is increasing. The currency has broken up through resistance at points 93000. This predicts a further rise. The short term momentum of the currency is strongly positive, with RSI above 70. This indicates increasing optimism among investors and further price increase for Bitcoin. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically positive for the short term.

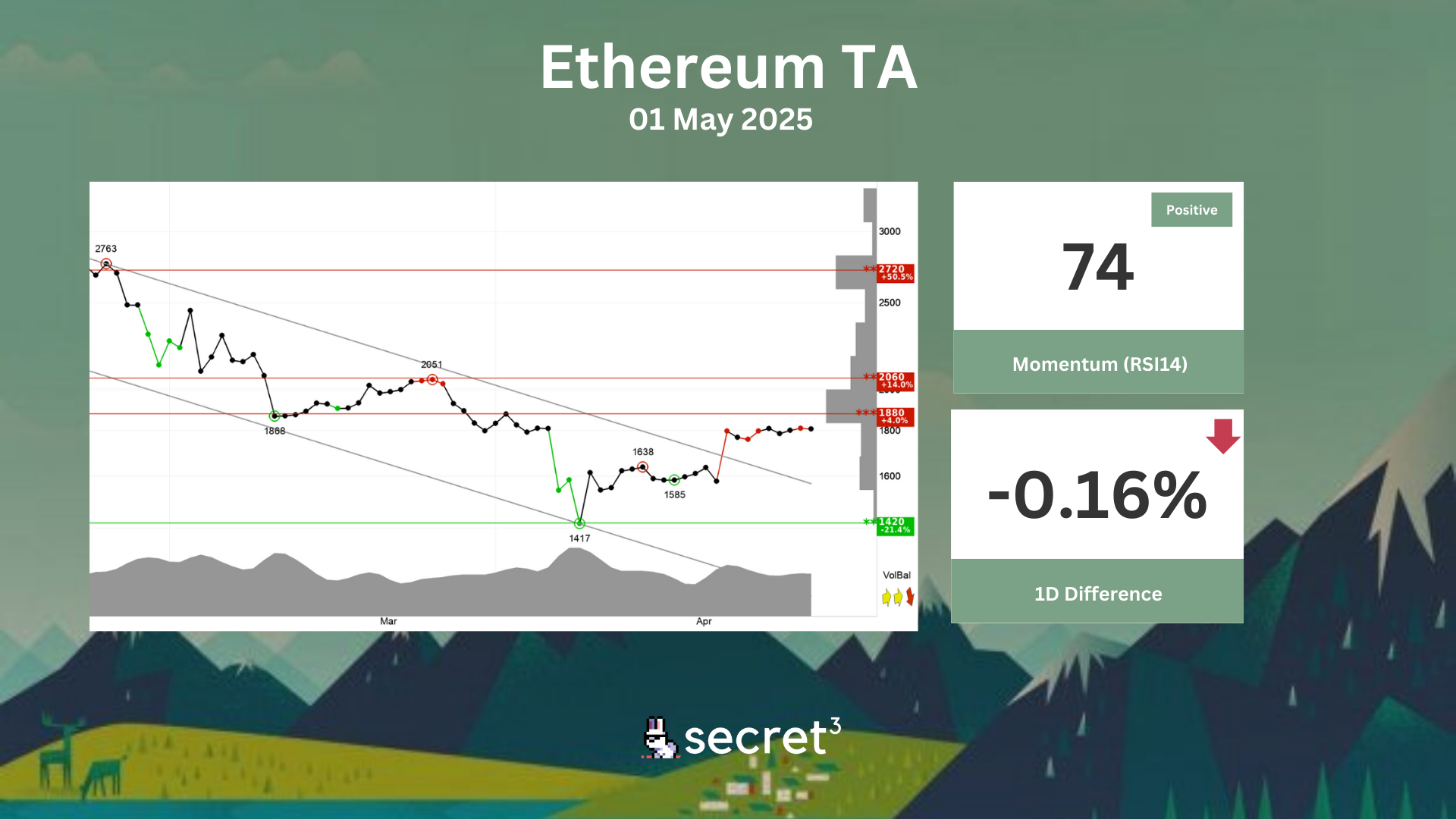

Ethereum - Ethereum has broken the ceiling of the falling trend in the short term, which indicates a slower initial falling rate. The currency is approacing resistance at 1880 points, which may give a negative reaction. However, a break upwards through 1880 points will be a positive signal. RSI above 70 shows that the currency has strong positive momentum in the short term. Investors have steadily paid more to buy the currency, which indicates increasing optimism and that the price will continue to rise. However, particularly for big stocks, high RSI may be a sign that the stock is overbought and that there is a chance of a reaction downwards. The currency is overall assessed as technically negative for the short term.