gm 01/03

Summary

gm, The Chicago Mercantile Exchange (CME) Group announced plans to launch Solana futures contracts on March 17, pending regulatory approval, which led to a 16% rally in Solana's price. Meanwhile, Bitcoin experienced a significant drop, falling below $80,000 before rebounding to around $85,000, driven by macroeconomic concerns and potential trade tensions. On the regulatory front, the SEC has dismissed its lawsuit against Coinbase and stated that memecoins are not considered securities, signaling a potential shift in the agency's approach to crypto regulation. Additionally, BlackRock incorporated its Bitcoin ETF into its model portfolios, reflecting growing institutional interest in cryptocurrencies despite recent market volatility.

News Headlines

💼 Sixth Street Invests $200M in Blockchain Lender Figure

- Sixth Street, a $100-billion investment manager, invested $200 million in Figure Technology Solutions, a blockchain-based lender.

- This investment will enable Figure to issue up to $2 billion in new loans and expand into diverse lending markets.

🤖 Olas Debuts Mech Marketplace for AI Agents to Hire Each Other

- Olas launched a decentralized marketplace called Mech Marketplace that allows AI agents to hire one another for specific tasks.

- The platform supports multiple blockchains, primarily operating on Gnosis Chain, with nearly 2,000 AI agents deployed.

🍽️ Blackbird Launches Flynet Mainnet for Blockchain Restaurant Loyalty

- Blackbird's blockchain restaurant loyalty platform has launched its Flynet mainnet, enabling on-chain restaurant payments.

- Users can pay for meals using the native token $FLY, which can be earned through loyalty programs or purchased with USDC.

💰 Illicit Crypto Transactions Hit Record $40B in 2024, Stablecoins Dominate

- Illicit cryptocurrency transactions reached $40 billion in 2024, expected to rise to $51 billion as more data emerges.

- Stablecoins became the preferred method for illegal transactions, overtaking Bitcoin which previously dominated such activities.

🚀 DeFi Set for Renaissance in 2025 as Adoption of Yield-Bearing Assets Grows

- DeFi and on-chain finance expected to see significant growth in 2025, driven by increasing adoption of yield-bearing assets like staking and liquid staking.

- Institutions likely to gradually embrace DeFi technologies while prioritizing security measures.

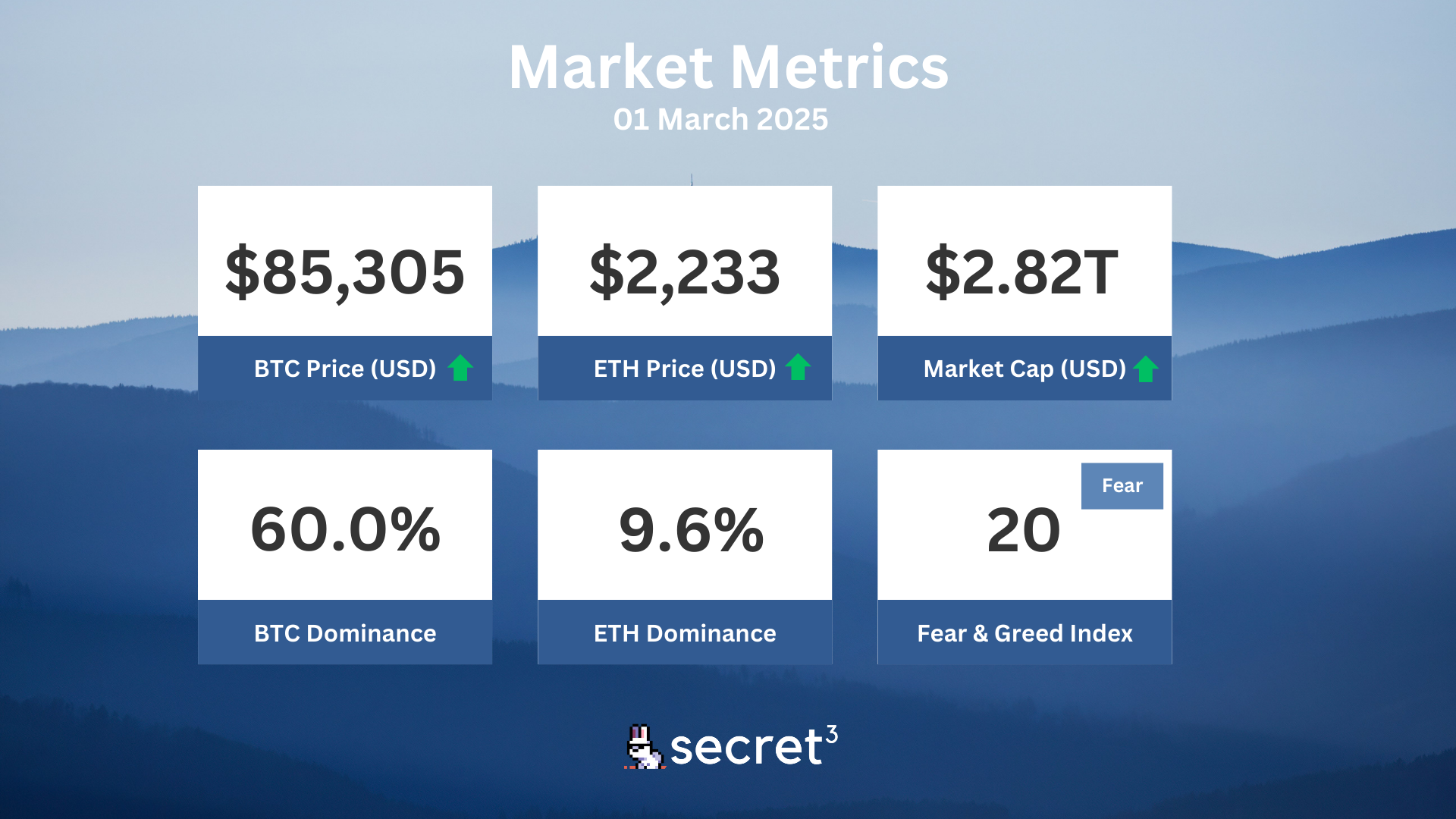

Market Metrics

Fundraising & VC

1. Figure (Undisclosed, $200M) - Web3 fintech company

2. Baselight (Seed, $3.75M) - Decentralized data marketplace and analytics platform

3. Badchain (Undisclosed, $1M) - Satirical layer-2 blockchain network on Solana

4. HARTi (Pre Series A, $398K) - NFT platform

On-chain Data

1. Sui (SUI) token unlocked today ($228M, 2.6%)

2. ZetaChain (ZETA) token unlocked today ($13.13M, 6.48%)

3. dYdX (DYDX) token unlocked today ($5.83M, 2.3%)

4. Wormhole (W) token unlock in 2 days ($6.15M, 1.54%)

Regulatory

💼 White House to Host Crypto Summit

- President Trump will lead a crypto roundtable on March 7th with industry leaders and the President's Working Group on Digital Assets.

- The summit aims to develop a regulatory framework supporting innovation while protecting economic freedom.

🌐 UAE Embraces RWA Tokenization

- The UAE is seeing rapid growth in real-world asset tokenization, particularly in real estate.

- Clear regulatory guidelines from VARA are fostering a favorable environment for tokenization projects.

🏛️ SEC Officially Dismisses Coinbase Lawsuit Over Crypto Securities Claims

- The SEC has officially dismissed its lawsuit against Coinbase, ending a significant legal battle for the crypto sector.

- This decision follows the SEC's evaluation of its regulatory approach to the crypto industry.

🏦 Boerse Stuttgart Partners with DekaBank for Institutional Crypto Trading

- Boerse Stuttgart has partnered with DekaBank to provide cryptocurrency trading services for institutional clients.

- DekaBank, with assets over 411 billion euros, will integrate cryptocurrency into its offerings using Boerse Stuttgart's regulated infrastructure.

Technical Analysis

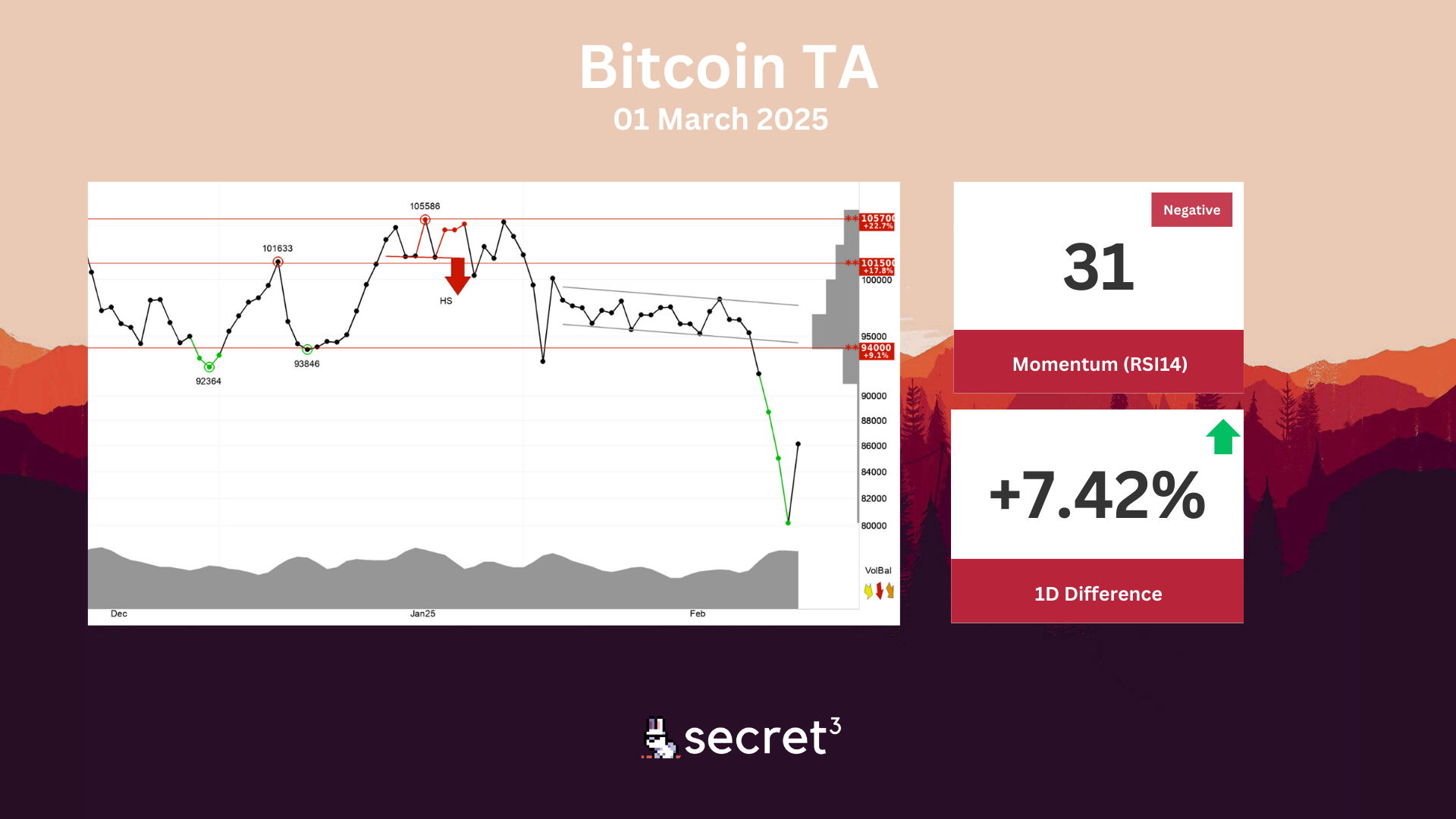

Bitcoin - Bitcoin has broken down from an approximate horizontal trend channel in the short term. This signals a continued weak development, and the currency now meets resistance on possible reactions up towards the floor of the trend channel. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 94000 points. Negative volume balance indicates that sellers are aggressive while buyers are passive, and weakens the currency. The currency is overall assessed as technically negative for the short term.

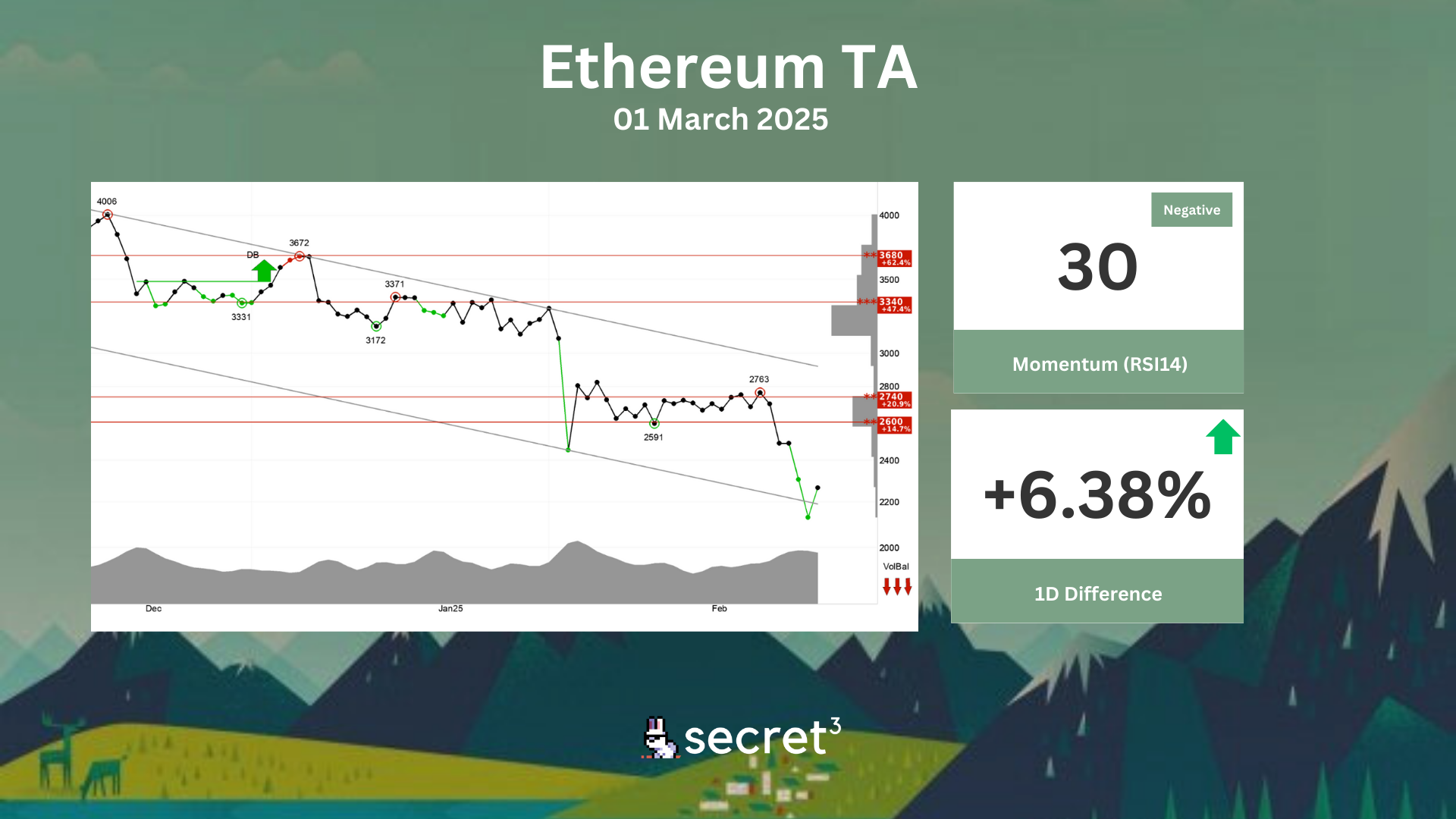

Ethereum - Investors have accepted lower prices over time to get out of Ethereum and the currency is in a falling trend channel in the short term. Falling trends indicate that the currency experiences negative development and falling buy interest among investors. There is no support in the price chart and further decline is indicated. In case of a positive reaction, the currency has resistance at 2600 points. Volume has previously been low at price tops and high at price bottoms. Volume balance is also negative, which confirms the trend. The short term momentum of the currency is strongly negative, with RSI below 30. This indicates increasing pessimism among investors and further decline for Ethereum. However, particularly in big stocks, low RSI may be a sign that the stock is oversold and that there is a chance for a reaction upwards. The currency is overall assessed as technically negative for the short term.

Governance & Code

👻 Aave DAO | Orbit Program Renewal - Q1 2025 (Preliminary Discussion)

- This proposal aims to renew the Orbit program for recognized delegates through Q1 2025.

🦄 Uniswap DAO | Saga and Uniswap v3 Liquidity Incentives

- This proposal requests $250,000 in UNI incentives over six months to support five Uniswap v3 pools on Saga.